The ManuInvest Duo is an insurance-focused investment-linked plan (ILP) that provides holistic insurance coverage while offering investment opportunities.

With the freedom to tailor your insurance coverage and premium plans, it is a versatile policy that can be customised to suit your protection needs and investment appetite.

In this review, we unpack the features of the ManuInvest Duo to determine if it’s suitable for you!

Keep reading;

My Review of the ManuInvest Duo

If you’re looking for a comprehensive insurance policy with long-term investment opportunities, Manulife’s ManuInvest Duo could be a great option.

Protection-wise, the ManuInvest Duo policy offers death, TI and TPD, optional early critical illness, and critical illness coverage.

Investment-wise, the ManuInvest Duo has a range of sub-funds for your selection.

The investment options offered can potentially provide higher returns than traditional endowment and whole life policies.

Additionally, the ManuInvest Duo is highly flexible, with adjustment features that enable you to alter the life insured under the policy, and the regular premium amount.

However, as this is an insurance-focused ILP, we can’t recommend it as it does not provide enough value.

The fees are a high 5% in your first 5 years. Many investment plans only have fees that go up to 3%.

Yes, the ILP fees drop to 1% after that, but you have to pay an additional fund-level fee that is not included in the fund returns.

This is because they invest in Manulife’s own funds that do not include these fees in the returns calculations.

Speaking of fund returns, I checked the annualised returns on the equity funds (generally higher returns due to higher risk).

The performance isn’t that fantastic. This is a concern as your insurance coverage and retirement fund is tied to this performance.

If the funds don’t perform well, the insurer will deduct (the already declining) account value to pay for the insurance portion.

And this is a big concern – something our team have been seeing more of these past few years due to the pandemic and recession.

You’ll find better value in purchasing a term plan at much lower costs with higher death coverage.

The money saved can be invested in an investment-focused ILP with better quality funds and lower fees.

Alternatively, a whole life plan with good participating fund performance will also be a better option.

This way, you get a bang for your buck + better returns on your investments.

Still unsure of whether this policy best suits your needs?

It’s best to get a second opinion and explore other alternatives to get the best policy for yourself.

And with the Manulife ManuInvest Duo requiring a minimum investment period of up to 20 years, it’s best to take some time to do this research.

If you’re interested in a free second opinion or are keen to explore alternatives, we partner with unbiased financial advisors who can assist you with this.

Click here to get a second opinion.

Here’s more on the Manulife ManuInvest Duo:

Criteria

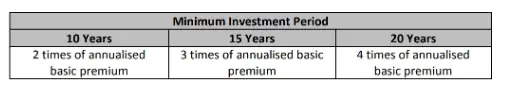

- Minimum Investment Period (MIP): 10, 15, or 20 years

- Minimum Regular Basic Premium: $1,800

General Features

Premium Payments

The following table illustrates the minimum regular premiums you’re required to pay yearly:

| Minimum Investment Period (MIP) | 10 years | 15 years | 20 years |

| Minimum Yearly Premium Payable | $3,600 | $2,400 | $1,800 |

Adhoc Top-Ups

You may make top-ups on an adhoc basis. Each adhoc top-up must be minimally $500 per sub-fund.

As top-up premiums contribute to your policy’s value, it may be eligible for the Loyalty Bonus.

However, top-up premiums will not increase your policy’s sum insured and may require financial underwriting.

Premium Allocation

100% of your basic premium payments will be applied to purchase units of your chosen sub-funds at the unit price.

Your premium allocation’s initial percentage must be at least 10% and above and a whole number.

Thus, you may select up to 10 sub-funds.

Protection

Death Benefit

A policyholder can choose the amount of protection (sum assured) they want when signing up for the policy. This can be up to 100 times the amount of your first-year premium.

So, for example, your yearly premiums are $1,800. You can choose up to a 100X multiple ($1,800,000) as your sum assured.

Note that the higher your multiple, the more your premiums will be used to provide you with insurance coverage (instead of being invested).

In the event that the policyholder passes on, a payout of either of the following would be disbursed, whichever is higher:

- Sum Assured – Partial Withdrawals – Outstanding Payables

- Policy Value – Outstanding Payables

Terminal Illness (TI) Benefit

Should the policyholder be diagnosed with TI before the policy anniversary immediately after he turns 99, his death benefit will be accelerated in a lump sum.

The maximum TI benefit for the ManuInvest Duo is $1 million.

The policy will remain active until the death benefit is completely accelerated.

Total and Permanent Disability (TPD) Benefit

If the policyholder encounters TPD before the policy anniversary upon age 70, the TPD benefit would be paid in a lump sum, accelerating the death benefit.

The TPD benefit claimable across all Manulife policies is capped at $5 million.

The policy will still be inforce if the death benefit is not fully accelerated.

Optional Riders

You may also increase your policy’s protection through optional early critical illness and critical illness riders.

Key Features

Change in Sum Insured

You may submit a request to adjust your policy’s sum insured.

The cost of insurance charges will apply to the adjusted net amount at risk after applying changes to the sum insured.

Increase of Sum Insured

For requests to increase the sum insured, you may raise them at the upcoming monthiversary of your policy.

Approval is subject to underwriting and must be within the minimum and maximum sum insured stipulated by Manulife.

The minimum and maximum amounts are not disclosed.

Increasing your sum insured would mean lesser money in the investment portion.

Decrease in Sum Insured

For requests to reduce the sum insured, you may raise them at the upcoming monthiversary of your policy, and after the end of the MIP.

Approval is subject to the minimum and the maximum sum insured stipulated by Manulife. Similarly, these amounts are not disclosed.

Should the sum insured of the supplementary benefit(s) tied to your policy go beyond the maximum allowable limit, it will be reduced accordingly.

Likewise, reducing your sum insured will increase your premiums in the investment portion.

Change of Life Insured

You can change the policy’s life insured upon meeting underwriting and administrative requirements.

The following conditions are to be met:

- You have an insurable interest on the new life insured at the time change is effected

- The new life insured must be alive on the policy’s effective date

Upon successful change, the cost of insurance will be recalculated based on the proposed new life insured.

This feature is subject to an administrative charge of $100, which is waived by default. However, Manulife may impose the fee at their discretion.

Vary Regular Premium

At the end of the MIP, you may increase or reduce your policy’s basic premium within the specified limits.

There are no mentions of the minimum and maxim increase/decrease in premiums, but I believe you must still meet the minimum basic premiums below:

| Minimum Investment Period (MIP) | 10 years | 15 years | 20 years |

| Minimum Yearly Premium Payable | $3,600 | $2,400 | $1,800 |

It’s important to note that increasing your premium won’t alter your policy’s sum insured.

Premium Redirection

You may submit a written request to direct your future regular basic premiums into other chosen sub-fund(s) without affecting the sub-fund(s) that you currently own.

Premium redirection can only be made to a maximum of 10 sub-funds.

The minimum proportion you are required to allocate per sub-fund is 10%.

Partial Withdrawals

You can withdraw a portion of your policy’s value, as long as you maintain an account balance of $1,000.

The minimum amount per partial withdrawal is $350.

Premium Flexibility Benefit

Commencing from your policy’s 6th anniversary till the end of the MIP, the premium flexibility benefit will kick in automatically should you fail to make regular premium payments within the grace period.

The premium flexibility benefit entails the total basic premiums you can miss paying without incurring premium shortfall charges.

This works similarly to a premium holiday.

The premium flexibility benefit is subject to the following limits:

During the period when the premium flexibility benefit is activated, all premium-paying supplementary benefit(s) tied to your policy will remain in force.

Regular premium payments for your riders will be subtracted from your policy’s value by cancelling sub-fund units.

Should your policy’s value be insufficient to fulfil the relevant charges and fees it is subjected to, the policy will be cancelled.

Fund Switching

There is no cap on the number of fund switches you can make under ManuInvest Duo.

Each fund switch must be minimally $500.

Should your sub-fund account value be less than $500, you must switch out all your sub-fund units.

Automatic Fund Rebalancing

Commencing from your 2nd policy anniversary, you may activate automatic fund rebalancing for your policy.

This feature redistributes your sub-funds at every policy anniversary according to the basic premium allocation that you’ve previously set.

Do note that automatic fund rebalancing will only occur if your portfolio’s variance from your pre-set basic premium allocation is more than 5%.

It’s also crucial to note that the following actions will result in the cancellation of this feature:

- Fund switching

- Premium redirection

- Partial withdrawal

- Top-up premium

You must re-apply for automatic fund rebalancing, subject to Manulife’s approval.

Maturity Benefit

You will receive a maturity benefit valued at your policy’s value upon the policy anniversary when you turn 99 years old.

The payout will be deducted from any outstanding fees and charges owed.

Dividend Payouts

If you’ve invested in dividend-yielding sub-fund(s), you will receive dividends according to the number of sub-fund units you have.

You may either opt to reinvest your dividends or encash them.

Your sub-fund must yield a $40 and above dividend to encash your dividends. Dividends below $40 will be reinvested by default.

Please note that dividends are not guaranteed. The frequency of dividend distribution is subject to the relevant fund manager’s discretion.

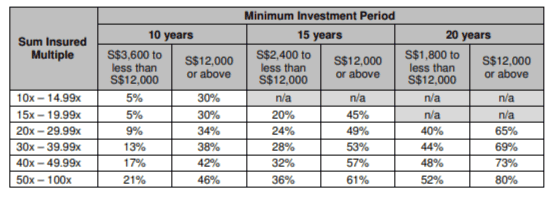

Welcome Bonus

The welcome bonus is computed as a percentage of the first 12 months of your regular basic premium payments, subtracting top-up premiums.

The following shows the Welcome Bonus rates for each MIP:

Referencing the above table, the sum insured multiple is the sum insured as at the policy’s date of issue divided by the annualised basic premium.

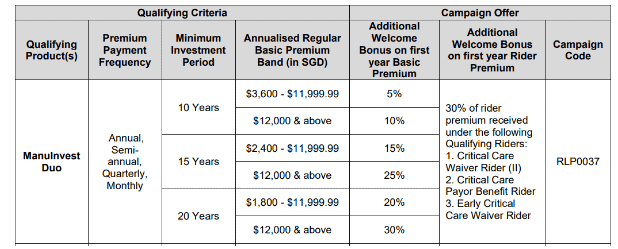

Additional Welcome Bonus (Q2 2023)

With Manulife’s Q2 2023 Additional Welcome Bonus Campaign, you may enjoy as much as a 30% additional bonus on basic premium and rider premium, respectively!

You must complete and submit your policy application for the ManuInvest Duo between 1 February 2023 and 31 July 2023 (including both dates).

More details of the promotion can be found in the table below:

Source: Manulife Q2 2023 Additional Welcome Bonus Campaign

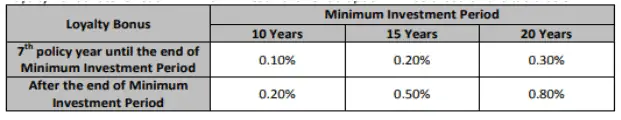

Loyalty Bonus

You are entitled to an annual loyalty bonus during your policy period commencing from your policy’s 6th anniversary.

The loyalty bonus is a lump sum payout that out be disbursed during your policy’s anniversary.

As a percentage of your policy’s value, additional premiums will be paid proportionately, according to your basic premium allocation.

This bonus is a proportionate percentage of your account value, which is paid out to you in one lump sum on your policy anniversary.

You may reference the below table for the loyalty bonus rates tied to each Minimum Investment Period:

ManuInvest Duo Fees and Charges

Cost of Insurance

The cost of insurance is a monthly charge calculated based on 4 factors:

- Age

- Gender

- Smoking Status

- Net Risk (NAAR)

This charge will only be imposed if your total account value is lower than your sum assured.

Fund-Related Fees

Ranging from 0.6% to 1.95%, the annual management fee for ILP sub-funds differs across the sub-funds offered.

As ManuInvest Duo invests in Manulife’s own ILP sub-funds, there returns you see on the fund factsheet do not include the fees payable.

Thus, you’ll have to check how much additional fees you’ll incur before calculating your returns on the fund level.

Administrative Charge

The administrative charge is payable monthly during the policy term.

It is based on the below structure:

| Policy Year | Administrative Charge |

| 1 to 5 | 5% p.a. |

| 6 onwards | 1% p.a. |

Surrender Charge

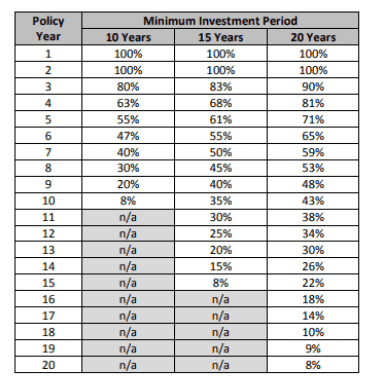

A surrender charge will be imposed if you decide to withdraw from your policy’s value during the Minimum Investment Period (MIP).

The formula for computing the surrender charge is as follows:

Surrender charge percentage x Number of sub-fund units surrendered x Unit price of each respective sub-fund(s)

The below table illustrates the surrender charge percentages according to the MIP:

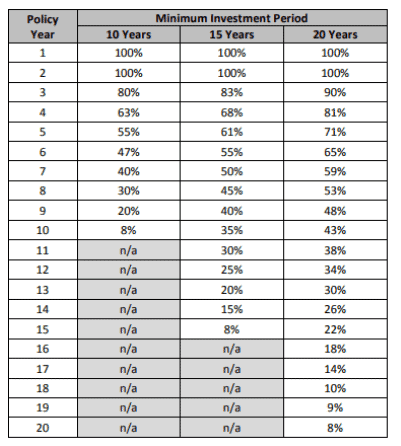

Partial Withdrawal Charge

You will be charged fees for partial withdrawals made during the MIP, subject to the limits set.

Here is the formula to calculate your partial withdrawal charge:

Policy Year’s partial withdrawal percentage charge x policy value withdrawn

Below are partial withdrawal charge percentages for the corresponding policy year and MIP:

However, a transaction fee of $50 will be imposed on every partial withdrawal made after your policy’s 5th anniversary until the end of the MIP.

This is subject to a maximum partial withdrawal of not more than 20% of the previous policy year’s premium payments.

So if you made $10,000 in premium payments last year, you can only withdraw up to $2,000 (20% of $10,000) this year.

Any partial withdrawal amounts that exceed this flexibility amount will be subjected to the partial withdrawal percentage charges.

But, if the partial withdrawal charges are lower than $50, then only the transaction fee will be imposed.

The partial withdrawal charges will be subtracted from the sale proceeds of your sub-fund unit(s) you requested to withdraw.

| Period of Withdrawal | Amount | Charges |

| Within 5 policy years | Within 20% limit | Premium withdrawal charge |

| Past 20% limit | Premium withdrawal charge | |

| After 5 policy years | Within 20% limit | The lower of:

|

| Past 20% limit | $50 + premium withdrawal charge on excess amounts |

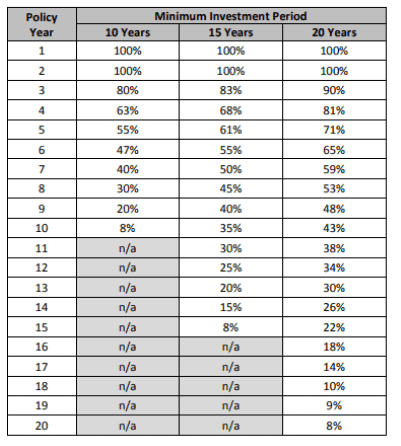

Premium Shortfall Charge

If you fail to pay your regular basic premium during the MIP, a premium shortfall charge will be incurred for the missed premium on a monthly basis.

The applicable premium shortfall charge percentage is shown below:

Summary of ManuInvest Duo

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Value Benefits | Available |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | Yes |

| TPD | Yes |

| Terminal Illness | Yes |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

| Optional Add-on Riders | Available |