The Great Eastern GREAT Protector Active is a personal accident insurance plan you can renew annually.

It is designed to provide coverage if an accident causes unexpected and involuntary harm to you.

This coverage applies only to accidents, not illnesses or other causes.

The plan provides benefits for accidental death, major permanent disability, other types of permanent disability, and reimbursement for medical expenses resulting from an accident.

There is also an additional benefit in specific situations called the Benefit Booster.

Here’s our review of the GREAT Protector Active.

My Review of the GREAT Protector Active

The GREAT Protector Active is the best personal accident plan for active individuals.

It offers comprehensive coverage at affordable premiums, providing financial support for major disabilities, accidental death, high reimbursement for medical expenses, and extra protection in the event of an accident.

It offers coverage of up to $3 million if the insured experiences permanent disabilities due to an accident.

The policy will also offer coverage for up to $1 million in case of accidental death.

You’ll receive extra protection when involved in a pedestrian, cyclist, or passenger accident in a car or public transport.

This plan applies not only when you’re in Singapore but also when travelling overseas.

This insurance plan provides generous reimbursement if you have medical expenses from an accident.

You can receive up to $7,500 per accident to cover your outpatient and hospitalisation expenses.

Moreover, after the accident, you can choose your preferred treatment and care from Complementary Medicine Practitioners or Allied Health Professionals.

Because of all these, we’ve awarded the Great Eastern GREAT Protector Active as one of the best personal accident insurance plans in Singapore.

However, not every policy is best for everyone.

For example, if you’re a cyclist or do deliveries on a bike, then the NTUC Income Personal Mobility Guard is better for you as it’s tailored specifically.

Or if you’re looking for higher medical and surgical coverage in a PA plan, the Manulife ReadyProtect is the best in this area.

Because of the vast amount of policies available and the different needs of various individuals, it’s best to explore your alternatives and to get a second opinion as to whether the Great Eastern GREAT Protector Active is the right personal accident insurance plan for you.

If you need someone to assist you in comparing policies or even get a second opinion, we partner with unbiased financial advisors who are happy to help.

Click here for a free comparison session.

Here’s more about the GREAT Protector Active:

Criteria

- Policy Term: 1 year (renewable)

- Maximum Insured age: 76 years next birthday

- Singapore Citizens, Permanent Residents, and Employment Pass holders between the ages of 17 and 65 can choose any plan (Basic, Classic, Elite) under this policy.

- Juveniles (aged 1 to 16) and holders of S Pass, Dependant’s Pass, or Student’s Pass can only purchase the Basic Plan under this policy.

General Features

Premium Payment

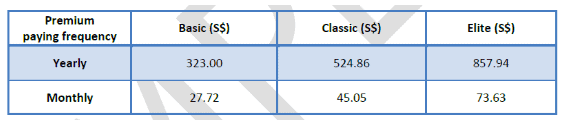

There are 3 plans available under the GREAT Protector Active with different premiums to suit your financial needs. The premiums are payable either on a monthly or annual basis.

Below are the current premium rates, which are inclusive of GST:

However, this policy is not a MediSave approved policy and you may not use MediSave to pay the premiums for this.

The combined benefits you can receive for all benefits cannot exceed 300% of the sum assured under the Accidental Death benefit.

The following benefits are applicable for compensation:

Accidental Death Benefit

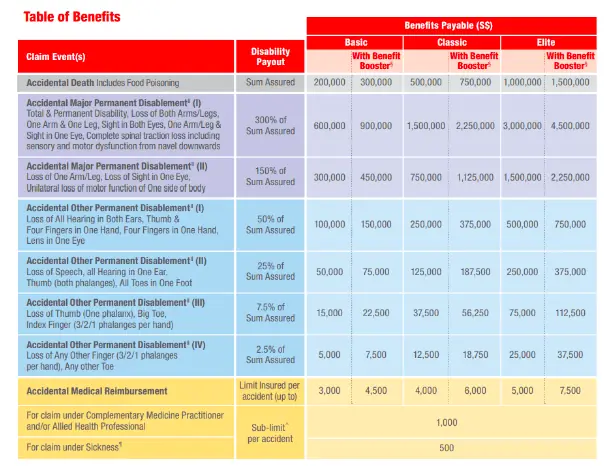

If the person dies as a result of the accident or food poisoning, the insured amount of up to $200,000 for the basic plan, $500,000 for the Classic plan and $1M for the Elite plan will be paid to the insured.

| Plan Type | Basic | Classic | Elite |

| Accidental Death Benefit Amount ($) | 200,000 | 500,000 | 1,000,000 |

However, any benefits already paid for Accidental Major Permanent Disablement and Accidental Other Permanent Disablement from the same accident will be deducted from this amount, depending on the chosen plan.

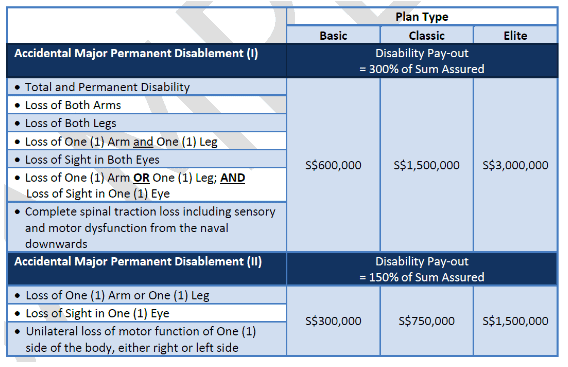

Accidental Major Permanent Disablement Benefit

A portion of the assured amount, determined by the Accidental Major Permanent Disablement Compensation Scale and corresponding to the chosen plan, will be paid if the person experiences a major permanent disability due to the accident.

However, any benefits already paid for Accidental Other Permanent Disablement from the same accident will be deducted from this amount.

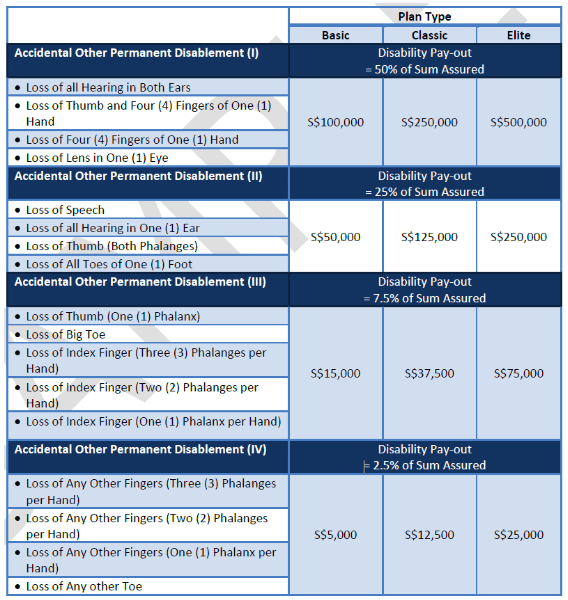

Accidental Other Permanent Disablement Benefit

A portion of the assured amount, determined by the Accidental Major Permanent Disablement Compensation Scale and corresponding to the chosen plan, will be paid if the person suffers other forms of permanent disability due to the accident.

Key Features

Accidental Medical Expenses Reimbursement Benefit

Based on your chosen plan, you can get reimbursed directly for certain medical expenses related to an accident up to the insured limit for each accident.

Kindly note the following;

- For treatment provided by Allied Health Professionals and Complementary Medicine Practitioners, the total reimbursement for each accident is capped at $1,000. This amount will be included in the insured limit.

- For sickness-related treatment, the total reimbursement is capped at $500 per sickness, which will also be counted towards the insured limit.

- Any government taxes on medical expenses (except for Goods and Services Tax in Singapore) won’t be reimbursed.

Benefit Booster

The benefit payable for all the aforementioned benefits will be multiplied by 150% if the injuries from an accident occur (overseas) while you are

- boarding,

- travelling in or

- exiting Singapore, or

- involved in a road traffic accident as a pedestrian, cyclist, or passenger outside of Singapore.

With the Benefit Booster, the total benefit amount for all the mentioned benefits (excluding Accidental Medical Expenses Reimbursement) cannot exceed 450% of the sum assured under the Accidental Death Benefit.

Summary of Compensations

Summary of Great Eastern’s GREAT Protector Active

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawal | N/A |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |