The GREAT Critical Protector is a standalone critical illness insurance plan that provides you with a lump sum cash payout upon diagnosis of any of the covered 53 critical illnesses, ensuring you have financial support when facing serious health challenges.

However, this policy is now obsolete, as it was a limited-time offering due to the MOH’s introduction of the Cancer Drug List (CDL).

So here’s one for those who already bought and are reviewing their current insurance coverage.

Here’s our review of the Great Eastern GREAT Critical Protector.

My Review of the Great Eastern GREAT Critical Protector

The Great Eastern GREAT Critical Protector is a great add-on to your ECI/CI coverage, providing additional protection due to the MOH’s Cancer Drug List.

This plan offers a 100% cash payout upon diagnosis of any one of the 53 critical illnesses, regardless of the stage of the illness (early, intermediate, or advanced), and it is not aggregated across any ECI/CI policies you have with Great Eastern.

The application process is also simple and convenient – with a 3 question medical underwriting.

In the event of an unfortunate death due to a critical illness, the GREAT Critical Protector provides a lump sum payout of $25,000.

The GREAT Critical Protector plan offers affordable and comprehensive coverage against various critical illnesses – and is an excellent add-on to your current insurance coverage.

However, as this policy is already obsolete, there might be policies in the market with better coverage or cheaper.

Thus, it’s worth exploring if anything else is available for you.

If you need someone to assist you with this, we partner with MAS-licensed financial advisors who can help you.

Criteria

- Minimum sum assured: $100,000

General Features

Premium Terms

Premiums for GREAT Critical Protector are payable monthly, quarterly, half-yearly, or yearly.

As this is a renewable policy, the premiums will also gradually increase with age till the end of the policy term.

Policy Term

The policy term is up to 85 years on the next birthday.

Waiting Period

As with all critical illness plans, there is a waiting period of 90 days before you can make your first claim.

Protection

Critical Illness Benefit

The Critical Illness Benefit offered by the GREAT Critical Protector insurance plan provides comprehensive coverage against critical illnesses, giving you options and flexibility.

Upon the diagnosis of any of the covered critical illnesses, whether at an early, intermediate, or late-stage, you will receive a 100% lump sum payout.

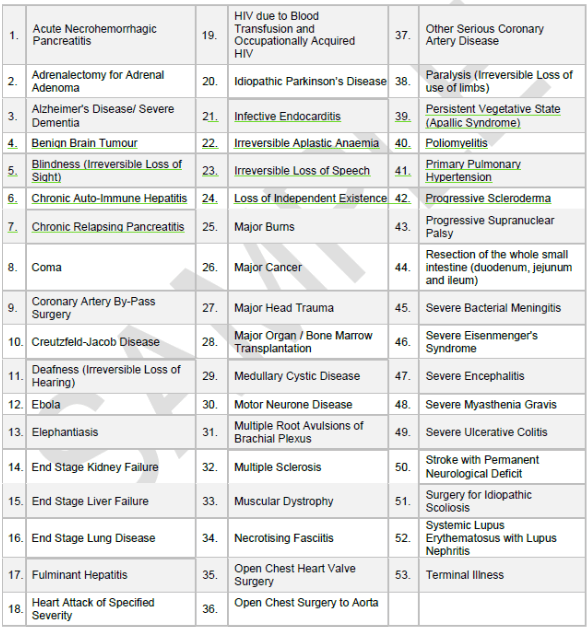

Here is a list of the covered critical illnesses:

Compassionate Benefit

The GREAT Critical Protector provides a lump sum payout of $25,000 in the event of the insured’s death due to a critical illness.

However, it’s important to note that this payout signifies the plan’s termination.

Angioplasty & Other Invasive Treatment For Coronary Artery Benefit

The Angioplasty and Other Invasive Treatment Benefits include procedures such as balloon angioplasty or similar catheter treatments for those with a blockage of at least 60% in major heart arteries.

If you go through this procedure, you may get an extra payout of 10% of the basic amount assured.

In addition, any money you receive for diagnostic tests won’t detract from the basic sum assured.

Key Features

3 Health Questions

Unlike typical critical illness insurance policies, you don’t need to undergo full medical underwriting.

Rather, you only go through 3 health questions as part of the underwriting process.

Changes To The Policy

Should you want to make changes to your policy, you can send Great Eastern a written request to either:

- Decrease the basic sum assured of the policy, or

- Alter the frequency of premium payments.

If there’s a revision in the basic sum assured or any changes to the premium frequency, the total premium you’ve paid will be recalculated.

This recalculation will be based on the current premium rates and frequency as if the change in the basic sum assured and/or premium frequency had been in effect from the start of the policy.

No Aggregation With Other Policies

For ECI/CI insurance policies, the total sum assured is usually aggregated across all ECI/CI coverage you have from the same insurer.

For the GREAT Critical Protector, Great Eastern does not consider your sum assured when calculating your total ECI/CI payouts with them.

Summary Of Great Critical Protector

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | Yes |

| Early Critical Illness | Yes |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |