HSBC Life EmpoweredMum is a maternity insurance plan covering early caesarean section delivery and more – the first of its kind in Singapore.

This plan acts as a bundled policy together with the HSBC Life – Life Treasure (II) or Flexi Protector.

It can also be used as part of a bundle to make products like the HSBC Life HappyMummy or HappyFamily.

It’s a simple policy, but it can get confusing for many – even us!

Take some time to read our review of the HSBC Life EmpoweredMum, so you’ll understand it better!

Criteria

- Pregnant mothers

- One-child pregnancies

- Single premium

General Features

Premium Payment Term

The HSBC Life EmpoweredMum is a single premium policy that accumulates no cash value. The premiums you pay depend on various factors such as age and smoker status.

Policy Term

The HSBC Life EmpoweredMum has a policy term of 3 years. This means that you and your newborn will be covered for 3 years!

Key Features

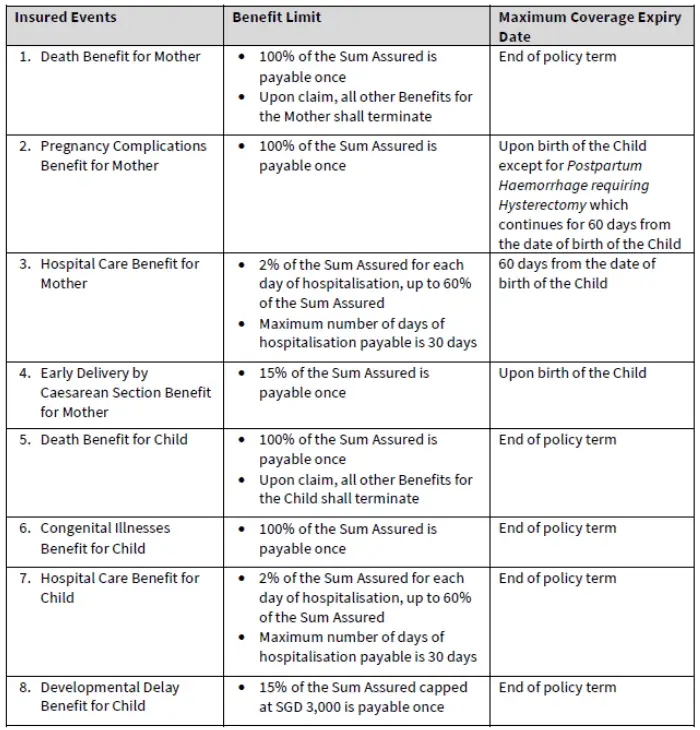

Table of Summary of Benefits

Before we dive into each of the insured events deeper, here are the limits to each of the benefits:

Coverage For Mother

Death Benefit

If the mother passes away while the HSBC Life EmpoweredMum Policy is active, a benefit of 100% of the sum assured is paid out, less outstanding debts related to the policy.

If the mother’s death occurs during pregnancy, the policy automatically ends when the benefit payment is made.

If the mother’s death occurs after the birth of her child, the benefit amount is 100% of the sum assured, along with any remaining benefits under the policy.

After this payment, the policy will terminate.

However, the remaining benefits for the child will continue if the specified benefit limit has not been reached and it is before the coverage expiry date.

In the case of a miscarriage, the death benefit will continue until the end of the policy term.

Pregnancy Complications Benefit

From the start of the HSBC Life EmpoweredMum until 60 days after your child is born, you are entitled to a benefit of 100% of the coverage amount (after deducting any outstanding debts).

This benefit can only be claimed once, and the policy ends once the coverage amount is paid or your child is born.

However, if you experience postpartum haemorrhage requiring a hysterectomy, you can keep receiving the benefit for up to 60 days from your child’s birth or until the benefit payment, whichever happens first.

If the Pregnancy Complications Benefit has ended because you claimed for any of the listed pregnancy complications, with the exception of a stillbirth, the other benefits under the policy will continue if the specified limits are not exhausted and it is before the coverage expiry date.

However, if the Pregnancy Complications Benefit is paid out due to a stillbirth, all benefits for your child will automatically end.

The remaining benefits under the policy will continue for you if the specified limits are not reached, and it is before the coverage expiry date for those remaining benefits.

It’s important to remember that this benefit is only paid once, even if you’re expecting multiple little ones at once.

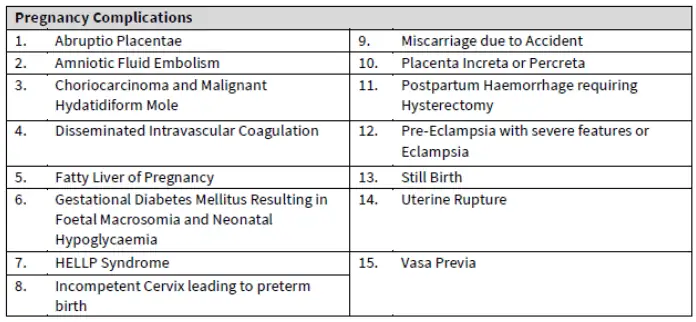

Please take note of the list of pregnancy complications:

Hospital Care Benefit

If you are hospitalised due to any of the pregnancy complications covered or other specified hospitalisation events 60 days after your child’s birth, you will receive a benefit of 2% of the agreed coverage amount for each day of hospitalisation.

The total benefit amount can go up to 60% of the coverage amount, and the maximum number of days for which this benefit will be paid is 30 days.

This benefit ends automatically when the total benefit amount reaches the coverage limit or 60 days after your child’s birth, whichever comes first.

The remaining benefits under the policy for you and your child will continue if they are below the specified limits and are within the coverage expiry date.

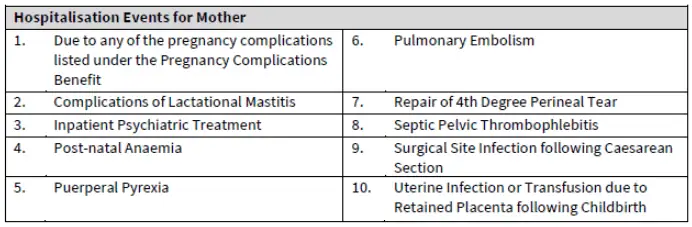

Here is the list of hospitalisation events for purposes of this benefit:

Early Caesarean Section Benefit

Sometimes, pregnancies can be a bit more complex and require a caesarian section before the 36th week of gestation.

If this happens, HSBC Life will pay 15% of the coverage amount. That is after deducting any outstanding debts related to the policy.

It’s important to note that this benefit only applies to pregnancies with a single baby (singleton pregnancies).

In the event that you make a claim for this benefit as well as a claim for another covered benefit under the policy, only the higher amount is honoured.

If the specified limits have not been reached and the coverage expiry date has not passed, the remaining benefits under the policy will continue to apply to you and your child.

This benefit ends automatically after the benefit payment or upon your child’s birth date, whichever happens earlier.

Coverage For Newborns

Death Benefit

If the newborn baby passes away anytime between childbirth and the policy’s expiration date, a benefit payment of 100% of the sum assured after deducting any outstanding debts related to the policy is provided.

Once this payment is made, the benefit automatically ends. Additionally, all remaining benefits under the policy for the deceased child will also automatically end.

If you have multiple pregnancies, each child’s death benefit applies separately.

As long as the remaining benefits are within the specified limits and before the coverage expiration date, they will continue to be covered.

It’s important to note that this benefit does not cover stillbirth (the loss of a child before birth).

Congenital Illnesses Benefit

If the newborn child is diagnosed with any of the listed congenital illnesses from the moment of birth until the policy expires, 100% of the sum assured will be paid.

However, any outstanding debts will be deducted first.

If it is a multiple pregnancy, the congenital illnesses benefit for each child applies separately.

This benefit ends automatically upon the benefit payment for the individual child or upon the policy’s expiration date, whichever happens earlier.

The remaining benefits will continue as long as the remaining benefits are below the specified limits and before the policy’s expiration date.

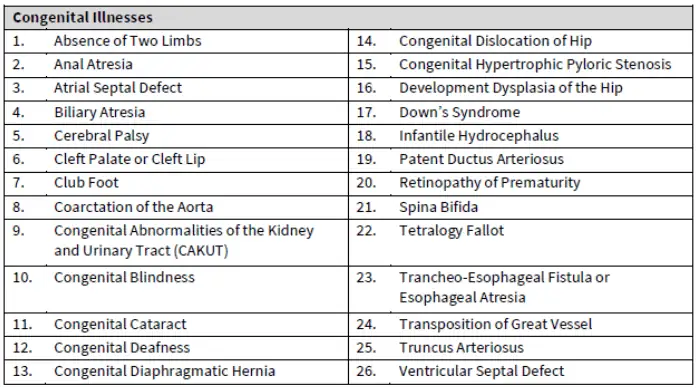

Here is the list of congenital illnesses for purposes of this benefit:

Hospital Care Benefit

If the newborn is hospitalised due to any of the listed hospitalisation events from the time of birth until the policy expires, a daily benefit payment of 2% of the coverage amount for each day of hospitalisation is provided.

The total benefit amount can go up to 60% of the coverage amount. However, the maximum number of days for this benefit will be paid is 30 days.

This benefit ends automatically when the total benefit amount reaches the coverage limit or upon the policy’s expiration date, whichever comes first.

Other benefits will continue as long as the remaining coverage is below the specified limits and before its expiration date.

Each child’s hospital care benefit limit applies separately if it is a multiple pregnancy.

If the limit is reached for one child, the limit for the other children remains available.

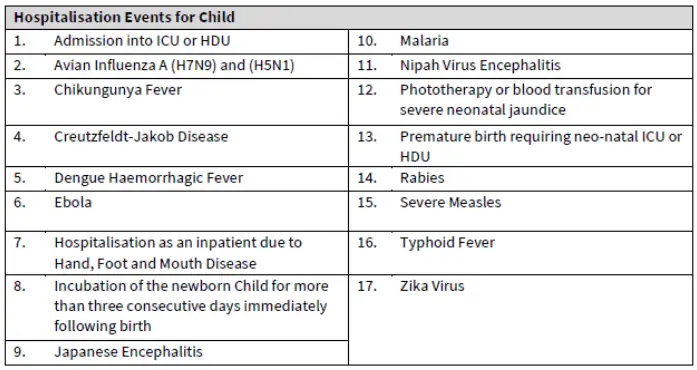

Here is the list of hospitalisation events under this benefit:

Developmental Delay Benefit

Should the newborn be diagnosed with a developmental delay in gross motor or speech development from the age of 28 months until the policy expires, the Developmental Delay Benefit is paid out.

In such a case, a benefit payment of 15% of the coverage amount is provided, up to a maximum of $3,000, minus any outstanding policy-related debts.

This benefit ends automatically after the benefit payment or upon the policy’s expiration date, whichever comes first.

The remaining benefits under the policy for the mother and child will continue if the specified limits aren’t exhausted and it is before the coverage expiry date for those remaining benefits.

The developmental delay benefit amount applies separately to each child if it is a multiple pregnancy.

If a claim is made for the developmental delay benefit for one child, the benefit amount remains available for the other children.

My Review of HSBC Life EmpoweredMum

The HSBC Life EmpoweredMum is a pretty good maternity insurance plan – especially when you bundle it to make the HSBC Life HappyMummy or HSBC Life HappyFamily.

It provides coverage for early delivery by caesarean section, which means that if you give birth before 36 weeks of gestation through caesarean section, you will receive 15% of the sum assured.

This benefit is the first of its kind in Singapore; not many maternity policies cover it.

So, if you’re looking for a policy covering caesarean section, you might want to consider the HSBC Life EmpoweredMum.

You at least have 15% of it covered.

This comprehensive plan also offers coverage for a range of pregnancy complications, congenital illnesses, and hospitalisation events.

It ensures that you and your baby are protected throughout the pregnancy and even after!

However, there are a few drawbacks I must point out.

Firstly, this policy only covers singleton pregnancies – so if you’re expecting twins or more, this isn’t for you.

It also doesn’t cover IVF and other forms of assisted conception procedures. Based on our experience, many Singaporeans are interested in more comprehensive maternity policies and opt for Singlife Maternity Care.

Premium-wise, there might be other more value-for-money policies in the market, though this will depend on each individual.

We suggest checking out our post on the best maternity insurance plans and comparing policies that suit you best.

If you’re unsure or need a second opinion, we partner with unbiased MAS-licensed financial advisors to assist you with this.

Click here for a non-obligatory consultation.