Have you always wondered where your money goes after your death?

More specifically, the hard-earned money you’ve saved up in your CPF as a Singaporean?

How can you ensure your loved ones receive your CPF money as intended?

Will they even get the money you have saved for them?

Well, that all boils down to whether you’ve made any CPF nominations!

Continue reading.

What is a CPF Nomination?

In simple terms, a CPF nomination is where you (the nominator) appoint one or more individuals (the nominees) to receive

- your remaining CPF savings in your Ordinary, Special, MediSave, and Retirement Accounts (OA, SA, MA, and RA) in cash,

- unused CPF LIFE premiums, and

- discounted Singtel shares, after you have passed on.

This process is free-of-charge, as well as for your nominees when it is time for them to claim your CPF savings.

This process falls under the CPF Nomination Scheme.

Other forms of CPF nominations include those under the Enhanced Nomination Scheme (ENS) or the Special Needs Saving Scheme (SNSS), which will be explained later on in the article.

What is not included in a CPF nomination?

This essentially means the assets you cannot distribute which include

- Properties bought under your CPF savings

- Payout from Dependent’s Protection Scheme (DPS)

- Investments made under CPF Investment Scheme (CPFIS)

If you wish to know more about CPFIS instead, click here!

Who Can Make CPF Nominations?

You are able to make a CPF nomination once you turn 16 years old and you must be of sound mind.

Having a sound mind means you are capable of making your own decisions, and not suffering from any permanent mental malfunctions that cause you to imagine and believe things a reasonable person would not.

You must also be a valid CPF account holder in order for a nomination to happen.

Who Can be a Nominee?

Can any Tom, Dick, or Harry be your nominee? The answer is, yes!

Besides your spouse (if any) or parents, you are free to name whoever you want to be your nominee – even if they do not have a CPF account.

However, the method by which your CPF monies are distributed may differ based on the individual you nominate.

Take a look.

| If your nominee is… | Method of Distribution |

| Below 18 years of age | The monies will be held in trust by the Public Trustee’s Office (PTO) until they turn 18. |

| Of unsound mind | The monies will be handled by their court-appointed deputies. |

| Bankrupt | The monies will be forwarded to the Official Assignee (OA) as the property of a bankrupt is vested in the OA by law. |

| Above 18, of sound mind, and not bankrupt | The nominee(s) will be contacted within 15 working days from the notification of your passing, where they can make a withdrawal from your CPF account either in cash or via General Interbank Recurring Order (GIRO). |

How many nominees am I allowed to appoint?

Well, there is no limit to the number of nominees you can appoint!

However, you can only indicate up to 8 nominees if you’re making a nomination online.

Any more, you’ll have to make a physical visit to CPF Service Centres to do so and file additional paperwork per nominee.

There are currently 5 such centres in Singapore, located at Bishan, Maxwell, Tampines, Woodlands, and Jurong.

Remember to make an appointment at least 1 working day in advance, as they only take in requests by appointment.

What happens if my nominee passes away before me?

If your nominee passes away before you, his/her share of your CPF savings will be given to the rest of your surviving nominees in the same proportion as you have specified.

Should there be no surviving nominees, in any case, all your CPF savings will be transferred to the Public Trustee Office (PTO) for distribution to your family members under the Interstate Succession Act – at which you will be charged a one-time administration fee (minimum of $15).

When should I review my CPF nomination or nominee(s)?

It’s recommended that you review your nominees, especially at major milestones, such as

- Marriage,

- having kids,

- divorce, or

- the death of your nominee(s).

This is because your intentions and sentiments may change over time, thus reviewing your nomination at typical life events is a good guideline to have.

Take note that once you are legally married – any existing CPF nomination you had made previously will be revoked.

So, do remember to also make a new CPF nomination after your marriage so that you can distribute your CPF savings to your spouse and new loved ones in your family tree.

On the contrary, divorce does not revoke any existing nominations like marriage does.

How do I check for an existing CPF nomination and its details?

You can log on to cpf.gov.sg and click on “My Messages”.

If you have made a CPF nomination previously, it should display a CPF nomination message.

To view more details, you can proceed to click on “Nomination Details” > “View My Nomination Details”.

Alternatively, you can also visit physical CPF Service Centres with your NRIC/passport to find out more about your existing nomination details.

If you wish to make any changes, this will be counted as a new nomination which will overwrite your earlier nomination.

What happens if you don’t make a CPF nomination?

Now, you may be wondering. What exactly happens to my money if I decide not to make a CPF nomination?

Does it still go to my loved ones? Or back to CPF Board?

Without a nomination, your CPF savings will be distributed by the Public Trustee’s Office (PTO) to legally entitled beneficiaries.

This can take up to 6 months for them to identify eligible beneficiaries to claim your savings.

These beneficiaries refer to your immediate family members and next-of-kin (i.e. closest living relatives through blood or legal relationships).

What’s more, you cannot decide which family member will receive your savings and exactly how much they will receive.

Whoever your savings get distributed to, he/she would have to pay a one-time fee of a minimum of $15 to the PTO for the purpose of this distribution.

To avoid imposing fees on your loved ones and to dictate who specifically gets your money, it is certainly best to nominate beforehand.

Besides CPF savings, your discounted Singtel shares will form part of your estate if you do not make a CPF nomination – which automatically makes it ineligible to be distributed.

CPF Nomination for Muslims

For Muslims in Singapore, the process of CPF nominations is slightly different.

Upon the death of a Muslim CPF member, the CPF Board will proceed to close the member’s CPF account and transfer the balance remaining in the account to the Public Trustee (PT).

From there, the PT will distribute the deceased CPF savings in accordance with Shariah law.

In any case, a Muslim does not make a CPF Nomination, the distribution is also done by the PTO to his/her legally entitled beneficiaries under the Inheritance Certificate for Muslims.

The Syariah Court of Singapore issues this certificate.

Keep in mind, that they will also have to pay the one-time fee to the PTO for the sake of the distribution.

CPF Enhanced Nomination Scheme (ENS)

The ENS scheme differs from the typical CPF Nomination Scheme, where instead of your CPF savings being distributed in cash – it goes into your nominees’ CPF accounts instead.

This would be recommended for nominees who you feel are not as cautious with their money or have terrible spending habits, since having money in their CPF will be more restrictive and towards better intentions such as medical needs or retirement.

CPF Special Needs Saving Scheme Nomination (SNSS)

This involves child nominee(s) who are born with special needs and need long-term care.

Under the SNSS scheme, your child will receive monthly disbursements from your CPF savings after your death.

Nominations under the ENS and SNSS schemes cannot be done online, unlike the regular CPF Nomination Scheme.

Instead, you’ll have to contact CPF Board directly and arrange an appointment at any of the 5 centres to do so.

How to make a CPF nomination (step-by-step guide)

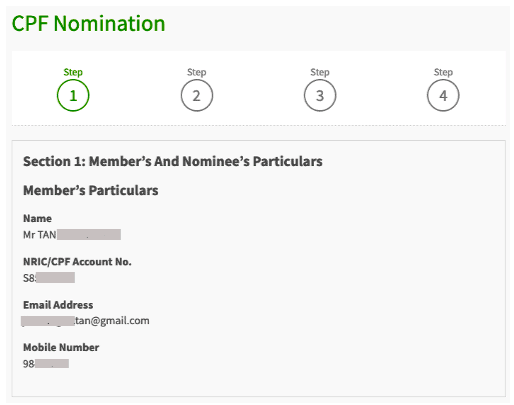

Logging In

You can make a CPF nomination either online or in person.

When doing so online, you can first log in to CPF Online Services using your SingPass details.

Source: CPF Board

Needed Documents and Share Percentages

For online nominations, you should also have the following details of yourself, your nominees, and witnesses ready so it will be an easier process to fill them in.

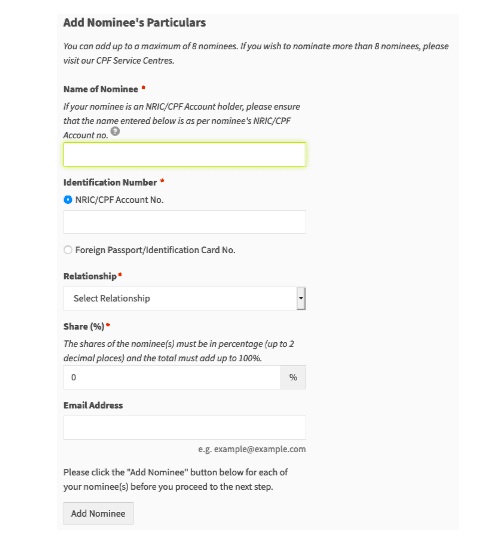

Remember that online nominations allow you to only add up to a maximum of 8 nominees.

For in-person appointments, make sure you have photocopies of these documents.

- Full name of Nominee(s), their NRIC/Foreign Passport/Identification Number and Mailing Address, Relationship with Nominator (you)

- Full name of Authorised Person(s) (i.e. yourself), your NRIC/Foreign Passport/Identification Number

- Full names of your 2 witnesses, NRIC/Foreign Identification Number, Email Address, and Mobile Number

Source: CPF Board

This is where you should also decide on the percentage of CPF savings you will be distributing to your nominee(s).

The percentages of your nominee(s) must be up to 2 decimal places and add up to a total of 100%.

Here’s a hypothetical example with 5 nominees:

| Relationship | Percentage of Share (%) |

| Spouse | 40.00 |

| Father | 10.00 |

| Mother | 10.00 |

| 1st Child | 20.00 |

| 2nd Child | 20.00 |

| Total | 100.00 |

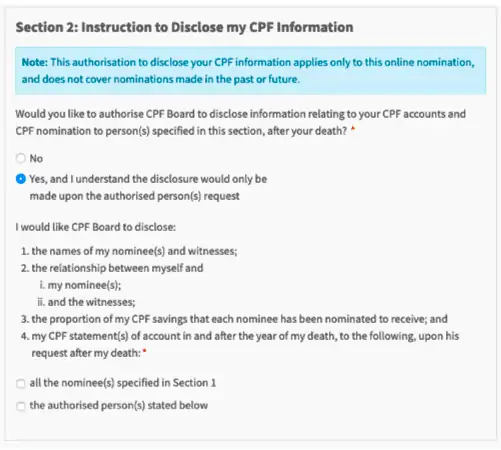

Disclosing your CPF Information

Next, you can also decide whether you want to allow specific individuals, including your nominees, to obtain your CPF account information upon your passing.

Source: CPF Board

Witnesses of your CPF Nomination

As the name suggests, witnesses are the ones who will be a testimony to your CPF nomination – where this decision is made by someone with a sound mind.

For online CPF nominations, you must get 2 persons to witness your nomination.

They must meet the following criteria:

- Be at least 21 years of age

- Be of sound mind

- Are valid SingPass account holders

- Must not be any of your nominee(s)

- Must not be yourself

Once your witnesses are appointed, both of them will be sent an SMS or email to notify them to witness your online nomination.

From there, they can log in to CPF Online Services using their SingPass account to be a witness to your nomination within 7 days.

Keep in mind that both witnesses must submit their declaration that they have been informed of your online nomination within 7 calendar days from the date of submitting your online nomination.

Or else, you would not be able to proceed with the online nomination.

Your nomination details will also not be shared with your witnesses.

If you decide to do it in person, your witnesses can either be those who have met the earlier criteria or the Customer Service Executives at the CPF Service Centres.

Online and in-person CPF nominations will only be completed when both witnesses have witnessed the online nomination.

And viola, within 4 working days – your CPF nomination will be processed!

Conclusion

Just one of the many aspects of CPF, It is extremely important to know about CPF nominations because it involves your hard-earned CPF savings after all.

You would want to know that your loved ones and those important to you will be taken care of upon your demise.

So now that you know about the ins and outs of CPF nominations, you can rest assured that your CPF savings will be distributed according to your wishes – so long as you make one!

It’s not too late to start thinking ahead for the future and the inevitable, so think wisely about who you want your nominees to be – especially at major milestones.

If you know of someone who wishes to know more about what happens to their CPF savings upon death or more details about CPF nominations, be sure to send this article to get them informed as you did!

Need your financial planning or estate planning done?

We partner with unbiased financial advisors who can help you with this.