In this pictorial guide, you will learn how to check your Dependents’ Protection Scheme (DPS) enrolment status.

You will also be guided on how to apply for DPS coverage, opt-out manually, and re-opt into the term life insurance scheme.

What is the Dependants’ Protection Scheme (DPS)?

Governed by the Central Provident Fund (CPF), the Dependents’ Protection Scheme (DPS) is a Term Life Insurance scheme.

DPS seeks to offer financial support to your beneficiaries for the initial few years, upon unexpected events such as total permanent disability, terminal illness, and death.

To walk you through the intricacies of DPS, we have prepared a comprehensive guide that you may access here!

Head over to our article to find out how you can check your DPS coverage status and make a nomination.

Who is eligible for DPS?

If you are a Singaporean or Permanent Resident between 21 to 65 years old, you are automatically enrolled into DPS once you have made your first valid working CPF contribution.

As DPS is an optional scheme, you can choose to opt out and re-opt into the scheme should you decide otherwise.

While annual renewal for your DPS coverage is automatic, your coverage can lapse if your CPF Ordinary Account or CPF Special Account has insufficient monies for premium deductions, or you have failed to make payment for your DPS premium in cash.

How to Check DPS Enrolment Status?

You can determine whether you are enrolled into DPS via your CPF Yearly Statement of Account.

Step 1: Access the CPF Website

Head over to the CPF Website and click “Login”.

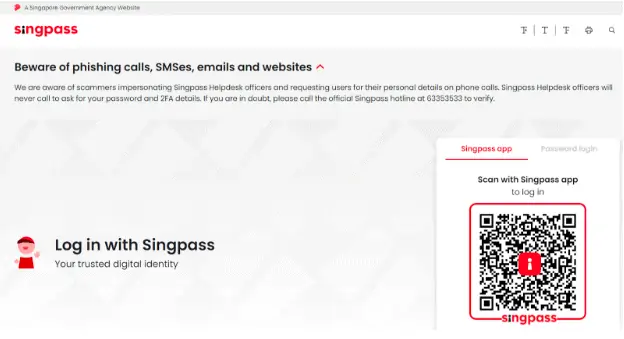

Step 2: Sign into Your CPF Account with Singpass

You will be directed to sign in with your Singpass to access your CPF account.

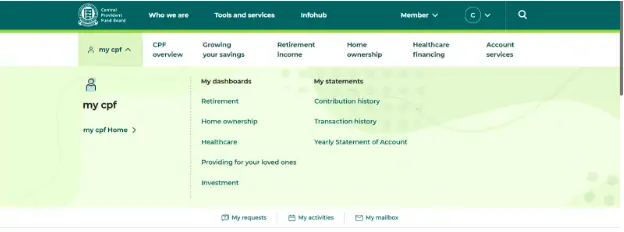

Step 3: “Providing for Your Loved Ones” Dashboard

Click on “my cpf” for a dropdown of dashboard and CPF statement options.

Under “My statements”, select “Yearly Statement of Account”.

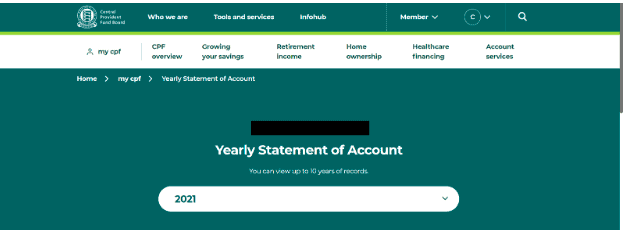

Step 4: Viewing of DPS Enrolment Status

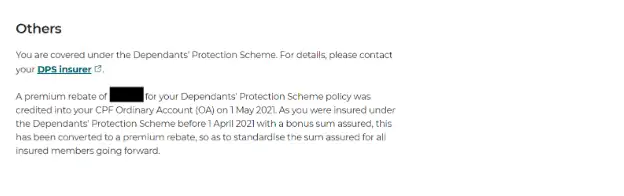

Upon accessing your Yearly Statement of Account, scroll to the “Others” section at the bottom of the page.

If you are enrolled into DPS, the statement will reflect that you are “covered under the Dependents’ Protection Scheme”.

Alternate Step: Transaction History

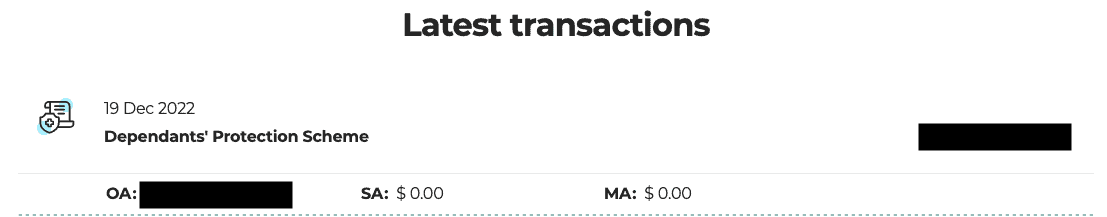

In Step 3, instead of clicking “Yearly Statement of Account”, you could click on “Transaction History”.

You can check if there were any DPS deductions over the past year. It’s a bit more cumbersome, but you get to check how much you’re paying in premiums as well.

How to Manually Enrol into the Dependants’ Protection Scheme (DPS)?

If you are between 16 and 65 years old but did not receive automatic DPS enrollment, fret not! You may still apply to join DPS directly with Great Eastern Life.

Here are 3 ways you may apply for DPS:

| Proposal Form |

|

||||

| Financial Representative | Contact your Financial Representative to assist with your DPS application process. | ||||

| Customer Service Centre | Visit Great Eastern Life’s Customer Service Centre at the following address:

1 Pickering Street #01-01 Great Eastern Centre Singapore 048659. |

How To Opt Out of Dependants’ Protection Scheme (DPS)?

Before you opt out of DPS, it is advised that you understand the benefits of the scheme:

- DPS offers Term Life Insurance coverage of as much as $70,000 to safeguard your loved ones in the event total permanent disability, terminal illness, or death occurs.

- DPS coverage is provided at affordable premium rates that can be conveniently paid via your CPF savings

- DPS entitles you to special pricing offers and gives you access to a variety of benefits

Do also consider that a re-opt into DPS would entail a resubmission of health declaration, and is subject to whether you are in good health.

So it’s best to ensure you already have a term plan before you opt out of DPS – though DPS will be much cheaper than a private term life policy.

Besides DPS, other term life insurance plans are offered in the market to provide you with more comprehensive coverage. Access our curated list of the best term plans here.

Should you still wish to opt-out of DPS, you may follow the following steps:

- Fill in the DPS Opt-out Form

- Submit the form to Great Eastern Life by either of the below methods

| [email protected] | |

| Post Mail | 1 Pickering Street

#01-01 Great Eastern Centre Singapore 048659 |

How to Re-Opt Back Into Dependants’ Protection Scheme (DPS)?

Step 1: Fill in one of the below relevant forms

| Where You are Re-opting In… | Action to Take |

| Within 30 days from the date of the Opt-out letter | Fill in the Opt-back^ Form, which may be found at the overleaf of your Opt-out Letter. |

| Between 30 to 120 days from the date of renewal* | Fill in the Reinstatement Form |

| Beyond 120 days from the date of renewal2 | Fill in the Proposal Form |

^ The Opt-back Form must be submitted within 30 days from the date indicated on your Opt-Out Letter.

* The approval of your re-opt-in is subject to satisfactory health underwriting.

Step 2: Submit the form to Great Eastern Life by either of the below methods

| [email protected] | |

| Post Mail | 1 Pickering Street

#01-01 Great Eastern Centre Singapore 048659 |

Conclusion

Being informed about your DPS enrolment status and taking action to join, opt-out, or re-opt into the scheme are essential in helping you plan for rainy days and ensure that your loved ones are financially provided for.

DPS offers coverage at affordable premium rates. However, other term plans available in the market will help supplement DPS, enabling you to receive more comprehensive and holistic coverage.

If you desire to safeguard yourself and your loved ones further through additional insurance, we would love to connect you with our reliable financial advisors.

Do forward this article to your family and friends if you have found it informative!