Income’s AstraLink is a whole life regular-premium investment-linked plan (ILP).

It offers investment options while providing coverage against unexpected events such as disability, terminal illness, and death.

Flexibility is at the heart of this policy, encompassing features such as adjusting your regular premium and sum assured, retirement options, and fund switching.

In this post, we unpacked and reviewed AstraLink so that you may assess its suitability for your needs.

Keep reading.

Criteria

- Minimum Investment Period (MIP) of 10, 15, 20, or 25 years

- Minimum Regular Premium: $100/month

General Features

Premium Payments

You must make regular premiums, which can be paid annually, half-annually, quarterly, or monthly.

| Premium Payment Frequency | Minimum Regular Premium |

| Annually | $1,200 |

| Half-Annually | $600 |

| Quarterly | $300 |

| Monthly | $100 |

Premium payments for AstraLink can only be made in cash.

Recurring/Adhoc Top-Ups

You may choose to make single or recurring top-ups to your policy.

You must make a minimum of $2,500 for single top-ups.

For recurring top-ups, the minimum top-up amounts are as follows:

| Premium Payment Frequency | Minimum Top-Up |

| Annually | $1,200 |

| Half-Annually | $600 |

| Quarterly | $300 |

| Monthly | $100 |

Do note that top-ups do not increase your policy’s sum assured, as they are not part of your regular premium payments.

Top-ups are not permitted when your policy is under premium holiday.

Premium Allocation

AstraLink allocates 100% to 105% of your premium payments to purchase your chosen sub-funds.

Each sub-fund will be allocated a minimum amount, as indicated below:

| Regular Premium and Recurring Top-Ups |

|

| Single Top-Ups | $1,000 per top-up |

NTUC Income may adjust the premium allocation according to its discretion, but you will be notified of these changes. The percentage of premium allocation will not be lower than 100%.

Protection

Firstly, you can select your sum assured multiple – 10X, 20X, 30X, 40X, or 50X – at the start of your policy.

This multiple will be based on your annual premiums. So if you make $10,000 in annual premiums and choose a multiple of 10X, your sum assured is $100,000.

This multiple will then be factored into the price of your annual premiums.

There is also a Minimum Protection Value (MPV) of this policy, which is 300% of the sum assured.

Thus, with a $100,000 sum assured, you’ll have an MPV of $300,000.

Death, Terminal Illness (TI), and Total and Permanent Disability (TPD) Benefit

If the insured contracts a terminal illness, becomes totally and permanently disabled, or passes away during the policy period, a payout would be made.

The payout would be the higher of these 2 amounts:

- The Basic Benefit at the date of claim*

- The policy value at the date of claim

This is the current value of his/her investment units in the funds chosen at the time of the claim.

*The Basic Benefit can be derived using either of these 2 formulas:

- Minimum Protection Value + Top-ups – Withdrawals before the anniversary immediately after the insured turns 70

- Sum assured + Top-ups – Withdrawals made at or after the anniversary immediately after the insured turns 70

Any relevant charges will be subtracted from the benefit payout. The policy will then cease to be in force.

Accidental Death and Accidental TPD Benefit

Should the insured encounter death or TPD by accident, he or she would be entitled to the following payouts:

- The full amount (100%) of the sum assured on top of the death or TPD benefit

- 30% of the sum assured on top of the death or TPD benefit, if the insured was partaking in a restricted activity

For a successful claim, the below conditions must be fulfilled:

- The accident must occur prior to the anniversary immediately after the insured turns 70

- The accident must occur within 365 days of the policy’s active period

The benefit payout will be less any debts owed to the policy. Subsequently, the policy will then be terminated.

No Lapse Guarantee (NLG) Benefit

Should your policy’s funds be insufficient during the Minimum Investment Period (MIP), the NLG benefit will be activated to cover any outstanding charges, keeping your policy inforce.

This benefit only applies if:

- Payment for all regular premiums has been fulfilled before the 30-day grace period

- Withdrawals (including sub-funds which declare distribution) must not be larger than the total top-up

You are still liable for your policy’s charges and any unit deducting rider. These charges will be subtracted from the policy value or claims processed.

Once the NLG benefit ends, it will not be reinstated.

Key Features

Regular Premium Adjustment

Once your policy turns 3 years old, you may change the regular premium you’re paying, as long as your policy is not under premium holiday.

Adjustments are subject to the following minimum amounts:

| Premium Payment Frequency | Minimum Increase / Decrease in Regular Premium |

| Annually | $600 |

| Half-Annually | $300 |

| Quarterly | $150 |

| Monthly | $50 |

If you are seeking to increase your regular premiums, 2 conditions are to be met:

- You are in good health (substantiated with documentary evidence)

- There are no changes in the policy’s risk coverage

Upon changing your regular premium amount, your policy’s sum assured and unit deducting rider(s) will be adjusted accordingly.

Sum Assured Adjustment

You can change your sum assured once your policy reaches its 3rd anniversary.

This is subject to 4 conditions:

- The policy is not under premium holiday

- You are in good health (substantiated with documentary evidence)

- There are no changes in the policy’s risk coverage

- The minimum sum assured is based on the applicable sum assured multiple.

Changing your sum assured will also cause a change in your regular premiums.

Do note that you will incur surrender charges if you reduce your sum assured during the MIP.

Life Events Benefit

You can utilise the guaranteed insurability option to increase your sum assured upon experiencing any of the below life events:

- Turning 21 years old

- Getting married

- Divorce

- Spouse’s demise

- Having a child

- Residential property purchase

Claims under the life events benefit must fulfil the following conditions:

- You are 50 years old or below at the time of exercising the benefit

- You are free of TI and/or TPD at the time of exercising the benefit

- You provide sufficient documentary evidence of the life event

- The life event must occur no earlier than 3 years after the policy’s cover start date

- The life benefit must be exercised within 3 months of the life event

- Each life event can only be claimed once

- Total TPD benefit due for the insured for any owned policies (issued by NTUC Income or other insurers) must be lower than $6.5 million, excluding bonuses after the benefit is activated.

Your policy’s sum assured automatically increases upon exercising the life events benefit, without NTUC Income having to evaluate your health condition.

Increments are based on the raised premium and relevant sum assured multiple.

Increments will be capped at the lower of the 2 options:

- $100,000

- 50% of your policy’s sum assured upon issuance

Do note that increments in sum assured also result in the following:

- A higher sum assured of your unit deducting rider(s)

- A higher regular premium

Premium Holiday

Should you fail to make premium payments after the 30-day grace period, when your policy has yet to reach its 2nd anniversary during the MIP, your policy will be cancelled.

However, from your policy’s 2nd anniversary onwards, should you fail to make premium payments after the 30-day grace period, your policy will automatically enter a premium holiday.

During this period, your cover and unit deducting riders will continue if enough funds are available to cover fees and charges as they fall due.

As you are not allowed to make any top-ups during your policy’s premium holiday, please ensure that your policy’s value is sufficient during the premium holiday period.

You may also request a premium holiday for your policy.

If you apply for your policy to take a premium holiday during the MIP, premium holiday charges will be incurred.

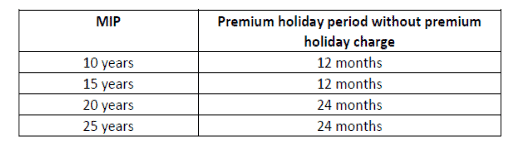

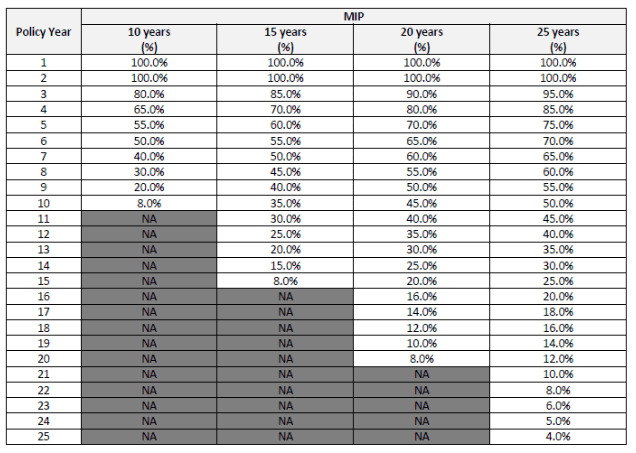

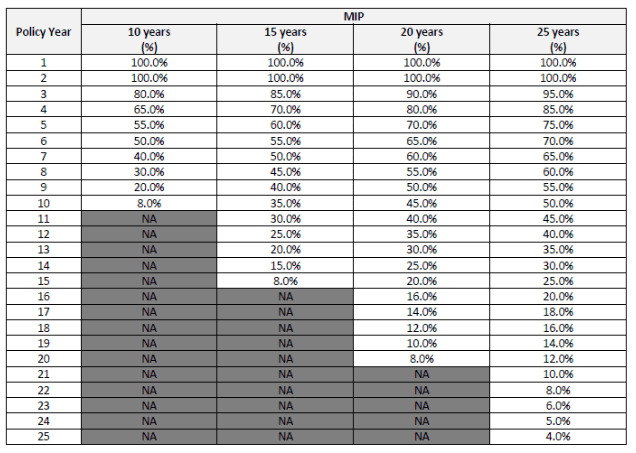

However, if you apply for a premium holiday after your policy’s 3rd anniversary, no premium holiday charges will be enforced depending on your MIP, as illustrated in the following table:

Retirement Option

You can reduce your policy’s coverage after the MIP to 0 upon reaching 55 years old or older.

Where applicable, your policy’s sum assured and unit deducting rider(s) will be decreased. The insurance cover charge will also be reduced accordingly.

After exercising the retirement option, you may continue to pay your regular premiums. Your policy will enter a premium holiday if you stop paying your premiums.

By doing this, you direct your premiums to the investment portion of your policy to accumulate accumulation for retirement.

Partial Withdrawals

You may withdraw a portion of your investments by selling a portion of your investments, subject to a partial withdrawal charge.

The minimum amount per partial withdrawal is $500.

There is no cap on the number of partial withdrawals you can make. However, you’re required to maintain an account balance of at least $1,000.

If, after subtracting the partial withdrawal charge, your policy’s value decreases below the Minimum Protection Value (MPV), partial withdrawals will not be permitted.

Partial withdrawals will decrease your policy’s protection coverage and the value of your sub-funds.

Fund Switching

You may reallocate the investments into any available ILP sub-funds without cost.

However, each fund switch must be minimally $1,000.

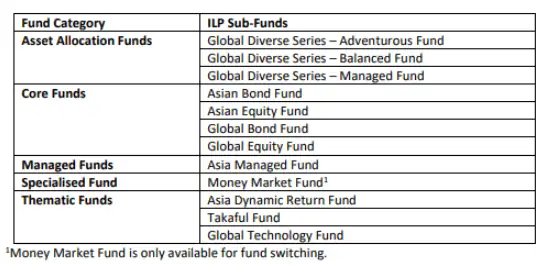

Funds Available via the NTUC Income AstraLink

The following table shows a list of funds available via the NTUC Income AstraLink:

Take note that these are ILP sub-funds, which will incur an additional layer of fees that are not stated in your fund-level returns.

Investment Bonus

The AstraLink disburses a bonus on investment earnings, which will be used to purchase more units of your chosen sub-funds.

The investment bonus is computed according to your premium payments in the first year.

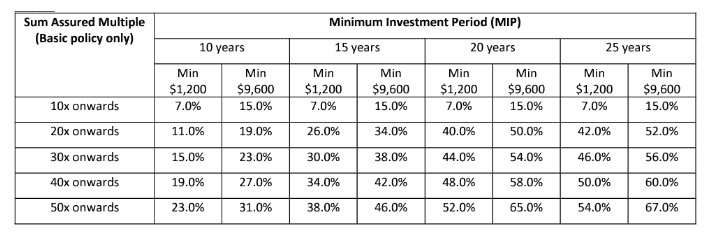

To qualify for an investment bonus, your policy must have a sum assured multiple beyond 10X. Policies with a sum assured multiple below 10X are not eligible for investment bonuses.

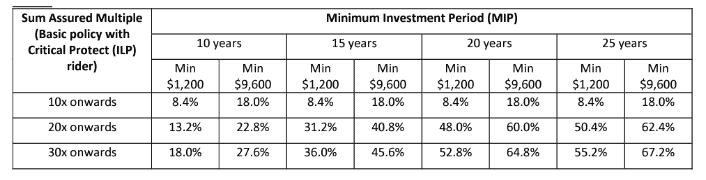

You may refer to the following table for the percentage of investment bonus you’re entitled to in relation to your sum assured multiple and MIP:

If you opted to include the Critical Protect (ILP) rider, then this table applies:

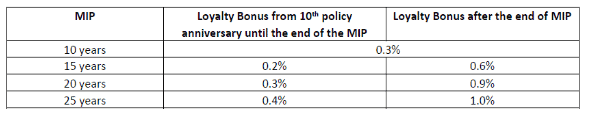

Loyalty Bonus

With effect from your policy’s 10th anniversary, you will receive a yearly loyalty bonus, which will be used to further investment in your chosen sub-funds.

The loyalty bonus is subject to 2 conditions:

- Your policy is still in force at the time the loyalty bonus is paid

- You have not made any withdrawals in the past 12 months

The loyalty bonus will be a percentage of your policy’s value based on its anniversary. It will follow these percentages:

Optional Add-On Riders

Critical Protect (ILP) Rider

The AstraLink offers a rider option for additional coverage against 49 specified dreaded illnesses.

The Critical Protect Rider’s sum assured will be 50% of your basic policy’s sum assured.

| Occurrence of Illness | Rider Benefit |

| Before the insured policy’s anniversary, immediately upon the insured’s 70th birthday | MPV of Critical Protect Rider |

| Upon or after the insured’s policy anniversary, immediately upon the insured’s 70th birthday | Sum assured of Critical Protect Rider |

NTUC Income AstraLink Fees and Charges

Policy Fee

A monthly policy fee will be imposed as part of policy administration charges.

Policy fees follow the below schedule:

| Policy Year | Policy Fee |

| 1st to 5th Year | 5% of policy value per annum |

| 6th Year and Beyond | 1% of policy value per annum |

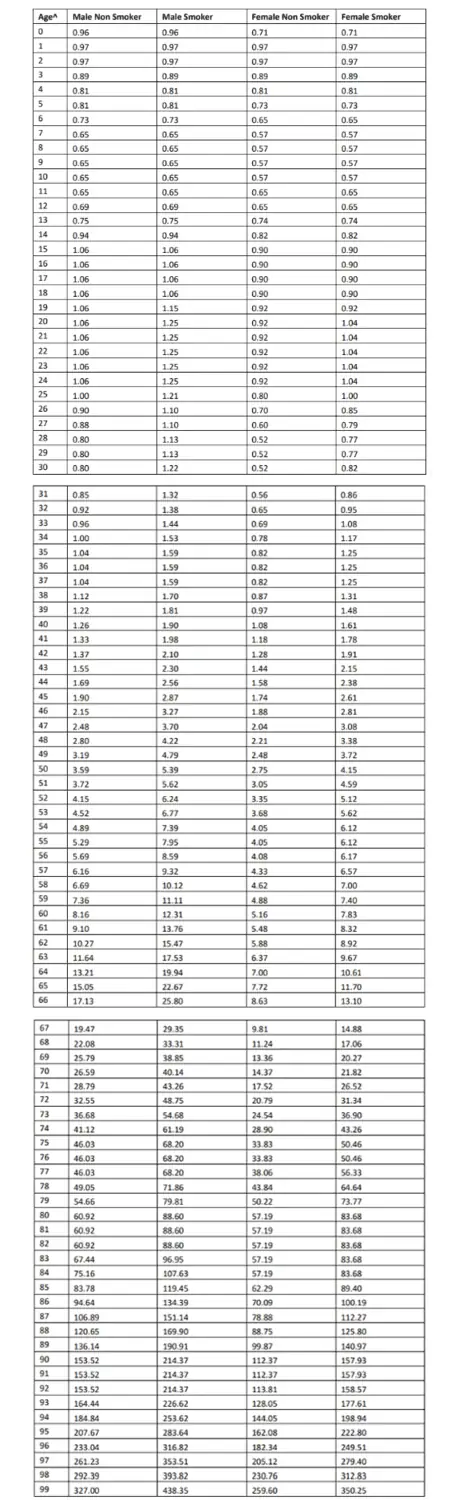

Insurance Cover Charge

A monthly insurance cover charge is payable under AstraLink should there be a sum-at-risk.

Here is the formula to calculate your sum-at-risk:

Sum-at-risk = Basic benefit – policy value

This charge will not be imposed if the sum-at-risk is zero or negative.

The insurance cover charge will only be imposed if the value is positive by multiplying the sum-at-risk by the sum-at-risk factor.

The following table illustrates the annual insurance cover charge rates for Death, TI, and TPD, based on every $1,000 sum at risk:

^ The insured’s age would be based on Age Last Birthday. For policyholders above 99 years old, NTUC Income would use the rate charged to policyholders aged 99.

Fund-Related Fees

The yearly management fee for ILP sub-funds varies from 0.25% to 1.45% and will not go beyond 2.0% p.a.

As mentioned, these are ILP sub-funds.

This means that fund-level fees are not included in the calculation of returns as seen in the fund factsheet.

To know how your policy is performing, you need to look at the net returns on the ILP level, not the fund performance.

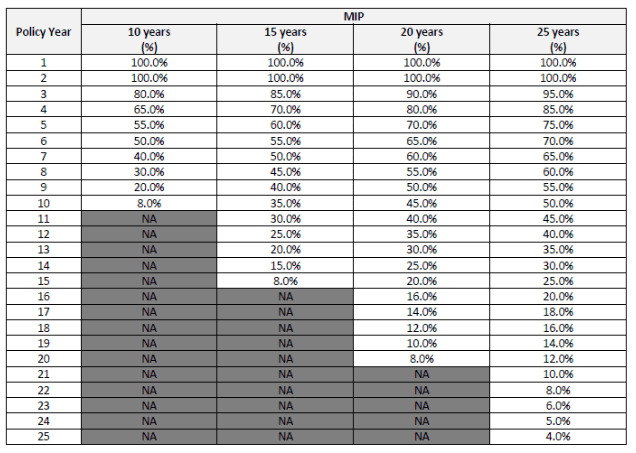

Partial Withdrawal Charge

A partial withdrawal fee will be charged if you withdraw a portion of your sub-funds during the MIP.

Refer to the following table for the specific rates applicable to your partial withdrawal fees:

Surrender Charge

The surrender charge applies when either of the following situations occur during the MIP:

- You cancelled your insurance policy

- You reduced your regular premium payment amount

- You failed to make premium payments before your policy’s 2nd anniversary

You may refer to this table for the specific rates applicable to your surrender fees:

For full surrender, the rates will be applied to the value you’ve withdrawn from your policy.

For surrender charges resulting from premium or sum assured adjustments, the rates will be applied to the proportion of reduction multiplied by your policy’s value.

If your policy’s cash-in value becomes zero or negative after deducting the surrender charge, the policy will cease to be active. No benefit payout will be disbursed.

Premium Holiday Charge

The premium holiday charge applies when any of the below occurs from your policy’s 2nd anniversary during the MIP:

- You applied for a premium holiday

- You stopped paying regular premiums during the MIP or the end of the policy.

The premium holiday isn’t unlimited. The amount of premium holiday you get depends on your selected MIP, as seen below:

| Minimum Investment Period (MIP) | Premium Holiday Period without Premium Holiday Charge |

| 10 years | 1 year |

| 15 years | 1 year |

| 20 years | 2 years |

| 25 years | 2 years |

Refer to this table for the specific rates for your premium holiday fees:

Summary of NTUC Income’s AstraLink

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of NTUC Income’s Astralink

With an investment of as little as $100 monthly, the AstraLink is an insurance-focused ILP that lets you obtain life insurance coverage while investing your money.

You may choose to adjust your regular premium payments, make recurring or ad-hoc top-ups, make partial withdrawals, or even take a break from premium payments through a premium holiday.

You’ll also get protection coverage based on your policy’s sum assured. If you’re between 0 to 69 years old, you’ll get a minimum coverage of 3 times your sum assured.

Additionally, if you keep your policy active for at least 10 years, you’ll receive a loyalty bonus of 1% of your annual premiums. In the first year, you can also receive an investment bonus of as high as 67% of the premiums paid.

However, as this is an insurance-focused ILP, we can’t recommend it as it does not provide enough value in terms of insurance coverage.

The fees are a high 5% in your first 5 years. Many investment plans only have fees that go up to 3%.

Yes, the ILP fees drop to 1% after that, but you have to pay an additional fund-level fee that is not included in the fund returns.

Speaking of fund returns, I checked the annualised returns on the equity funds (generally higher returns due to higher risk).

As of 14 June 2023, only the Global Equity Fund and the Global Technology Fund are producing positive 10-year annualised returns of 8.57% and 14.16% p.a., respectively.

However, both are underperforming against their benchmarks, and the returns have yet to include fund fees of 1.25% p.a. each.

The GDS Adventurous Fund and Asian Equity Fund are producing negative 1-year returns before fees, and they are new funds with no track record yet.

If it was up to me, I would choose a cheap term plan and invest my remaining money in an ILP that has better fund performances.

Alternatively, a whole life plan is a safer bet for those seeking life insurance coverage with mid-level investment risk.

But that’s just my personal opinion. Everyone has different needs based on their own unique situation.

It’s always best to get advice (or a second opinion) from a trusted financial advisor.

Looking for a trusted financial advisor?

We partner with MAS-licensed financial advisors to assist you with this.