The Singlife Legacy Income is a whole life annuity plan that guarantees monthly income and cash bonuses alongside coverage for up to 100 policy years, ensuring that you and your loved ones are well-protected for life.

As the name indicates, the Singlife Legacy Income can also serve as a form of legacy planning.

With the option to change the insured person, the policy can be carried on to your children, allowing them to benefit by leaving the policy to mature.

If this has gotten you interested in the Singlife Legacy Income, read on for a complete review of the Singlife Legacy Income policy.

Criteria

- Premium payment term: Single, 3, 5, or 10 years

- Minimum entry age: 1-year-old or 19 years old (for SRS)

- Policy term of 100 years

- No medical underwriting needed

General Features

Premium Payment Term

With this plan, you can choose from either:

- A single premium payment term; or

- A limited premium payment term of 3, 5, or 10 years.

If Choosing a limited premium payment term requires you to ensure that the selected premium payment term combined with your entry age does not exceed 75 years of age.

In addition, those who choose the limited premium payment term can choose from either monthly, quarterly, half-yearly or yearly payment frequencies.

Depending on your chosen premium payment term, this will affect your eligibility to pay your premiums using your Supplementary Retirement Scheme (SRS) monies.

The following table shows your eligibility based on your chosen premium payment term.

| Life Assured Entry Age (Age-Next-Birthday “ANB” basis) | ||||

| Premium Payment Term (Years) | Payment Method Other Than SRS | SRS | ||

| Entry Age (ANB) | Entry Age (ANB) | |||

| Minimum | Maximum | Minimum | Maximum | |

| Single Premium (1) | 1 | 70 | 19^ | 70^ |

| 3 | NA | NA | ||

| 5 | ||||

| 10 | 65 | |||

^ Subject to prevailing SRS guidelines

| Assured/Policyholder Entry Age (Age-Next-Birthday) | |

| Minimum | Maximum |

| 17 | 99 |

Those who are not using your SRS monies to fund your policy may opt to make premium payments via the following methods:

| Frequency | Type | Payment Mode |

| Single Payment |

|

|

| Regular Premium Payments (3, 5, or 10 Years) | Initial Premium |

|

| Renewal Premiums |

|

|

Protection

Death Benefit

In the unfortunate event that the life assured passes away while the policy is still in effect, the Death Benefit payable will be the sum of the 3 components listed below.

- The higher of:

- 101% of total premiums paid for the basic plan up to the date of passing (excluding advance premiums and Supplementary Benefits premiums) minus the total Guaranteed Income paid out to date; or

- the Guaranteed Cash Surrender Value.

- Any Terminal Bonus amounts declared by Singlife

- Any reinvested Guaranteed Income and Cash Bonus with non-guaranteed interest (if not previously withdrawn)

It is important to note that any amounts owed to Singlife will be deducted from the Death Benefit before the payout is made.

Terminal Illness Benefit

In a scenario where the life assured is diagnosed with a terminal illness (TI) while the policy is active, the insured will receive the Terminal Illness Benefit in a lump sum as an advance of the Death Benefit.

This benefit is only applicable if the diagnosis is supported and confirmed by Singlife’s appointed medical practitioner, that the TI will result in the insured’s passing within 12 months.

You may wish to refer to the previous section on the Death Benefit for details on how much payout will be made under this benefit.

Optional Add-on Riders

Those who feel that the existing benefits might be insufficient may also request to add Supplementary Benefits to your policy at an additional premium.

The available options include:

- Easy Term

- Payer Critical Illness Premium Waiver II

- Critical Illness Premium Waiver II

- Cancer Premium Waiver II

- EasyPayer Premium Waiver

Do note that the request to add on these Supplementary Benefits would have to be made at the point of application.

Key Features

Early Payouts

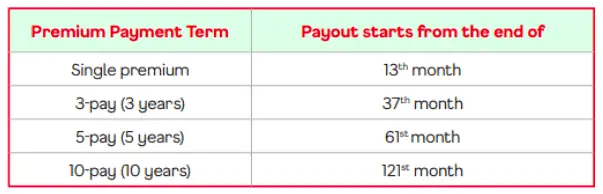

One key feature of the Singlife Legacy Income is the commitment by Singlife to begin your monthly payouts as soon as possible.

Regardless of your chosen premium payment term, you can be sure to start receiving your payouts 1 month after your premium payment term ends.

You may wish to refer to the table below for the guidelines on when you can expect to start receiving your monthly payouts.

Payout Options

Guaranteed Income

With the Singlife Legacy Income policy, you will receive a Guaranteed Income starting 1 month after the end of your chosen premium payment term.

As a form of Singlife’s appreciation for your commitment to this policy, the Guaranteed Income as a percentage of the sum assured will increase with your payout year.

Do note that any amount owed to the policy will be deducted before each Guaranteed Income is paid.

| Payout Year | Guaranteed Income (% of Sum Assured) |

| 1st to 2nd | 1.00% p.a. |

| 3rd to 15th | 1.28% p.a. |

| 16th Onwards | 1.37% p.a. |

For example, if you make a single premium payment of $100,000, your monthly Guaranteed Income in the first 2 payout years will be $100,000 x 1% / 12 = $83 (rounded off to the nearest dollar).

Depending on your preference, you can choose to receive the Guaranteed Income or reinvest the Guaranteed Income in the fund.

However, the Guaranteed Income payout will be credited to your SRS account for policies funded by SRS monies.

Non-Guaranteed Income

In addition to the Guaranteed Income, you can also enjoy Non-Guaranteed Income in the form of Cash Bonus and Terminal Bonus.

Cash Bonus

The Cash Bonus forms part of the monthly payout you would receive alongside the Guaranteed Income.

However, unlike the Guaranteed Income, which is based on a fixed percentage, the Cash Bonus amount depends on the premium payment term option and the performance of the policy’s participating fund.

Based on an illustrated investment rate of return (IRR) of 4.25% p.a., the Cash Bonus rates as a percentage of the sum assured can be found in the table below:

| Payout Year | IRR of 4.25% p.a. | |||

| Single Premium | 3-Pay | 5-Pay | 10-Pay | |

| 1st to 2nd | 1.35% p.a. | 1.32% p.a. | 1.31% p.a. | 1.30% p.a. |

| 3nd to 15th | 2.16% p.a. | 2.10% p.a. | 2.08% p.a. | 2.05% p.a. |

| 16th Onwards | 2.38% p.a. | 2.25% p.a. | 2.22% p.a. | 2.20% p.a. |

For example, if you make a single premium payment of $100,000, your Cash Bonus in the first 2 payout years will be $100,000 x 1.35% / 12 = $112 (rounded off to the nearest dollar).

Terminal Bonus

Unlike the Cash Bonus, which is payable monthly, the Terminal Bonus is only payable upon policy discontinuation.

This occurs in the following situations, whichever is earliest:

- Passing of the life assured;

- Terminal Illness of the life assured;

- Surrender of the policy; or

- End of the policy.

Early Surrender

Depending on the premium payment term chosen for your policy, you are eligible to receive a Guaranteed Cash Surrender Value on the basis that you fully surrender your policy.

| Premium Payment Term | When the Guaranteed Cash Surrender Value is Granted |

| Single Premium Payment Term | Upon inception of the policy and receipt of the single premium |

| 3-Year Premium Payment Term | Start of the 2nd policy year |

| 5-Year or 10-Year Premium Payment Term | Start of the 3rd policy year |

To ensure that you do not lose out, Singlife ensures that the sum of Guaranteed Cash Surrender Value and Guaranteed Income will at least be equivalent to the total premiums paid.

If any Terminal Bonus is payable under the policy, the Total Cash Surrender Value will comprise the Guaranteed Cash Surrender Value and Terminal Bonus.

However, note that an early policy termination would also incur high termination costs, which might negate any Cash Surrender Value payable.

Centennial Benefit

With most policies having a maturity benefit, this Centennial Benefit under the Singlife Legacy Income can be seen as a form of maturity benefit, rewarding you with a lump sum payment if your policy is still in force at the end of the policy term and no claims for benefits have been made.

The Centennial Benefit will then be made up of the sum of the following components, less any debts owed to Singlife.

- 105% of the total premiums paid;

- Any payable Terminal Bonus; and

- The reinvested Guaranteed Income and Cash Bonus with earned (but unwithdrawn) interest

For those who chose the SRS payment method, the Centennial Benefit will be credited back to your SRS account.

Withdrawal Of Reinvested Cash Bonus and Guaranteed Income

Since Singlife has enabled the option to reinvest your Cash Bonus and Guaranteed Income, you may also choose to fully or partially withdraw the reinvested amounts, including any interest earned.

The minimum withdrawal amount is $1,000, or the balance available, whichever is lower.

Do note that those who had chosen the SRS payment method will also have the amounts withdrawn back to their SRS accounts.

Policy Loan

As a whole life annuity plan is a lifelong commitment, you may face liquidity issues during your policy term.

As such, you may opt for a policy loan of up to 65% of the Cash Surrender Value at the prevailing interest rate, less any policy debt.

However, those who make payments using their SRS funds would not be eligible for a policy loan.

Change of Life Assured

As mentioned in the introduction to this review, the Singlife Legacy Income policy can act as a form of legacy planning, allowing for the policy’s continuity to fulfil the maturity requirements (the Centennial Benefit in this case).

This policy allows you to change the life assured up to 2 times after the 1st policy year, subject to proof that the new life assured has sufficient insurable interest in relation to the existing policyholder.

However, those who plan on getting or have already purchased this policy should note that a change of life assured is not allowed if:

- The life assured dies;

- A claim has been made for supplementary benefits covering the life assured;

- A claim has been made for a premium waiver; or

- The Reduced Paid Up option has been activated.

Singlife Legacy Income Fund Performance

Premium Allocation

To grow your paid premiums, Singlife invests the premiums in 2 sub-funds with diversified asset classes to minimise any risks, ensuring that your Non-Guaranteed Income remains relatively stable over the years.

The following table shows the allocation of premiums in the participating fund as of 31st December 2021.

| Type of Asset | Strategic Allocation |

| Fixed Income | 78% |

| Equities | 12% |

| Property | 9% |

| Money Market Securities, Deposits and Cash | 2% |

| Total Assets | 100% |

Investment Rate of Return

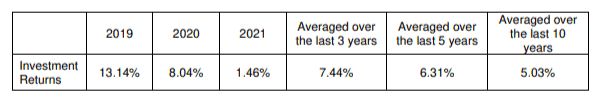

To better understand how your Non-Guaranteed Income will vary over time, it is highly recommended that you compare their participating fund’s performance with the industry average.

Over the past few years, this is how Singlife’s participating fund has performed.

Accurate as of 31 December 2021.

The fund performed exceptionally in 2019 and 2020 before dropping drastically in 2021.

The fall could be due to the global COVID-19 pandemic that affected the performance of various sectors.

However, when compared to other companies, Singlife (previously known as Aviva) may not be performing as well regarding their geometric net investment returns on a 5 and 10-year average.

While this means that investing in other policies may provide you with better returns, it is also crucial to consider the other aspects of the policy, such as its key features and protection provided, to make a more well-informed decision.

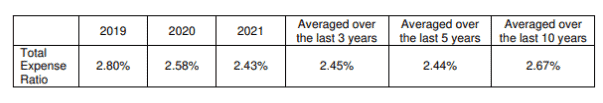

Total Expense Ratio

It is also crucial to understand your fund’s Total Expense Ratio (TER), which is an indication of associated fund expenses such as distribution costs, taxation, investment, and management fees.

With this information, you can better gauge how your premiums are allocated and predict how this might impact your non-guaranteed benefits.

Accurate as of 31 December 2021

To compare Singlife’s TER against other companies, we can look at the table below.

From the above table, it is evident that Singlife (previously known as Aviva) has consistently maintained its TER to be among the industry average.

While this means that other companies offer participating funds with lower TERs, it is important that you consider the features of policies from those companies to find one that best suits your needs.

Illustration of How Singlife Legacy Income Works

Meet James, a 40-year-old who decided to purchase Singlife’s Legacy Income plan with a single premium payment of $100,000.

Read on to see how he can benefit from Singlife’s Legacy Income plan over the years!

| Policy Year | Description | Amount earned |

| 1 | James makes a single premium payment of $100,000 | – |

| 2 to 4 | Guaranteed Monthly Income @ 1.00% p.a. | $83 |

| Cash Bonus @ 1.35% p.a. | $112 | |

| Total Payout per Month | $195 | |

| 4 | James changes the life assured to his wife | – |

| 4 to 17 | Guaranteed Monthly Income @ 1.28% p.a. | $106 |

| Cash Bonus @ 2.16% p.a. | $180 | |

| Total Payout per Month | $286 | |

| 17 to 31 | Guaranteed Monthly Income of 1.37% p.a. | $114 |

| Cash Bonus of 2.38% p.a. | $198 | |

| Total Payout per Month | $312 | |

| 31 | James retires at policy year 31 and activates 2nd change of life assured to his daughter | – |

| 32 to 100 | Guaranteed Monthly Income of 1.37% p.a. | $114 |

| Cash Bonus of 2.38% p.a. | $198 | |

| Total Payout per Month | $312 | |

| 100 | If James’ daughter is still alive, the Centennial Benefit is paid, and the policy ends | – |

| Guaranteed Income (105% of premium paid) | $105,000 | |

| Non-Guaranteed Terminal Bonus | $5,000 | |

| Total Centennial Benefit Payout | $110,000 |

Singlife Legacy Income Fees and Charges

Operating expenses such as staff salaries, office maintenance, investment costs, intermediaries’ commissions, and other ongoing costs, are incurred while running the business.

To establish equitable payouts, a portion of these expenses are usually assigned to the activities of each investment pool within the Par sub-fund.

Under the Singlife Legacy Income policy, all fees and charges have been factored into the calculation of the premium will not be separately charged to the policyholders.

This means that you can rest assured that there will not be any additional charges on top of your regular premiums.

Summary of Singlife Legacy Income

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Policy Add-ons | Yes |

My Review of the Singlife Legacy Income

The Singlife Legacy Income is an amazing product if you’re looking for a policy to provide for your future generations.

This policy not only provides you with protection but also helps you to grow your premiums to provide you with monthly payouts, perfect for those who are looking for a passive source of income too!

Apart from flexible premium payment terms and frequencies, new policyholders are not required to undergo any medical underwriting, ensuring that you undergo a hassle-free sign-up process.

This customisability of the Singlife Legacy Income is accentuated by the option of receiving a Guaranteed Income and Cash Bonus while the policy is active, up to 3.75% of the sum assured.

Those looking for extra protection can also customise your policy with the Supplementary Benefits available.

Despite your flexibility in designing your ideal Singlife Legacy Income, it is still important to speak to a financial advisor to help you choose the best option that meets your needs.

This is because the Singlife Legacy Income is a long-term plan, and making sure you make the right decision of choosing the best annuity plan for yourself is of utmost importance so that you don’t regret it in the future.

Looking for a second opinion?

We partner with MAS-licensed financial advisors to assist you with this.