Introducing the AIA Platinum Retirement Elite, an investment-linked annuity designed to make your retirement savings journey a breeze.

With this plan, you have the flexibility of deciding your desired monthly retirement income, retirement age, and the duration of payout.

You can also opt for an increased monthly payout as you become older with the Stepped-up Income Option.

Read on to discover more about the AIA Platinum Retirement Elite for a convenient and personalised approach to saving for your retirement!

My Review of the AIA Platinum Retirement Elite

I think the AIA Platinum Retirement Elite gives you lots of freedom to customise how you want to structure your retirement payouts.

Firstly, you can select an amount starting from a minimum of S$500 per month for the Regular Premium plan or S$800 per month for the Single Premium plan.

To protect your retirement income from the impact of inflation, you can opt for a yearly stepped-up income.

This means that your monthly retirement income will increase annually by a certain percentage (ranging from 0% to 5%) to keep up with rising living costs.

This helps ensure that your income retains its purchasing power over time.

AIA Platinum Retirement Elite also allows you to select your preferred retirement age, ranging from 50 to 85 years old.

This flexibility lets you align the start of your retirement income with your specific plans and goals.

You can make top-up payments whenever you choose, whether on a one-time basis or at regular intervals. There are no limits on the number of top-ups or the amount you can contribute.

As an additional benefit, AIA Platinum Retirement Elite provides Power-Up Bonus units to accelerate the growth of your investments.

Starting from the 10th policy year and every 5 years thereafter, you’ll receive these bonus units, which contribute to the potential growth of your policy and enhance your retirement savings.

In the unfortunate event of death or being diagnosed with a terminal illness, a lump sum payment equal to 105% of the policy value is offered.

This payout provides financial support to loved ones during difficult times and helps ensure their financial security.

In the first 5 policy years, an extra death benefit payout will be provided to your beneficiaries if death occurs due to an accident.

This additional benefit offers added protection and financial assistance to your loved ones in case of accidental loss.

AIA Platinum Retirement Elite offers a straightforward application process without the need to answer medical questions. This simplifies the process of acquiring the policy, making it more convenient for you.

However, there are some downsides that I must point out.

Firstly, I believe the 5% premium fee for the one-time premium payment option is on the high end.

Additionally, top-ups incur a 3% charge, further diminishing your initial investment.

In the same vein, the premium fees for regular payments in the initial years of the policy are prohibitively high, reaching up to 30%.

Notwithstanding the Supplementary Charge of up to 2.50% per annum for the first 5 years, further reducing your retirement funds.

The selection of funds is also restricted, offering only 3 portfolios: Conservative, Balanced, and Adventurous.

Except for the Adventurous fund, the other 2 have shown underwhelming performance since their inception.

It’s important to note that the returns mentioned do not include fund-level fees and charges.

Accounting for these, the performance of the Conservative fund is at -1.46% per annum, Balanced at 0.99% per annum, and Adventurous at 4.7% per annum, since their inception.

With these returns, you’ll need to deduct the 2.50% Supplementary Charge and the Premium Charges you incur on the ILP-level.

Even with the most Adventurous portfolio, that’s 2.2% annual in returns, barely enough to beat inflation.

And if the AIA Platinum Retirement Elite is something that you’re considering, you’re either nearing retirement or in retirement.

The risk involved with the AIA Elite Adventurous Fund might be a bit too high for my liking, given the shorter time horizon you have.

Not forgetting that your monthly payouts may not be what you’re expecting and that the targeted payout period might be cut short too.

For many individuals nearing their retirement, many would choose a traditional retirement plan as a less risky option.

While it’s true that these options don’t offer a direct comparison and may not seem entirely fair, I believe there are better alternative solutions for various individuals.

Given the plethora of choices available for wealth protection and accumulation plans, it’s understandable that making a decision can be daunting.

To make certain that you select a plan that aligns perfectly with your unique circumstances, it’s advisable to spend time evaluating different options.

It’s a 10-year plan, directly meant for your retirement – so making sure you make the best decision now is crucial.

You should also consider seeking a second opinion from an unbiased financial advisor to evaluate if the AIA Platinum Retirement Elite is for you and to explore alternatives.

Need someone to get a second opinion from?

We partner with MAS-licensed financial advisors to assist you with this.

Click here for a free non-obligatory chat.

Here are the features offered by the AIA Platinum Retirement Elite:

Criteria

- Age range: 0 – 75 years old

- Minimum investment period of 10 years

- Minimum regular premium of $552/month

General Features

Premium Payment Terms

With this plan, you can choose from either:

- A single premium payment term,

- Regular instalments over a period of 5 years

This plan accepts payment in Singapore dollars (S$) or US dollars (US$) in cash. However, if you opt to pay using your Supplementary Retirement Scheme (SRS) savings, you must pay for a single premium term in SGD.

The minimum regular premium amounts are shown below;

| Premium Mode | Amount ($) |

| Annually | 6,000 |

| Half-yearly | 3,120 |

| Quarterly | 1,563 |

| Monthly | 522 |

Policy Term

The following table outlines the options available for your retirement planning:

| Options | Range |

| Target Retirement Age | Entry age 0 to 65: From age 50 to 75 (1-year intervals)

Entry age 66 to 75*: From age 76 to 85 (1-year intervals) |

| Target Payout Period | Minimum 10 years or up to age 100 of the insured |

| Stepped-up Income Option | From 0 to 5% |

*Entry age of 66 to 75 is applicable for single pay only.

This means that you can select a retirement age between 50 and 75 when you purchase the policy before you are 65 years old; or a retirement age between 76 and 85 when you purchase the policy between 66 and 75 years old.

From here, you select whether you’d like to receive payouts for at least 10 years or until you turn 100.

Monthly Retirement Income Benefit

You will receive your selected monthly retirement income upon reaching your designated retirement age.

This will be minimally $500 for regular premium policies and $800 for single premium policies.

This monthly income will persist till your policy’s value reaches zero.

It is important to note that the final payment you receive may be less than your initial selected monthly retirement income.

Your payouts may also end earlier than the Target Payout Period.

This is because the AIA Platinum Retirement Elite is an investment-linked plan, rather than a traditional one.

Because of this, your payouts are based on how well your selected funds perform.

Should your funds perform poorly, you won’t have enough to get the minimum payouts and/or the full payout period.

Protection

Death Benefit

The Death Benefit will be provided to the beneficiaries in the unfortunate event that the insured passes away.

This benefit will amount to 105% of the policy’s value, after deducting any relevant fees and charges.

Accidental Death Benefit

If the insured passes away due to an injury sustained in an accident that happens within the first 5 years of the policy, an Accidental Death Benefit will be paid out.

It is important to note that the death has to occur within 90 days of the accident.

The additional benefit is calculated as follows:

| Payment Term | Benefit |

| Single Premium Payment | 10% of the initial payment |

| Regular Premium Payments | 50% of the total regular premiums paid up to that point in time |

Terminal Illness Benefit

In the scenario where the insured is diagnosed with a terminal illness, and the diagnosis is confirmed by a designated physician, a Terminal Illness Benefit will be paid out.

This benefit allows for an advanced payment of the Death Benefit, which would usually be paid upon the insured’s death.

Key Features

Stepped-Up Income Option

The AIA Platinum Retirement Elite offers a stepped-up income option, where you can request additional payouts between 0% to 5% to combat inflation.

Opting for the Stepped-up Income option means any increase in your monthly retirement income will be applied on the policy anniversary following your first payment, and every successive policy anniversary.

Power-up Bonus

The Power-up Bonus is issued if your policy remains active and you have paid all the required premiums.

This bonus will be paid after the 10th policy year and recurs every 5 policy years after that.

It is important to note that it will be allocated to your policy as extra units in the investment fund.

The calculation of the Power-up Bonus is as follows, depending on your type of payment term:

| Payment Term | Bonus |

| Single Premium Payment | 2.5% of the single premium amount, multiplied by an adjustment factor |

| Regular Premium Payments | 12.5% of the annual premium amount, multiplied by an adjustment factor |

The adjustment factor is calculated based on the multiple of partial withdrawals made after the fifth policy year.

| Payment Term | Adjustment Factor |

| Single Premium Payment | 1 – (Withdrawn single premium policy value at the relevant valuation day/ Single premium policy value prior to withdrawal at the relevant valuation day) |

| Regular Premium Payments | 1 – (Withdrawn regular premium policy value at the relevant valuation day/ Regular premium policy value prior to withdrawal at the relevant valuation day) |

Premium Top-Up

Premium top-up is an optional feature that allows policyholders to pay an additional premium on a non-regular basis.

It is important to note that all regular payments should have been paid on time.

The minimum top-up amount is $1,000.

When you opt for the premium top-up, 100% of the net amount you pay, after deducting premium charges, is allocated to purchase units in the ILP sub-fund.

Full Surrender

If you choose to terminate your policy before its designated maturity date, you can opt for a full surrender by providing a written notice.

The surrender value is calculated by deducting the full surrender charge, which varies depending on the year of policy surrender, from the policy value.

Partial Withdrawal

You can access some of your funds within your policy through a partial withdrawal.

The minimum amount you can withdraw is $1,000. However, the remaining policy value must be at least $10,000 after the withdrawal.

It is important to note that your accumulated Power-up Bonus will be reduced if you choose to withdraw partially.

Fund Switching

You can switch units from a particular sub-fund to another sub-fund.

AIA Platinum Retirement Elite Funds

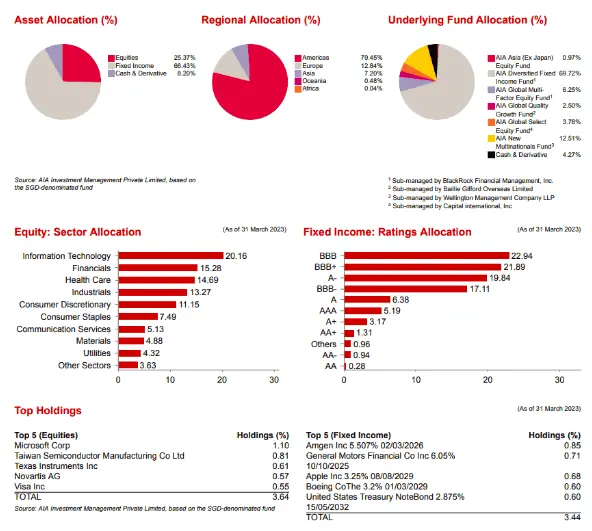

With the AIA Platinum Retirement Elite, you have 3 different funds: AIA Elite Adventurous Fund, AIA Elite Balanced Fund, and AIA Elite Conservative Fund.

These funds are unit trusts and are insurer sub-funds, which means you might incur an additional layer of fees.

Also, each of these funds has both USD and SGD versions, so make sure to look at the correct fund factsheet.

In this post, we will only be looking at the SGD versions.

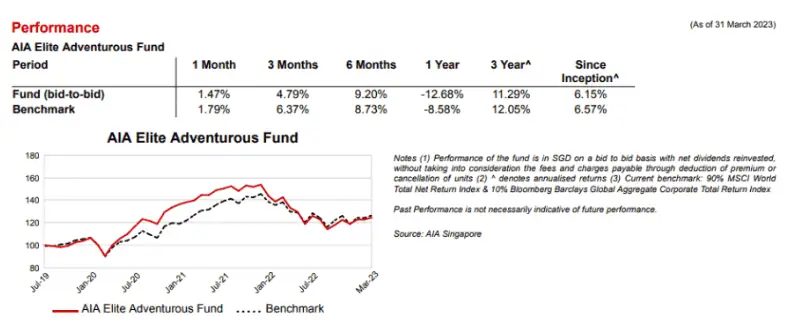

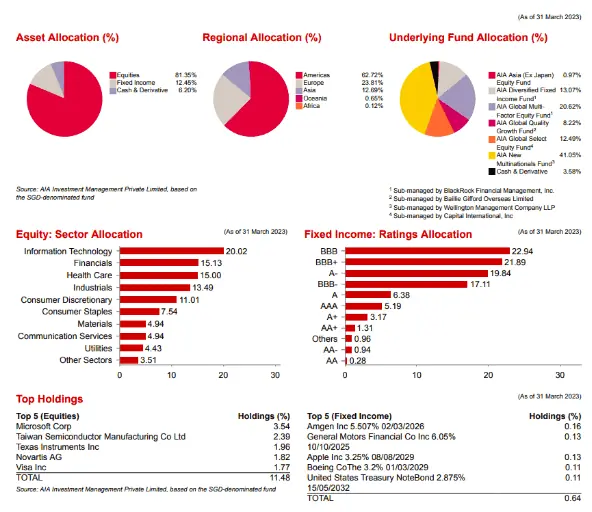

AIA Elite Adventurous Fund

This is the most aggressive fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are 6.15% p.a, before fees:

Here are what it allocates your investments into:

As you can see, about 80% is allocated to equities, and the remaining 20% is to fixed income, cash, and cash derivatives.

It also invests in its own AIA sub-funds, which then invests directly in the assets.

The fees are at 1.45% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 4.7% p.a.

Information is accurate as of 31 March 2023.

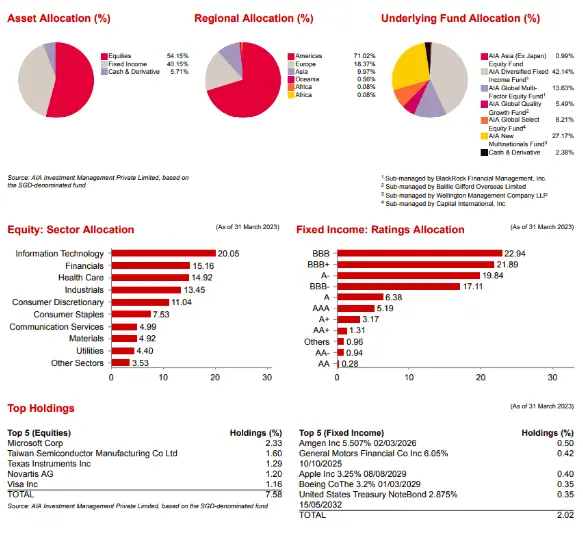

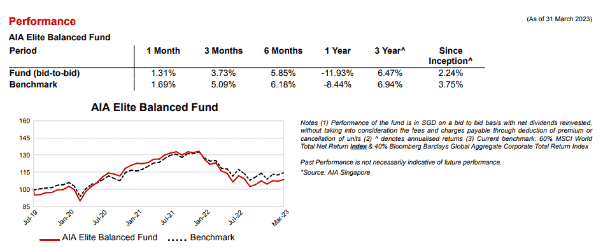

AIA Elite Balanced Fund

This balanced fund invests about 50% in equities and 50% in fixed income, cash, and cash derivatives.

Similarly, it invests in its own AIA sub-funds.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at 2.24% p.a, before fees.

The fees are at 1.25% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 0.99% p.a.

Information is accurate as of 31 March 2023.

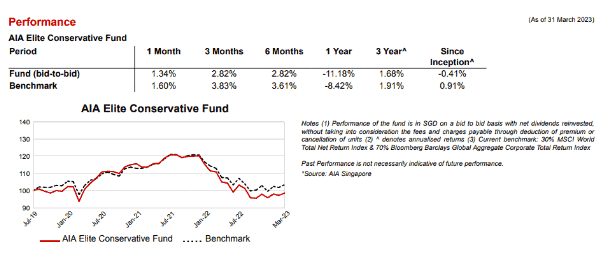

AIA Elite Conservative Fund

This is the most conservative fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at -0.41% p.a, before fees.

The fees are at 1.05% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about -1.46% p.a.

Here are the fund allocations of the AIA Elite Conservative Fund:

Information is accurate as of 31 March 2023.

AIA Platinum Retirement Elite Fees and Charges

Premium Charge

Premium charges vary based on the type of premiums paid.

| Payment Term | Premium Charge | |

|---|---|---|

| Single Premium Payment | 5% of Single Premium Payment | |

| Regular Premium Payments | 1st Year | 30% of Regular Premium Payments |

| 2nd Year | 20% of Regular Premium Payments | |

| 3rd Year | 10% of Regular Premium Payments | |

| 4th Year | – | |

| Top-up Premiums | 3% of Additional Payment | |

Supplementary Charge

The supplementary charge is deducted from your policy monthly, for the first 5 policy years. This charge is also applicable during premium holiday periods.

| Payment Term | Supplementary Charge (per year) |

| Single Premium Payment | 0.50% of the policy value |

| Regular Premium Payments | 2.50% of the policy value |

Premium Holiday Charge

The Premium Holiday Charge only applies to regular premium payments, where an amount will be deducted monthly if you fail to pay your premium on time.

This charge will persist till you resume making premium payments, and complete payments for all outstanding premiums.

The current premium holiday charge rate is 35% per year, prorated every month and applied on annualised regular premiums as shown below:

| Number of Regular Premiums paid to and accepted by AIA | Premium Holiday Charge Annual Rate | |||

| Annual | Semi-annual | Quarterly | Monthly | |

| 1-4 | 1-9 | 1-19 | 1-59 | 35% |

| 5 onwards | 10 onwards | 20 onwards | 60 onwards | 0% |

Full Surrender Charge

When you decide to terminate your policy via full surrender, a charge will be deducted from your policy value.

This charge varies depending on the year of policy surrender, and the premium type. This charge is only waived from the 11th year onwards.

The full surrender charge is calculated by multiplying the full surrender charge rate with the premium policy value.

| Policy Year | Full Surrender Charge Rate | |

| Single Premium Payment | Regular Premium Payments | |

| 1 | 12 | 50 |

| 2 | 11 | 45 |

| 3 | 10 | 40 |

| 4 | 9 | 35 |

| 5 | 8 | 30 |

| 6 | 7 | 25 |

| 7 | 6 | 20 |

| 8 | 5 | 15 |

| 9 | 4 | 10 |

| 10 | 3 | 5 |

| 11 onwards | 0 | 0 |

Partial Withdrawal Charge

If you choose to make a partial withdrawal from your policy, a charge will be imposed by cancelling a number of units from the investment fund linked to your policy.

The charge rate varies depending on the policy surrender year and the premium type.

This charge is only waived from the 11th year onwards. This charge does not apply to top-up premium units.

The partial withdrawal charge is calculated by multiplying the partial withdrawal charge factor with the premium policy value withdrawn.

| Policy Year | Partial Withdrawal Charge Factor | |

| Single Premium Payment | Regular Premium Payments | |

| 1 | 0.136 | 1.00 |

| 2 | 0.124 | 0.818 |

| 3 | 0.111 | 0.667 |

| 4 | 0.099 | 0.538 |

| 5 | 0.087 | 0.429 |

| 6 | 0.075 | 0.333 |

| 7 | 0.064 | 0.250 |

| 8 | 0.053 | 0.176 |

| 9 | 0.042 | 0.111 |

| 10 | 0.031 | 0.053 |

| 11 onwards | 0 | 0 |

Fund Management Charge

The policy charges a fund management charge, to cover fund management expenses. This charge is deducted from the net asset value of each IP sub-fund.

Summary of AIA Platinum Retirement Elite

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal Benefits | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | N/A |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |