Co-payments on health insurance can become a costly nightmare.

Especially when you think you have everything covered with all your other insurance coverage.

That’s when the NTUC Income Co-Pay Assist Plan comes in handy.

The NTUC Income Co-Pay Assist Plan is a group health insurance policy designed to help cover medical expenses in certain situations, working together with the Comprehensive Co-payment Scheme (CCS).

It covers the co-payment rate for medical expenses if you receive treatment in a hospital ward specified in the policy schedule.

Here’s our review of it.

Criteria

To qualify for the NTUC Income Co-Pay Assist plan, you must meet the following requirements:

- You must be a public officer included in the CCS.

- If your dependents are also covered under the CCS, they can apply for this policy.

General Features

Premium Terms

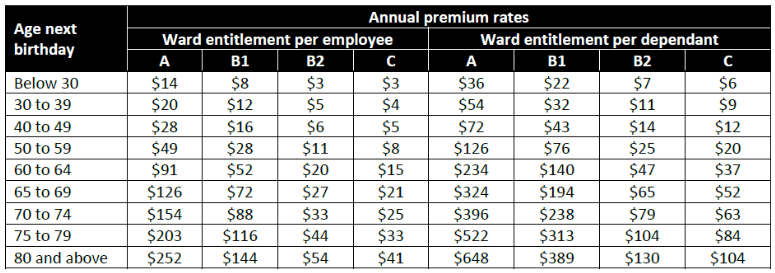

The amount you pay for your annual premiums is determined by the type of hospital ward you choose and your age on your next birthday.

These premium rates will be adjusted as you move into a higher age bracket.

The initial premium for the first year must be paid by cash or cheque before the NTUC Income Co-Pay Assist Plan is issued.

These can be conveniently paid through payroll deduction for subsequent annual renewal premiums.

Suppose you are a pensioner and still eligible for coverage under the Comprehensive Co-payment Scheme (CCS).

In that case, you may choose how to pay your annual premium.

You can opt for cash, cheque, or set up a GIRO payment arrangement for your convenience.

You may not use your MediSave funds to pay for the premiums.

Policy Term

The NTUC Income Co-Pay Assist Plan is designed to be renewed annually as long as NTUC Income receives your renewal premium before the renewal date, ensuring that your coverage continues seamlessly for the upcoming calendar year.

Protection

Hospital Bill Benefit

The NTUC Income Co-Pay Assist Plan is designed to reduce your out-of-pocket medical expenses.

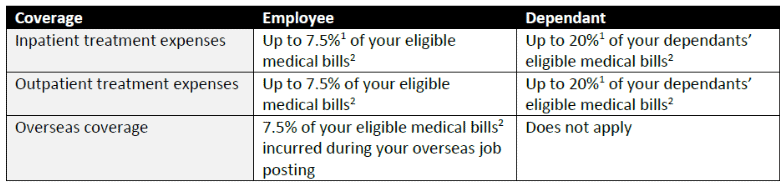

It covers some eligible medical bills you would typically have to co-pay under the Comprehensive Co-Payment Scheme.

Specifically, it pays half your co-payment amount, translating to up to 7.5% of your eligible medical bills.

For your dependents, the plan covers up to 20% of their qualifying medical bills.

This assistance helps ease the financial burden of medical costs for both you and your family members.

Please note:

Suppose you choose to receive treatment in a hospital ward of a higher standard than what is specified in the NTUC Income Co-Pay Assist Plan schedule.

In that case, the co-payment rates will be modified to align with the respective plans.

Eligible medical bills pertain to the portion of the medical expenses covered by the insurance policy and approved by the employer who holds the policy.

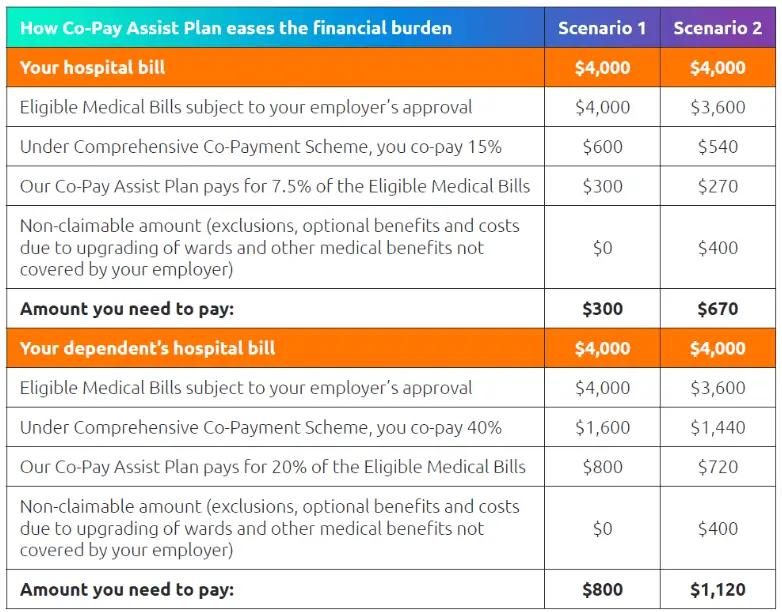

The table below illustrates how this NTUC Income Co-Pay Assist Plan co-sharing mechanism is applied:

However, suppose you are already covered for medical expenses by another existing policy.

The NTUC Income Co-Pay Assist plan will cover either the co-payment rates or the remaining balance of the medical expenses, whichever amount is lower, ensuring you receive the most beneficial coverage with multiple insurance policies.

However, it’s important to note that the NTUC Income Co-Pay Assist Plan does not provide coverage for specific pre-existing conditions that were diagnosed, treated, or received medical attention within the 12 months before the start date of this policy.

These conditions include:

- Dental expenses,

- Injuries related to industrial accidents,

- Major psychiatric illnesses,

- Cosmetic surgery,

- Treatment for drug and alcohol abuse,

- Injuries that were intentionally self-inflicted,

- Claims related to pregnancy or childbirth within 12 months from the start date of this policy,

- Charges associated with childbirth (accouchement charges), and

- Other medical expenses that your employer does not cover.

Waiting Period

If you have pre-existing illnesses, the NTUC Income Co-PayAssist Plan will not cover any medical expenses if you received medical treatment, diagnosis, consultation, or prescribed drugs for such conditions during the 12 months preceding the policy’s start date.

In other words, pre-existing conditions are not covered initially.

For claims related to pregnancy or childbirth, the NTUC Income Co-Pay Assist Plan will not provide coverage if these claims occur within the first 12 months from the start date.

The result is that maternity-related expenses will not be covered during the initial year of the NTUC Income Co-PayAssist Plan.

If you need maternity coverage, it’s best to choose a maternity insurance plan instead.

Grace Period

You have a 30-day grace period to pay the premiums due on the NTUC Income Co-Pay Assist plan.

During this grace period, your insurance coverage will remain in force.

However, if any benefits become payable during this period, the unpaid premium amount will be deducted from those benefits.

If the premium remains unpaid after the grace period expires, the NTUC Income Co-PayAssist plan will automatically end on the day the grace period ends.

It’s essential to keep up with premium payments to ensure continuous coverage under the policy.

Summary of NTUC Income Co-Pay Assist Plan

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of the NTUC Income Co-Pay Assist Plan

The NTUC Income Co-Pay Assist Plan offers great financial support if you’re currently covered by the Comprehensive Co-Payment Scheme.

It goes the extra mile to reduce your medical expenses, ensuring you can concentrate on your recovery without worrying about excessive bills.

The NTUC Income Co-Pay Assist Plan is designed to minimise the amount you have to pay out of your pocket for medical care.

It covers half the eligible medical bills you would typically have to co-pay under the Comprehensive Co-Payment Scheme.

The plan also assists both you and your dependents.

It pays up to 7.5% of your eligible medical bills and up to 20% of your dependents’ eligible medical bills, depending on the ward class at Singapore government/restructured or private hospitals.

The Co-Pay Assist Plan covers a range of medical expenses, including inpatient hospital treatments following illnesses or injuries.

It also includes outpatient treatments such as kidney dialysis, chemotherapy, cancer radiotherapy, cyclosporin, and erythropoietin.

While the Co-Pay Assist Plan offers valuable support to help you manage your medical expenses, you may need to supplement it with health insurance plans for even better coverage.

You may contact a financial advisor to help decide whether it’s the right policy to meet your needs.