Launched in 1996 by Phillip Capital, Phillip’s Online Electronic Mart System— or more commonly known as POEMS— is Singapore’s first-ever online trading brokerage.

Since the launch of POEMS, the number of online brokerages available to Singapore investors has multiplied, stiffening the competition to attract and retain clients.

This article provides an up-to-date in-depth look at POEMS to see how the pioneer of Singapore’s online brokerage industry is fairing in 2022, almost 26 years after its debut.

Markets Offered by POEMS

While originally, POEMS trading centred around the Singapore market only, today POEMS offers trading in 28 global markets spanning 3 continents.

The combined number of exchanges offered is 26.

In addition to the Singapore Exchange (SGX), global markets include:

America’s

- United States (NYSE, NYSE-MKT, NASDAQ)

- Canada (TSX)

Asia and Pacific

- Hong Kong (HREX, Pre-IPO)

- Australia (ASX)

- China A and B Shares (SH/SZ – HK Stock Connect, SSE, SZSE)

- Indonesia (IDX)

- Japan (TSE, MOTHERS, JASDAQ)

- Malaysia (BURSA)

- Philippines (PSE)

- South Korea (KRX)

- Taiwan (TWSE)

- Thailand (SET)

- Vietnam (HOSE/ HNX)

Europe

- United Kingdom (LSE)

- Belgium (Euronext Brussels)

- France (Euronext Paris)

- Germany (FWB)

- Netherlands (Euronext Amsterdam)

- Portugal (Euronext Lisbon)

- Turkey (BIST)

POEMS global market offerings cover all the bases including world-class mega exchanges like the United States NASDAQ, Hong Kong, and the London Stock Exchange, though these days this is a prerequisite for most top online brokerages.

What is perhaps more impressive, is POEMS’ wide variety of Asian markets.

Some of the Asian markets offered by POEMS, such as Vietnam, Philippines, Indonesia, and Thailand, are far less common among other online brokerages in Singapore.

POEMS’ extensive list of global markets means investors can achieve a high level of geographic diversification within their investment portfolios.

Furthermore, trades can be conducted in 10 currencies (SGD, USD, HKD, AUD, MYR, JPY, GBP, EUR, CNY, CAD) using POEMS live currency conversion.

This helps to ease the process of trading in markets outside Singapore.

Tradable Asset Classes Offered by POEMS

POEMS claims to offer a whopping 40,000+ investment products. The product offerings fall under the categories listed below:

- Stocks and Shares

- Exchange-Traded Funds (ETFs)

- Warrants

- Daily Leverage Certificates (DLCs)

- Contracts For Differences (CFDs)

- Unit Trusts (Mutual Funds)

- Futures

- Bonds

- Forex

- Securities

- Gold

- Special Purpose Acquisition Companies (SPACs) IPOs

POEMS’ wide range of tradable asset classes makes the brokerage suitable for investors of all skills and experience levels.

New investors can choose to restrict trading to classic retail assets such as stocks and shares, mutual funds, bonds, and ETFs, allowing them to ease into trading.

Experienced traders who follow market trends more closely or are looking to invest more actively will find assets like DLCs and CFDs appealing, though we must reiterate that these leveraged assets require a certain level of trading savvy.

In addition, POEMS offers specialised investment services that can be enrolled based on your long-term and personal investment goals.

Some examples include the Regular Savings Plan, Securities Financing, Securities Borrowing and Lending, IPO financing, and Supplementary Retirement Scheme (SRS).

Commissions and Fees Charged by POEMS

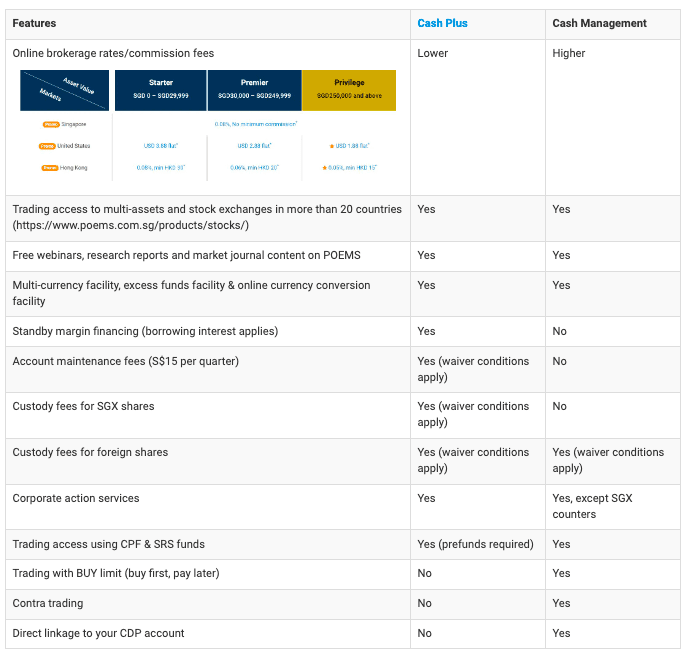

POEMS offers 2 accounts— the Cash Plus Account and the Cash Management Account.

The Cash Plus Account allows for low-cost trading in global markets.

The Cash Management Account is linked to your Central Depository Pte Ltd (CDP) and allows for Contra trading.

Cash Management commission fees are higher than the Cash Plus Account option, though the Cash Management Account does not have account maintenance or SGX custody fees.

Here’s a screenshot of the differences between the 2 accounts as highlighted by POEMS.

Commission fees for trading SGX stocks and ETFs are fixed.

For global markets, commission fees for stocks and ETFs vary based on the Total Value of Assets.

The higher the amount you invest, the lower the commission fees.

Let’s look at stock and ETF commission fees for some of the major markets offered by POEMS.

Cash Plus Account Commission Fees for Stocks and ETFs

| Market | Starter: S$0 – S$29,999 | Premier S$30,000 – S$249,999 | Privilege S$250,000 and above |

| Singapore | 0.08%, No minimum commission | ||

| United States | USD 3.88 Flat | USD 2.88 Flat | USD 1.88 Flat |

| Hong Kong | 0.08%, min HKD 30 | 0.06%, min HKD 20 | 0.05%, min HKD 15 |

| China | 0.15% min CNH80 | 0.12% min CNH60 | 0.08% min CNH5 |

| Australia | 0.18% min A$25 | 0.15% min A$20 | 0.12% min A$15 |

| United Kingdom | 0.18% min GBP20 | 0.15% min GBP15 | 0.12% min GBP10 |

| Germany | 0.18% min EUR20 | 0.15% min EUR12 | 0.12% min EUR8 |

| Japan | 0.18% min JPY1500 | 0.15% min JPY1200 | 0.12% min JPY1000 |

Cash Management Account Commission Fees Stocks and ETFs

| Market | < S$50,000 | S$50,000- S$100,000 | > S$100,000 |

| Singapore | 0.28%, min S$25 | 0.22%, min S$25 | 0.18%, min S$25 |

| United States | 0.30%, min USD20 | ||

| Hong Kong | 0.25%, min HKD100 | ||

In comparison to SGX trades on other Singapore online brokerages such as Saxo Markets, DBS Vickers, FSMOne, and OCBC Securities, POEMS commission fees are quite low.

POEMS has the added advantage of not having a minimum commission fee for SGX stock and ETF trades and offers zero unit trust fees and zero commission over-the-counter bonds.

But there are a few brokerages in the industry that offer cheaper SGX stock and ETF commission fees, for example, Tiger Brokers and Moomoo.

Inactivity/Maintenance Fees POEMS

One notable downside of POEMS is that it charges conditional inactivity/maintenance fees.

For example, with the Cash Plus Account, if you make less than 1 trade per quarter, you are charged a maintenance fee of S$15.

Cash Plus Accounts are also subject to a custody fee of S$2 fee per counter per month for foreign shares (this can be waived if the client does more than 6 trades a quarter or 2 trades a month).

All maintenance fees are waived for accounts with S$250,000 or more.

Custody fees are a little higher for the Cash Management Account at S$2.14 per counter per month.

The Singapore online brokerage landscape has several options with zero inactivity fees, such as Webull and Tiger Brokers, and thus these changes may make POEMS less attractive to investors who are wishing to hold onto every bit of capital that they can.

Sign-Up, Funding, and Withdrawal Options at POEMS

Sign-Up with POEMS

There are a few platforms that you can visit to sign-up for a POEMS Cash Plus Account (non-CDP linked account).

This account type can be opened instantly via the official POEMS website.

When opening an account, you will be asked to choose which facilities you would like to be added to your account.

Facilities include:

- Trading Facilities

- Multi-Currency Facility

- Excess Funds Management Facility (SMART Park)

- Securities Borrowing and Lending (SBL) Facility

- Contracts for Difference (CFD)

Because the main purpose of an online brokerage is to trade financial assets, trading facilities will be automatically added to your account.

All other facilities are optional.

Trading facilities include the POEMS suite of high-tech, professional trading platforms– POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3, POEMS Pro, and Specialized Platforms.

The Multi-Currency Facility enables clients to trade in different currencies.

The Excess Funds Management Facility makes sure your money is always working for you by investing any idle funds in your account in Money Market Funds.

The interest rate for SGD is currently 0.1808%. The SBL Facility allows you to borrow securities for short selling or lend securities.

CFDs also allow you to short sell, with up to 20 times the leverage.

Personal details can be entered manually into the online application form, or automatically if you have SingPass MyInfo.

When entering manually, you will need to provide a national ID, supporting documents like bills and proof of address, tax information, and bank information.

After submitting your application and receiving approval via email, you can start funding your account and trade.

The sign-up process can also be completed on POEMS Mobile 3, POEMS’ latest app release.

Funding and Withdrawal Options on POEMs

There are many convenient options to fund POEMS accounts, many of which are paperless, cashless, and hassle-free.

You are bound to find a payment method that works for you no matter your preferences and budget.

The full range of options is as follows:

- PayNow (15 minutes)

- FAST (Fast And Secure Transfers) (15 minutes)

- eNETS Debit Payment (5-15 minutes)

- Electronic Payment for Shares (EPS) (next working day)

- Internet Bill Payment (2 days)

- Telegraphic Transfer (up to 1 week)

- Cheque (same day if deposited before 3pm)

- CPF Investments

- SRS (Supplementary Retirement Scheme)

- GIRO (General Interbank Recurring Order)– Shares (1 day)

- GIRO – Regular Savings Plan (1-5 days)

- GIRO – Share Builders Plan (1-5 days)

If funding an account in SGD, PayNow is particularly convenient as it comes with a 0% transaction fee and has a typical processing time of about 15 minutes.

PayNow can be used with funds coming from UOB, Bank of China, Citibank, DBS Bank/POSB, HSBC, ICBC, Maybank, OCBC, and Standard Chartered Bank.

FAST, eNETS also provides immediate account funding with zero transaction fees.

Funding accounts with CPF/SRS is possible, but the transaction will be subject to an agent bank fee and the standard SRS fee.

Funds can be withdrawn from POEMS accounts by filling in a withdrawal form on the website or the POEMS mobile app and can be transferred to a pre-registered local bank account or collected in person by cheque from a Phillips cashier.

Usability of Platforms POEMS

Having been in the online brokerage game for 26 years, POEMS has consistently reinvented and upgraded its trading platforms to stay competitive.

Today, POEMS offers 4 different platforms, POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3, and POEMS Pro.

POEMS 2.0

POEMS 2.0 is the standard web browser and desktop platform and offers users a one-stop shop to trade multiple assets in 15 global exchanges.

The interface can be customised with live global charts and historical trading charts, advanced order type tabs, stock analysis, and more.

POEMS 2.0 is suitable for traders of all levels and accessible on PCs, tablets, and phone web browsers.

POEMS Mobile 2.0

POEMS Mobile 2.0 offers similar features to POEMS 2.0, but in a mobile app.

In addition, the app offers a mobile heat map for global exchanges and funds, enabling users to conveniently track daily performance.

Users can create customised news feed settings, alerts, and set up fingerprint authentication.

Like POEMS 2.0, this option is suitable for all traders regardless of trading frequency and experience.

POEMS Mobile 3

POEMS Mobile 3 is the newest revamped version of POEMS 2.0.

In addition to its sleek new look, the mobile app offers new functions like a built trading view charts following 100+ indicators and an economic calendar to track major global events.

POEMS Pro

POEMS Pro is POEMS’ most advanced platform.

It offers a variety of complex trading and leverage tools aimed at active and seasoned investors.

Features include timed market entry, expedited order execution, a customisable dashboard, and synced watch lists for POEMS 2.0. POEMS Pro (and all other POEMS trading platforms) is completely free.

Specialized Platforms

In addition to the standard platforms, POEMS clients also have access to specialised Phillip platforms to trade CFDs, Forex, and Futures.

These include Phillip MetaTrader 5, Phillip Nova, Trading Technologies (TT), and CQG.

Is POEMS safe?

For the Cash Management Account, when trading locally on the Singapore Exchange, funds are linked to your Central Depository Pte Ltd (CDP) and the CDP will be the share depository.

Foreign shares are held in custody with Phillip Securities Pte Ltd (PSPL).

PSPL is regulated and supervised by The Monetary Authority of Singapore (MAS).

Client assets are protected by keeping them in segregated accounts, separate from the online brokerage’s operational capital.

Extra Perks POEMS

POEMS offers regular promotions, which it lists online under its promotions tab.

Active promotions range from extended trading hours for US trading markets and 0%-unit trust fees to no minimum commission on SGX trades and S$200 cash credit when you trade DLCs.

These are just a few.

Taking advantage of these promotions can end up saving you a significant amount of money in the long term.

Furthermore, POEMS offers several free educational tools such as webinars, seminars, a market journal, and video tutorials to help clients brush up on their investment knowledge and make informed investment choices.

To Sum it Up — Is POEMS for you?

There are several reasons to trade with POEMS, especially if you plan to invest mostly in the Singapore Exchange.

With 26 years of experience under its belt, the pioneer of Singapore online brokerages is still going strong.

POEMS’ strengths include competitive rates, a comprehensive suite of high-performing trading platforms, and a world-class selection of global exchanges and assets.

So if you’re looking to trade globally across different exchanges, then POEMs is competitively priced for you to use their platform.

But, as we noted early, even though POEMS fees are some of the most impressive in the industry, there are still a few competitors that will give you a bigger bang for your buck, especially if you plan to conduct a large number of trades in outside markets.

If your priority is minimising fees and commission, then you should consider a few other options before settling on POEMS.

Personally, we prefer moomoo if you’re trading/investing in the Singapore markets as they’re the cheapest.

If you’re looking to trade/invest in China and Hong Kong markets, Tiger Brokers is arguably the cheapest option.

And for the US markets, our preference lies with Webull Singapore, which provides commission- and platform-free trades.