You have some shares or ETFs in your CDP account and are now thinking of selling them, but you’re not sure how to do it.

Or perhaps you’re wondering which is the cheapest brokerage to sell the securities in your CDP.

Don’t worry, here’s our guide to selling shares in your CDP account.

By the end of this article, we hope that you’ll be able to execute sell trades using your very own CDP account confidently.

The first action to take would be to check if you have any shares in your CDP!

How to check if I have shares in my CDP?

Log in

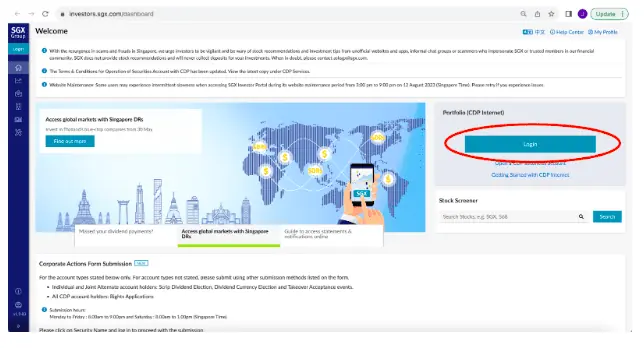

Firstly, you’ll need to head over to the SGX Investor’s Dashboard to log in to your CDP account.

Do note that this portal is for CDP Internet, meaning that if you have registered for a CDP account in person, you’re required to log in using your Singpass.

If you’re a foreigner or have a corporate/trustee account, you’ll need to fill in the “Apply for CDP Services” form in order to access CDP Internet.

Don’t have a CDP account? Read our post on how to open a CDP account.

View your dashboard

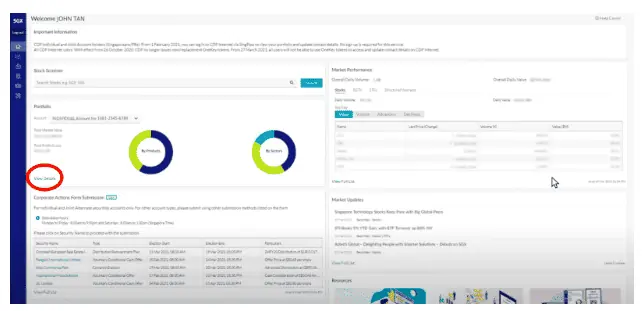

Once you’re logged in, this is the dashboard which you should see.

Note: This is a sample dashboard for educational purposes provided by SGX.

This dashboard shows a breakdown of your portfolio by financial products (ETFs, equities, bonds) and by sector (healthcare, transport, finance).

To view the full breakdown of your holdings, click on “View Details” below your Portfolio section.

Under “View Details”, you can also download your monthly e-statements!

These e-statements would show all the changes in your CDP account, ranging from trading of shares to charges on your CDP account.

Which brokerages can I use to sell my shares in my CDP account?

If you’re wondering, CDP accounts are securities deposit accounts secured by the Singapore Exchange, but you need a brokerage to help you complete trades.

Hence, you will need to find an online brokerage of your choice to help you execute these trades.

Here’s a list of online brokerages which you can link to your CDP account:

- CGS-CIMB Securities (Singapore) Pte. Ltd.

- DBS Vickers Securities (Singapore) Pte Ltd

- iFAST Financial Pte Ltd (FSMOne)

- KGI Securities (Singapore)

- Lim & Tan Securities Pte Ltd

- Maybank Securities Pte. Ltd

- Moomoo Financial Singapore Pte. Ltd.

- OCBC Securities Private Limited

- Phillip Securities Pte Ltd

- Tiger Brokers (Singapore) Pte. Ltd.

- UOB Kay Hian Pte Ltd

Only these select brokerages have been approved by the Singapore Exchange to be CDP linked, meaning that any account on a brokerage not on this list would be a custodian account.

Very briefly, custodian accounts are not linked to your CDP; hence, all securities are not insured by the Singapore Exchange but by each respective brokerage.

Factors to consider before selecting a brokerage to sell your CDP Shares

Fees

Of course, you should be concerned about how much each brokerage is charging you for their services.

These fees usually come as a percentage of the amount you trade, but there are other fees, such as inactivity and account fees which add up to the total amount payable.

Since fees are such an important factor in your decision for which brokerage to sell shares on, I’ll dedicate an entire section to it later on in the article.

In the meantime, hold tight as I run through some of the other key factors you need to consider before choosing your brokerage.

Usability

When I say “Usability”, I mean how beginner-friendly the platform is.

This factor would be especially important for those who are just starting out in retail investing and would like to have a platform that is easy to understand and offers lessons on how to trade.

Given the list of brokerages which offer CDP-linked accounts, I would say that moomoo is the most beginner-friendly brokerage for you.

Moomoo has fast account opening procedures and fully digital desktop and mobile applications for making trades.

Also, moomoo offers demo accounts to beginners, which is a great way to practice trading without incurring the risk of real losses.

Click here to sign up for moomoo.

Spread of Asset Classes

Each brokerage will cover a different range of asset classes.

Diversification is an important factor in investing, and investing in a good spread of asset classes such as ETFs, bonds, REITs, and equities is essential in establishing a firm investment base.

As such, we recommend DBS Vickers for the option to invest in multiple asset classes.

DBS Vickers offers trades in stocks, REITs, bonds, ETFs, structured warrants, daily leverage certificates, and American Depository Receipts (ADR).

With this wide range of tradable instruments, you’ll certainly have the option to diversify your portfolio.

However, DBS Vickers is rather pricey and is recommended for more advanced users.

Which is the cheapest brokerage to sell my CDP shares?

Now, I’m going to walk you through which brokerage is the cheapest to use and why.

Each brokerage has a commission fee, and this fee is charged for every transaction you make via their platform.

All the commission prices listed in the table below are strictly only for online trades (there are separate fees for offline trades).

The minimum commission fee is the minimum amount the brokerage will charge you for every trade.

For instance, if you use DBS Vickers for a trade for $3,000, based on the commission rate, you’ll only need to pay $8.40.

However, you’ll still be charged the minimum commission fee of $27 until your commission fees exceed $27.

| Commission Fees across All CDP-linked brokerages | |||||

| Brokerage | For Contract Value of up to $50,000 | For Contract Value of $50,001 to $100,000 | For Contact Value of above $100,000 | Minimum Commission | Minimum to trade to hit Minimum Commission |

| CGS-CIMB Securities | 0.275% | 0.22% | 0.18% | S$25 | $9,091 |

| DBS Vickers Securities | 0.28% | 0.22% | 0.18% | S$27 | $8,929 |

| iFAST Financial

(FSMOne) |

$8.80 | $8.80 | $8.80 | $8.80 | NIL |

| KGI Securities | 0.275% | 0.22% | 0.18% | S$25 | $9,091 |

| Lim & Tan Securities | 0.28% | 0.22% | 0.18% | S$25 | $8,929 |

| Maybank Securities | 0.275% | 0.22% | 0.18% | S$25 | $9,091 |

| Moomoo | 0.03% | 0.03% | 0.03% | S$0.99 | NIL |

| OCBC Securities | 0.275% | 0.22% | 0.18% | S$25 | $9,091 |

| Phillip Securities | 0.28% | 0.22% | 0.18% | S$25 | $8,929 |

| Tiger Brokers | 0.03% | 0.03% | 0.03% | S$0.99 | NIL |

| UOB Kay Hian | 0.275% | 0.22% | 0.20% | S$25 | $9,091 |

From this comparison, just based on fees alone, Moomoo and Tiger Brokers are tied for the most affordable option.

However, it should be noted that for Singapore stocks, Moomoo is offering $0 commission for eligible traders, but only for a year.

For U.S. stocks, Moomoo also offers $0 commission for eligible traders.

As such, if you are eligible for the year-long $0 commission under Moomoo, Moomoo would ultimately be the cheapest CDP-linked brokerage for you to use.

Do note that this table only reflects commission fees, but there are other charges such as inactivity fees or platform fees which different brokerages will charge.

There is also a clearing fee of 0.05% charged by the CDP, which is standardised across all brokerages, so do keep a lookout for that too!

SGX Common Fees

On top of the fees which the brokerages will charge you, SGX will be charged 4 different fees for all transactions.

- SGX Settlement Fee – 0.35% of the contract value

- SGX Trading Fee – 0.0075% of the contract value

- CDP Clearing Fee – 0.0325% of the contract value

- 8% GST charged on top of all other fees

To further illustrate this point, you will be paying S$15.01 of tax for every S$1,000 you invest on the Singapore Exchange.

How to sell shares in CDP from your (cheapest brokerage) account

While Moomoo and Tiger Brokers are both clearing members and depositary agents of the CDP, neither of them offers CDP-linked accounts to investors yet.

This means that these 2 brokerages can offer CDP-linked accounts to investors soon but haven’t done so just yet.

I’ll update this post when they’re ready, but for now, I’ll show you how to sell shares in CDP from your next cheapest brokerage, FSMOne.

Account Opening

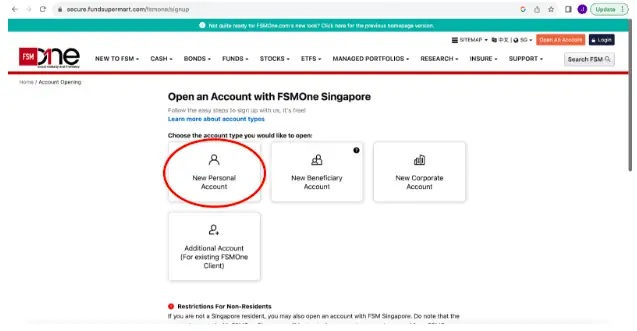

Firstly, you’ll need to open an account with FSMOne.

Simply head over to their website, and click on “New Personal Account” as shown below.

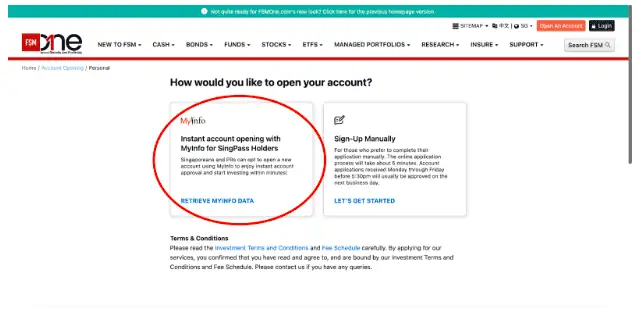

Next up, you can sign up using MyInfo under Singpass.

This makes the sign-up process a lot faster compared to manually typing in your details.

However, this service is only available for Singaporeans, so foreigners will have to spend a little more time setting up their accounts.

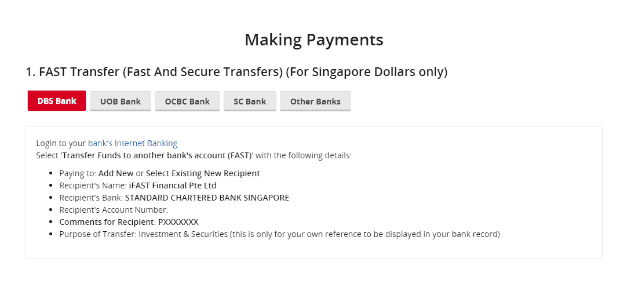

Funding your account

Once your account is set up, you can begin funding your account.

You’ll need to first fund your account in order to pay for the selling fees charged by FSMOne.

FSMOne offers quite a few ways to fund your account, including FAST Transfer, PayNow, Internet Bill Payment, Cheque, Telegraphic Transfer (for USD, and other foreign currencies), and Bank Drafts.

For most, FAST Transfer or PayNow would be the quickest way to fund your FSMOne account.

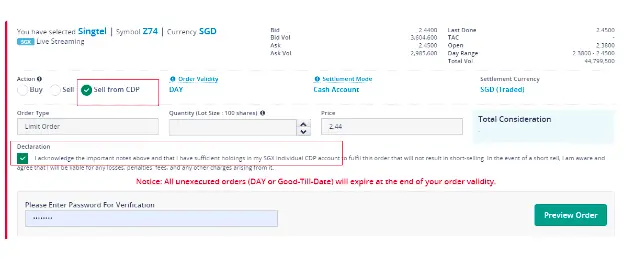

Selling Shares from your CDP-linked account

Yes, we’ve finally reached this part on how to sell your shares!

Head over to the “Live Trading” tab in your FSMOne dashboard, and search for any Singapore-listed security which you’d like to trade.

Click on that particular security, and the option to Buy, Sell, or Sell from CDP should be there.

Simply click on “Sell from CDP”, enter the amount you’d like to sell, key in your password to confirm and voila!

Securities have been sold.

The Other Brokerages

Granted, not all of you will decide to choose FSMOne as your go-to CDP-linked brokerage.

And that’s okay, as each brokerage has different features which cater to varying individual needs.

So here’s a quick list of brokerages and links on how to set up accounts with them!

| Links for Setting up Accounts in Other Brokerages | |

| CGS-CIMB Securities | https://www.cgs-cimb.com/en/opening-a-trading-account-on-cgs-cimb-with-singpass.jsp |

| DBS Vickers Securities | https://www.dbs.com.sg/personal/support/investment-vickers-apply-dbsv-account.html |

| KGI Securities | https://www.kgieworld.sg/futures/open-trading-acct |

| Lim & Tan Securities | https://www.limtan.com.sg/page/site/public/openaccount_form.jsp |

| Maybank Securities | https://www.maybank.com/investment-banking/sg/help_centre/opening_account/index.html |

| OCBC Securities | https://www.iocbc.com/accounts/basic-securities-trading-account.page?qualtric=faq |

| Phillip Securities | https://www.poems.com.sg/open-an-account/ |

| UOB Kay Hian | https://sg.uobkayhian.com/login/open-trading-account.html |

Final Words

So that’s it, your conclusive guide to selling shares via a CDP-linked account!

It’s important to note that while the price is a large determining factor in choosing which brokerage to use, the other factors of usability and spread of asset classes should be included in your decision.

I hope this post has been useful in sharing how to sell shares in your CDP account!