Caring for an elderly loved one is challenging – especially if we’re talking about cost. More so if your loved one is severely disabled.

Studies show that 1 of 2 Singaporeans aged 65 and above face severe disabilities.

Aside from the usual living expenses everyone faces, disabled individuals will require special long-term care. How are you going to fuel these additional financial costs?

Eldershield is such a scheme that Singaporeans can tap into for situations like these.

What is Eldershield?

Eldershield is a severe disability insurance plan rolled out in September 2002 for Singaporeans and Permanent Residents (PRs) by the Singapore government.

This insurance policy provides necessary financial assistance to those, especially older adults, who require long-term care.

By long-term care, it means those who suffer from severe disabilities and cannot perform any 3 out of the 6 simple activities of daily living – dressing, bathing, going to the bathroom, transferring, and moving around.

Singaporeans and PRs covered under the Eldershield insurance scheme will receive payouts of $300 per month for 5 years upon severe disability.

However, after its review in 2007, the plan was upgraded to Eldershield 400 to provide $400 per month for 6 years upon severe disability.

Depending on the scheme you took back then (Eldershield 300 vs Eldershield 400), your benefits can differ.

But it is important to note that insurance companies currently do not accept the upgrade from a $300 policy to a $400 policy.

With the new CareShield Life taking over ElderShield from 1st October 2020, the payouts have increased to $600 monthly and will increase by 2% yearly until 2025. This increase will be reviewed by the ElderShield Review Committee.

It is also important to know that severe disability insurance (what ElderShield and CareShield life are), is different from disability income insurance.

Who is Eligible for Eldershield?

Until 2019, every Singapore permanent resident and citizen holding MediSave accounts are eligible and automatically registered in the Eldershield scheme from 40 years of age, unless they choose to opt out.

However, if you turn 40 years old in 2020 and beyond, you will be registered automatically into the CareShield Life scheme, with effect from 1st October.

Don’t worry; there will be no exclusions based on pre-existing medical conditions during the new registration.

To be eligible for the upgraded CareShield Life insurance, you need to be born on or after 1980. Only those born in 1979 or earlier can still apply for the ElderShield $400 scheme (subject to approval).

However, note that you will have to go through medical assessments by MOH-accredited severe disability assessors. The assessor will then submit the assessment to the insurer for processing. There’s also a severe disability assessment fee involved.

Plus, if you already have any pre-existing medical conditions, then rejection of your application is very likely.

And once you get registered in ElderShield, you can choose to move to CareShield Life from the end of 2021, whether you have a pre-existing disability or not.

The ElderShield program will close after its stipulated time and will no longer be made available to new applicants.

The Government is also taking over the ElderShield insurance from the existing firms by the end of 2021. There will be more information on this policy at the end of 2021.

You can avail further information regarding ElderShield policy on https://www.careshieldlife.gov.sg/faqs/eldershield.html.

Read our comparison if you’re not sure about the difference between Careshield Life and ElderShield.

What coverage does ElderShield provide?

Eldershield provides you with long-term disability coverage for life.

In the scenario where you need to make any claims for disability, the ElderShield 300 provides payouts of $300 per month for 5 years upon severe disability. ElderShield 400 provides monthly payouts of $400 for 6 years upon severe disability.

There will be no exclusions for pre-existing medical conditions like diabetes, high blood pressure, cardiac problems, etc., during the auto-registration.

However, it won’t cover any pre-existing severe disabilities before your registration in the ElderShield scheme. And you can refund your premiums by making a declaration of your conditions.

How much are ElderShield Premiums?

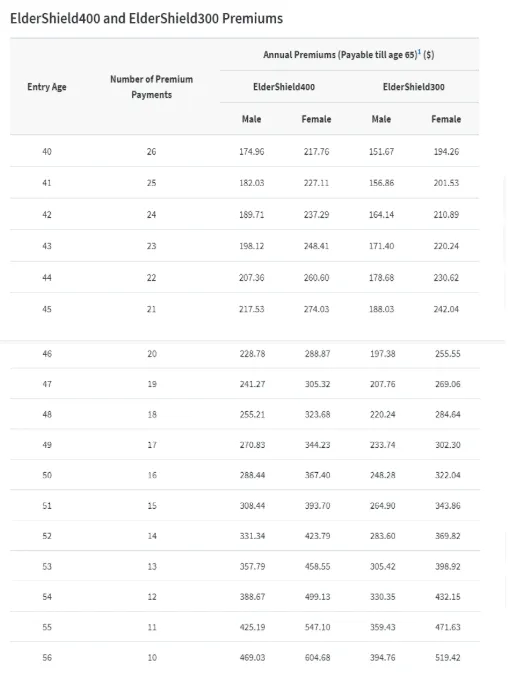

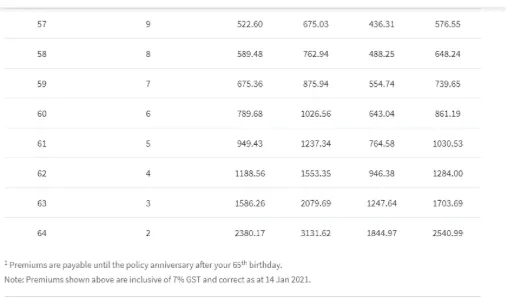

Your age of entry alone determines the premium amount you pay and does not increase with age. The payment is paid on an annual basis until you turn 65 years old or whenever you want to make a claim.

Fortunately, this means you don’t have to wait until you’re 65 years old strictly to make claims.

Below is a chart summarisation of premiums payable under the ElderShield insurance plan for both the ElderShield 300 and ElderShield 400:

You can make payment through a MediSave account- it can be either yours or any of your family members too.

You can also make premium payments through cheque, cash, or General Interbank Recurring Order (GIRO).

Depending on your premium payment mode, there are specific necessary actions you need to take. Your financial advisor or the insurer will let you know in this case.

Can I Opt-Out of ElderShield?

Yes, you can opt out of ElderShield if you think you don’t need the disability insurance coverage.

Opting out of the scheme is easy. All you need to do is submit your name and NRIC to your insurer, expressing your wish to come out of ElderShield.

However, keep in mind that there will be no refunds after the first 60 days of the policy year.

Should I Opt-Out of ElderShield?

Once you opt out of the ElderShield scheme, you may not be able to avail of the insurance’s services and benefits.

The main disadvantage of opting out of ElderShield is when you try joining in later. In theory, the option to apply later sounds convenient – you pay later and still enjoy the benefits when you’re at higher risk.

But practically, it is not easy. You will firstly have to undergo medical assessments. Secondly, the insurer’s underwriting and approval are needed for your application to be successful.

The worst scenario is when you re-apply for insurance with pre-existing medical conditions. In such a case, your application is most likely to fall into the rejection pile.

The bottom line is that you need to think carefully or at least have other credible financial backups before you decide to opt-out of ElderShield.

Moreover, you will no longer be able to opt back into the plan when the new CareShield Life policy rolls in at the end of 2021.

Financially speaking, you don’t have to opt out of it since you can make your annual payments via your CPF MediSave account – money you can’t touch anyway.

It is affordable and even more beneficial with an early application as premiums do not increase with your age.

ElderShield Supplements

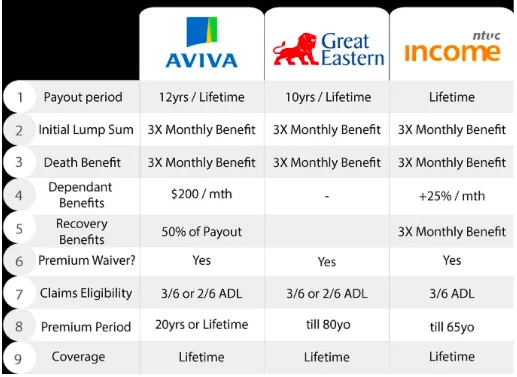

Supplements in ElderShield insurance are additional benefits to increase payouts and coverage, should you desire to do so. You need to be already registered under the ElderShield scheme to buy supplement plans.

Supplement plans differ in their benefits from one insurance firm to another. It is, therefore, advisable for you to first check in with your preferred insurer before any purchases.

Here’s a further look at the comparisons from the 3 appointed private insurers-

To buy these supplements, you can use your MediSave or any family members with a limit of $600/year per insured person. It also means that you can support your ailing grandparents or parents if they’re currently not enrolled in this disability insurance scheme.

You can check out our guide on ElderShield upgrades to help you understand these better.

Again, you should talk to a financial advisor to see if you need these or not.

Conclusion

Planning on insurance and keeping it on a monthly to monthly basis can be tedious. But it is better to have a plan than not to have one.

As you would have hopefully read our complete guide to ElderShield- you can see that there are more benefits to having the ElderShield scheme than opting out or not having one at all.

Look around the world today; the spike in medical expenses only continues to increase. Adding on, growing old and frail is bound to happen naturally. It’s only a matter of time and chance before you realise you should’ve acted sooner.

That is why it is best to prepare for the long run when you can. If you’re in need of advice on how to properly conduct financial planning, talk to an unbiased financial advisor in our network.