The PRUVantage RetireCare is a regular premium investment-linked annuity policy that helps individuals plan retirement, secure investments, and provide a financially stable future.

This unique product provides flexibility to you in terms of

- Your premium term,

- Retirement payout age,

- Policy sum assured, and

- Target monthly income payout amount aligned perfectly with your distinct financial needs.

Beyond its investment benefits are protection and care fund benefits, including a diverse range of PRULink Funds, facilitating investments that align with your risk appetite and financial aspirations.

Keep reading for our review.

My Review of PRUVantage RetireCare

PRUVantage RetireCare is an investment-linked retirement plan designed to take care of both your health and your wealth, giving you the freedom to retire on your terms.

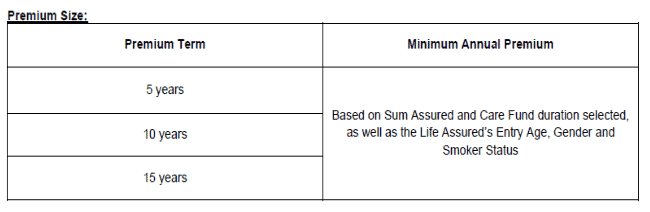

You can choose from premium payment terms of 5, 10, or 15 years and retirement ages of 55, 60, or 65.

Plus, you can adjust your retirement age, monthly income, and coverage and make withdrawals or top-ups as needed.

The Care Fund Benefit is a unique feature that covers selected medical expenses starting from your chosen retirement age for 10 or 20 years.

It helps safeguard your retirement savings from unexpected medical costs.

More so, you’ll receive a monthly income starting from your chosen retirement age, and you can even increase it by up to 5% each year to keep up with inflation.

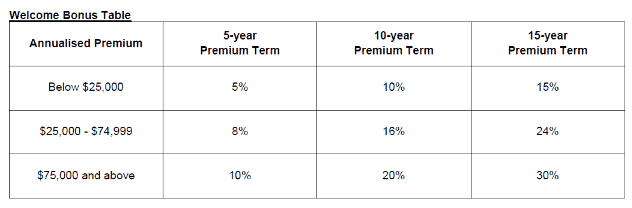

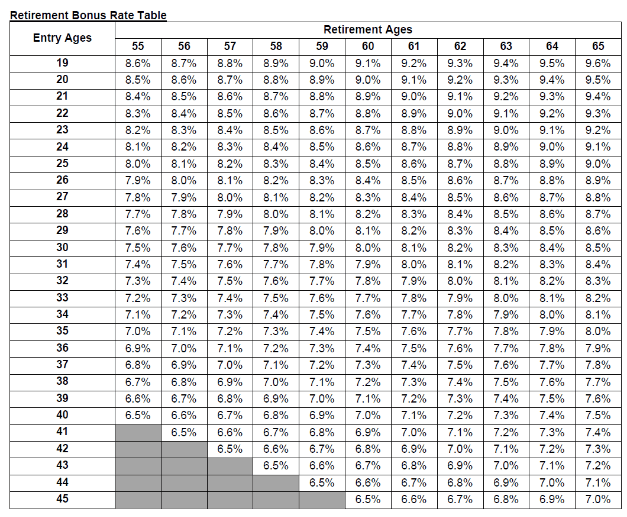

PRUVantage RetireCare also offers various bonuses to boost your investment journey, including a Welcome Bonus of up to 30% in the first year, a Loyalty Bonus of 0.8% every 8 years, and a Retirement Bonus of up to 9.6% when you reach retirement age.

However, I’m not a big fan of using investment-linked annuities.

Firstly, if you’re considering this policy, you are either nearing retirement or already in your retirement years.

Choosing an investment as a source for your retirement income at this age would be considered a pretty high-risk move due to your shorter time horizon compared to everyone else.

Also, you are putting your retirement funds up against market forces; should the market crash or correct itself, your nest egg is at risk of being lost.

And since this policy pays your monthly retirement income until your account value turns 0, you’ll have a shorter payout period.

Purchasing an investment-linked annuity is a big risk unless you have another big pile of cash saved up for retirement.

Instead, consider a traditional retirement plan instead for a less risky policy.

And if you’re interested in investments, perhaps a pure investment plan might be better as they usually come with a wider fund choice for individuals with different risk tolerance.

Before deciding if the Prudential PRUVantage RetireCare is for you, it’s wise to get a second opinion from an unbiased financial advisor.

This helps you understand if the PRUVantage RetireCare is the best option for you or if there are better alternatives in the market.

That way, you don’t unnecessarily risk your precious retirement funds while still getting the best option to grow it.

Should you need someone to get a second opinion from, we partner with MAS-licensed financial advisors to assist you with this.

They have helped hundreds of our readers in similar situations, and will definitely be able to provide you with the guidance you need.

Click here for a free non-obligatory second opinion.

Criteria

- Minimum Entry Age: 19

- Maximum Entry Age: 45

- Minimum premium term: 5 years

- Minimum policy term: 8 years

General Features

Premium Terms

The regular premiums are invested in the Initial Investment Account, while the top-up premiums from the Investment Booster (Lump Sum) are invested in the Additional Investment Account.

Policy Term

The PRUVantage RetireCare policy term is undetermined as it depends on your selected payouts and how long your funds can sustain these payouts.

Target Retirement Monthly Income

Starting from the policy anniversary just before you reach your chosen retirement age, this policy offers the monthly income chosen from your Initial Investment Account.

This monthly income continues until the value in your account reaches 0.

If the Initial Investment Account has less money than you’d get in 2 months, the remaining amount is paid as a lump sum.

You can change the amount of your monthly income 12 months before the policy anniversary before your chosen retirement age.

Your policy ends after the final payment and if no units are left in the Additional Investment Account.

Protection

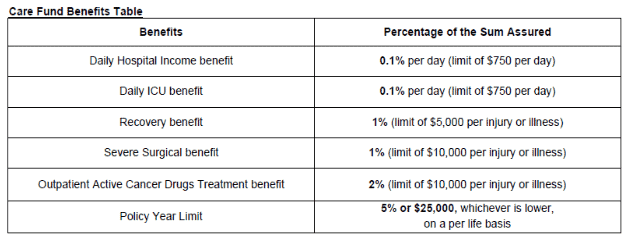

Care Fund Benefit

The Care Fund lasts 10 or 20 years from the policy anniversary, right before your chosen retirement age.

Once you pick this duration, you start the policy and cannot change it later.

In a policy year, you can claim money from the Care Fund up to 5% of your sum assured or $25,000, whichever is less.

If you do make a claim, it will reduce the total amount of money your policy covers.

However, If your sum assured is reduced, or you get a partial payout due to the accelerated terminal illness benefit, the limit for the Care Fund benefit changes based on the new sum assured.

This benefit will end when your sum assured reaches zero or reaches the date when your assured amount expires, whichever is first.

Here is a summary table of expenses covered and the Care Fund sub-benefit limits.

Worth noting the following are not covered in the Care Fund Benefit.

Death Benefit

In the unfortunate circumstance of the life assured’s passing, here’s what’s provided:

- If you pass away within the period of the policy’s start date to the sum assured expiration date, the payout will be the sum assured and the total account value from both the Initial Investment Account and the Additional Investment Account (if applicable).

This amount is adjusted for any deductions taken under the Care Fund benefit and any outstanding debts.

- However, suppose your death occurs after the expiration of the sum assured.

The payout will be a combined account value from the Initial Investment and Additional Investment Accounts (if applicable) after adjusting for any outstanding debts.

The expiration of the sum assured aligns with the policy anniversary that falls just before the 10th or 20th year following the selected retirement age.

For instance, if your retirement age is 60, the expiration of the sum assured would align with the policy anniversary just before your 70th or 80th birthday (whichever applies).

When the sum assured has been previously lowered, the most recent reduced sum assured will be considered for payout purposes.

The amount used under the Care Fund benefit will be adjusted back when the sum assured is lowered.

Note that any administration and assurance charges deducted from the account before the claim date for the death benefit will not be refunded.

There are special exclusions and terms and conditions in the life insurance certificate that will be considered should you pass away.

Under these exclusions, no death benefit will be paid.

Instead, you’ll be refunded through the total unit value in the account or through a refund of all premiums paid, depending on which is higher.

This amount will be calculated after any withdrawals and outstanding balances owed to the policy have been deducted.

Scenario vs Death Benefit Table

| Scenario | Death Benefit |

| Death occurs within the sum-assured timeframe. | The payout includes the sum assured and combined account value from both Initial Investment and Additional Investment Accounts (if applicable), adjusted for any deductions from the Care Fund benefit and any outstanding debts. |

| Death occurs after the sum-assured expiration. | Payout is the total account value from both Initial Investment and Additional Investment Accounts (if applicable), adjusted for any outstanding debts. |

| The sum assured has been previously lowered. | The most recent reduced sum assured will be paid out, and the amount used under the Care Fund benefit will be adjusted back from when the sum assured was lowered. |

| Death due to special exclusions or particular terms and conditions: | No death benefit will be paid. Instead, a refund will be made, either through the total unit value in the account or a refund of all premiums paid, whichever is higher, after withdrawals and outstanding balances owed to the policy have been deducted. |

Accelerated Terminal Illness Benefit

If you develop a terminal illness before your life insurance policy ends, you may qualify for the accelerated terminal illness benefit.

Any amount previously used from the Care Fund benefit (up to the date of your terminal illness diagnosis) and any outstanding debts you still have will be deducted.

If the sum assured has been lowered at any point, the most recent sum assured is taken into account, and the amount drawn from the Care Fund benefit is reset, starting from when the sum assured was reduced.

It’s crucial to understand that any administrative and assurance charges deducted from your account before the date you claim the accelerated terminal illness benefit won’t be refunded.

Once the expiry date of the sum assured occurs, the accelerated terminal illness benefit ends.

This expiry date aligns with the policy anniversary preceding the 10th or 20th year after your chosen retirement age.

For instance, if you’ve set 60 years as your retirement age, then your sum assured expiry date would fall on the policy anniversary just before you turn 70 or 80 years old (depending on your policy).

Scenario vs Terminal Illness Benefit Table

| Scenario | Terminal Illness Benefit |

| Diagnosed with a terminal illness before the end of the sum assured. | The payout includes the sum assured specified for the accelerated terminal illness benefit, adjusted for any amount used from the Care Fund benefit and any outstanding debts. |

| Sum assured has been previously lowered. | The most recent lowered sum assured is considered, and the amount drawn from the Care Fund benefit is reset from when the sum assured was reduced. |

| After the sum assured expiry date. | The accelerated terminal illness benefit ends.

The expiry date aligns with the policy anniversary preceding the 10th or 20th year after your chosen retirement age. |

| If the sum assured for terminal illness benefit equals the death benefit. | The total value of all units combined in both the Initial Investment Account and Additional Investment Account (if applicable) will be paid out, resulting in the termination of your policy. |

| If the sum assured for the terminal illness benefit is less than the death benefit. | Your policy continues, providing the Care Fund and death benefit according to the remaining sum assured. |

After Payout

Suppose the sum assured for the accelerated terminal illness benefit equals the death benefit.

The total value of all units in both your Initial Investment Account and Additional Investment Account (if applicable) will also be paid out, resulting in policy termination.

Every year, starting from the policy anniversary before your chosen retirement age, a certain amount is set aside to help cover some of your medical expenses if needed.

Family Waiver Benefit

If a close relative passes away, this benefit covers your policy premiums and any additional benefits you might have for the next 12 months.

If your premium payment term is less than 12 months from when your close relative passed away, the benefit covers the premiums only until your payment term ends.

Any premiums you’ve already paid before the start of the waiver won’t be refunded, and the waiver stops once you’ve caught up on your payments.

Optional Rider Add-ons

Crisis Waiver III

Upon diagnosis of any of the specified 35 critical illnesses, the Crisis Waiver III ensures a waiver of premiums.

Early-Stage Crisis Waiver

If you are diagnosed with early-stage medical conditions, the Early-Stage Crisis Waiver ensures that your premiums will be waived for 5 years and furthermore allows you to make a 2nd claim.

In case of diagnosis with intermediate-stage medical conditions, your premiums will be waived for a period of 10 years.

Payer Security Plus

Payer Security Plus ensures that in the untimely event of your death, total and permanent disability, critical illness, or the premiums of your spouse’s or child’s policy will be waived.

You are covered under this benefit up to the end of the premium term or until you reach the age of 85, whichever is first.

Early Payer Security

Early Payer Security ensures that if anything unexpected happens to you, your loved ones are protected, and their premiums will be waived.

In case of a diagnosis of an early or intermediate-stage medical condition, the waiver term extends up to 10 years.

Key Features

Stepped-Up Payouts

You may opt to increase your monthly payouts between 0% to 5% each year to counter the effects of inflation.

Change of Retirement Age

You can adjust your chosen retirement age at any time, but only up to 3 times during the policy’s life.

Your new retirement age should fall within a range of 55 to 65 years old, and you can pick in 1-year intervals.

However, you can’t select a retirement age younger than the current age of the person whose life the policy is based on.

Also, there should be at least a 10-year gap between the end of your premium payment term and your retirement age.

If you want to change to a younger retirement age, there should be at least a 2-year gap from the change to the new retirement age.

And if you’re changing to an older retirement age, you need to do so at least 2 months before the start of the policy anniversary, immediately before your current chosen retirement age.

Reduction of Sum Assured

You can reduce the sum assured of your policy after the premium term, but only down to a minimum limit of $100,000.

In doing so, the charges for Death, Terminal Illness, and Care Fund Benefits will also decrease accordingly.

The limit for the Care Fund Benefit will be adjusted based on the latest reduced sum assured.

If you’ve selected the 20th year as the date when your sum assured expires, you can choose to reduce the sum assured down to zero after the 10th year from your chosen retirement age.

For example, if your retirement age is 60, you can reduce the sum assured to 0 starting from the policy anniversary before you turn 70.

Top-up premium (Lump Sum)

You can make additional one-off premium payments, referred to as the Investment Booster (Lump Sum), to increase your investment.

The minimum Investment Booster (Lump Sum) premium amount you can pay is $1,000.

You may allocate your Investment Booster (Lump Sum) premium to one or more of the PRULink funds offered within your policy.

You must invest at least 5% of your Investment Booster in any PRULink fund you select.

After that, you can allocate the remaining premium in multiples of 5%.

An upfront premium of 3% is applied to your Investment Booster (Lump Sum) premium.

Thus, only 97% is used to purchase units in the selected PRULink fund(s).

Premium Holiday

This Premium Holiday feature provides flexibility, allowing you to stop premium payments while keeping the policy active temporarily.

However, there should be sufficient units in your investment account to cover the administration charge and premium holiday charge.

I’ll cover the premium holiday charges later in the fees & charges section.

Switching PRULink Funds

With PRUVantage RetireCare, you can switch your investments between different PRULink Funds, subject to certain conditions.

First, you can request a fund switch once you have accumulated enough units in your Initial Investment Account and Additional Investment Account (if applicable).

Secondly, funds from different accounts, such as the Initial Investment Account and Additional Investment Account, cannot be combined for switching purposes.

You must switch funds within the same account.

Thirdly, the value of the remaining units in the PRULink fund you are switching from should not fall below a minimum specified amount.

If the remaining unit value is below this threshold, you must switch all units out of that fund.

Change of Premium Allocation

You can request a change in the proportions of how your regular premiums are allocated among different PRULink funds at any time.

Upon doing so, you adjust the allocation in multiples of 5%.

This allows precise control over how your premiums are distributed among the available PRULink funds.

The requested changes will take effect the next time you make a regular premium payment.

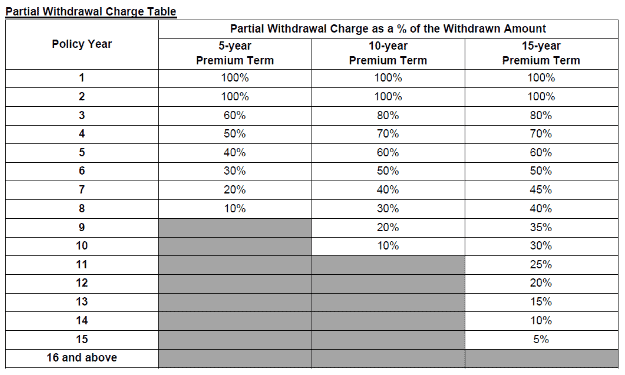

Partial Withdrawal

You can withdraw partially from your PRUVantage RetireCare policy by selling some units in your Initial Investment Account and/or Additional Investment Account (if applicable).

To do this, you must have a minimum account value of more than $1,000 in your Initial Investment Account and Additional Investment Account (if any).

The remaining units in the policy must be worth at least $1,000.

However, partial withdrawals reduce the account value of the Additional Investment Account or the Initial Investment Account.

I’ll cover the withdrawal charges later.

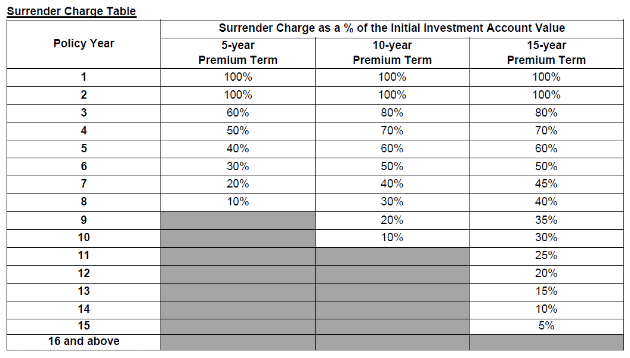

Policy Surrender

When you surrender your policy, you will receive a surrender value composed of the units in your account(s) minus any surrender charges (if applicable).

Any premium payments you have made that have not yet been invested will also be included.

The surrender value is paid to you after deducting any outstanding amounts you owe Prudential.

If the surrender amount is less than the surrender charge amount, no payment will be made as the surrender value.

Note that a surrender charge will apply if you surrender your policy within the specified years from the cover start date, which will be shared later.

Fund Investment

PRUVantage RetireCare allows you to invest in PRULink Funds and potentially earn returns over time.

This ensures flexibility in choosing investment funds that align with your risk tolerance and financial goals.

Take note that PRULink funds are unit trusts and are the insurer’s own sub funds.

Welcome Bonus

The Welcome Bonus is like a special gift to give your investments a jumpstart in the policy’s first year.

It’s a way to add extra units to boost your Initial Investment Account.

The number of units you get as part of the Welcome Bonus will be distributed in the same way as your regular premiums are allocated among the PRULink funds you’ve chosen.

The amount of the Welcome Bonus you receive depends on your premium term, and you can find the specific details in the table below.

Loyalty Bonus

As a reward, you’ll receive a Loyalty Bonus.

This bonus is calculated at 0.8% of the most recent value of your Initial Investment Account for every set of 8 completed policy years.

The Loyalty Bonus isn’t cash; instead, it’s converted into extra units and added to the same fund or funds you’ve selected for your investments.

The proportion of these additional units will match the allocation you already have for your investments.

Retirement Bonus

When you reach your selected retirement age, you’ll receive a one-time lump sum as a percentage of your most recent sum assured amount.

This retirement bonus isn’t given as cash; instead, it’s converted into extra units and added to your Initial Investment Account.

The allocation of these additional units matches the same funds and proportions you’ve chosen for your investments.

The formula for Retirement Bonus Rate Calculation is 5% + (0.1 x Policy Accumulation Period)%.

Fees & Charges of PRUVantage RetireCare

Here is a breakdown of the fees & charges associated with your PRUVantage RetireCare policy, usually by cancelling units at the bid price unless stated otherwise.

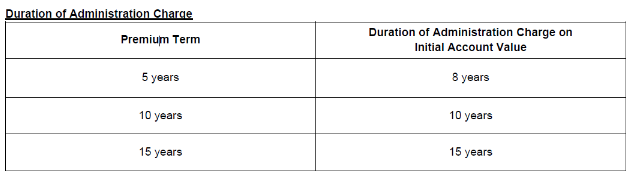

Administration Charge

Starting from the first premium due date, a monthly administration charge of 1.75% per annum is applied on the same day each month.

This monthly administration charge is calculated as a percentage of the most recent value of your Initial Investment Account.

How long this administration charge continues depends on the premium term of your policy.

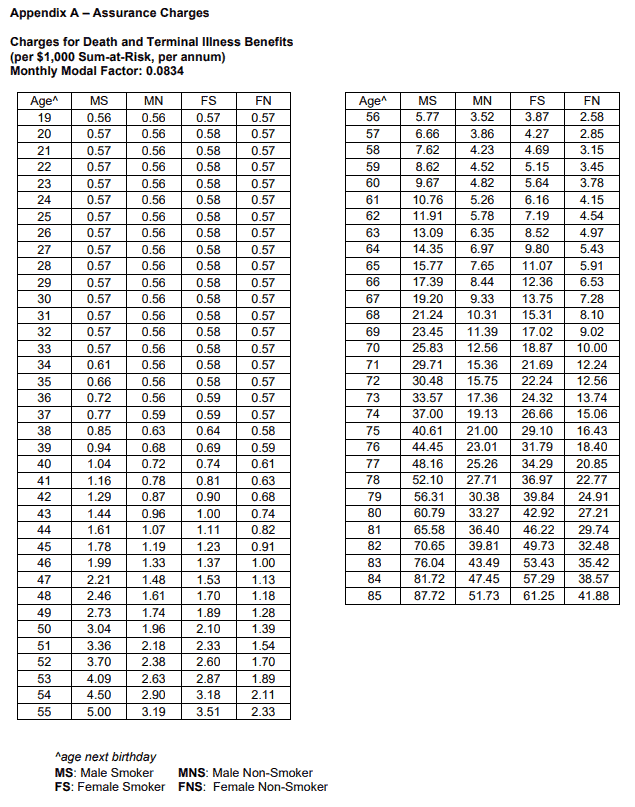

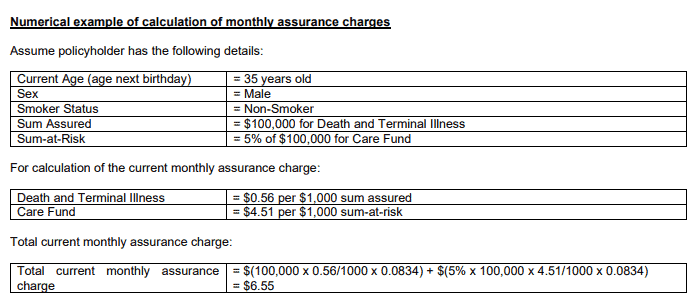

Assurance Charge

This charge starts from the first premium due date of your policy and on the same day every month thereafter until your sum assured expires.

It covers the cost of providing benefits for death, terminal illness, and the care fund.

The specific amount of this assurance charge is determined based on several factors, including.

- The current assurance rates.

- The total benefits payable under your policy and

- The age of the person whose life the policy is based on at each billing cycle.

Premium Charge

An upfront premium of 3% of your Investment Booster (Lump Sum) premium, which is subtracted directly from the Investment Booster (Lump Sum) premium amount you’ve paid.

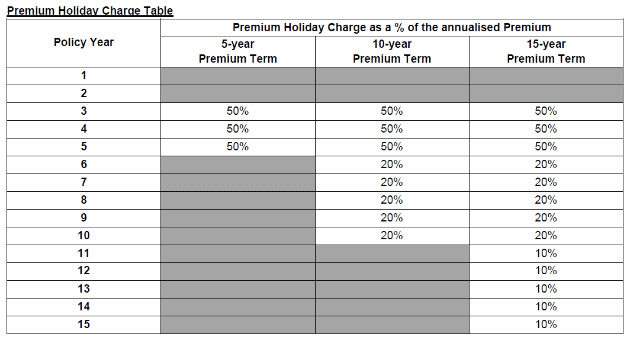

Premium Holiday Charge

As shown below, a premium holiday charge is imposed every month until the end of the premium term.

If you pay all the unpaid premiums during the premium holiday period, the policy returns to its regular premium payment status.

Should that happen, Prudential will refund some of the premium holiday charges.

Partial Withdrawal Charge

Surrender Charges

Here are the surrender charges for the PRUVantage RetireCare:

Fund-Related Charges

The fund-related charges vary based on which funds you or your financial advisor have decided to invest in.

Here are the funds that you have access to via the PRUActive LinkGuard.

There are 2 fund-related charges you will incur – Continuing Investment Charge and Initial Investment Charge.

Continuing Investment Charge

This fee is charged by the fund yearly to the fund managers managing your respective sub-funds.

According to Prudential, the daily investment charge is deducted proportionally throughout the year and is included in the price of the corresponding PRULink fund.

Prudential also states that this charge is not an extra fee added to the policy.

I’m not sure what Prudential meant when it says it’s not an extra fee added to the policy, but I will presume that the annualised returns you see from your funds have already considered the Continuing Investment Charge.

Initial Investment Charge

This fee is charged every time you invest with the fund manager. This charge varies depending on the fund you chose, but based on a quick glance, I’ve seen the Initial Investment Charge go as high as 5%.

This means that every time you make a regular premium payment, the investment portion of your premium will incur this charge.

For example, if your premium is $100 monthly, it will go through the Premium Charges first, and whatever is remaining will incur the Initial Investment Charge.

Check the fund factsheet for both the Continuing Investment Charge and Initial Investment Charge.

Summary of PRUVantage RetireCare

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Riders | |

|

Yes |