The Aviva MyLongTermCare and MyLongTermCare Plus have been renamed to Singlife CareShield Standard and Singlife CareShield Plus respectively, as of 16 August 2022.

Singlife’s CareShield Standard and CareShield Plus provide you coverage for severe disabilities. Meant to supplement your CareShield Life coverage, this plan provides you with a monthly payout if you’re severely disabled.

My Review of Singlife’s CareShield Plans

Among the 3 insurers that offer CareShield Life supplement plans, I personally feel that Singlife’s plan provides you with the most bang for your buck, offering you a multitude of benefits and features not offered by other insurers.

The Singlife CareShield Standard and Singlife CareShield Plus is the only plan that offers the rehabilitation and caregiver relief benefit.

Even if your disability improves and you only cannot perform 2 ADLs from 3 ADLs previously, the reality is that you would likely still require some assistance, which is why the rehabilitation benefit is a great feature to have.

Our needs and circumstances also tend to change as we age, and so too do our liabilities and the coverage we require.

With the GIO and escalating payout options, you can ensure your Singlife Careshield supplement plan keeps pace with you and sufficiently protects you.

On the other hand, if you’re looking for a plan that provides greater coverage for mild disability, then GE’s Great CareShield Advantage might be a better plan to consider with its lump sum payout when you’re unable to perform 1 ADL.

Additionally, Great CareShield Enhanced (the lower tier option) starts paying you 50% of your monthly benefit once you’re unable to perform 2 ADLs. In contrast, Singlife CareShield Standard only starts paying out at 3 ADLs.

If you’re unsure whether Singlife’s plans are for you, we have a guide on choosing the best CareShield Life supplements based on different circumstances.

All in all, as with all types of insurance plans, the right plan varies for each individual. Therefore, making the right choice involves a proper assessment of your needs and wants.

And before pulling the trigger on the Singlife CareShield plans, I recommend getting a second opinion from an unbiased financial advisor to whether it’s actually good for you.

Insurance is a long-term commitment, and something as important as your CareShield supplement that takes care of you in your toughest times, deserves some time for you to explore your alternatives.

Should you need a second opinion, we partner with MAS-licensed financial advisors who will be happy to help you with this.

Click here to get a free non-obligatory chat.

And in case you’re wondering what CareShield Life is and why it’s so important, we provide a quick crash course on it in the section below.

If not, skip ahead to the second section to dive straight into the features of Singlife CareShield Standard and Singlife CareShield Plus and find out whether it is for you.

What is CareShield Life?

A long-term care scheme set up by the government with our greying population in mind, CareShield Life alleviates the financial burdens that come hand in hand with severe disability. It provides you with a monthly payout for as long as you’re severely disabled.

Here’s a quick view of what it is you need to know:

- Compulsory; you are automatically enrolled when you turn 30, regardless of any pre-existing conditions or disability

- Premiums are fully paid using MediSave and coverage is for life

- Pays out $600 a month (in 2020)

- Payouts increase every year until you turn 67 or you make a successful claim, whichever comes first

As great as it is to have this safety net, if you really take the time to think about it, $600 alone is not enough to afford the care you require while providing for your basic needs.

Additional Reading: Complete Guide to CareShield Life

Ultimately, we need to be self-sufficient, and this is where Singlife’s CareShield plans might come in handy, allowing you to upgrade your coverage and increase your monthly payouts.

Available in 2 options – a basic plan (Singlife CareShield Standard) and an enhanced plan (Singlife CareShield Plus), let’s take a look at how it works.

Basic Features of Singlife’s CareShield Supplement

Monthly Benefit

Payout Criteria

There is a certain criterion you would need to fulfil to be considered severely disabled and claim your payouts.

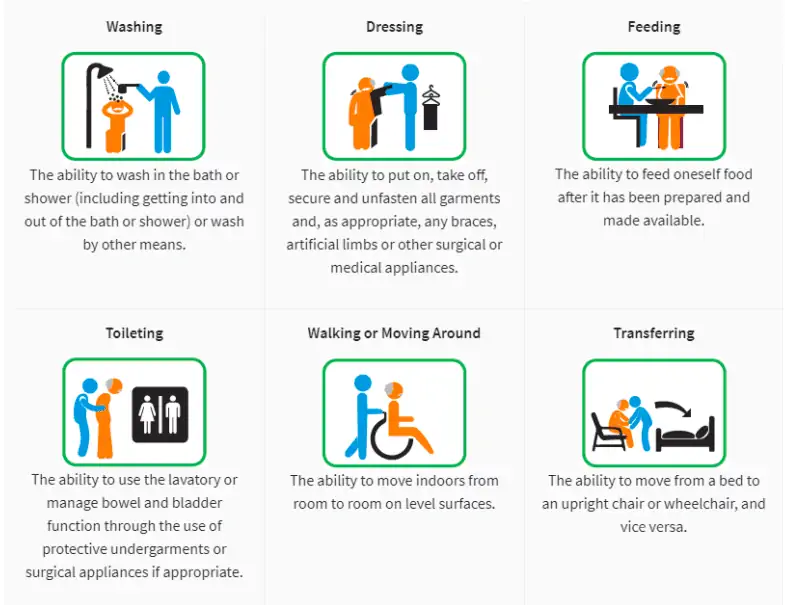

But before diving headfirst into the full product features, you would first need to understand the term Activities of Daily Living (ADL) as this determines whether you’re severely disabled, and by extension when you can receive certain benefits.

The ADLs are:

Source: CareShield Life Website

Now that you understand what ADLs are, to be considered severely disabled under the Singlife CareShield Standard, you would need to be unable to perform at least 3 ADLs, similar to CareShield Life.

Whereas for the Singlife CareShield Plus plan, the definition is relaxed slightly and you will start receiving payouts once you can’t perform 2 ADLs.

You will be eligible for the monthly payouts for life, as long as you’re considered severely disabled under the respective plans. However, if your condition improves and you are not considered severely disabled, your monthly payouts will stop.

Deferment Period

Do note that there is a waiting period of 90 days from the date that you were confirmed and verified as severely disabled by an Appointed Assessor before your monthly payouts start, also known as the deferment period.

If within 180 days of you recovering from your disability, you were to suffer from a severe disability due to the same reason again, the deferment period will be waived.

Payout Amount

Both plans allow you to choose a monthly payout amount that ranges from $200 to $5,000. This will be paid out on top of the CareShield Life payouts that you receive.

To better illustrate, let’s say you opt for the Singlife CareShield Standard with a monthly payout of $1,000. When you’re unable to do 3 ADLs, you will receive a payout of $1,600 per month ($600 from CareShileld Life and $1,000 from your Singlife with Aviva plan).

Alternatively, if you purchase the Singlife CareShield Plus with the same monthly payout, once you’re unable to perform 2 ADLs, you will receive $1,000 from your plan monthly. And if you can’t perform 3 ADLs, you will get $1,600 monthly.

If you’re not sure whether the basic or Plus plan would be more suited for you, think about when you would like to be able to receive your payouts.

Of course, the Plus plan would definitely cost more as well, so do consider your affordability and how willing you are to fork out the extra cash.

Also, when deciding on your monthly payout, some factors to consider include:

- What type of care would you require? Would your family be caring for you, or would you need to hire a domestic helper or live-in caregiver?

- How much do your basic necessities cost per month? This includes items like the cost of your meals and any household essentials for you to live comfortably and safely.

Escalating Payout Option

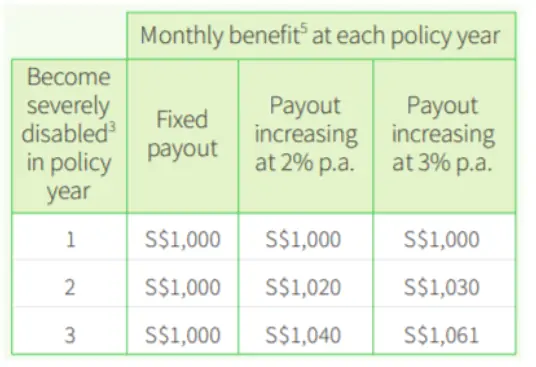

Ensure that your monthly premiums keep pace with inflation by having your payouts increase at a rate of 2% or 3% p.a with the escalating payout option.

Your premiums will increase year on year until the end of your term unless a claim is made. Once you make a claim, your premiums will stop increasing and all future premiums will stay constant at an amount equal to your first monthly payout.

Assuming you opt for a monthly benefit of $1,000, below helps to illustrate the payout that you would receive if you become severely disabled in the first 3 years.

Based on the above, if you were to opt for a payout that increases 2% p.a. and you become severely disabled in year 2, your monthly payout will be $1,020 for the rest of your policy term.

Premium Terms and Options

When it comes to choosing how long to pay your premiums for, you can choose to pay:

- Until the policy anniversary after you turn 97, or

- For a limited time which is the later of:

- the policy anniversary after you turn 67, or

- 20 years from when you purchase the policy if your age next birthday is 49 at policy purchase

The premiums for a 36-year-old female non-smoker who opts to pay his premiums until he turns 97 are:

| Monthly Payout | ||||

| $1,200 | $1,500 | $2,000 | $2,500 | |

| Annual Premium ($) | 840 | 1,050 | 1,378 | 1,723 |

To offset the cash that you have to pay and perhaps as an encouragement to enhance your CareShield Life plan, you’re able to use up to $600 per calendar year from your MediSave to fund your premiums.

If you choose to exercise the escalating payout option, your premiums will also increase 2% or 3% p.a., based on the rate of your increasing payout.

20% Premium Discount

Enjoy a 20% lifetime premium discount when you purchase a Singlife CareShield Standard and Singlife CareShield Plus plan now (August 2022). This is a perpetual discount and is ongoing until further notice from Singlife with Aviva.

There is a Minimum Annual Premium (MAP) condition of $500 per policy (before discount) that your plan needs to meet before you can enjoy the discount. This amount includes GST but excludes any additional substandard lives premium loading.

If at any time during your policy’s term, your annual premium falls below the MAP, the premium discount will stop.

Premium Waiver

To help ease your financial burden, when you’re unable to perform at least 1 ADL, your premiums will be waived. This waiver of premium will only be effected after the deferment period.

If your condition improves and you can perform all the ADLs, your premiums will resume.

Other Features by Singlife’s CareShield Supplement

Care Benefits

Suffering from a severe disability takes a huge toll on your finances. On average, it takes a couple of years for your condition to improve, in the event that it does improve.

To help ease the burden on your wallet, the Singlife CareShield Plus has many other benefits that provide you with a payout under certain circumstances.

Lump-Sum Benefit

This is a once-off benefit that is worth 3 times your monthly benefit, paid out under both plans when you first get diagnosed as severely disabled based on the plan you get. The deferment period applies for this as well.

Rehabilitation Benefit

Applicable only for the Singlife CareShield Standard plan, you are eligible for this benefit if your condition improves, yet you still cannot perform 2 ADLs independently.

In other words, you would need to have suffered from a severe disability based on Singlife CareShield Standard’s definition, which is the inability to perform 3 ADLs, before you’re eligible for this benefit.

Under this, you will receive a monthly payout equal to 50% of your last monthly benefit as long as you’re unable to perform 2 ADLs.

The benefit does not apply for the Singlife CareShield Plus plan as it considers you as severely disabled and pays out your full monthly benefit once you cannot perform 2 ADLs.

Dependent Care Benefit

At the point when you can claim the monthly benefit or the rehabilitation benefit, if you have a child who is 21 (age next birthday = 22) and below, you’re eligible to receive an additional 20% of your monthly benefit for up to 36 months.

A severe disability might affect your ability to work, resulting in a drop in the money you bring home every month. If you have a child who depends on you, this can be incredibly worrying as you have to feed an additional mouth on top of getting the care you require.

This benefit eases those worries and ensures that you can still provide for your child even if something unfortunate were to happen.

Caregiver Relief Benefit

To take the edge off the cost of hiring a caregiver, this benefit gives you an additional 60% of your monthly benefit for up to 12 months from when you can claim the monthly benefit or receive the rehabilitation benefit.

Death Benefit

If you pass on while you’re still receiving the monthly payouts or rehabilitation benefit, a lump sum amount worth 3 times of your last paid monthly or rehabilitation benefit will be paid to your loved ones.

Guaranteed Issuance Option (GIO)

As we grow older, we experience many milestones, possibly leading to an increase in our liabilities. As a result, if we want to ensure minimal disruption to our current lifestyle, our protection needs will increase as well.

With this in mind, Singlife with Aviva allows you to increase your monthly benefit without having to prove your health at the following life milestones:

- Property purchase

- Marriage, Divorce, or becoming Widowed

- Become a parent by either having a child or legally adopting a child 18 and below

- Get a 50% or more increase in salary based on initial salary at policy application

- Complete a skills development course of 6 months or longer

- Purchases a new Single Life insurance policy or rider from Singlife with Aviva with full underwriting at standard terms

- Spouse becomes severely disabled and cannot perform at least 3 ADLs or passes on

This option is only available if your policy was incepted at standard terms. If you choose to increase your monthly benefit, your premiums will also increase accordingly.

The maximum increase in your monthly payout is the lower of 50% of either the:

- Initial monthly payout at policy inception, or

- Monthly benefit on the date the option is used

References

https://singlife.com/disability-insurance/careshield

https://www.careshieldlife.gov.sg/careshield-life/about-careshield-life.html