Manulife SmartRetire (V) is a whole life investment-linked policy offering life insurance coverage and investment options.

As a whole life plan, it covers your entire lifetime, with regular premium payments that can be customised to fit your budget and financial goals.

Although technically a whole life policy, the Manulife SmartRetire (V) lets you withdraw once you’ve hit your selected retirement age – making it a whole life annuity plan.

But unlike a traditional annuity, 100% of your premiums go towards investing in professionally managed funds, which may grow over time.

By combining life insurance coverage with investment opportunities, Manulife SmartRetire (V) offers a flexible and holistic approach to financial planning – allowing you to protect yourself and your loved ones while building wealth over the long term.

This review explores Manulife SmartRetire (V) to help you decide if it’s the best policy to meet your goals.

Keep reading.

My Review of the Manulife SmartRetire (V)

The Manulife SmartRetire (V) is an investment-linked annuity policy that merges the benefits of an annuity with the growth potential of investment funds.

This policy is designed for individuals seeking a flexible approach to retirement planning, allowing for wealth accumulation alongside providing a lifetime of retirement income.

Here’s a breakdown of Manulife’s SmartRetire (V) pros and cons to help you assess if it aligns with your financial planning goals.

Pros

1. Flexibility in Retirement Planning: Manulife SmartRetire (V) offers significant flexibility, allowing you to choose your target retirement age, retirement period, and desired retirement income. This adaptability ensures that the plan can be tailored to meet your specific financial goals and retirement timelines.

2. Comprehensive Investment Options: With the ability to invest in up to 10 selected funds, you have the opportunity to diversify your investment portfolio. This diversification can potentially enhance the growth of your retirement savings, depending on the performance of the chosen funds.

3. Premium Allocation and Top-up Options: The plan invests 100% of your premiums into the selected funds, maximising the potential for investment growth. Additionally, making premium top-ups allows for further investment flexibility, enabling you to increase your investment amount whenever you choose.

4. Loyalty and Welcome Bonuses: Manulife SmartRetire (V) rewards you with loyalty and welcome bonuses, adding additional units to your investment. These bonuses can contribute to the overall growth of the policy’s value over time.

5. Waiver of Premium on Total and Permanent Disability (TPD): The policy includes a waiver of premium benefit in the event of the policyholder’s total and permanent disability, ensuring that the investment continues to grow even if you are unable to make premium payments due to disability.

Cons

1. Dependence on Fund Performance: Since the retirement income and policy value are heavily reliant on the actual fund performance, there is an inherent risk that the selected retirement income may not be achieved if the investments underperform.

2. Complex Structure and Charges: The policy comes with various charges, including surrender charges, partial withdrawal charges, and fund management charges. These fees can impact the overall returns of the policy and may make it challenging for you to fully understand the cost implications of your investment.

3. Minimum Investment Period: The policy requires a minimum investment period, during which withdrawals are restricted or subject to charges. This could limit your access to funds in case of financial emergencies.

4. Investment Risk: As with any investment-linked product, there is a risk that the investment may not perform as expected, which could affect the policy’s ability to provide the desired retirement income. You need to be comfortable with the level of investment risk associated with your chosen funds.

The Manulife SmartRetire (V) offers a unique blend of the benefits of an annuity plan and investment opportunity, making it a potentially attractive option for those looking to actively manage their retirement savings.

However, the policy’s suitability will depend on an individual’s financial goals, risk tolerance, and understanding of investment-linked products.

However, it’s crucial for you to know that this is an investment-linked policy – which means that none of your premiums nor retirement payouts are guaranteed.

Should you hit your retirement years and the market crashes, you risk losing a large part of your hard-earned money that’s supposed to be used for your retirement.

Personally, I wouldn’t recommend such policy types – especially if it’s supposed to provide you with income when you’re retiring.

When you’re old, it’s better to play it safe and choose an annuity plan that provides you with guaranteed and non-guaranteed payouts as compared to one that is completely non-guaranteed.

It’s also better to separate your insurance coverage from your investments, so look into a term plan (to 99 years old if you wish) or a whole life plan that gives you guaranteed cash value when you surrender.

However, these are just my own opinions – what’s best for me might not be best for you.

To ensure you make the best decision for your future, especially when it comes to retirement planning, consider seeking guidance from a trusted financial advisor who can provide valuable insights and advice tailored to your needs.

We partner with MAS-licensed financial advisors to help you with this.

Click here to get connected to our network of unbiased financial advisors.

Here are the nitty-gritty details of what the Manulife SmartRetire (V) offers.

Criteria

- Minimum investment period of 8 years

- Minimum investment amount of $300 monthly

General Features

Select your Target Retirement Age

With Manulife SmartRetire (V), you can choose your Target Retirement Age between 40 to 70 years old, in multiples of 5.

You can also select your Target Retirement Period, which determines how long you’ll get your payouts for, between 10 to 30 years in multiples of 5, and your desired retirement income.

However, it’s important to note that there is no guarantee that your selected retirement income will be achieved, as it depends on the actual fund performance.

Premium Allocation

The plan will invest 100% of your basic premium by purchasing units in up to 10 selected funds.

Minimum Investment Period

You have multiple minimum investment periods (MIP) to choose from, and the shortest MIP is 8 years.

The options available are:

- 8 Years Flexi 3

- 8 Years Flexi 5

- 12 Years Flexi 8

Here’s how to read the MIPs above – the “Years” portion indicates how long your money will be minimally invested, while the “Flexi” refers to the minimum number of years you’ll have to make investments.

So the 8-Year Flexi 3 plan means you must make regular investments for minimally 3 years, and this investment will be locked for 8 years in total before you can make withdrawals.

Take note that for this policy, the term “Flexi start date” will be used in reference to the period between after the minimum regular investment and before the minimum investment period.

So for an 8-Year Flexi 3 plan, the Flexi start date refers to the end of your third year and before the eighth year.

Minimum Investment Amount

The minimum annual investment for each Minimum Investment Period (MIP) is as follows:

| Minimum Investment Period (MIP) | Minimum Investment Amount (Yearly) | Minimum Investment Amount (Monthly) |

| 8 Years Flexi 3 | S$24,000 | $2,000 |

| 8 Years Flexi 5 | S$6,000 | $500 |

| 12 Years Flexi 8 | S$3,600 | $300 |

Protection

Death Benefit

The Death Benefit will be paid under the following circumstances;

- If death occurs during the MIP, your beneficiaries will receive the higher of your account value or 105% of the total basic premium paid, plus any top-up premium minus withdrawals and debts owed to the policy.

- In the event of death during the accumulation period, your beneficiaries will receive the greater value of either your account value or the basic sum insured minus any withdrawals. The basic sum insured is calculated as the Target Retirement Income multiplied by 12 months.

- If death occurs on or after the Target Retirement Age, your beneficiaries will receive the account value minus debts owed to the policy.

The accumulation period is the time between the policy anniversary following the end of the MIP and the Target Retirement Age.

Waiver of Premium (WOP) Benefit on Total and Permanent Disability (TPD)

A waiver of premium applies in the event that you are diagnosed with a total and permanent disability under the following circumstances;

With this policy, you won’t have to worry about basic premiums if you are diagnosed with TPD before your 70th birthday and before the flexi start date.

For a claim to be valid, the disability must last at least 6 consecutive months.

Moreover, any future basic premiums waived will be fully invested into the current Fund(s) based on your selected premium frequency when such payments were originally due.

The maximum amount payable for this and all other policies for the same person, including supplementary benefits for any TPD benefit, is $5,000,000.

The total TPD benefit issued on a guaranteed issuance basis for the Manulife SmartRetire (V) should be less than $1,000,000.

Refund of Cost of Insurance (COI)

The plan refunds the COI amount without interest if this policy is active and no claims are made for the death or WOP benefits before the Target Retirement Age.

Notably, this refund is paid out as a lump sum by allocating additional units based on your pre-specified premium allocation on your Target Retirement Age policy anniversary.

Maturity Benefit

The policy will end on the policy anniversary immediately following your 99th birthday.

When the policy terminates, you will receive any remaining account value after deducting any amounts owed.

Key Features

Welcome Bonus

With this plan, you can receive a Welcome Bonus as additional units depending on your annualised premiums and do not include top-up premiums.

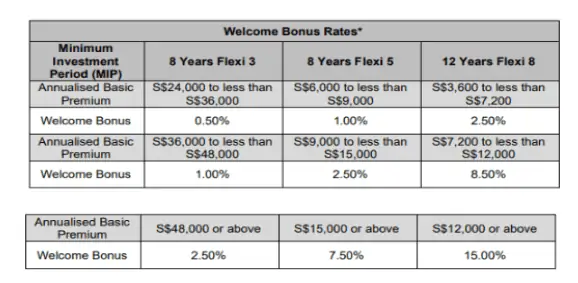

This table shows the Welcome Bonus rates depending on your MIP period and investment amount:

Loyalty Bonus

From the next policy anniversary after the end of MIP and every policy anniversary thereafter, you will receive additional units based on 0.35% of your account value.

You will receive this bonus as a one-time payment on your policy anniversary, subject to your pre-specified premium allocation.

To be eligible for the Loyalty Bonus, you must satisfy 2 criteria:

- Your policy must be in force at the time of bonus payment, and

- You Have not made partial withdrawals in the preceding 12 consecutive months from the Loyalty Bonus declaration date.

However, if you fail to qualify for a Loyalty Bonus, you can still qualify for subsequent bonuses if these 2 criteria are met in any subsequent policy year.

It’s worth noting that the Target Retirement Income payout does not affect your eligibility for the Loyalty Bonus.

Payment of Target Retirement Income

Your monthly Target Retirement Income will be paid on the policy monthiversary starting from the Target Retirement Age you’ve selected up to the end of the Target Retirement Period, as long as there is sufficient account value.

Since this policy is investment-linked, the Target Retirement Income are non-guaranteed and depends on various factors, including investment performance, timely payment of basic premiums, withdrawals made, and dividends withdrawn from invested funds.

Policy Premium Adjustment

You may submit a written request to adjust your basic premium from the Flexi start date.

Note that any adjustment must fall within your plan’s minimum and maximum basic premium amount.

Any changes to your basic premium will not affect your sum insured.

Premium Top-ups

Premium top-ups are an exclusive offering that enables you to invest beyond your regular basic premium during the policy term.

The minimum top-up is $2,500, which can be allocated to up to 10 funds with a minimum of 10% per fund.

When a top-up is made, 100% of the premium will be utilised to purchase your chosen funds.

During MIP, top-ups will increase your death benefits but will not raise the sum insured during the accumulation period.

Financial underwriting may be necessary, but medical underwriting is not needed.

In addition, top-ups form part of the account value and are subject to partial withdrawal or surrender charges during MIP when partially withdrawn or fully surrendered.

They qualify for loyalty bonuses but not for welcome bonuses.

Oh, premium top-ups are free.

Premium Redirection

If you want to tailor your investment strategy, your future basic premiums can be redirected into other funds.

This change won’t impact the units in your current funds.

You can allocate your basic premiums to 10 different funds, with a minimum of 10% per fund.

Fund Switching

With Manulife SmartRetire (V), you can make unlimited free fund switches throughout the policy term.

For each fund switch, a minimum amount of $500 is required.

If the account value of each fund is less than $500 at the time of the request, you must transfer all units in that particular Fund.

Automatic Fund Rebalancing

Your holdings are automatically rebalanced based on pre-determined allocations at each policy anniversary.

This option becomes available starting from the second policy year. Rebalancing will only occur if the variance from the original premium allocation exceeds 5%.

It’s important to note that this feature will be discontinued if any fund switch, premium redirection, partial withdrawal, or top-up premium application is made.

Partial Withdrawal

The minimum amount for each partial withdrawal is $500, and the withdrawn amount must not cause the account value to fall below $1,000.

Others

Below are other plan flexibility options;

- Changes to your policy’s mode of payment can be requested, and the change will be effective on the next premium due date.

- You may also request a change in the basic sum insured for your policy.

- You can receive dividend payments or reinvest them.

- In case your policy lapses, you may request reinstatement within 3 years from the lapse date.

Manulife SmartRetire (V) Fees and Charges

Cost of Insurance (COI)

Worth noting that insurance coverage or protection is provided by monthly cancelling units from your fund.

The COI is determined based on various factors such as age, gender, smoking status, and the net amount at risk (NAAR), as shown in the table below.

| Benefit | COI |

| Death Benefit

No COI will be charged if NAAR is lesser than or equal to zero. |

|

| Waiver of Premium Benefit on Total and Permanent Disability (TPD) (covering only policy owner)

The NAAR is capped at a maximum of S$1,000,000. No COI will be charged if NAAR is lesser than or equal to zero. |

|

Policy Charge (Administrative Charge)

Your policy’s account value is subject to an administrative charge applied monthly throughout the policy term.

Based on the MIP, here is the administrative charge table:

| Minimum Investment Period (MIP) | Policy Years 1-5 | Policy Year (Above 6) |

| 8 years flexi 3 | 2.5% p.a | 0.75% p.a |

| 8 years flexi 5 | 2.5% p.a | 0.75% p.a |

| 12 years flexi 8 | 2.5% p.a | 0.75% p.a |

Surrender Charge

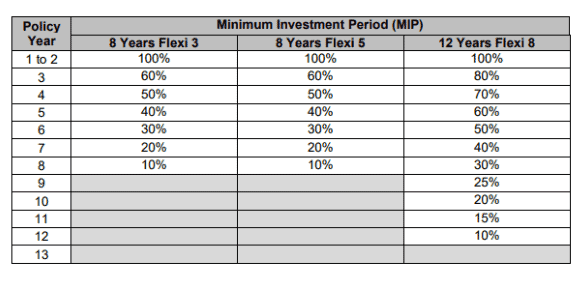

A surrender charge will apply if you opt for a full surrender during the MIP. The following table shows the surrender charge based on the MIP:

The surrender charge is calculated as a percentage of the account value.

Partial Withdrawal Charge

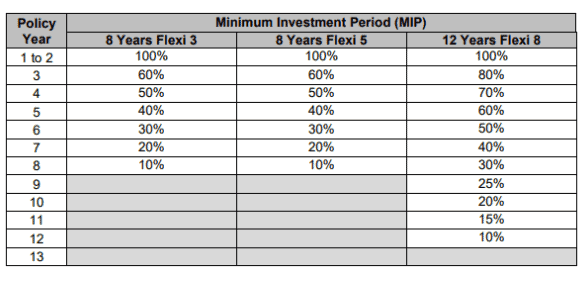

A partial withdrawal charge will be applied if you withdraw partially during the MIP.

The following table shows the partial withdrawal charge based on the MIP:

This charge will be calculated as a percentage of your account’s value.

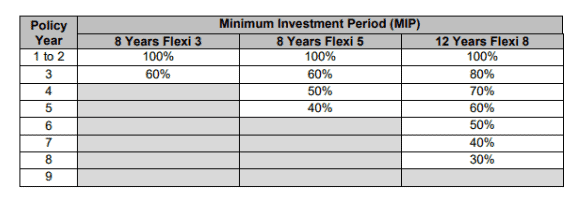

Premium Shortfall Charge

If you fail to pay any basic premium before the Flexi start date, a monthly premium shortfall charge will be applied starting from the grace period day of each missed basic premium.

The charge will accrue every month until you resume the basic premium payment.

The following table shows the premium shortfall charge based on the MIP:

Fund Management Charge

The fund management charges are paid from the underlying funds you’ve invested in. The returns you see on your investments are net of this charge.

Summary of the Manulife SmartRetire (V)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |

| Additional Features and Benefits | Yes: Waiver of Premium (WOP) Benefit on Total and Permanent Disability (TPD) |