Manulife’s ReadyProtect is a non-participating, personal accident insurance that financially safeguards you and your loved ones against unexpected death, illness, diseases and accidents.

Not sure how good this is or whether it’s the best PA plan for you?

Here’s our review of the Manulife ReadyProtect:

My Review of the Manulife ReadyProtect

Upon viewing the policy’s features and coverage, the 3 prominent features of the Manulife ReadyProtect are flexibility, double reimbursements for accidents that occurred overseas, and the Child Care Benefit.

With 5 base plans of varying coverage to choose from, Manulife’s ReadyProtect is a versatile policy that can be customised to suit all profiles.

From the fresh graduate who is looking for basic coverage that goes easy on his pocket to the executive who desires to be covered extensively, the insured may select the plan that best suits his desired coverage level and income level.

The Manulife ReadyProtect also safeguards you against accidents, reimbursing you with payouts that are twice the amount of payouts for accidents that have taken place locally.

If you would like to insure your child against the unexpected, the Manulife ReadyProtect’s Child Care Benefit offers the necessary payouts that alleviate the education and medical expenses of your child.

The Payor Waiver Benefit prevents the inflation of premiums payable, ensuring affordability.

As we all have varying preferences and priorities, the personal accident plan that suits others might not be ideal for you.

That’s why it’s best that you compare personal accident plans and find one that’s best for you.

Once you’ve compared policies, get a second opinion on whether it (or the Manulife ReadyProtect) is for you. This way, you make sure you select the best possible plan for yourself.

Since the PA plan covers the insurance gap that your health insurance plan won’t cover, it’s essential that you take some time to research which policy suits you most, as you’ll probably be making a lot of claims against this policy.

Still deliberating which personal accident policy is best for you and your loved ones?

We partner with unbiased MAS-licensed financial advisors who can help you compare and find the best PA plan for yourself.

If this is something you’re interested in, click here for a free non-obligatory chat.

Now let’s delve deeper into what the Manulife ReadyProtect has to offer:

Entry Age

The policy insures individuals from as young as 15 days old to 65 years old. You will be entitled to coverage under core benefits till 99 years old and medical expenses till 75 years old.

Product Features

Premium Payment Terms & Options

Premiums payable start as low as $2 weekly. The following tables contain the annual premium rates payable for each occupation class.

| Annual Premium Rates for Class 1 & 2 Occupations | Core Benefit | |||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | ||

| 15 days to 55 years old | Core Benefits | $96 | $173 | $288 | $468 | $924 |

| Income Support Benefit (Optional) | $42 | $72 | $122 | $222 | $380 | |

| Hospital Cash Benefit (Optional) | $20 | $35 | $55 | $95 | $150 | |

| Child Care Benefit (Optional) | $108 | $198 | Not Available | |||

| 56 to 65 years old | Core Benefits | $144 | $260 | $432 | $702 | $1386 |

| Income Support Benefit (Optional) | $63 | $108 | $183 | $333 | $570 | |

| Hospital Cash Benefit (Optional) | $30 | $53 | $83 | $143 | $225 | |

| Annual Premium Rates for Class 3 Occupations | Core Benefit | |||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | ||

| 15 days to 55 years old | Core Benefits | $164 | $295 | $490 | $796 | $1,571 |

| Income Support Benefit (Optional) | $72 | $123 | $208 | $378 | $646 | |

| Hospital Cash Benefit (Optional) | $34 | $60 | $94 | $162 | $255 | |

| 56 to 65 years old | Core Benefits | $144 | $260 | $432 | $702 | $1,386 |

| Income Support Benefit (Optional) | $63 | $108 | $183 | $333 | $579 | |

| Hospital Cash Benefit (Optional) | $30 | $53 | $83 | $143 | $225 | |

| Annual Premium Rates for Class 4 Occupations | Core Benefit | |||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | ||

| 15 days to 55 years old | Core Benefits | $212 | $381 | $634 | $1,030 | $2,033 |

| Income Support Benefit (Optional) | $93 | $159 | $269 | $489 | $836 | |

| Hospital Cash Benefit (Optional) | $44 | $77 | $121 | $209 | $330 | |

| 56 to 65 years old | Core Benefits | $317 | $572 | $951 | $1,545 | $3,050 |

| Income Support Benefit (Optional) | $139 | $238 | $403 | $733 | $1,254 | |

| Hospital Cash Benefit (Optional) | $66 | $117 | $183 | $315 | $495 | |

(Classification details of Manulife’s occupational class are not available online or in the product summary)

You will enjoy a 10% discount on all your ReadyProtect policies if you purchase more than 2 ReadyProtect policies for your household (yourself included).

The following sample premium illustrates the premium payable and coverage for a family of 3.

| Family Coverage (Daily Premium: $2.50) | |||

| Male

(35 Years Old) |

Female

(35 Years Old) |

Child

(5 Years Old) |

|

| Core Benefit | Advantage

|

Head Start

|

|

| Optional Benefit | Income Support Benefit

|

Child Care Benefit:

|

|

| Total Payout | $430.8K | $430.8K | $225K |

Core Benefits

Accidental Death and Dismemberment (ADD) Benefit

The ADD Benefit covers you till 99 years old. In the event of an unexpected death, an ADD Benefit payout ranging from $50K to $1M will be reimbursed.

Double Payout

The ADD Benefit reimbursed will be doubled in the following scenarios:

- When accidental death or dismemberment occurs in public transportation.

- When the child insured experiences accidental or dismemberment;

-

- Within or outside school premises on a school day or during school activities

- As the child travels between home and school or the location of school activity

| Core Benefit | ||||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | ||

| ADD | $50K | $100K | $200K | $500K | $1M | |

| Double payout for ADD occurred in public transportation or during a school activity | $100K | $200K | $400K | $1M | $2M | |

Schedule of Indemnity

Should you encounter any of the below events within 52 weeks from the accident date, Manulife will reimburse the corresponding percentages of the face amount.

Only one payout per accident will be issued. Should the insured experience more than one injury, the highest benefit of the two injuries will be paid.

The maximum payout of your ADD Benefit is capped at 150% of the face amount. With every subsequent claim, Manulife will deduct prior payouts issued.

Once the maximum payout is reached, all benefits besides the Child Disability Support Allowance (see “Child Care Benefit” under “Optional Benefits”) will cease.

| Event | Percentage of Face Amount |

| Loss of life | 100% |

Permanent total loss of sight of:

|

150% 100% |

Loss of, or the permanent total loss of use of

|

150% 125% 150% |

| Permanent total loss of speech and hearing | 150% |

Permanent total loss of hearing of

|

75% 25% |

| Permanent total loss of speech | 50% |

| Permanent total loss of the lens of one eye | 50% |

Loss of, or the permanent total loss of use of

|

70% 40% |

Loss of, or the permanent total loss of use of, one thumb

|

30% 15% |

Loss of, or the permanent total loss of use of, fingers

|

10% 7.5% 5% |

Loss of, or the permanent total loss of use of, toes

|

15% 5% 3% 1% |

| Fractured leg or patella with established non-union | 10% |

| Shortening of leg by at least 5cm | 7.5% |

Third-degree burns

|

50% 75% 100% 50% 75% 100% |

Medical Expenses Benefit

The Medical Expenses Benefit covers you till 75 years old. You may claim medical expenses for accidents, TCM treatment, chiropractic treatment, ambulance fees, and mobility aids that have been incurred within 52 weeks from the date of the accident.

| Core Benefit | ||||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | ||

| Medical expenses incurred per accident | Accidental Medical Reimbursement (AMR) | Up to $1K | Up to $2K | Up to $3K | Up to $4K | Up to $10K |

| AMR occurred while overseas | Up to $2K | Up to $4K | Up to $6K | Up to $8K | Up to $2K | |

| TCM or Chiropractic treatment | Up to $250 | Up to $500 | Up to $750 | Up to $1K | Up to $1.5K | |

| Ambulance fees (capped at $200 per accident) and mobility aids | Up to $700 | Up to $1.2K | Up to $1.2K | Up to $2.2K | Up to $3.2K | |

Infectious Disease Coverage

Manulife’s ReadyProtect insures you against 21 types of infectious diseases, namely the following:

| Viral Infection |

|

| Degenerative Neurological Disease |

|

| Bacterial Infection |

|

| Mosquito-Borne Infection |

|

Optional Benefits

Income Support Benefit

The Income Support Benefit covers you till 75 years old. The table below indicates the payouts you are entitled to under the Income Support Benefit.

| Core Benefit | |||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | |

| Weekly income for Temporary Total Disablement* (per accident, for a maximum of 104 weeks) | $50 | $100 | $200 | $350 | $500 |

| Weekly income for Temporary Partial Disablement** (per accident, for a maximum of 104 weeks) | $12.50 | $25 | $50 | $87.50 | $125 |

| Disability support allowance

(per lifetime, paid over 10 years) |

$50K | $100K | $200K | $500K | $1M |

| Home modification

(per lifetime) |

Up to $5K | Up to $5K | Up to $10K | Up to $15K | Up to $20K |

Manulife classifies disablements into 2 types:

*Temporary Total Disablement:

- Disability occurred within 90 days from the accident date

- The insured is unable to execute all job duties due to the accident or

- Does not have a job at the time of the accident and cannot executive 3 or more Activities of Daily Living

**Temporary Partial Disablement:

- Disability occurred within 90 days from the accident date

- The insured cannot execute at least 1 of his job duties due to the accident

- Cannot perform at least 1 Activity of Daily Living

Hospital Benefit

The Hospital Benefit covers you till 99 years old. It gives you a daily hospitalisation cash benefit for a maximum of 365 days per accident.

This payout is doubled should you be admitted into the ICU, for a maximum of 30 days.

Expenses incurred for fractures, broken bones and reconstructive surgery are also claimable under the Hospital Benefit.

| Core Benefit | |||||

| Head Start | Accelerate | Advantage | Ultimate | Signature | |

| Daily hospitalisation cash

(per accident, up to 365 days) |

$50 | $100 | $150 | $300 | $500 |

| Daily hospitalisation cash upon admission to ICU

(per accident, up to 30 days) |

$100 | $200 | $300 | $600 | $1000 |

| Fractures and broken bones^ (per policy year) | Up to $5K | Up to $5K | Up to $10K | Up to $15K | Up to $20K |

| Reconstructive surgery (cosmetic surgery or skin transplant)

(per accident) |

Up to $5K | Up to $10K | Up to $10K | Up to $15K | Up to $20K |

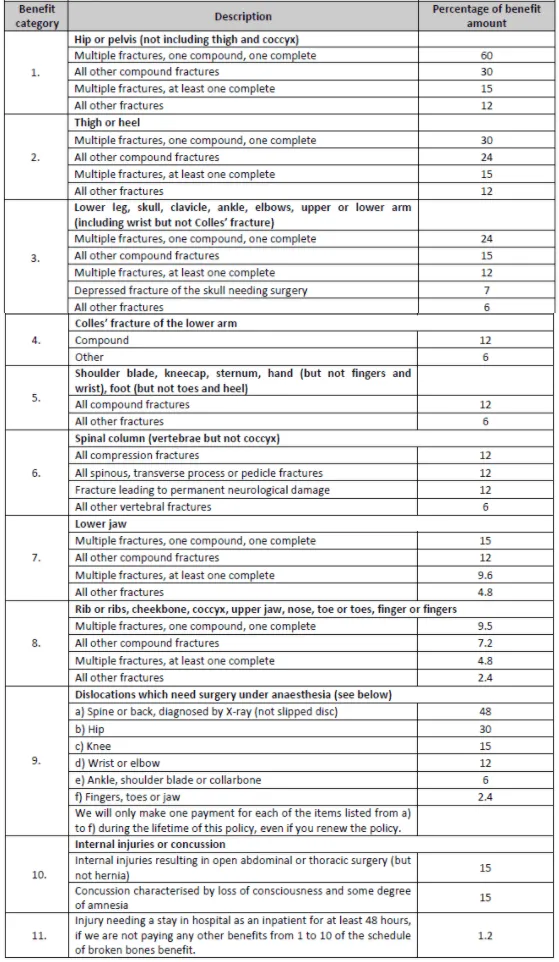

^Schedule of Injuries for Fractures and Broken Bones:

Child Care Benefit

The Child Care Benefit is only available under the “Head Start” or “Accelerate” scheme. For your child to receive coverage under this benefit, he must be 16 years old or below.

He will be covered till age 25.

Where an accident has resulted in the death of the policyholder before 75 years old, a payor waiver benefit will be put in force.

This maintains all future premiums payable and optional benefits at the same value till the child of the life insured turns 25 years old.

The Child Care Benefit alleviates your child’s education expenses by providing a one-time payout.

An Accidental Medical Reimbursement (AMR) Booster is also offered.

It increases the cap on claims for AMR and doubles the payout for accidents occurring overseas.

Lastly, the child support allowance will be paid over a span of 10 years.

| Core Benefit | ||

| Head Start | Accelerate | |

| Payor waiver benefit | Yes | Yes |

| Education assurance fund | $50K | $100K |

| Accidental Medical Reimbursement (AMR) Booster | Up to $1K | Up to $2K |

| AMR Booster while overseas | Up to $2K | Up to $4K |

| Child disability support

allowance (per lifetime) |

$100K | $200K |