In this step-by-step tutorial, you will be guided on how you can check whether you are covered under the Dependents’ Protection Scheme (DPS).

You will also learn how to nominate a DPS beneficiary/beneficiaries, so that the Central Provident Fund Board (CPFB) may disburse claim benefits to your loved ones in the event of the unfortunate.

What is Dependents’ Protection Scheme (DPS)?

The DPS is a voluntary Term Life Insurance scheme extended to Central Provident Fund (CPF) account holders who are between 21 to 65 years old.

It financially supports the insurer’s beneficiaries for the initial few years in the event of total permanent disability, terminal illness, and death.

Access our DPS complete guide to read everything you need to know about the scheme!

As a CPF account holder, you are enrolled into DPS by default once you make your first valid working CPF contribution.

Since DPS is an optional insurance plan, you may choose to opt-out of the scheme, and re-opt subsequently should you change your mind.

Read our article to find out how to enrol and re-enrol into DPS.

Checking Your DPS Coverage Status

You may view the status of your DPS coverage via the CPF website.

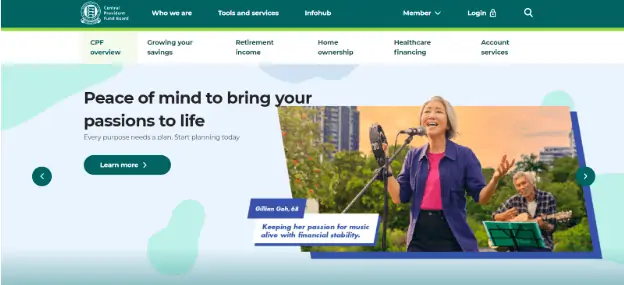

Step 1: Access the CPF Website

Head over to the CPF Website and click “Login”.

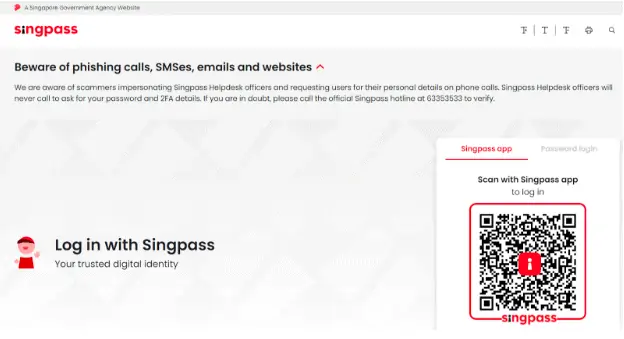

Step 2: Sign into Your CPF Account with Singpass

You will be directed to sign in with your Singpass to access your CPF account.

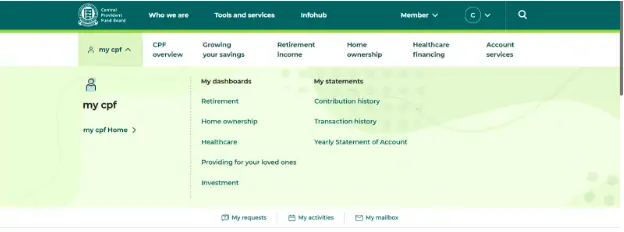

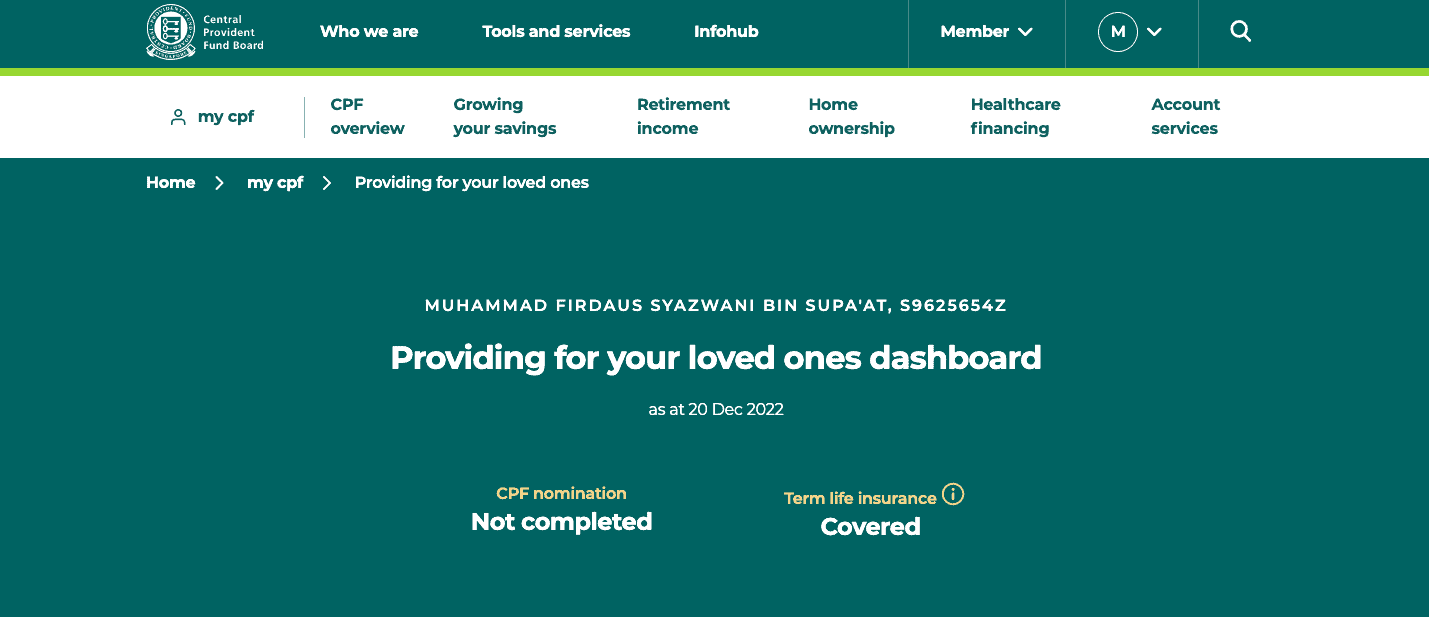

Step 3: “Providing for Your Loved Ones” Dashboard

Click on “my cpf” for a dropdown of dashboard and CPF statement options.

Under “My dashboards”, select “Providing for your loved ones”.

Step 4: Viewing of DPS Coverage Status

A summary of your CPF Nomination and Term Life Insurance status will be provided at the top of the dashboard.

With DPS being a Term Life Insurance, your DPS coverage status will appear under “Term Life Insurance”.

To view further details of your DPS coverage, scroll to the bottom of the dashboard.

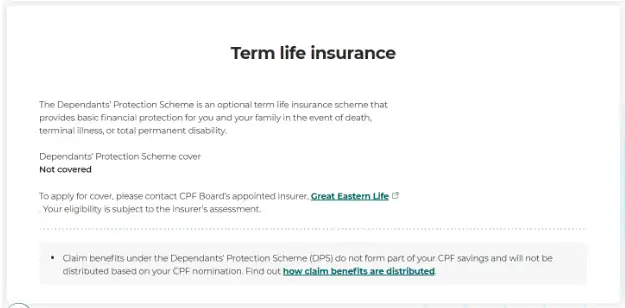

If you are not covered under DPS, you will see the following interface:

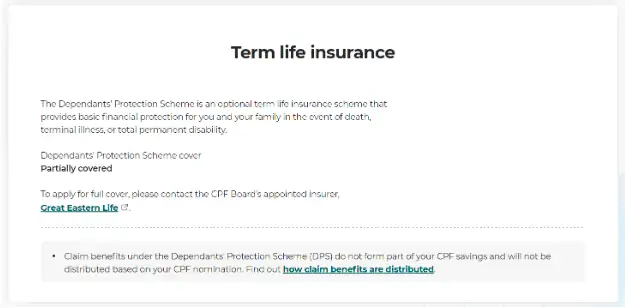

If you are partially covered under DPS, you will see the following interface:

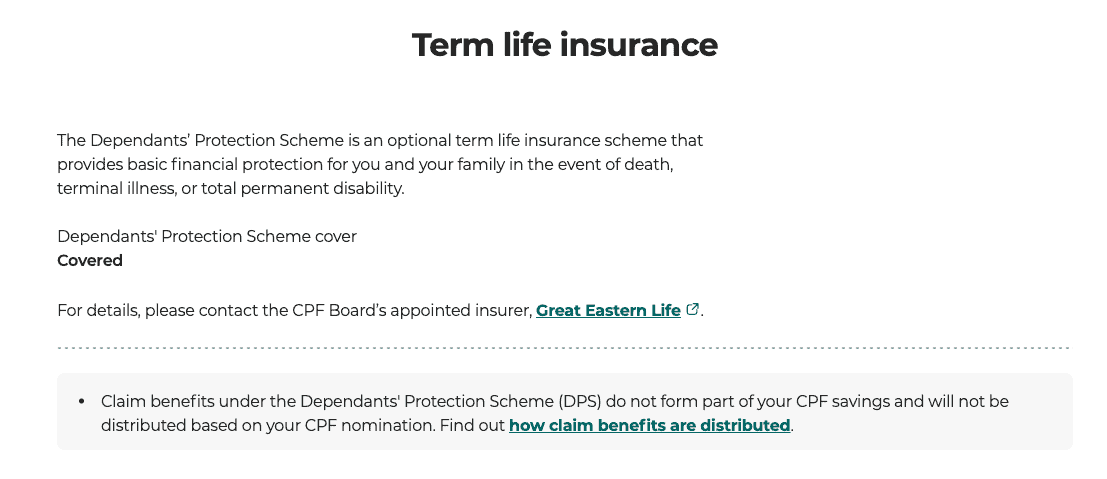

If you’re fully covered, this is what you’ll see:

How to Check My DPS Nomination?

Unfortunately, I couldn’t find a way to check my DPS nomination. Tried scouring everywhere on the CPF website to no avail.

Did a Google search with no success either.

Your best bet would be to contact Great Eastern Life to check who you previously nominated for your DPS payout.

How to Make a DPS Nomination

Step 1: Select Up to 8 Beneficiaries

Making a DPS Nomination entails enrolling your selected beneficiary/beneficiaries into the scheme.

Your beneficiary/beneficiaries will receive claim benefits from your DPS insurance should total permanent disability, terminal illness, or death occur.

Previously, 2 insurance providers offered DPS – NTUC Income and Great Eastern Life. With effect from 1 April 2021, Great Eastern Life has been appointed the sole insurer for DPS.

In light of the above change:

- If you are an existing Great Eastern Life policyholder that has made a DPS nomination previously, you do not need to resubmit your nomination.

- However, if you were insured under NTUC Income previously, your DPS coverage would have ceased to be valid on 31 March 2021. You will hence need to submit a new nomination under Great Eastern Life.

Step 2: Complete the Nomination Form

Head to Great Eastern Life’s website with the following to complete the form:

- A hardcopy version of the nomination form

- Your DPS policy number

- Nominee’s particulars, i.e. name, NRIC number, address, date of birth

- 2 witnesses above 21 years old and must not be a nominee or the spouse of a nominee

Step 3: Post it to Great Eastern

The Great Eastern Life Assurance Company Limited

1 Pickering Street #01-01

Great Eastern Centre

Singapore 048659

How to Cancel Your DPS Nomination?

Re-nomination of Beneficiary / Beneficiaries

You may cancel the DPS Nomination you have made and re-nominate a new beneficiary/beneficiaries by doing the following:

- Fill in the Revocable Nomination Form

- Mail the form to Great Eastern Life’s address:

1 Pickering Street

#01-01 Great Eastern Centre

Singapore 048659

Upon processing your nomination, you will receive an acknowledgement letter from Great Eastern Life.

Revocation of DPS Nomination without Re-nomination

You may also cancel your DPS Nomination without re-nominating a new beneficiary/beneficiaries by engaging in the following:

- Complete the Revocation of Revocable Nomination Form

- Mail the form to Great Eastern Life’s address:

1 Pickering Street

#01-01 Great Eastern Centre

Singapore 048659

Conclusion

Keeping up to date about your DPS coverage status and appointing a beneficiary/beneficiaries via DPS Nomination are crucial steps to safeguarding you and your loved ones against unexpected events.

While DPS provides affordable protection, supplementing it with the best term plans in the market provides greater shielding and boosts the comprehensiveness of your coverage.

If you seek to further protect you and your loved ones with additional insurance coverage, our reliable financial advisors are here to help!