When accidents occur, people panic and having a financial plan to cover you during those unfortunate times may help ease the burden.

Great Eastern’s AccidentCare Plus II is an annual renewable personal accident insurance plan that covers various accident scenarios.

This AccidentCare Plus II covers various accident-related scenarios, including:

- Death,

- Permanent disablement,

- Total and partial disablement,

- Medical expense reimbursement,

- Mobility aid reimbursement,

- Hospitalisation benefits, and

- Evacuation and repatriation.

Here is a complete review of Great Eastern’s AccidentCare Plus II plan.

Let’s get started.

General Features

Premium Terms

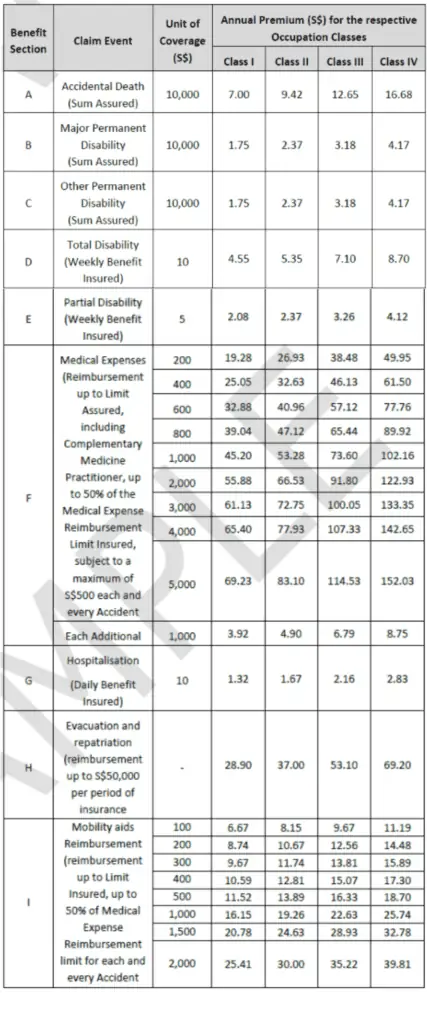

The annual premium depends on your chosen specific protection needs and your occupational class.

Below is a table of premiums payable for each benefit:

The categorisation of occupational classes is not disclosed.

Policy Term

The Great Eastern AccidentCare Plus II is a one-year cover, renewable yearly.

Protection

Great Eastern’s AccidentCare Plus II plan provides benefits if you are injured due to an accident and it leads to any of the claimable events within 365 days of the accident.

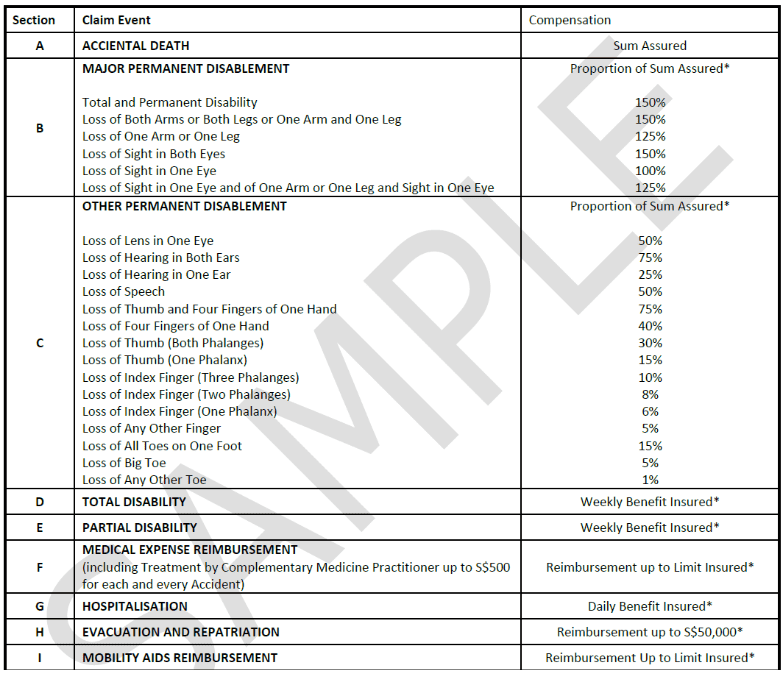

Here’s the table of compensation for coverage types offered by AccidentCare Plus II:

Accidental Death

Accidental Death coverage under the AccidentCare Plus II plan provides a lump sum payout equal to the sum assured.

This benefit is applicable if the insured individual passes on due to injuries sustained from an accident.

The lump sum is up to $10,000, regardless of occupation class.

However, any benefits already paid out for Accidental Major Permanent Disablement or Accidental Other Permanent Disablement resulting from the same accident will be deducted from this payout.

Accidental Major Permanent Disablement Benefit

This coverage under the AccidentCare Plus II plan provides a payout for a portion of the sum assured.

This benefit is tailored to provide financial support in the event of a significant and permanent disability resulting from an accident.

The lump sum is up to $10,000, regardless of occupation class.

However, any benefits already paid out for Accidental Other Permanent Disablement resulting from the same accident will be deducted from this payout.

Accidental Other Permanent Disablement

Accidental Other Permanent Disablement coverage under the AccidentCare Plus II plan provides a payout for a portion of the sum assured.

The maximum benefit is capped at $10,000 per policy year.

However, the total benefits payable under Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement combined shall not exceed 1.5 times the sum assured under Accidental Death.

This benefit is intended to offer financial assistance in the event of a permanent disablement resulting from an accident not classified as a “major” permanent disablement.

Weekly Disability Benefit

With the AccidentCare Plus II plan, if the insured individual becomes partially or entirely disabled and a qualified medical doctor confirms this, the insured individual can qualify for a weekly payment.

This payment starts when the medical doctor declares they are disabled.

The total time they can receive these payments for both partial and complete disability combined is up to 104 weeks.

In other words, the payments will continue for a maximum period of 104 weeks, whether the insured individual suffers a partial or entire disablement.

Medical Expenses Reimbursement

The Medical Expenses Reimbursement benefit covers medical expenses incurred due to an accident.

The benefit amount for medical expenses is subject to the limit insured.

The limit includes treatment by a Complementary Medicine Practitioner or Allied Health Professional, subject to a sub-limit of $500 or 50% of the limit insured, whichever is lower, per accident.

Hospitalisation Daily Benefit

The Hospital Daily benefit offers a daily cash payout for each day the life assured is hospitalised.

The benefit applies to hospitalisation due to any accident, where the life assured is hospitalised for 12 hours continuously or more.

The maximum daily cash benefit payable period is 180 days for each hospitalisation event.

Mobility Aids Reimbursement

The Mobility Aids Reimbursement benefit covers the cost of mobility aids due to an accident up to the sum assured in the policy.

The maximum reimbursement is, however, to the maximum of 50% of the Medical Expenses Reimbursement benefit.

To qualify for this reimbursement, the mobility aids must be prescribed by a medical practitioner to aid the assured recovery or mobility.

Specifically, only the expenses incurred for the rental or purchase of one artificial leg, per leg will be reimbursed during the lifetime of the life assured.

Extra Cover For Females

If you are a female, the amount of money you can receive and the daily hospitalisation benefit will increase by 20% when calculating what you get under:

- Accidental Death,

- Accidental Major Permanent Disablement, and

- Accidental Other Permanent Disablement.

This further includes any limits on these benefits, if there are any.

Terrorist Activities

If the individual insured experiences something covered by this policy because of a terrorist attack, the most they can receive for that event is $2,000,000.

This applies to this policy and any other personal accident policies or add-ons that cover the same person.

Great Eastern AccidentCare Plus II Rider

AccidentCare Plus II Rider is an optional add-on to your other whole life, endowment, or investment-linked policies, providing additional personal accident coverage.

Take note that this is not a rider for the standalone plan, but rather an add-on if you have other policies like the GREAT (Complete) Flexi Living Protect 2 or the GREAT Flexi Goal.

The rider provides benefits when accidents lead to sudden and unexpected injuries, completely separate from illnesses, diseases, or other causes, as long as these accidents occur during the policy period.

Benefits of AccidentCare Plus II Rider

Here’s what this comprehensive personal accident rider covers:

- Death: AccidentCare Plus II Rider provides financial support to the bereaved family in the unfortunate event of a fatal accident.

- Permanent Disablement: If an accident results in a long-term disablement, the AccidentCare Plus II Rider offers compensation.

- Total & Partial Disability: AccidentCare Plus II Rider provides benefits due to total and partial disability, as certified by a doctor.

- Medical Expense Reimbursement: You get reimbursed for accident-related medical expenses, such as doctor visits, surgeries, or therapies.

- Mobility Aids Reimbursement: If you need mobility aids during your recovery, the AccidentCare Plus Rider covers the cost.

- Hospitalisation Benefits: If an accident lands you in the hospital, the AccidentCare Plus II Rider provides financial assistance to manage additional expenses.

- Evacuation and Repatriation: If the insured individual is in a foreign country and needs to be evacuated due to an accident or in case of accidental death, it takes care of the expenses.

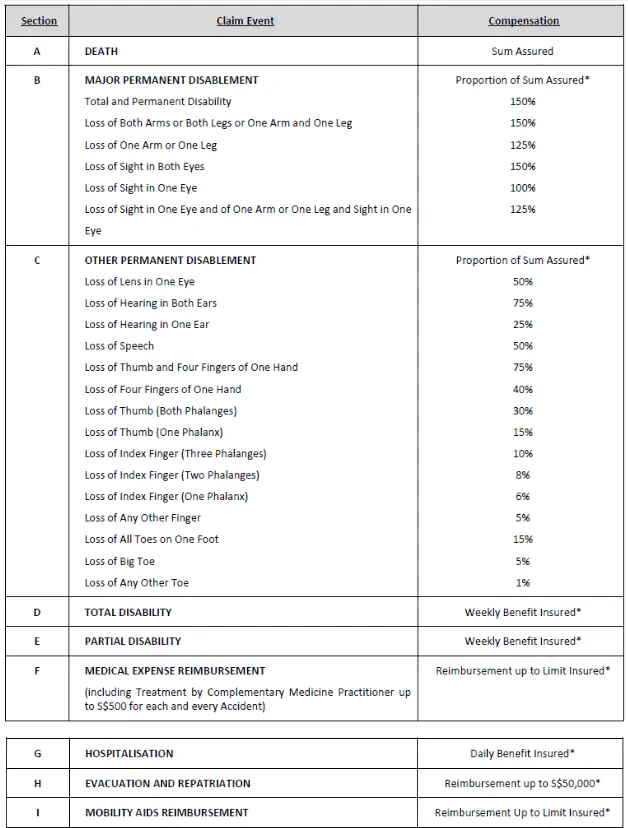

The table below illustrates the Benefits Assured for the respective claim event under the AccidentCare Plus II rider:

Summary of Great Eastern’s AccidentCare Plus II

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of the Great Eastern AccidentCare Plus II

The Great Eastern AccidentCare Plus II is a customisable personal accident insurance plan and is one of the most customisable plans we’ve seen.

It offers a range of benefits to provide financial support and peace of mind in the event of an accident.

You get to choose how much sum assured you want for each benefit, personalising the policy to your own needs.

These benefits include lumpsum payouts in the unfortunate case of demise or disability from an accident.

Should you incur medical expenses from an accident, such as doctor visits, surgeries, or alternative treatments like physiotherapy and Traditional Chinese Medicine (TCM), this plan will reimburse you for these costs, too.

If you become partially or fully disabled because of an accident, the policy provides you a weekly cash benefit.

This payment continues for up to 104 weeks, offering financial support while unable to work and helping cover daily living expenses.

The Evacuation and Repatriation coverage is particularly valuable for travellers.

If you suffer an accidental injury while abroad, the Great Eastern AccidentCare Plus II covers the expenses of evacuation from a foreign location to receive medical care.

In the tragic event of accidental death while abroad, the benefit includes the costs of bringing the insured’s remains back to their home country.

The policy provides a daily cash benefit if you are hospitalised due to an accident.

This benefit is designed to help you cope with additional expenses that may arise during your hospital stay, such as transportation or childcare expenses.

When recovering from an accident, you may require mobility aids like crutches, wheelchairs, or other assistive devices.

Great Eastern’s AccidentCare Plus II covers the cost of these aids, ensuring you have the necessary equipment to assist you in your recovery.

Ladies receive enhanced benefits, including a 20% increase in the hospitalisation benefit and the sum assured for accidental death and permanent disablement.

This added coverage recognises the unique needs and circumstances that women may face in the event of an accident.

Further, if you drive a motorcycle, you can enjoy full benefits under this accident plan, with only a 15% premium increase based on your occupational class.

This means you can get comprehensive protection tailored to the risks associated with driving a motorcycle.

What are the downsides?

Well, if you’re looking for a PA plan that covers HFMD, dengue, and ambulance costs, this is not for you.

For that, you might want to check out the Manulife ReadyProtect.

Also, customising your plan might add up to your total premium costs.

So make sure to compare the premiums of your customised policy with other plans with the same sum assured amounts.

Unless you need something very specific, or your plan has lower premiums than normal PA plans, you’re better off buying ready-made personal accident plans.

As usual, we recommend checking out alternative personal accident plans before making a decision.

After that, you should talk to another financial advisor for a second opinion on whether the Great Eastern AccidentCare Plus II is for you or to explore possible alternatives.

We partner with unbiased financial advisors to help you with this.

Click here to get connected for free.