Prudential’s PRULink FlexGrowth is an investment-focused investment-linked plan (ILP) that allows you to invest 1 lump sum and locks in 90% of the gains you make on your investments.

It protects you from potential market losses by guaranteeing your initial investment when the plan matures.

Here’s our review of the PRULink FlexGrowth.

My Review of PRULink FlexGrowth

The Prudential PRULink FlexGrowth is a decent investment-linked policy for you to invest your SRS funds with due to the 90% capital gain lock-in feature.

Once locked in, this value remains constant, providing stability regardless of market fluctuations.

Whether you choose a Single Premium payment through cash or opt for a Supplementary Retirement Scheme (SRS), you can tailor your investment period to either 12 or 15 years, aligning with your financial goals.

With Prudential’s PRULink FlexGrowth, 100% of your premiums start working for you from day one.

This means your entire investment is put to use immediately, maximising the potential for returns.

However, you only have access to 1 fund – the PRULink FlexGrowth Fund (SGD), which, as of November 2023, doesn’t seem to be performing well.

Not only is the fund not performing well, I think the fees & charges are on the higher side at 2.5% + 0.5% per year for the 12-year policy, or 2.0% + 0.5% for the 15-year policy.

This also excludes the index management fees and the fund expense ratios of up to 2.42% per year.

If you’re looking to invest your SRS funds, there are better alternatives out there, with the HSBC Life Wealth Invest being the best, in our opinion.

And if you’re looking to invest your cash, there are many investment plans to choose from that offer more funds to choose from, lower fees, and even more features.

However, that doesn’t mean the PRULink FlexGrowth isn’t for you – there must be a reason why this was recommended to you.

Perhaps you really need the Growth Assure Value feature, which is completely understandable.

Thus, we suggest getting a second opinion from someone unbiased to see if the PRULink FlexGrowth is truly the best option for you or if there is a better choice.

You’re about to make a long-term investment decision, so it’s best to do a little bit more research to save yourself from regret in the future.

If you’d like a second opinion, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a free non-obligatory second opinion.

Now let’s break down the PRULink FlexGrowth in detail:

Criteria

- Minimum investment period of 12 years

- Minimum single premium of $6,000

- Pay with cash or your SRS funds

General Features

Premium Terms

PRULink FlexGrowth (SP) is a single premium policy with a minimum investment amount of $6,000.

You are able to invest either with cash or your Supplementary Retirement Scheme (SRS) funds.

Policy Term

The Prudential PRULink FlexGrowth (SP) has a policy term of 12 or 15 years.

Protection

Death Benefit

Should the policyholder pass on, the PRULink FlexGrowth provides a payout based on the highest value among the 3 options:

- The Sum Assured: This is set at 101% of the single premium paid

- Growth Assure Value that reflects the growth of your investment

- The current value of your investment account, less any outstanding amounts owed to the insurer

The Growth Assure Value and Sum Assured are reduced if you have previously made partial withdrawals.

The assured sum is adjusted to 101% of the updated premium amount.

Once a death benefit claim is paid, the policy ends.

Maturity Benefit

When the PRULink FlexGrowth plan matures, Prudential pays out a lump sum based on either the higher account value at maturity or the Growth Assure Value at maturity.

Any outstanding amounts owed to the insurer should be deducted from this amount before the payout is made and the policy ends.

Key Features

Growth Assure Value

- Initial Value: The Growth Assure Value starts equal to the single premium paid at the beginning of the policy.

- Daily Calculation: Each day, the Growth Assure Value is recalculated. It will be the higher of:

- The previous day’s Growth Assure Value, or

- The sum of the single premium paid plus 90% of the account value gain.

- Account Value Gain: This is calculated by subtracting the single premium from the current account value (value of all units in the account at the bid price).

- Lock-in Feature: The highest daily value is locked in at 90% of the account value gain. This means that once the Growth Assure Value increases, it will not decrease unless there are partial withdrawals.

- Impact of Withdrawals: If partial withdrawals are made, the Growth Assure Value is adjusted downwards accordingly.

Illustration Example:

Let’s say you have a policy term of 15 years with a single premium of $100,000. Here’s how the Growth Assure Value might change over time:

- Age 45 (Policy Start):

- Account Value = $100,000

- Growth Assure Value = $100,000

- Age 50:

- Account Value = $150,000

- Growth Assure Value = $145,000 (90% of the gain from $100,000)

- Age 55:

- Account Value = $90,000 (a decrease)

- Growth Assure Value = $145,000 (remains the same due to lock-in)

- Age 60 (Maturity):

- Account Value = $100,000

- Growth Assure Value = $145,000

In this example, the Growth Assure Value benefits by locking in gains and not decreasing even if the account value drops at certain points.

PRULink Fund

When you purchase the PRULink FlexGrowth, all your premiums are automatically invested into the PRULink FlexGrowth Fund (SGD).

This will be the only fund that you can invest in via the PRULink FlexGrowth.

You can find more information on the PRULink FlexGrowth Fund (SGD) here.

Partial Withdrawals

Prudential’s PRULink FlexGrowth allows you to request a partial withdrawal if you want to withdraw money from your policy before it matures.

However, the withdrawal comes with some conditions.

- You must minimally withdraw $1,000,

- The remaining value of units must be more than $1,000.

There are charges associated with the withdrawal request, which are calculated by the amount you choose to withdraw.

We will cover this in the fees & charges section.

Fees & Charges of PRULink FlexGrowth

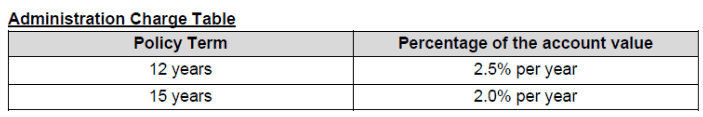

Administration Charge

With Prudential’s PRULink FlexGrowth, starting from the single premium due date of your policy and continuing on the same day each month after that, an administration charge is billed to your account.

This monthly administration charge is initially a percentage of the single premium at the time of policy issuance.

As time progresses, the charge becomes a percentage of the most recent account value.

Your policy term will determine the duration for which the administration charge applies.

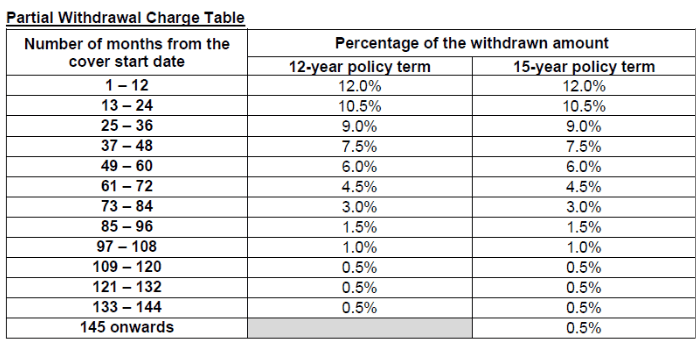

Partial Withdrawal Fees

Below is a table of charges showing the applicable rates for each policy month and term.

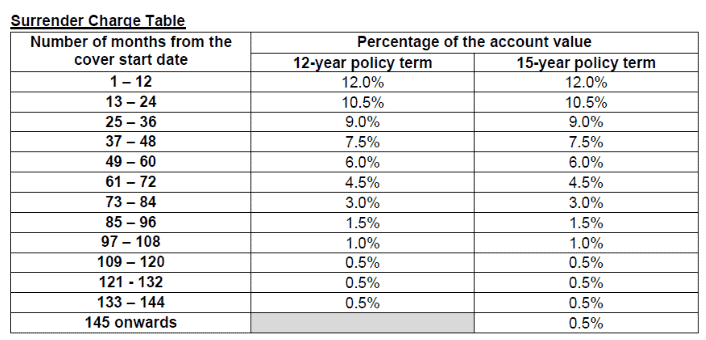

Surrender the policy

You may choose to surrender your policy at any time, but the Growth Assure Value won’t be considered, instead allowing you to receive the surrender value.

The surrender value is calculated as the account value less the surrender charge.

The surrender charge is a percentage of the account value, as shown below.

Continuing Investment Charge

The continuing investment charge is an annual fee of 0.5%.

This charge is deducted proportionally on each unit pricing day throughout the year.

It’s important to note that this fee is already included in the fund price, and it’s not an extra cost on top of your policy.

There are also the following charges involved:

- Index management fee of 0.42% p.a.

- Fund Total Expense Ratio of between 0.5% – 2.0% p.a.

More information can be found here.

Summary of PRULink FlexGrowth

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |