The CPF Special Account (SA), alongside the CPF Ordinary Account (OA) and CPF MediSave Account (MA), is a savings account managed by the Central Provident Fund (CPF) Board as part of Singapore’s national savings scheme.

To boost retirement planning efforts, the CPF Board has advocated the Retirement Sum Topping-Up scheme (RSTU), where CPF account holders make cash top-ups to their SA, or CPF Retirement Account (RA), created at the age of 55.

In this post, I will share an instructional guide to orient you through the steps to making a cash top-up for your personal or loved one’s CPF SA or RA.

Before I begin, I believe it’s important to understand why it’s beneficial to top up your CPF Special Account.

Benefits of Topping Up Your CPF Special Account (CPF SA)

Topping up your CPF SA (or RA, should you be over 55 years old) allows you to enjoy higher interest rates, monthly retirement payouts, and tax reliefs.

Higher Interest

With the CPF SA and RA offering an interest of 4% per annum respectively, it provides a higher interest rate than the 2.5% per annum that the CPF OA provides.

Additionally, you will enjoy added interest rates on the combined balances of your CPF SA and RA:

| Account holder or recipient below age 55 | Extra 1% interest per annum on the first $60,000* |

| Account holder or recipient aged 55 and above | Extra 2% interest per annum on the first $30,000 and extra 1% on the next $20,000*. |

*Interest is capped at $20,000 for CPF OA.

As such, making cash top-ups to your CPF SA or RA yields greater savings through the higher compound interest rate and extra interest rates.

Don’t forget, the interest you earn from your CPF accounts are (almost) risk-free too!

To further enhance your SA or RA interest earnings, leverage on the compounding interest by making cash top-ups early in the year.

By making a top-up in January instead of December, you can receive as much as 20% more interest on your cash top-ups in 10 years.

Learn more hacks and tips to maximise your CPF in this article!

Larger Monthly Payouts Upon Retirement

Higher compound interest from your CPF SA or RA will yield greater retirement savings. This will translate to larger monthly payouts upon your retirement.

Wondering how you can spend your retirement fruitfully? Read this article for inspiration!

For tips on how you can plan your retirement, check out this article.

Matched Retirement Savings Scheme (MRSS)

Additionally, if you or your recipient is 55 and older, the MRSS scheme can contribute added monies to the RA, increasing monthly retirement payouts.

The MRSS scheme is extended to CPF account holders who have yet to hit their Basic Retirement Sum (BRS), to aid them in achieving sufficient CPF monies for retirement.

To qualify for the MRSS, the CPF account holder must fulfil the following:

- Be a citizen of Singapore

- Be 55 to 70 years old as of 31st December in the year of assessment

- Have a Retirement Account (RA) balance below the current BRS

- Have an average monthly income of S$4,000 or less

- The annual value of residence does not exceed S$13,000

- Not own more than one property

The CPF Board will automatically assess your eligibility for the MRSS; no application is needed.

You will be notified at the beginning of every year should you qualify. Additionally, you may review your eligibility status via CPF Board’s MRSS checker or your CPF account’s Retirement Dashboard.

Should you or your recipient qualify for the MRSS at the time of the cash top-up, the government will fulfil a matching grant for every $1 cash top-up made. This matching grant is capped at $600 annually and will be reimbursed to the RA1 at the beginning of the next calendar year.

Also applicable for account holders turning 55 later in the year that are eligible for MRSS

Tax Reliefs

Under the CPF Cash Top-Up Relief, you are entitled to tax relief claims of up to $16,000:

- For cash top-ups to your personal CPF SA or RA: up to $8,000 per calendar year.

- For cash top-ups to the Special Account or Retirement Account of your loved ones: An additional $8,000 per calendar year. This is on top of the $8,000 tax relief you are entitled to under top-ups to your personal SA.

Your loved ones include your spouse, parents, siblings, grandparents, parents-in-law, or grandparents-in-law.

Wish to enjoy greater tax relief? Discover more ways to reduce your taxes legally.

Points to Note When Making Top-Ups

Top-Up Limit

Your CPF cash top-ups are capped at a maximum amount known as the top-up limit.

The CPF Board derives your top-up limit using the following computations:

| Account holder or recipient below age 55 | Current Full Retirement Sum – (SA savings + net SA savings withdrawn under CPF Investment Scheme for investments that are not completely disposed of) |

| Account holder or recipient aged 55 and above | Current Enhanced Retirement Sum – RA savings |

The Retirement Account savings include the cash balance in your RA (excluding interest earnings and governmental grants) and your CPF Life withdrawals.

Upon submitting your cash top-up application, your top-up limit will be displayed.

Top-Ups are Irreversible

You cannot reverse a top-up you make to your SA once it has been deposited.

So make sure you know that topping up your SA is what you actually want.

9 Step-by-Step Instructions on How to Top Up Your CPF SA (or RA)

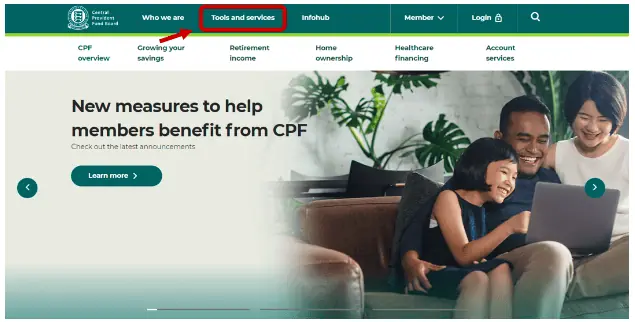

Step 1: Access the CPF Website

Head to the CPF website and click on “Tools and Services”.

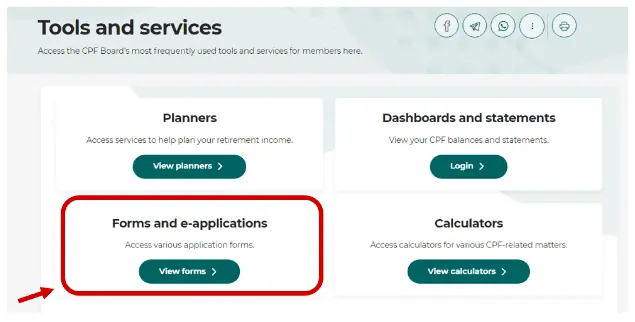

Step 2: Forms and E-Applications

Under the “Tools and Services” tab, select “Forms and e-applications”.

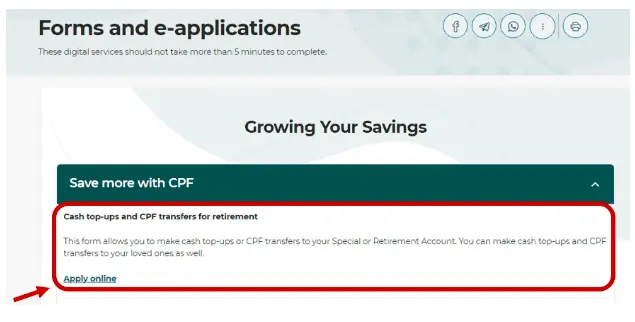

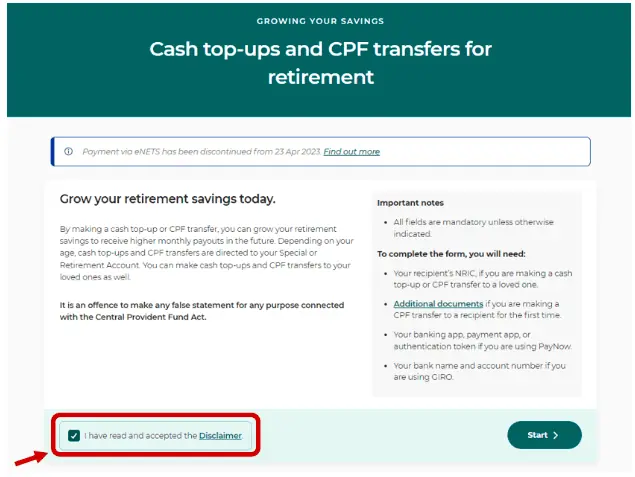

Step 3: Cash top-ups and CPF transfers for retirement

Under the “Growing Your Savings” section, click on “Save More with CPF”. Select the “Apply online” option under “Cash top-ups and CPF transfers for retirement”.

Step 4: Disclaimer

Read and accept the terms of the Disclaimer.

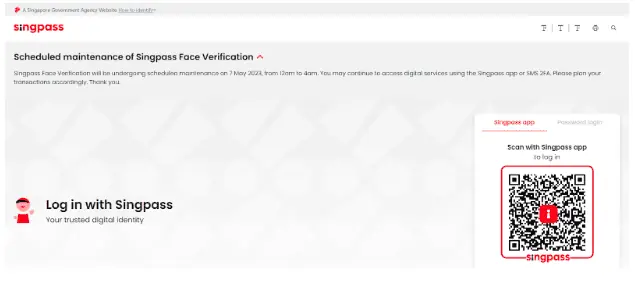

Step 5: Singpass Login

You will be directed to log into your Singpass account.

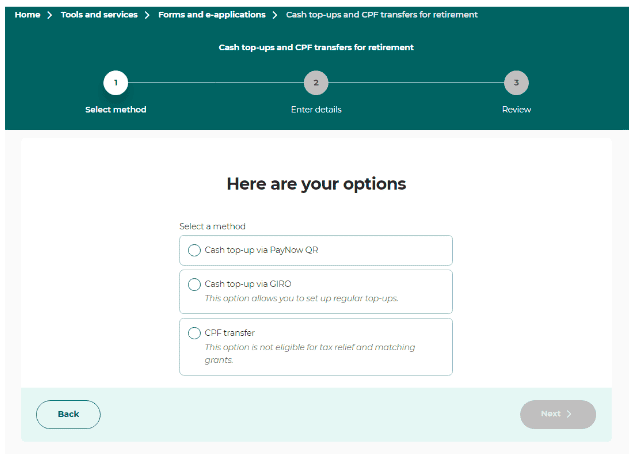

Step 6: Preferred Cash Top-Up Method

You may make top-ups via PayNow QR, or GIRO.

If you want a quick and instant cash top-up via your banking app, opt for the PayNow QR method.

Select the GIRO option if you prefer to arrange monthly or annual cash top-ups.

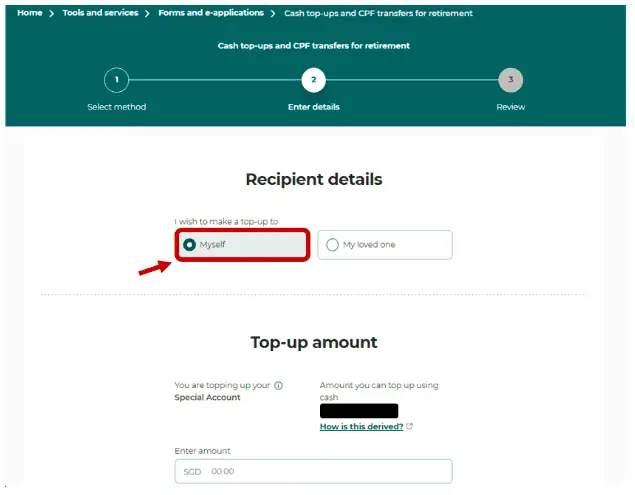

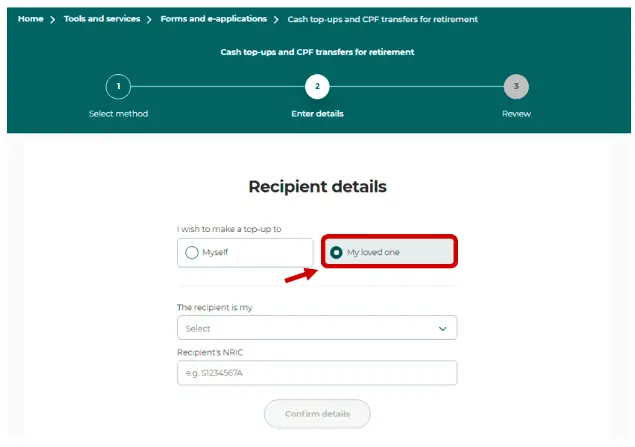

Step 7: Recipient Details

Select the recipient you want to direct the cash top-up to – yourself or your loved one.

If you make a cash top-up to your own SA or RA, you will be informed of your top-up limit.

You will also be directed to input the amount you wish to deposit.

If you are making a cash top-up to your loved one, you must indicate the relationship between you and your recipient and your recipient’s NRIC.

Should you be topping up your loved one’s SA for the first time, you will be requested to submit the respective document(s) of proof:

- Spouse: Your marriage certificate

- Parent: Your birth certificate

- Sibling: Birth certificates (you and your siblings’)

- Grandparent: Birth certificates (you and your parents’)

- Parent-in-law: Your marriage certificate and your spouse’s birth certificate

- Grandparent-in-law: Your marriage certificate and birth certificates (your spouse’s and parents-in-law)

Your marriage certificate will only be required if your marriage is registered overseas.

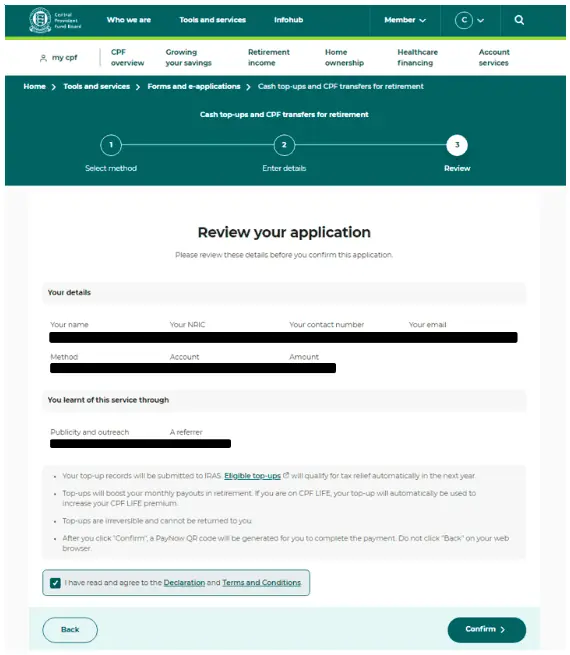

Step 8: Review Application

After checking the details of your top-up application, accept the terms and conditions and hit “Confirm”.

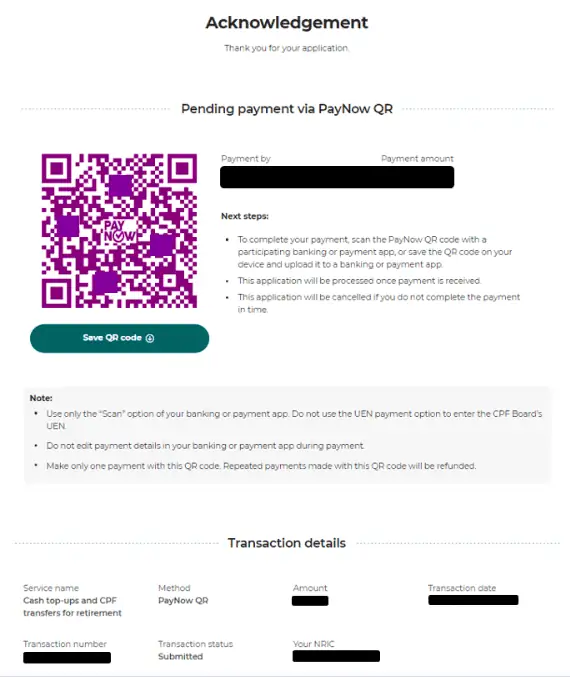

Step 9: PayNow QR Payment

You may proceed to scan the PayNow QR code via your banking app to make payment. Details of your transaction can also be found at the bottom of the page.

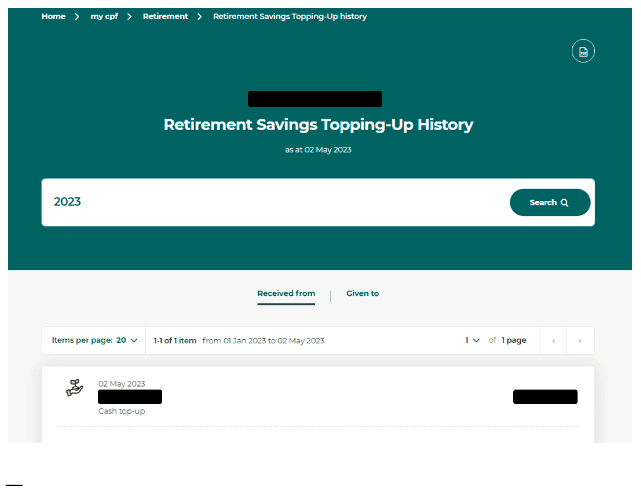

Checking CPF SA Top-Up Status

Your top-up will be reflected within one working day and you may review the transaction details via the CPF website.

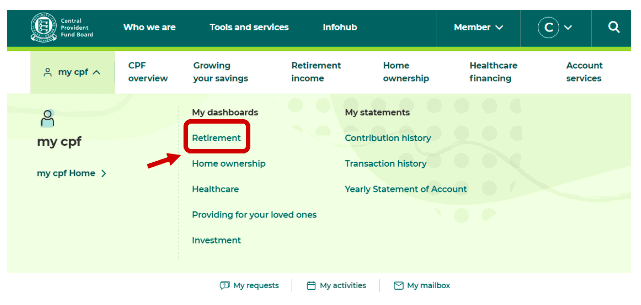

Step 1: Access the Retirement Dashboard

Log into the CPF website via Singpass and click on “my cpf”.

Under “My dashboards”, select “Retirement”.

Step 2: Review Transaction

You may check the details of your cash top-up under the Retirement Savings Topping-Up History.

Conclusion

We hope this article has been informative in walking you through the benefits of making SA or RA cash top-ups and the steps to do so.

Besides making cash top-ups, there is a myriad of ways that you may prepare ahead for retirement.

Retirement planning can be tedious and stressful, but you do not have to navigate it alone.

If you need help planning for your retirement, our reliable and unbiased financial advisors are here to help.

Share this article with your loved ones and friends should you have found it useful!

References

- https://www.cpf.gov.sg/member/growing-your-savings/saving-more-with-cpf/top-up-ordinary-special-and-medisave-savings

- https://www.cpf.gov.sg/member/growing-your-savings/saving-more-with-cpf/top-up-to-enjoy-higher-retirement-payouts

- https://www.cpf.gov.sg/member/tnc/cash-top-up-to-special-or-retirement-account

- https://www.cpf.gov.sg/member/faq/growing-your-savings/retirement-sum-topping-up-scheme/what-supporting-documents-would-i-need-if-i-m-making-a-first-time-cpf-transfer-