Income Personal Mobility Guard is a personal accident insurance plan that shields the insured financially against accidents while riding, mounting, or dismounting from a bicycle or personal mobility device in Singapore.

Here is our detailed review of the NTUC Income Personal Mobility Guard.

Criteria

- Issue age for the insured: 8 – 65 years old

- Valid Singapore identification

- Residing or working in Singapore

General Features

Premium Payment Terms

There is only a tier for the NTUC Income Personal Mobility Guard, and it costs $96.90 annually, including an 8% GST tax.

However, the premium amount is not guaranteed, and any changes will be informed to policyholders 30 days in advance.

Policy Term

NTUC Personal Mobility Guard is a short-term personal accident plan with 1-year coverage, renewable yearly until you turn 65 years old.

Additional age coverage up to 70 years old is possible but will come with new terms that will be made known to you when the time comes.

Protection

Accidental Death / Permanent Disability Benefit

This benefit covers the policyholder against accidental death or accidental permanent disability when faced with an accident on a bike or personal mobility device.

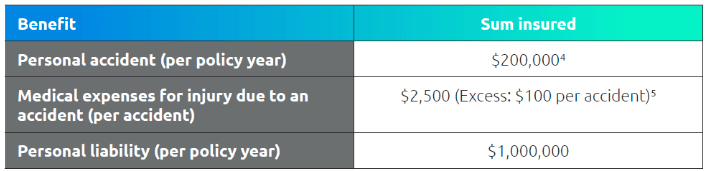

Suppose the insured tragically passes away or suffers a life-changing disability from an accident while using a personal mobility device; this insurance can pay up to $200,000 to their loved ones.

It can also help cover medical bills if you get hurt in such accidents, up to $2,500 for 1 accident or up to 90 days after the accident, whichever comes first.

However, for this insurance to kick in, the accident must cause your death or permanent disability within 12 months from the accident date.

The table below shows the sums assured for the benefits covered:

Notes:

- 4. The personal accident benefit includes accidental death or permanent disability and is subject to policy scale of compensation.

- 5. Medical expense benefit applies for a maximum of 90 days.

Medical Expenses Benefit

The Medical Expenses Benefit covers your medical bills above $100 if you get hurt in an accident in Singapore.

In case of an event leading to a claim under this policy, you must inform the company within 30 days of the event or accident.

Personal Liability Benefit

Personal Liability Benefit is like a protective shield if you accidentally hurt someone or damage their stuff while riding a bike or a personal mobility device in Singapore.

The policy covers up to $1,000,000 if you ever find yourself in this situation. It includes legal expenses for your defence or court-ordered damages payment.

Personal mobility devices don’t include regular bikes, shopping carts, baby strollers, cars, or motorcycles.

To qualify as a personal mobility device, it should

- be designed for 1 rider,

- have at least 1 wheel that moves on a single axis, runs on electric power, human power, or both, and

- does not look like a car or motorcycle

Summary of NTUC Income’s Personal Mobility Guard

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of the NTUC Income Personal Mobility Guard

The NTUC Income Personal Mobility Guard is a unique insurance plan designed specifically for those who use personal mobility devices such as e-scooters, e-bikes, or wheelchairs, this insurance is made just for you.

It offers coverage for different situations.

Firstly, if you have a serious accident while riding that leads to accidental death or a permanent disability, the NTUC Income Personal Mobility Guard will provide financial support for you while taking care of your medical bills.

Plus, if the accident causes harm to someone else or damages their property, the insurance has you covered for that as well.

This policy is best for those who often use personal mobility devices like bicycle riding.

Thus, if you use a personal mobility device for work, such as a food delivery rider, or you travel to work on a bicycle, this is for you.

Enjoy cycling as a hobby? The NTUC Income Personal Mobility Guard is a PA plan that you should consider, too!

The NTUC Income Personal Mobility Guard has been ranked as one of the best personal accident insurance plans, so rest assured knowing that it’s good.

However, not all policies are made for everyone, and what’s good for me might not be the best for you.

We suggest talking to an unbiased financial advisor for a second opinion and exploring alternatives that suit you.

Click here for a free, non-obligatory chat with one of our partners!