GREAT Flexi Goal is a regular-premium endowment plan that provides potential returns to help you confidently reach your goals.

The plan guarantees your capital upon maturity and lets you invest in their pretty decent par funds.

Here’s our comprehensive review of the GREAT Flexi Goal to help you decide if it’s the right policy to meet your needs.

Read on:

My Review of the Great Eastern GREAT Flexi Goal

If you’re on the lookout for an endowment plan that combines savings with a touch of insurance coverage, Great Eastern’s GREAT Flexi Goal might just catch your eye.

Let me walk you through what makes this policy stand out, but also where it might fall short for some of you.

Starting with the premiums, they’re set at a manageable $100 per month, making it accessible for a broad range of budgets.

This is particularly appealing if you’re starting out and looking for a disciplined savings route without breaking the bank.

Plus, the plan doesn’t just sit there; it’s working for you, investing in a par fund that has shown decent performance.

And let’s not forget the safety net it offers – coverage for terminal illness, death, and total permanent disability (TPD) for the life assured, alongside the capital guarantee upon maturity.

These features ensure that your investment is not only growing but also protected against life’s uncertainties.

However, no plan is without its drawbacks.

The GREAT Flexi Goal’s rigidity in terms of premium payment terms and the lack of withdrawal options before maturity could be a deal-breaker for those who value flexibility.

With terms fixed at either 15 or 20 years and no room to adjust the life assured or take a premium holiday, it might feel a bit too locked in for some.

Given these points, it’s crucial to weigh your options carefully.

Endowment plans are a long-term commitment, often spanning decades.

Imagine locking yourself into a plan that doesn’t quite fit your evolving needs – it’s a scenario worth avoiding.

This is why I always recommend doing your homework.

For instance, if you’re looking for flexible premium payment terms, Prudential’s PRUActive Saver III is pretty good.

Have no set maturity date and don’t mind leaving your monies in a policy? Check out Singlife’s Flexi Life Income.

What about a feature-packed endowment plan? The Manulife ReadyBuilder II packs a punch with its array of features.

Alternatively, our post on the best endowment plans in Singapore is a great place to start.

It’ll give you a broader view of what’s out there, ensuring you make a choice that’s truly in line with your goals.

And if you’re feeling a bit overwhelmed by the options, why not take advantage of a free comparison session with one of our unbiased financial advisors?

They can help you sift through the details, ensuring you’re not just choosing a good policy, but the right one for you.

Click here to speak to one of our partners.

Let’s break down the GREAT Flexi Goal in detail:

Criteria

- Minimum premium of $100/month

- Policy term of 15 or 20 years

- Premium payment term of 15 or 20 years

General Features

Policy Terms

The plan offers different premium terms to match your individual needs.

You can choose a plan that suits you with an affordable contribution of $100 every month.

Notably, this policy comes with fixed premiums that won’t be subject to any modification.

With GREAT Flexi Goal, you can opt for a 15-year term or choose a 20-year term. Also, you can choose between the following;

- Limited or Full Pay for the 20-year term

- Full Pay for both 15 and 20-year terms

Basically, if you choose the 20-year policy term, you may opt for the limited pay option so that you will only need to pay your premiums for 15 years.

If you choose this option, note that it will affect your maturity benefit and/or premiums.

Premium Allocation

As this is a participating policy, it’s important to understand what types of investments your premiums are allocated to:

| Asset | Allocation Goals | Actual Allocation |

| Equities | 20% | 23% |

| Bonds | 66% | 61% |

| Properties | 10% | 8% |

| Loans | 4% | 3% |

| Cash & Equivalents | 0% | 5% |

| Others | 0% | 0% |

Accurate as of Dec 2021.

Payout Options

Unlike other endowment plans, the only payout you’ll get is at the end of your policy term, AKA your maturity benefit at either 15 or 20 years.

At maturity, the maturity benefit includes bonuses, if applicable. However, these benefits can only be paid out if the life assured remains alive.

The death benefit will be paid if the life assured has passed.

Protection

Death Benefit

If death occurs, your beneficiaries will receive the following in a single lump sum, including any bonuses;

The higher of

- The guaranteed surrender amount, or

- 105% of the sum of standard annual premiums paid

The surrender amount differs from policy to policy, so check the benefit illustration of your policy.

Total and Permanent Disability (TPD) Benefit

If an accident happens and you become disabled such that you can’t perform any of the 6 ADLs, you will receive the death benefit as a single payment.

If you become totally and permanently disabled, the death benefit will be accelerated and paid in a lump sum.

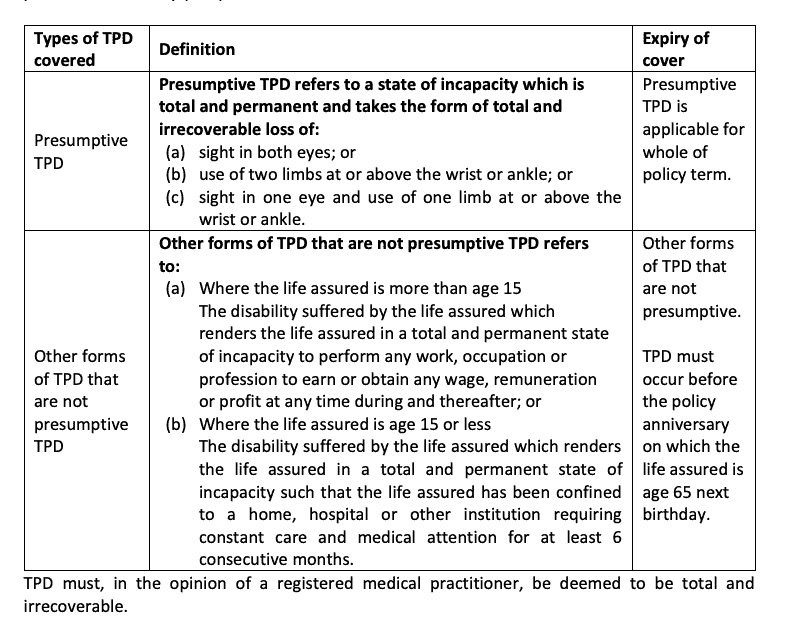

Here are the TPD definitions laid out by Great Eastern for the GREAT Flexi Goal:

The maximum amount payable for TPD, including riders, is $5,000,000 across all policies.

Terminal Illness Benefit

The death benefit will be paid in one lump sum upon a diagnosis of an illness that will result in the life assured’s death within 12 months.

Optional Riders

The plan allows you to boost your coverage with optional riders. Personal Accident and Waiver of Premiums are some available options to increase your protection.

Key Features

Reversionary Bonus

The reversionary bonus is usually declared on an annual basis and, once declared, will contribute to the total guaranteed benefits of the policy.

The benefit can, however, only be added after 3 consecutive years or at Great Eastern’s discretion.

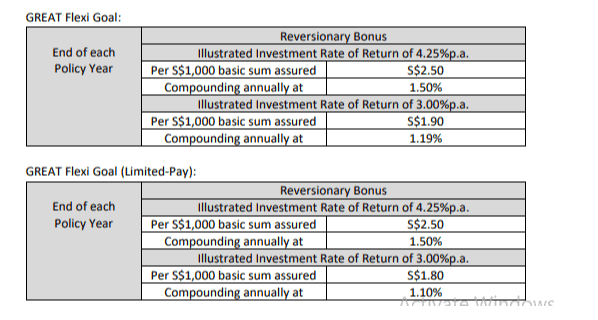

The following table shows the illustrated reversionary bonus rates for GREAT Flexi Goal and GREAT Flexi Goal (Limited-Pay):

Two IIRRs are provided for illustration purposes only. They do not represent the future performance of the participating funds.

Terminal Bonus

The terminal bonus (if any) is a single payment which will be paid out upon either submitting a claim under the policy, the policy’s maturity, or on surrender of the policy, whichever event occurs first.

Participating Fund Performance

Now when you’re investing in an endowment or annuity plan, it’s important to take a look at the performance of the par fund.

To recap, here is the asset allocation of the participating fund as of December 2021.

| Asset | Allocation Goals | Actual Allocation |

| Equities | 20% | 23% |

| Bonds | 66% | 61% |

| Properties | 10% | 8% |

| Loans | 4% | 3% |

| Cash & Equivalents | 0% | 5% |

| Others | 0% | 0% |

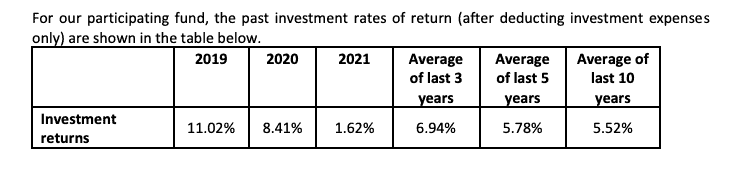

As of December 2021, here is how the par funds have performed:

Based on 5- and 10-year annualised returns, it’s 5.78% p.a and 5.52% p.a, respectively.

I think these are decent performances for par funds as it meets the industry average.

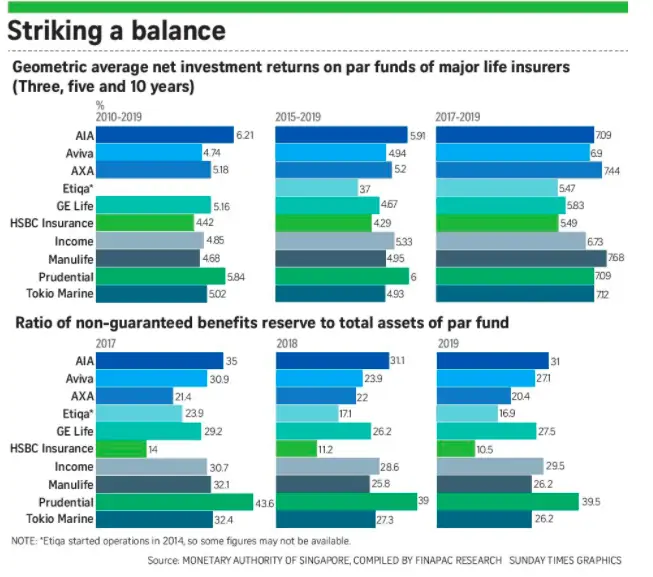

The table below shows the geometric (3, 5, and 10-year) net investment returns of par funds across life insurers in Singapore – so the GREAT Flexi Goal is pretty good.

However, note that the data is dated and does not reflect future performance.

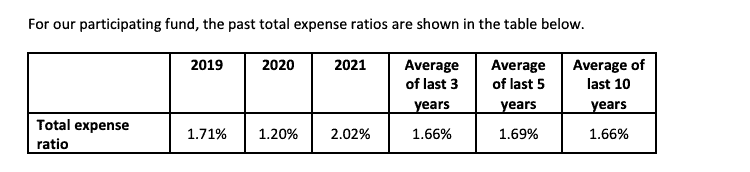

Total Expense Ratio

When looking at par funds, you should also consider the total expense ratio, which measures the total costs incurred to manage them.

This is crucial as it determines how much returns you’ll make. Here are the expense ratios shared by Great Eastern:

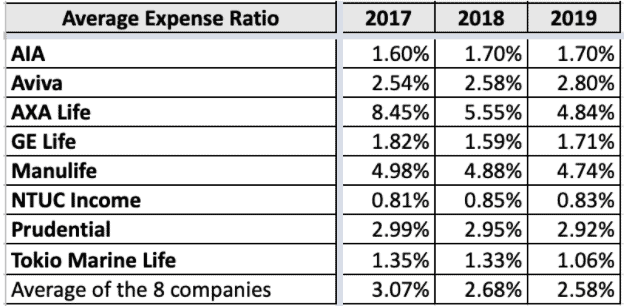

Again, these numbers will mean nothing unless compared against others, so here’s the table of average expense ratios across life insurers in Singapore:

As you can see, Great Eastern’s par funds perform above average in terms of the expense ratio, ranking 4th out of 8 companies measured.

Surrendering Your Policy

After paying a minimum of 3 consecutive policy years in premiums, you can surrender your policy.

On surrender of the policy, you will receive any declared and terminal bonus (if applicable), subject to any amounts payable under the policy being deducted first.

The surrender value varies across different policies; thus, look at your policy documents for more information.

GREAT Flexi Goal Fees And Charges

The fees and charges for the GREAT Flexi Goal are already calculated in the premiums you’ll pay – so don’t be worried about paying additional or unexpected charges.

An Illustration of How the GREAT Flexi Goal Works

Assume that Peter purchases a GREAT Flexi Goal for his one-year-old son Braden to save some money for his university education.

He chooses a premium payment term of 15 years and a policy term of 20 years. In addition, he makes $6,000 yearly payments.

The following table illustrates how his investment grows;

| Age- Life Assured | Value | |

| 1 year | Father invests $6,000 annual premium for son | |

| 15 years total premiums paid

6,000 x 15= $90,000 |

$90,000 |

|

| At 21 years old | Guaranteed Maturity Benefit | $94,571 |

| Non-guaranteed Maturity Benefit | $38,807 | |

| Total Illustrated Maturity Benefit | $133,324 | |

Assumption: Total IIRR 3.00% per annum.

When Branden reaches 21 years old, he is expected to receive $133,324. Of that amount, $94,517 is guaranteed, and $38,807 is non-guaranteed.

Summary of the GREAT Flexi Goal

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Value Benefits | NA |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

| Optional Add-on Riders | NA |