NTUC Income Care Secure is a CareShield Life supplement that provides you with additional monthly payments for life if you have a disability.

But how does this compare to the other supplements available in the market?

Here’s our review of the NTUC Income Care Secure.

My Review of the NTUC Income Care Secure

NTUC Income’s Care Secure has favourable coverage with multiple benefits, and it’s the cheapest CareShield Life supplement.

You can start making claims at the onset of 2 ADLs, get 300% of your last disability payment as a death benefit, and an extra 25% of your monthly benefit for 36 months as a dependent care benefit.

Despite these benefits, one of the drawbacks of the NTUC Income Care Secure is that its monthly benefits include your basic CareShield Life payout.

This contrasts with Singlife MyLongTermCare and GREAT CareShield Advantage, which offer monthly benefits alongside the basic payout.

Therefore the amount you receive under NTUC Care Secure is technically less than the other 2 policies.

It also lacks some benefits, such as the caregiver and rehabilitation benefits present in Singlife with Aviva’s MyLongTermCare. Therefore, it may not benefit you if you recover from disability and still need aftercare.

On the other hand, it doesn’t provide more excellent coverage if you have a mild disability where you can’t perform at least 1 ADL – something that the Great Eastern GREAT CareShield offers.

Nevertheless, NTUC Income Care Secure is the best choice if budget concerns you, thanks to the affordable premiums.

Overall, no single policy can cover everything to meet your needs; that’s why it’s important to evaluate several options beforehand.

You can check out our post on the best CareShield Life Supplements whereby we highlighted the best plans for different needs and circumstances.

From there, you should speak to an unbiased financial advisor about which policy suits you best.

As a CareShield Life supplement will come to your aid when you need it most, you shouldn’t skip over comparing and finding the best one for yourself.

If you need someone to help you compare policies, we partner with MAS-licensed financial advisors who’ve helped thousands of our readers compare various types of policies in the market.

Click here for a free comparison session.

Here’s a breakdown of the NTUC Income Care Secure:

Criteria

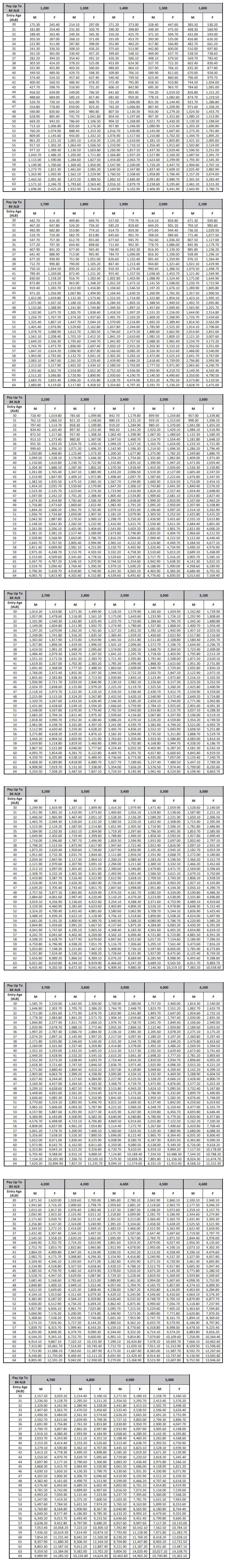

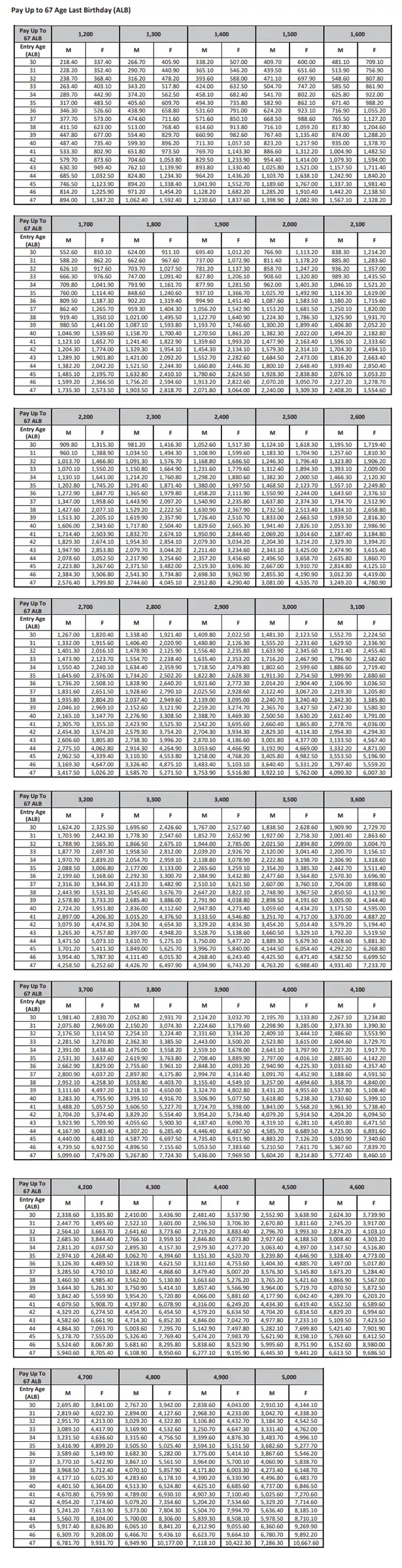

The Care Secure premiums are based on your entry age or last birthday. If you apply early, you’ll be eligible for lower premium amounts because the older you become, the higher your risk of medical conditions.

You can choose a premium term of up to 67 years or 84 years (Age last birthday).

Like most policies, the premium is payable monthly, quarterly, semi-quarterly, or yearly.

Here is a table to illustrate the premium terms;

| Entry Age | Pay up to 67 | Pay up to 84 |

| Minimum | 30 | 30 |

| Maximum | 47 | 64 |

Here’s the premium table for pay up to 84;

And here’s the premium table for pay up to 67;

Take note that the premium amount doesn’t include your CareShield Life premium.

You can pay the premiums using your CPF MediSave account or that of your spouse and dependents.

Also, payments are acceptable via cheque, cash, or using GIRO.

It’s essential to remember that the maximum payable for the CareShield Life Supplements when using the CPF MediSave accounts is S$600.

Eligibility

For you to apply, you must meet the following conditions;

- Be a Singapore citizen or a permanent citizen

- Aged between 30 to 64

- Have a running CareShield Life policy

Payout Options

Under the CareShield Life Plan, you’ll receive cash payouts of S$600 for a lifetime as long as you remain severely disabled.

The monthly payouts increase annually until you reach 67 years, whichever is higher upon a successful claim. S$600 is a small amount because a severely disabled individual requires money for medication and caregiving.

With the NTUC Income Care Secure, you can get payouts of up to S$5,000 per month, depending on your payout option.

As seen in the premium table above, the lowest supplement starts at $1,200 monthly, and increments are every $100.

Deferment Period

The deferment period refers to the 90 days from the day of claiming the benefit. Usually, you’ll receive the first benefit after the deferment period.

If you recover from a disability but become disabled again from the same condition, the deferment period for new claims will not be enforced.

If you have a disability from the same condition after 180 days or a different disability, the deferment period of 90 days becomes applicable for new claims.

Benefits

Disability Benefit

If you become disabled and the disability continues, you’ll get a lifetime monthly disability benefit.

Disability can be severe or moderate.

Here is a table to illustrate:

| Type of Disability | Benefit |

| Moderate | 100% monthly disability benefit |

| Severe | 100% monthly disability benefit minus CareShield Life benefit |

Being moderately disabled means you can’t perform any of the 2 activities of daily living (ADL). Thus you must get assistance from your loved ones to perform these functions.

Examples of Activities of daily living include:

- Washing or bathing

- Dressing

- Feeding

- Toileting

- Walking or moving

- Transferring

Upon claim approval, you’ll receive the initial payment of the monthly disability benefit immediately after the deferment period.

Subsequently, you’ll receive a similar amount every month on the same day. If you recover and become disabled once more, you’ll still receive this benefit.

If you are currently getting the CareShield Life base benefit, you’ll automatically be considered to be severely disabled.

To clarify, you’ll still get the disability benefit minus the CareShield Life benefit applicable to you even if your CareShield Life plan ends.

It applies as long as you still have the Basic ElderShield policy and the Care Secure policy continues.

Support Benefit

If you become disabled and the disability continues, you’ll get the following support:

| Disability Status | Benefit |

| Moderately Disabled | 300% of the disability benefit |

| Severely Disabled | 600% of the disability benefit |

You’ll receive the support benefit as soon as the deferment period ends. The maximum amount you can receive is 600% of the disability benefit.

If you become moderately disabled and then recover, you can claim the balance of the support benefit if you become disabled on another date.

Dependant Benefit

If you have at least one dependent and become disabled, you’ll receive the dependent benefit capped at 25% of your disability benefit.

This amount is paid each month for 36 months.

There are several conditions for you to enjoy the dependent benefit;

If you recover from the disability and haven’t utilised the entire amount, you can make another claim for the balance if you become disabled again. However, it can’t exceed the 36-month cap.

If the dependent is a child and he/she becomes an adult after the payment commences, you’ll still receive the benefit for your lifetime. However, should death occur, the payment ceases.

Notably, the dependent benefit is payable only after the deferment period.

Death Benefit

The death benefit is payable after demise while the policy is still running. The amount payable is 300% of the disability benefit.

Premium Waiver

You can receive a premium waiver if you become disabled on the month when the premium is due.

However, you’ll continue paying the premiums if you recover from the disability and benefit payments have ceased.

If you become disabled during the 90-day waiting period, you’ll receive a refund of your premiums.

Examples To Illustrate The NTUC Income Care Secure

Example 1

John, aged 32 years, is covered under the CareShield Life policy. Towards the end of 2020, he decided to supplement the NTUC Care Secure with a monthly disability benefit of S$1,500 for extra protection of long-term needs.

Unfortunately, in April 2021, he got involved in a car crash. In May 2021, after hospitalisation, he was declared moderately disabled. Consequently, he can’t perform 2 of the ADLs.

From Age 33 to 48 years or from August 2021 to July 2036, John will start receiving a monthly disability benefit of S$1,500. The total amount paid is as follows:

| Date | Amount Paid |

| May 2021 to July 2021 (3 months) | S$4,500 |

| August 2021 to July 2036 (180 months) | S$270,000 |

| Total amount paid | S$274,500 |

It’s important to note that the monthly payout continues during the disability period.

Example 2

Jen, aged 40 years, has 2 children and is currently covered under the CareShield Life in December 2020.

She uses the NTUC Care Secure to supplement with a monthly disability benefit of S$1,800 for extra protection to meet her long-term care needs.

Unfortunately, at 44 years in June 2024, Jen suffered a stroke. Subsequently, in September 2024, doctors declared her as severely disabled and hence can’t perform 3 ADLs.

From December 2024 to November 2027 (36 months), Jen receives a support benefit of S$10,800 and a dependent benefit of $16,200.

From December 2024 to November 2034, Jen will enjoy a waiver for Care Secure premiums and start receiving a monthly disability benefit of $1,800 from CareShield Life and Care Secure.

By December 2034, Jen succumbs, and dependents receive S$5,400 under the Death Benefit.

To sum up, Jen will receive the following amounts.

| Date | Amount Paid |

| December 2024 to November 2027 (36 months) -Support Benefit | S$10,800 |

| December 2024 to November 2027 (36 months) -Dependant Benefit | S$16,200 |

| From December 2024 to November 2034 -Disability Benefit | S$216,000 |

| December 2034 – Death Benefit | S$5,400 |

| Total Paid | S$248400 |

Comparison of NTUC Income Care Secure With Other CareShield Life Supplements Plans

| CareShield Life Supplement | Premium Payable (Example) | Sample Monthly Payout at 30 Years | Eligibility of Claims | Death Benefit | Dependent care | Caregiver Relief | Rehabilitation benefit | Premium Terms |

| NTUC Income Care Secure | S$218 (up to 67 years) | $1,200 (including CareShield Life payout) | At least 2 out of the 6 ADLs | 300% of the last paid disability benefit | Extra 25% of the monthly benefit for 36 months. | Not Available | Not Available | Premium term options of 67 – 84 years |

| Great Eastern GREAT CareShield | S$291 Up to 65 years | S$600 -excludes CareShield Life payout | Any of the 1 out of 6 ADLs | Not Available | 30% monthly benefits if unable to perform at least 2 ADLs | Extra 60% of the monthly benefit for 12 months | Not Available | The premium term for 30 to 47 years is up to 67 or 95 (ANB) or 20 years.

The premium term for 48-64 is up to 95 (ALB) or 20 years |

| Singlife with Aviva MyLongTermCare Plus | S$457 – Up to age 67 | S$600 (excludes CareShield Life payout) | At least 2 out of 6 ADLs | 300% of the last paid disability benefit | Extra 20% of the monthly benefit for 36 months. | Extra 60% of the monthly benefit for 12 months | Not Available | Premium term options up to ANB1 68 and 99 |

| Singlife with Aviva MyLongTermCare | S$381 – Up to age 67 | S$600 (excludes CareShield Life payout) | At least 3 out of 6 ADLs | 300% of the last paid disability benefit | Extra 20% of the monthly benefit for 36 months. | Extra 60% of the monthly benefit for 12 months | 50% of your last monthly benefit (2 ADLs) | Premium term options up to ANB1 68 and 99 |

- Sample for a 30-year-old non-smoking male.

- All payouts are subject to the Deferment Period.

- Payouts are payable during the time the insured suffered disabilities or lifetime.

- The maximum payout is equal to S$5,000 for all policies