The AIA Platinum Wealth Elite is an investment-linked policy that helps you grow your capital while covering you until you’re 122 years old.

Here’s our review of the AIA Platinum Wealth Elite.

Keep reading.

My Review of the AIA Platinum Wealth Elite

The AIA Platinum Wealth Elite is an investment-linked policy (ILP) that aims to help you protect your wealth and grow your money, just like other ILPs in the market.

It’s worth noting that the AIA Platinum Wealth Elite is available for cash payment in both Singapore dollars and US dollars, providing flexibility in currency choice.

Premium payment options are somewhat flexible, allowing you to make a single lump sum payment or opt for regular payments over 5 years (or up to 20 years).

The policy also allows for top-ups, enabling you to add funds to enhance your investments.

The policy offers coverage for death and terminal illness benefits. You can vary, increase, or reduce the insured amount depending on your changing needs.

Need cash?

You may also make full surrenders or partial withdrawals with the AIA Platinum Wealth Elite.

Additionally, this plan comes with a No Lapse Privilege, which helps ensure you’re always fully protected, even if you cannot make premium payments for some time.

It’s the ideal choice for legacy planning, allowing you to distribute your wealth to your loved ones while making sure your dependents are covered in case of any unfortunate events such as death and terminal illness.

While the AIA Platinum Wealth Elite offers various benefits, it’s important to note that there are certain limitations.

I find the 5% premium charge for the single premium payment option to be high. Top-ups are also charged at 3% – further lowering your initial investment.

Similarly, the premium charges for regular premiums during the policy’s early years are extremely expensive, up to 40%.

The fund choices are also limited to 3 portfolios – Conservative, Balanced, and Adventurous.

All 3 funds, except for the Adventurous fund, haven’t performed well since inception.

Also, the returns you see above exclude fees and charges. After fees, the Conservative fund performs at -1.46% p.a, Balanced at 0.99% p.a, and Adventurous at 4.7% p.a; since inception.

A whole life insurance plan, coupled with a good investment-linked policy, may give you more coverage and better returns on your plan.

A term insurance plan may reduce your premiums further.

Yes, these options may not offer you coverage up to 122 years old or the No-Lapse Privilege (which we think is really good), but for much lower premiums, you really get much more.

Again, these are not an apples-to-apples comparison, so it might not be fair, but I feel it might be a better alternative, for me at least.

With so many wealth protection and accumulation plan choices, we understand that the decision process can be overwhelming.

To ensure you’re getting exactly what works for your specific situation, take some time to compare other options and talk with a financial advisor who is experienced in helping people like yourself determine which policy best meets your needs.

Sometimes, a second opinion is all you need.

We partner with unbiased MAS-licensed financial advisors to help you with this.

Click here to talk to a financial advisor.

Let’s now dive into what the AIA Platinum Wealth Elite offers.

Criteria

- Single premium or 5-year premium payment term

- Entry Age: 18 years to 70 years

- Minimum sum assured: $500,000

General Features

Premium Payment Terms

The AIA Platinum Wealth Elite offers flexibility in premium payment options.

You can choose to pay your premium in a single lump sum or opt for regular payments over 5-years.

For single pay, you have the option to make a one-time premium payment, providing immediate coverage and potential cash value growth.

If you prefer regular pay, you can choose to make premium payments over a 5-year period.

Additionally, you can extend the premium term for regular payments to a maximum of 20 years.

This allows you to tailor the payment schedule to your financial needs and preferences.

It’s important to note that AIA Platinum Wealth Elite is available only for cash payment and is offered in both Singapore dollars and US dollars.

This flexibility allows you to choose the currency that suits your needs and preferences.

Policy Term

The policy term for AIA Platinum Wealth Elite is 122 years.

Protection

Death Benefit

The AIA Platinum Wealth Elite will provide you with a death benefit until you turn 122 years old.

Before you turn 122 years old, this will be the higher of your sum assured or the policy value, minus any applicable fees and charges.

The current insured amount is calculated by subtracting total withdrawals (excluding those made under the Income Withdrawal Privilege and top-up policy value) and payments from the Terminal Illness benefit.

When it’s your 122nd birthday, the death benefit will be your policy value, minus any applicable fees and charges.

Terminal Illness Benefit

In the event that the insured receives a conclusive diagnosis of a terminal illness and provides satisfactory proof, AIA will pay the death benefit.

Terminal Illness is a diagnosed illness expected to lead to the insured’s death within 12 months.

Key Features

Regular and Ad Hoc Top Ups

The AIA Platinum Wealth Elite allows ad hoc or regular top-ups.

This means you can add additional funds to your policy periodically or whenever you choose, enhancing your investment potential and cash value accumulation.

The minimum amount you can top up at any time is $1,000.

Varying the Insured Amount

You can vary your insured amount a year from the policy issue date while it is still in force.

Increasing the Insured Amount

If you wish to increase your insured amount, you can exercise this option after providing satisfactory evidence of insurability. This may involve medical underwriting.

The minimum amount by which you can increase the insured amount is $10,000.

Reducing the Insured Amount

You may reduce the insured amount provided that the revised insured amount is not less than the minimum insured amount set by the policy, which is $500,000.

However, there are specific conditions under which you can exercise this option:

- The policy has been active for 25 years from the date it was issued.

- On or after the policy’s anniversary when you celebrate your 65th birthday.

Whichever of these conditions is later, you can reduce the insured amount to any amount as long as it’s not below the minimum insured amount.

Full Surrender

You have the option to surrender or terminate your policy at any time while it is still active.

Take note that surrendering your policy might incur hefty surrender charges (more on this later).

Check with your financial advisor or your policy documents for your current surrender value.

Partial Withdrawal

You can make partial withdrawals from your policy at any time while it is still in force.

This allows you to withdraw some of the accumulated funds while keeping the policy active.

Fund Switching

If you wish to change the allocation of your funds within the policy, you can instruct the policy to switch units from one sub-fund to another.

No Lapse Privilege

This policy ensures that your insurance coverage remains intact for the first 15 years or during the premium payment term of your first layer, whichever comes later.

This holds true even if the policy value isn’t enough to cover charges, provided these conditions are met:

- All regular premiums for your basic policy have been paid. Note that this doesn’t include regular premiums due to increasing the insured amount.

- No withdrawals have been made from regular or single premium units, except those from top-up premiums or income withdrawal privilege.

However, the No Lapse Privilege does not apply when changing the insured if the insurance risk charge for the new insured is higher than what would apply to the original insured.

AIA Altitude Membership

AIA Altitude membership provides a personalised array of privileges based on your wealth status.

You can enjoy complimentary will-writing services, invitations to AIA Altitude events, exclusive lifestyle perks, priority queues, and access to AIA Altitude Lounge.

Changing The Insured Person

You can request a change of the insured person within a year from the date it was issued.

If you are an entity (a company or corporation), there are no limitations on the number of times you can change the insured as long as the policy is in force.

However, if you are not an entity, you can only change the insured once while the policy is active.

Please note that fees and charges will continue at the current rate, except for Insurance Risk Charges and Administration Charges, which may be subject to adjustment.

AIA Platinum Wealth Elite Funds

With the AIA Platinum Wealth Elite, you have 3 different funds: AIA Elite Adventurous Fund, AIA Elite Balanced Fund, and AIA Elite Conservative Fund.

These funds are unit trusts and are insurer sub-funds, which means you might incur an additional layer of fees.

Also, each of these funds has both USD and SGD versions, so make sure to look at the correct fund factsheet.

In this post, we will only be looking at the SGD versions.

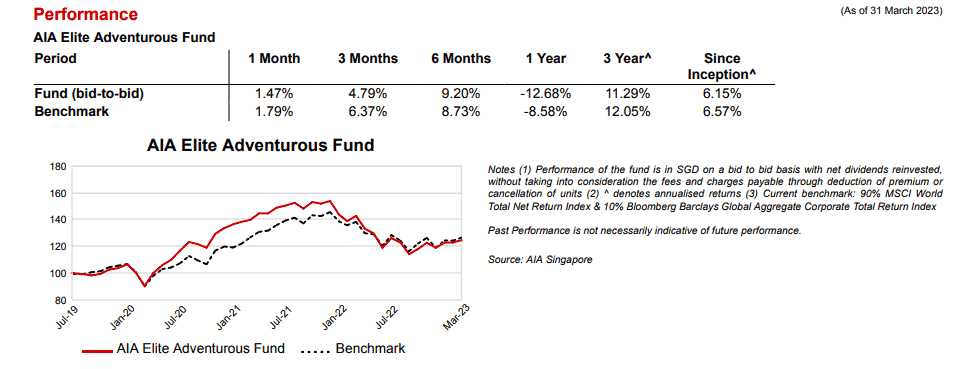

AIA Elite Adventurous Fund

This is the most aggressive fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are 6.15% p.a, before fees:

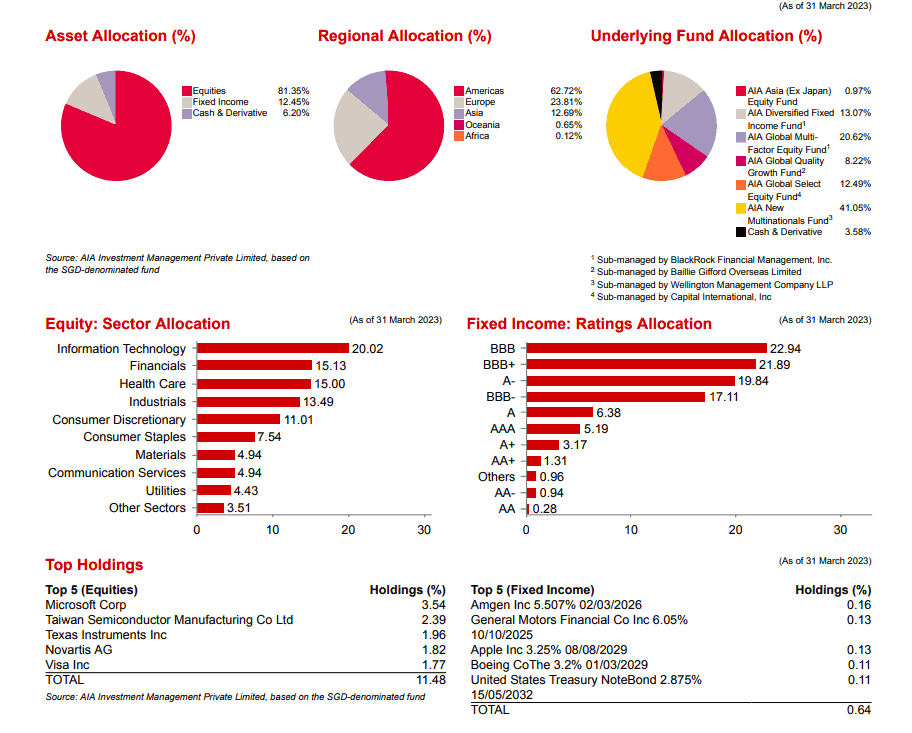

Here are what it allocates your investments into:

As you can see, about 80% is allocated to equities, and the remaining 20% is to fixed income, cash, and cash derivatives.

It also invests in its own AIA sub-funds, which then invests directly in the assets.

The fees are at 1.45% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 4.7% p.a.

Information is accurate as of 31 March 2023.

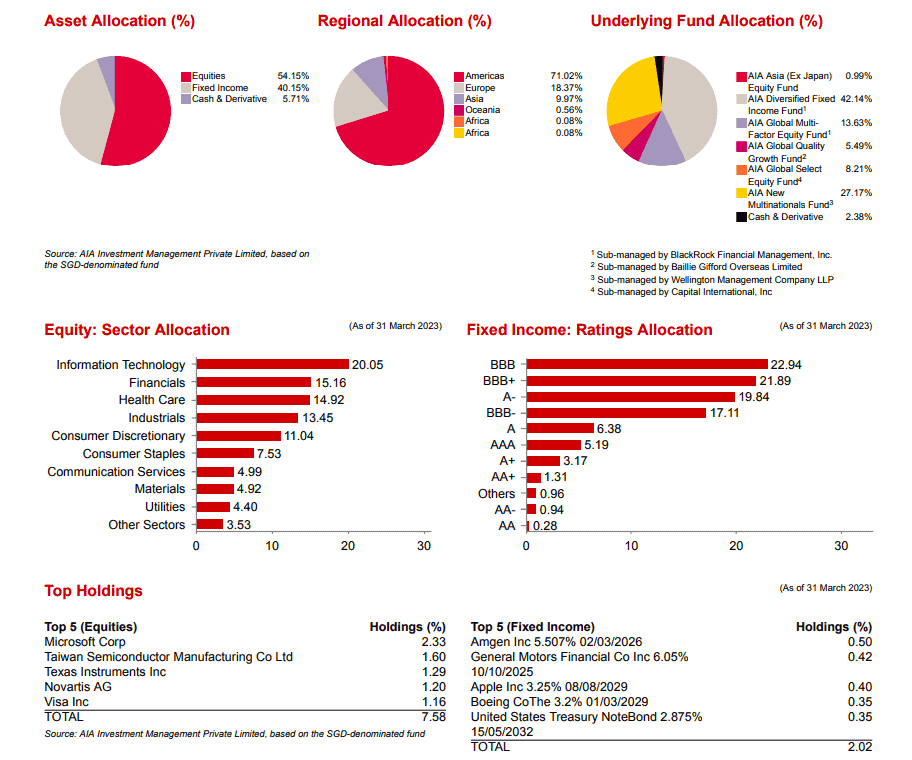

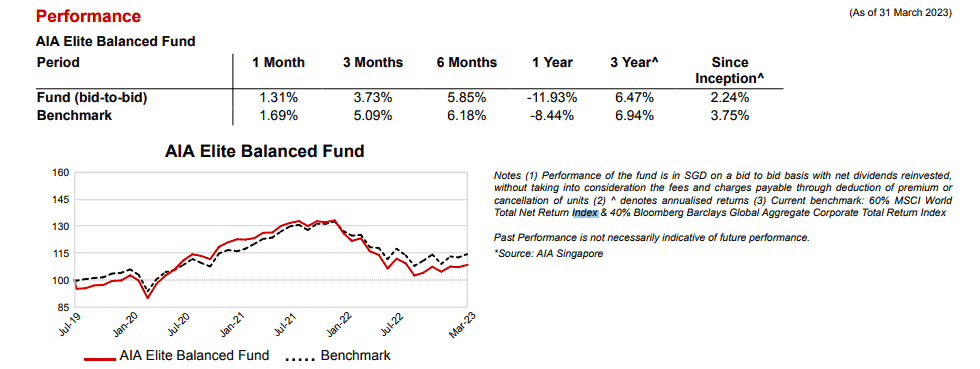

AIA Elite Balanced Fund

This balanced fund invests about 50% in equities and 50% in fixed income, cash, and cash derivatives.

Similarly, it invests in its own AIA sub-funds.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at 2.24% p.a, before fees.

The fees are at 1.25% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 0.99% p.a.

Information is accurate as of 31 March 2023.

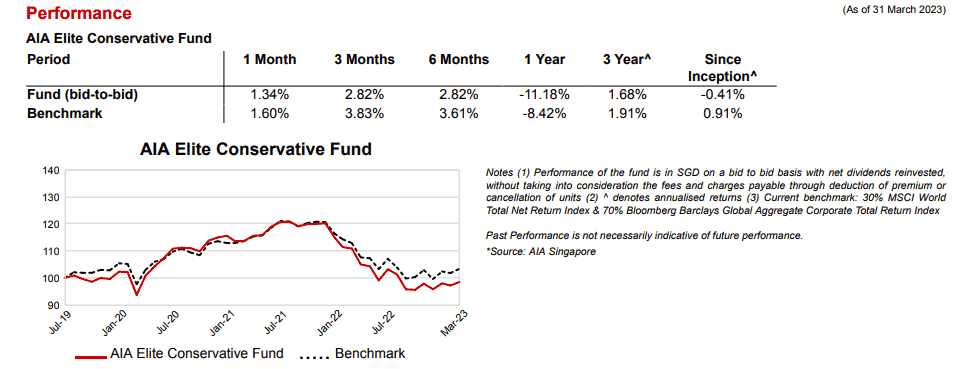

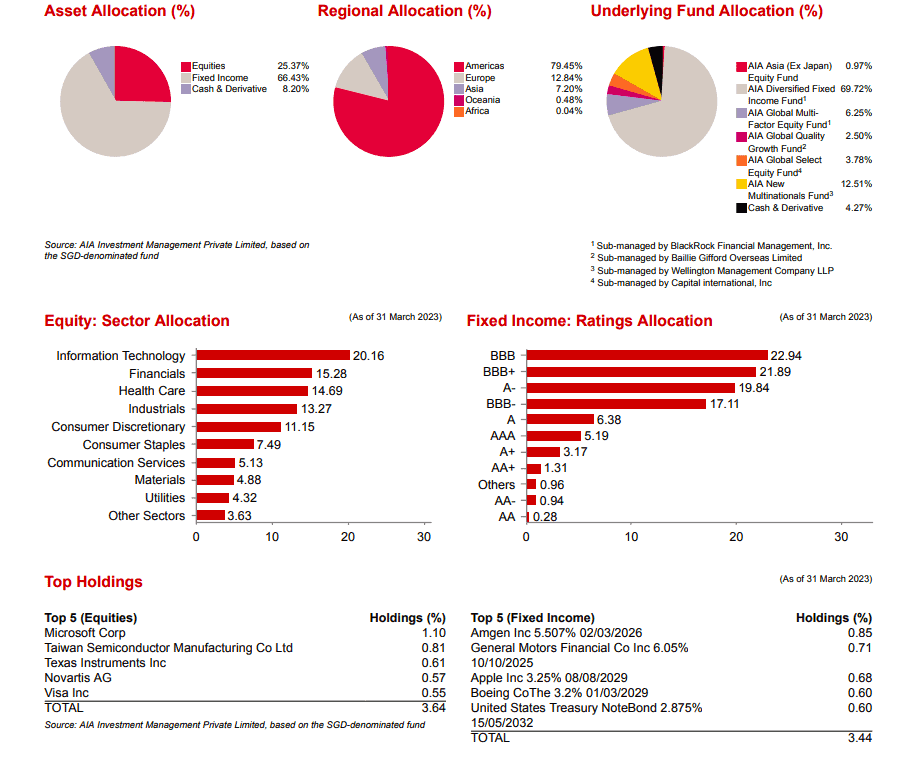

AIA Elite Conservative Fund

This is the most conservative fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at -0.41% p.a, before fees.

The fees are at 1.05% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about -1.46% p.a.

Here are the fund allocations of the AIA Elite Conservative Fund:

Information is accurate as of 31 March 2023.

AIA Platinum Wealth Elite Fees and Charges

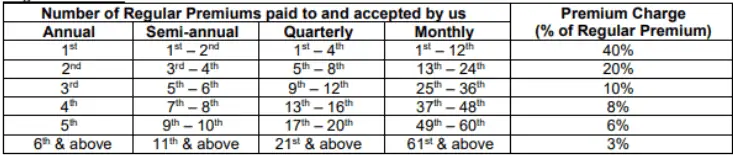

Premium Charge

For the Single Premium payment option, there is a Premium Charge of 5% of the Single Premium amount.

This charge is applicable at the time of making the lump sum premium payment.

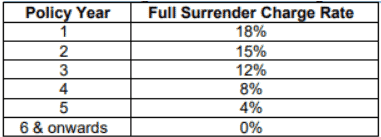

For regular income, the premium charge is calculated depending on the number of regular premiums paid, as shown in the following table:

For the Top-Up Premium option, a Premium Charge of 3% is applied to each Top-Up amount.

This charge is incurred when additional premium amounts are added to the policy after the initial premium payment.

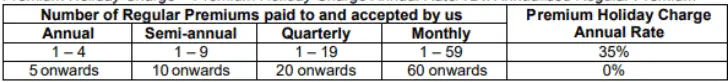

Premium Holiday Charge

The premium holiday charge is not imposed if you opt for a Single Premium payment.

Failure to pay the premium on time for the Regular Premium payment option will result in adding a Premium Holiday Charge every month until you resume the premium payment by fully settling all outstanding premiums.

Please note that you will not be charged the Premium Holiday Charge after the 5th annual premium payment, 10th semi-annual, 20th quarterly, or 60th monthly premium payment.

To calculate the Premium Holiday Charge, use the following formula:

Premium Holiday Charge = (Premium Holiday Charge Annual Rate/12) x Annualised Regular Premium.

Remember that each approved increase in the Insured Amount by the insurance provider establishes a new layer with its own Premium Holiday Charge.

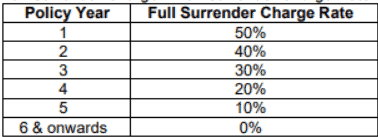

Full Surrender Charge

If you decide to surrender your single premium units policy, a full surrender charge will be deducted from your policy value.

After deducting the surrender charge, the remaining policy value will be paid out to you.

The full surrender charge is calculated by multiplying the full surrender charge rate by the single premium policy value.

The full surrender charge for regular premium units policies is calculated by multiplying the full surrender charge rate by the regular premium policy value.

The full surrender charge is not applicable for top-up premium units.

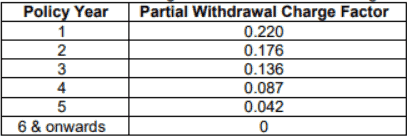

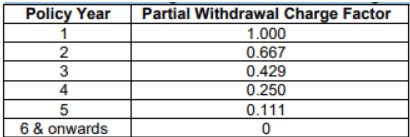

Partial Withdrawal Charge

If you decide to make a partial withdrawal from your single premium units policy, a partial withdrawal charge may be applicable.

This charge is calculated by multiplying the partial withdrawal charge factor by the amount you withdraw.

Here are the partial withdrawal charges for single premium policies:

Here are the charges for regular premium policies:

In both scenarios, the specific partial withdrawal charge factor and its corresponding calculation method may vary depending on the terms and conditions of your policy

For top-up premium units, there is no partial withdrawal charge.

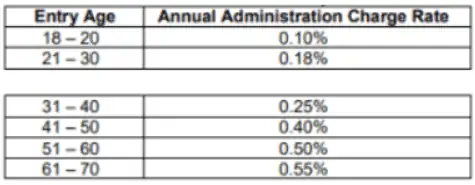

Administration Charge

During the first 5 policy years, an administration charge will be deducted monthly, even during a Premium Holiday.

The administration charge is calculated using the following formula:

Administration Charge = Insured Amount at the Issue Date or issue of new Layer x Annual Administration Charge Rate at the Issue Date or issue of new Layer / 12

The specific Annual Administration Charge Rate and its calculation method are determined at the time of policy issuance or when a new layer is issued.

It’s important to note that the administration charge is deducted in equal monthly instalments over the course of the first 5 policy years.

Insurance Risk Charge (IRC)

The Insurance Risk Charge (IRC) is a monthly deduction made to cover the insurance cost, even during a Premium Holiday.

If the Sum-At-Risk for a given month is zero or negative, no Insurance Risk Charge is payable for that month.

The calculation for the Insurance Risk Charge is as follows:

Insurance Risk Charge = Annual Insurance Risk Charge Rate/12 x Sum-At-Risk

The Sum-At-Risk is calculated by subtracting the policy value from the current Insured Amount. It represents the amount of risk that the insurer is covering.

It’s important to note that the Insurance Risk Charge rates are not guaranteed and may vary.

Fund Management Charge

The fund management charge is a fee that is deducted from the net asset value of each Investment-Linked Policy (ILP) sub-fund.

This ranges between 1.05% to 1.45% p.a., depending on the fund chosen.

Summary of the AIA Platinum Wealth Elite

| Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |