The NTUC Income Gro Power Saver Pro is a participating endowment plan that helps you save money while insuring you at the same time.

Read our review to learn more about the NTUC Income Gro Power Saver Pro and determine if this policy is right for you.

My Review of the NTUC Income Gro Power Saver Pro

With the NTUC Income Gro Power Saver Pro, you can save money over the long term while ensuring your loved ones are financially supported in the future.

This 12-year term policy offers coverage against death and terminal illness, and waives premiums for total and permanent disability.

Once you have paid at least 3 years’ premiums, you won’t have to pay premiums for the remaining 9 years of the policy.

This means you can sit back and enjoy full coverage without worrying about ongoing premium payments.

Should you pass away or be diagnosed with a terminal illness, the policy will provide up to 105% of all the premiums paid and any bonuses earned.

You can also receive the policy’s cash value if it is the higher option.

If you become totally and permanently disabled before age 70, the policy will waive the remaining premium payments.

This means you won’t have to pay any more premiums, and the policy will continue.

At this point, you can choose to receive a lump sum benefit instead of waiving your future premiums. Once this benefit is paid, the policy will terminate.

On top of the general protection features, you have the option to add on the Cancer Premium Waiver rider.

If diagnosed with major cancer during the rider term, the future premiums will be waived, ensuring that the coverage continues without the burden of premium payments.

Thus, the NTUC Income Gro Power Saver Pro provides pretty comprehensive coverage against unfortunate events.

You’ll be covered for the major risks that can substantially impact your finances.

Upon maturity of the policy, you are guaranteed to receive back all the premiums paid (excluding optional rider premiums) – making sure that you at least get all your money back!

However, if you prefer liquidity, this 12-year plan may not be the right choice for you.

You could consider short-term endowment plans such as the NTUC Income Gro Capital Ease or Tiq’s Endowment Plan with shorter policy terms of 3 years.

It is important to research before choosing any insurer since each offers unique products, benefits, and features.

I recommend you take a look at our post on the best endowment plans in Singapore to help you find the available alternatives in the market right now.

Once you know your choices, get a second opinion on whether the NTUC Income Gro Power Saver Pro is for you and compare other options to find the best plan for yourself.

That way, you don’t risk making huge financial mistakes that you’ll surely regret in the future.

If you’re interested in a comparison session, we partner with unbiased financial advisors who have helped thousands of our readers with second opinions and have compared countless of policies.

Click here for a free non-obligatory comparison session.

Now let’s explore what the NTUC Income Gro Power Saver Pro has to offer:

Criteria

- Entry age: 0 -70 years old (last birthday)

- Premium payment term: 3 years

General Features

Policy Term

The NTUC Income Gro Power Saver Pro is a 12-year savings policy, meaning you will get your savings and more at the end of 12 years!

Premiums Payment

With the NTUC Income Gro Power Saver Pro, premiums are payable throughout the premium term on a monthly, quarterly, half-yearly, or yearly basis.

Despite being a 12-year policy, you don’t actually have to make premium payments for the entire period.

The Premium Privilege is a special benefit that comes into effect after you have paid premiums for the policy for at least 3 years.

Once you reach this milestone, you won’t be required to make any further premium payments for the remaining 9 years of your policy.

The policy will continue during this period, and you’ll still enjoy all the benefits.

Protection

Death Benefit

If the insured passes away while the policy is in effect, the policy will provide a death benefit.

The death benefit for this policy is whichever amount is higher between the following;

- 105% of all paid premiums plus 100% of any bonuses you have earned.

- The policy surrender value (the amount you would receive if you cancel the policy early).

Any loans you may have taken against the policy and accrued interest will be subtracted before the benefit is paid out.

The policy terminates once the death benefit is paid.

Terminal Illness Benefit

The policy will provide a terminal illness (TI) benefit if the insured is diagnosed with a terminal illness during the policy term.

The TI benefit is whichever amount is higher between these 2 options;

- 105% of all premiums paid, minus applicable charges, and 100% of any bonuses you earned.

- The policy surrender value (the amount you would receive if you cancel the policy early).

Any loans taken against the policy or with any outstanding interest will be deducted from this benefit before it is paid out.

The policy will terminate once the TI benefit is paid, and no further benefits will be provided.

Total and Permanent Disability (TPD) Premium Waiver Benefit

In the event that the insured becomes totally and permanently disabled before turning 70, they will not have to pay any more premiums.

In this situation, you can choose to keep the policy active without paying premiums or receive a lump sum payment instead.

The lump sum payment will be based on the premiums you’ve already paid, and it will be higher than the amount you would get if you cancel the policy early (depending on your cash value, check your policy documents).

Once the waiver of premiums has started, you can’t switch to the lump sum payment option.

If you have any loans or outstanding interest on the policy, they will be deducted from the benefit amount.

To qualify for this TPD benefit, a doctor must confirm that you are completely and permanently disabled for at least 6 months.

The total TPD benefits you can receive from all your policies, including the waived premiums, cannot exceed $6.5 million.

The TPD benefit will reduce your overall sum assured.

Maturity Benefit

You may be wondering what happens when you reach the end of the policy term, and, thankfully, you’re still with us, and the policy hasn’t ended early.

You will be given the maturity benefit, that is, whichever amount is higher between these 2 options;

- 100% of the sum assured and 100% of bonuses, or

- 100% of all net premiums paid and 100% of bonuses

Same with the other benefits, any loans taken against the policy, and interest will be deducted from the benefit amount payable.

The policy terminates once the maturity benefit is paid out.

Key Features

Capital Guarantee

The NTUC Income Gro Power Saver Pro offers a capital guarantee upon maturity. This means you will receive at least the total premiums you paid during the policy period.

This is great for individuals looking for a low-risk place to park their savings, ensuring that you get your money back minimally and more!

This guaranteed amount excludes any premiums you paid for optional rider(s).

Bonuses

Bonuses are extra payments that you can receive depending on the profits made from the participating fund.

Hence, the bonuses are not guaranteed and are determined yearly by NTUC Income.

Regardless of the fund’s performance, any bonuses already added to your policy will become guaranteed.

With this plan, you can earn 2 bonuses: Reversionary Bonus and Terminal Bonus.

Annual/Reversionary Bonus

The reversionary bonus may be added to your policy each year and are usually calculated as a percentage of the basic sum assured and any bonuses received in previous years.

Once these annual bonuses are added to your policy, they become guaranteed, which means they are assured and will be provided to you, regardless of the performance of the Life Participating Fund.

Hence, these annual bonuses can enhance the overall cash value of your policy over time.

Terminal Bonus

This bonus may be paid out when you make a claim, reach the policy’s maturity date, or decide to surrender the policy.

It is an additional amount provided on top of the other benefits you are entitled to.

Optional Add-On Rider

Cancer Premium Waiver (GIO)

You can add the Cancer Premium Waiver (GIO) rider to your insurance policy for even more coverage.

In the event of a diagnosis of any major type of cancer, this rider provides a waiver of future premiums.

After the diagnosis, you won’t have to pay any more premiums. The premiums that were already paid will be refunded to you in full (shiok ah!).

The rider terms can range from 3 to 45 years, depending on your choice.

However, the maximum age to enter this rider is 65 years old (based on the last birthday).

The coverage cannot extend beyond your 85th birthday (last birthday) or the premium term of the basic policy, whichever comes earlier.

To be eligible for the rider benefits, you must survive for at least 30 days after receiving the cancer diagnosis.

NTUC Income Gro Power Saver Pro Fund Performance

Current Asset Mix

Currently, the assets are allocated to closely match the target allocation for the entire fund.

The fixed-income portion of the portfolio includes government and corporate bonds, which are intended to cover most of the guaranteed bonuses.

To achieve the objectives and ensure good performance, the fund managers have the flexibility to adjust the investment mix.

They continually assess the performance of different investment options and may change the allocation of funds to maximise returns and manage risks effectively.

Below is the strategic and actual asset allocation as of 31st December 2022:

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Fixed-Income | 64 | 63 |

| Equities and Properties | 36 | 37 |

| Total | 100% | 100% |

Investment Rate of Return

The return on your investment can be influenced by various factors in the larger economy as well as the business environment.

These factors may include changes in interest rates, inflation, market conditions, and the overall performance of businesses and industries.

Due to these fluctuations, the bonuses you receive may also be affected. Bonuses are often tied to the overall performance of the investment fund or the specific investment products you have.

If the fund or investments experience lower returns or face challenges due to economic conditions, it may impact the amount of bonuses paid out.

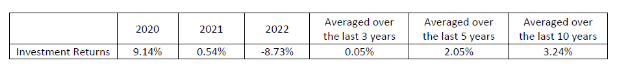

Below are the historical investment rates for this participating fund between 2020 and 2022:

From 2020 to 2022, the rate of return for this fund has declined from 9.14% to -8.73%.

A negative rate of return can result from various factors, including dwindling income, economic turbulence, and inflation. In this case, it can be due to the market downturn caused by the pandemic in 2020.

However, the investment returns have been positive when averaged over the past 3, 5 and 10 years (2010-2019).

Looking at the geometric average net investment returns, NTUC Income has a pretty stable track record.

It has been performing above average among other insurers for the past 3, 5 and 10 years. Take note that the data is dated, so use this as a gauge instead.

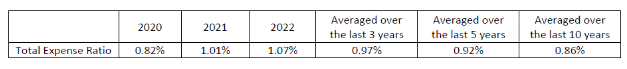

Total Expense Ratio

If you are new to the world of investments, fret not!

The total expense ratio is a helpful metric that helps you understand the costs associated with managing the participating fund. It indicates the portion of the fund’s assets that goes to covering expenses.

When you pay your policy premiums, a portion is already allocated to cover the expected expenses.

These expenses are not an extra cost for you as the policyholder.

However, if the expenses incurred by the participating fund are significantly higher than expected, it can affect the non-guaranteed benefits you may receive.

Higher expenses can reduce the fund’s overall returns, which may impact the potential bonuses or additional benefits that the policy may provide.

It’s important to monitor the total expense ratio to ensure the fund’s costs are reasonable and in line with expectations, as it can impact your policy’s performance and potential benefits.

Below are the past years’ total expense ratios:

Accurate as of 31 December 2022.

The below report shows the top 8 insurance companies’ performance from 2017 to 2019 regarding expense management:

While the information provided highlights NTUC Income’s lower and consistent expense ratio, it’s good to note that expense management is just one of the many factors to consider when evaluating an investment or insurance plan.

A lower expense ratio indicates efficient cost management but does not guarantee higher returns or benefits.

It’s crucial to consider various factors, including financial stability, the specific features and benefits of the plan, and your individual financial goals and risk tolerance.

NTUC Income Gro Power Saver Pro Fees and Charges

The NTUC Income Gro Power Saver Pro does not charge you any additional fees and charges on top of the premiums you’ve paid.

However, it’s important to understand that the participating fund incurs fees and charges to cover operating costs.

It’s like paying bills: these costs include agent commissions, administrative expenses, and policy claim fulfilment.

It’s important to note that the fund is responsible for directly covering these expenses.

On top of that, there are shared expenses that apply to multiple funds managed by your insurance company. These expenses include general administrative costs.

To ensure fairness, these shared expenses are allocated to each fund, including the policy’s participating fund, based on a cost-sharing methodology.

This methodology considers the specific costs associated with each fund’s operations.

By allocating shared expenses using this methodology, NTUC Income ensures that the costs are distributed fairly among the funds, considering their respective operational expenses.

Illustration of How NTUC Income Gro Power Saver Pro Works

Introducing Mr Rice, who is 40 years old, wants to secure his future and buys an insurance savings plan. He chooses the NTUC Income Gro Power Saver Pro.

The plan has a sum assured, or guaranteed payout, of $60,000.

For the first 3 years, Mr Rice pays an annual premium of $20,000.

After these 3 years, the Premium Privilege starts. This means that he no longer needs to pay any more premiums for the remaining 9 years of the policy.

The policy matures at the end of the 12 years, and Mr Rice receives a lump sum of money as the policy’s maturity benefits.

In his case, he will receive $22,174 as non-guaranteed bonuses. He will also receive the guaranteed maturity benefit of $60,000.

This amount was assured to him when he signed up for the policy.

Hence in total, the maturity benefits amount to $82,174.

Summary of the NTUC Gro Power Saver Pro

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | N/A |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |