Manulife GrowSecure is a participating endowment plan offering coverage and investment in a single plan.

Here is a complete review of Manulife GrowSecure to help you decide if it’s the right policy to meet your needs.

Keep reading.

General Features

Policy Terms

There are 2 policy terms to choose from – 16 and 18 years, depending on when you require the policy to mature.

Premium Payment

Manulife GrowSecure offers a unique advantage in terms of premium payment flexibility.

You can choose between 5, 8, or 10 years as your premium payment term.

You may also make monthly, quarterly, semi-yearly, or yearly premium payments.

Thus, there are 6 combinations available for you to choose from.

| 16-Year Policy Term | 18-Year Policy Term |

Pay for only

|

Pay for only

|

This flexibility allows you to align your premium payments with your financial capabilities and goals, making it suitable for those seeking a medium-term commitment to accumulate wealth.

Protection

Death Benefit

If the insured passes away while the policy is in force, his beneficiaries will receive a one-time payout.

The death benefit consists of:

- Either of the following, whichever is higher;

- 105% of all basic policy premiums paid, excluding any advanced payments made, or

- The guaranteed surrender value

- Accumulated revisionary bonus, where applicable

- Non-guaranteed claim bonus, where applicable

- Minus outstanding policy payables

The policy will terminate upon payment of the death benefit.

Accidental Death Benefit

If the insured dies due to an accident, he will receive the accidental death benefit if the following conditions are met:

- Accidental death occurs before the policy anniversary right after the insured’s 80th birthday.

- The policy is still active.

The accidental death benefit payout will be disbursed on top of the death benefit. The amount is 50% of the total premiums paid, less all advance payments.

Terminal Illness (TI) Benefit

The insured is entitled to the TI benefit where:

- He is diagnosed by a medical examiner to have an illness that is likely to result in death in the next 12 months from the diagnosis date

- The diagnosis is confirmed by Manulife’s appointed medical examiner

- The policy is still active

The TI benefit will be an advanced one-time payment of the death benefit.

Waiver of Premium on Total and Permanent Disability (TPD) Benefit

If the insured is diagnosed with TPD

- Before the policy anniversary immediately after turning 70 years old (TPD expiry date) or;

- Before the premium payment term ends, whichever case precedes;

Future basic premiums will be waived.

It’s important to note that the disability must persist for 6 months straight before a claim is submitted.

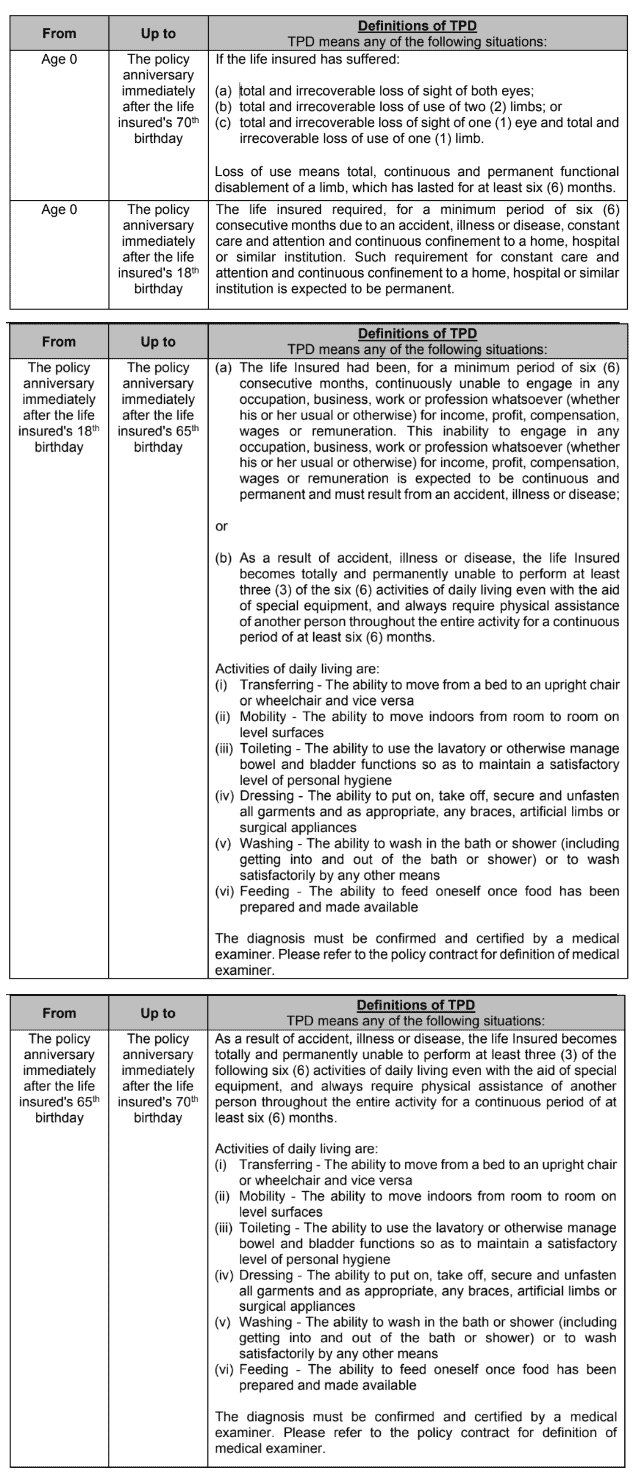

Further details on TPD can be found in the below tables:

Key Features

Capital Guaranteed at Policy Maturity

Upon policy maturity, you are guaranteed to receive 100% of your capital back, ensuring that your principal amount is always preserved and available to meet your financial goals.

Maturity Benefit

A maturity benefit will be disbursed upon the policy’s maturity, provided 2 conditions are met:

- The insured is still alive on the policy’s maturity date

- The policy is still active

A one-time maturity benefit will be paid, which includes the following:

- Guaranteed policy maturity value

- Accumulated revisionary bonus, where necessary

- Non-guaranteed maturity bonus, where necessary

- Less any policy payables

Change of Life Insured Option

You may change the insured of your policy after your policy’s 2nd anniversary. This is provided you have an insurable interest in the new life insured.

This option follows the below schedule:

| Where the policyholder is a | Number of times the Change of Life Insured option may be exercised |

| Corporation | Unlimited number of times |

| Individual or an Organisation | 2 times |

Premium Freeze Option

Under this option, you may stop paying premiums a year, including premiums for additional benefits attached to your policy.

This is subject to 2 conditions:

- Your policy must be active for at least 2 policy years.

- You must’ve made 2 complete annual premium payments.

The maximum number of successful applications for this option is as follows:

- Premium payment term of 5 years: 1 application

- Premium payment term of 8 or 10 years: 2 applications

In the duration where the premium freeze option is exercised:

- Your policy remains active

- Premiums cease to be payable

- Your policy’s anniversary date remains the same

- All basic and supplementary benefits remain applicable

- No reversionary bonus will be declared

- The accumulated reversionary bonus will follow a yearly compounding rate declared by Manulife

- The guaranteed surrender value and non-guaranteed surrender bonus rate remain unchanged at the value before the activation of the option

- The benefit end date for death and Terminal Illness (TI) benefit will be extended by 1 year for every time the option is exercised, up to the expiry date of the Accidental Death Benefit (ADB), whichever comes first

- The benefit end date for the waiver of premium on the Total Permanent Disability (TPD) benefit will be extended by 1 year for every time the option is exercised, up to the expiry date of the TPD, whichever comes first

- Reduced paid-up insurance will not be applicable

Reversionary Bonus

Manulife may choose to issue a reversionary bonus every year.

Once the revisionary bonus is declared, the bonus payout is guaranteed regardless of the performance of the participating fund.

The bonus rate is, however, not guaranteed.

Should you decide to surrender your policy, Manulife will pay the surrender value of the accumulated revisionary bonus.

This amount will be lower than the accumulated reversionary bonus declared and guaranteed by Manulife.

The accumulated reversionary bonus will be paid upon the insured’s diagnosis of terminal illness, death, or the policy’s maturity date.

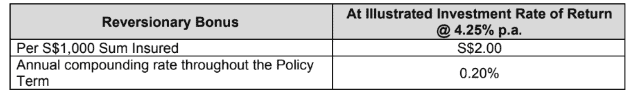

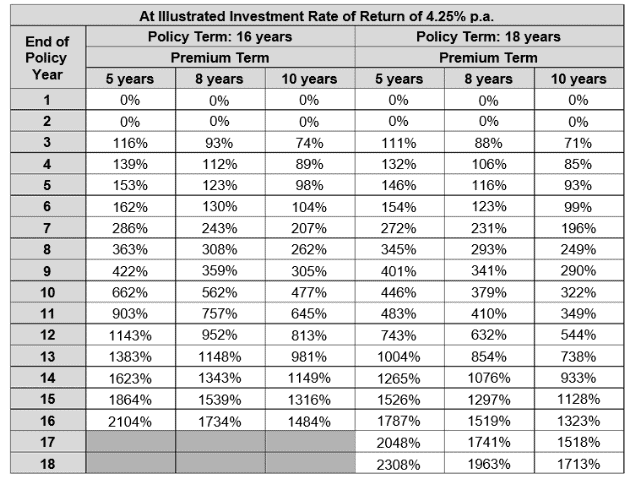

The following illustration depicts the reversionary bonus you’re entitled to at an investment rate of return of 4.25% per annum:

Reversionary bonuses and interest accrued on them are calculated using the compounding rate.

Maturity Bonus

Upon maturity, Manulife may pay a non-guaranteed maturity bonus.

The maturity bonus is calculated as a percentage of the accumulated reversionary bonus.

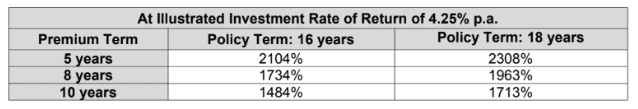

The below illustration shows the maturity bonus you’re entitled to at an investment rate of return of 4.25% per annum:

Surrender Bonus

Upon surrendering your policy, Manulife may choose to pay a non-guaranteed surrender bonus.

As soon as your policy reaches its 3rd anniversary, you are eligible for the surrender bonus.

Surrender bonuses are expressed as a percentage of accumulated reversionary bonuses.

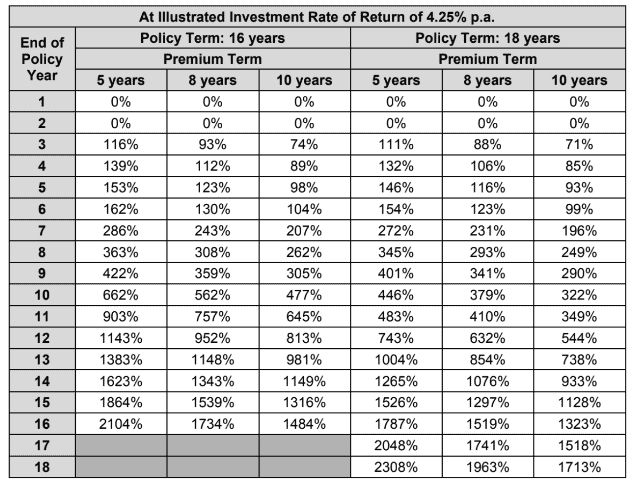

The table below details the surrender bonus you’re entitled to at an investment rate of return of 4.25% per annum:

Claim Bonus

Manulife may issue a claim bonus when you make a successful claim on your policy.

The claim bonus is expressed as a proportion of the accumulated reversionary bonus.

The following table shows the claim bonus you’re entitled to at an investment rate of return of 4.25% per annum:

Manulife GrowSecure Fund Performance

Premium Allocation

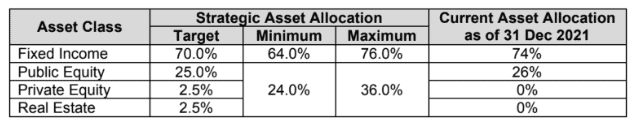

Manulife seeks to follow the above asset allocation so that your policy is able to achieve the guaranteed benefit, capitalise on new opportunities, and remain solvent.

Your guaranteed benefits are primarily obtained from bonds belonging to the fixed income asset class.

The fixed income asset class also comprises money market instruments and cash.

As a result of the higher investment returns generated by real estate and public and private equity, your non-guaranteed bonuses generally come from these assets.

Manulife GrowSecure Fund Performance

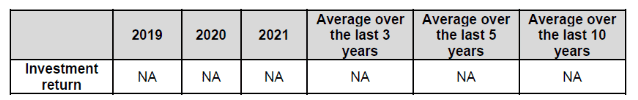

Accurate as of 31 December 2021.

Since the participating fund was established in April 2021, historical return of investment rates are unavailable.

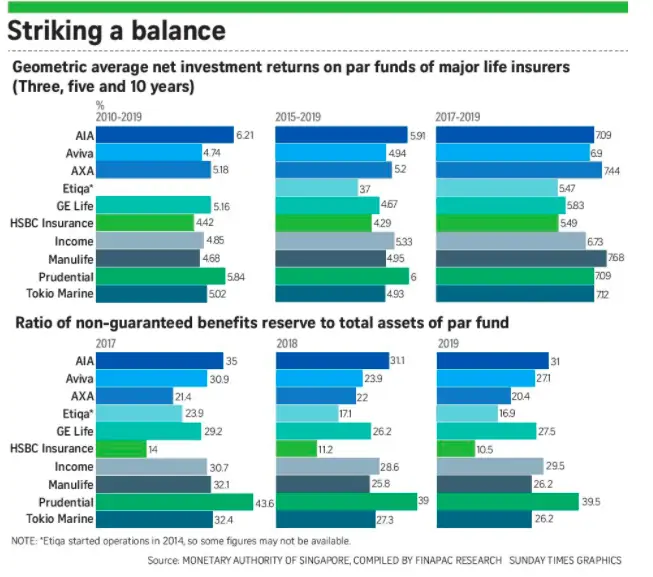

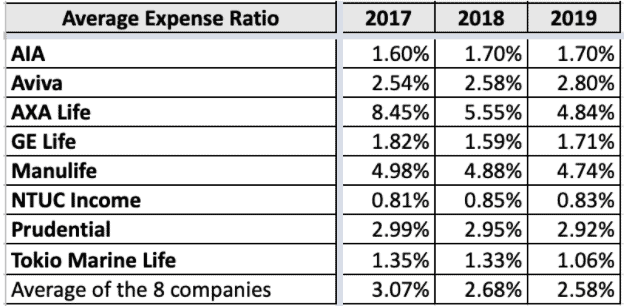

However, we can try to estimate the fund performance based on other participating funds by Manulife. Even better, the geometric average net returns give a good gauge of this:

Manulife’s par funds have been performing averagely in terms of the geometric net average over 5 and 10 years. However, the has the highest 3-year returns from 2017 to 2019.

Take note that the information is dated, so use this as a gauge only.

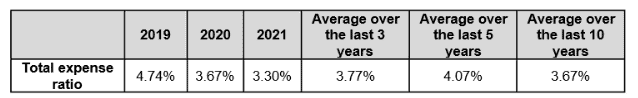

Total Expense Ratio (TER)

The TER is the portion of the participating fund’s assets used to cover various expenses incurred by the fund.

These expenses can include investment costs, management fees, distribution fees, taxes, and other related expenses.

The premiums you pay for your policy account for the expected expenses incurred by the participating fund. Therefore, these expenses are not an additional cost to you.

However, if the actual expenses differ significantly from the expected level, it may impact the non-guaranteed benefits you could receive.

The following table shows the historical total expense ratios for the participating fund:

Accurate as of 31 December 2021.

Compared to other market players, Manulife has the second-highest TER and is also above the industry averages between the years 2017 to 2019.

However, the change in annual TER was on a downward trend; from as high as 4.98% in 2017, to the most current 3.30% in 2021.

Despite having one of the highest TER, Manulife has shown a dedication to reducing costs. If continued consistently, this could lead to even higher rates of return in the future.

It’s also worth noting that the fund was recently established in April 2021.

Surrender/Ending the Policy

You may choose to surrender/terminate the policy through the following ways:

- When Manulife receives the insured’s written request to end the policy.

- When the policy lapses.

- The death of the life insured.

- When the death benefit is fully accelerated as a result of TI benefit claim or other supplementary benefit paid as an acceleration of the death benefit.

- On the benefit end date indicated on the endorsement or schedule page.

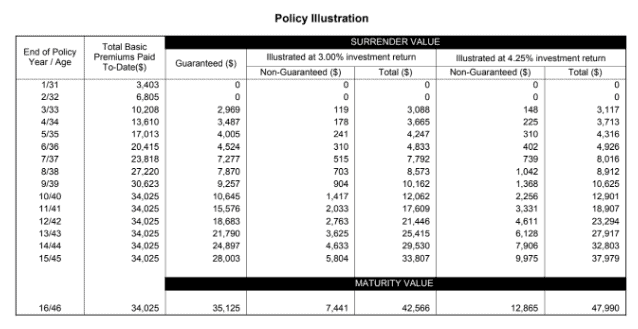

Manulife GrowSecure Surrender Value

The above showcases the benefit illustration (BI) of a policyholder who has annual savings of approximately $6,000 for 10 years with the Manulife GrowSecure.

As shown, the insured will have up to $60,000 of total savings during this period.

The policy’s guaranteed aspects enable him to “breakeven” at the policy’s 15th anniversary with $62,474 should he surrender his policy.

With that, many financial consultants will attempt to sell you this policy based on both the guaranteed and non-guaranteed portions.

While that is not wrong of them, these 2 reasons detail why we should only focus on the policy’s guaranteed aspect:

- The guaranteed aspect is what you will definitely receive upon surrendering your plan. Anything beyond the guaranteed amount is a bonus as you may or may not obtain it.

- The returns stated in the BI are based on an illustrated amount. As such, you may receive much more or less non-guaranteed returns depending on your investment’s performance (note that the GrowSecure isn’t an investment plan).

That being said, do not completely disregard the non-guaranteed aspect of your policy.

It may be tempting for Manulife to declare zero returns under non-guaranteed benefits, but this doesn’t make business sense.

Imagine the backlash and potential legal repercussions Manulife would face if they made they do so.

Therefore, they will almost certainly include non-guaranteed returns, but the exact returns are usually unknown.

Take note that every policy has a different surrender value, so make sure to check your policy documents or ask your financial advisor.

Manulife GrowSecure Fees and Charges

The plan has taken into account all the expenses from the participating fund when calculating the premiums for your policy.

This means that you won’t be charged any additional fees for these expenses.

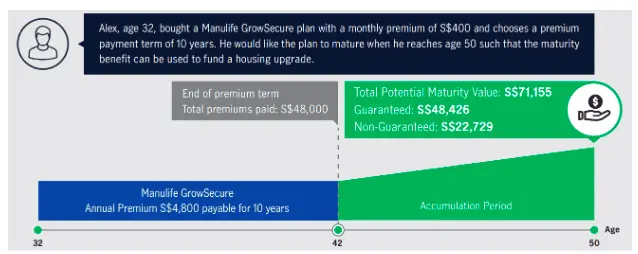

How much will I receive upon maturity of the Manulife GrowSecure?

The above illustration assumes a 4.75% rate of return.

In the case where no withdrawals are made and you manage to accumulate the entire amount, save $4,800 annually, and opt for a 10-year premium term, you will have a total return of $71,155 upon maturity at 50 years old.

$48,426 of it will be guaranteed, while the remainder is the non-guaranteed portion.

Summary of the Manulife GrowSecure

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the Manulife GrowSecure

I’d say the Manulife GrowSecure pretty decent capital-guaranteed endowment plan.

It’s also somewhat flexible, whereby you can select the duration of your policy to be either 16 or 18 years, and have the flexibility to choose from 3 premium payment options: 5, 8, or 10 years.

Protection-wise, the policy provides coverage against death, accidental death, and terminal illness.

Additionally, premium payments are waived if you’re diagnosed with total permanent disability.

Manulife GrowSecure’s flexible features put it above the crowd, with options to switch the life insured of your policy and freeze your premiums!

However, I believe that there are better endowment plans out there, like the Manulife ReadyBuilder – which has everything the GrowSecure has but with a loan feature and a track record for its par funds.

I suggest reading our post on the best endowment plans in Singapore so that you can find one that’s suitable for you (spoiler: there are).

Need help in finding the best plan for your needs?

We partner with unbiased financial advisors to assist you with this!