When travelling abroad for business or leisure, we are ready to explore new places and enjoy new environments.

We never really think about the negatives of what would happen if something unexpected were to occur.

For this reason, travel insurance are an essential part of your travels.

And MSIG’s TravelEasy with (or without) COVID-19 Cover Travel Insurance could give you a piece of mind.

Here’s our review of MSIG’s Travel Insurance:

Key Features Of MSIG TravelEasy Travel Insurance

MSIG TravelEasy offers some tremendous key features, and when considering your options, it is always important to stay informed and know what you are buying.

- COVID-19 Coverage: If you are travelling and get affected by COVID-19, MSIG TravelEasy w/ COVID-19 Cover has your back. This includes situations like testing positive, being in close contact with a COVID-19 case, or if a family member is hospitalised due to COVID-19.

- Medical & Travel Assistance: If you face a medical emergency related to COVID-19 during your trip, MSIG Assist is there to help. Just remember to contact them immediately for any medical claims related to COVID-19.

- Automatic Extension of Cover: If you cannot complete your journey before your policy ends due to COVID-19-related hospitalisation or quarantine, your cover will automatically extend for up to 30 days without any extra premium.

- Overseas Quarantine Daily Benefit: If you test positive for COVID-19 and have to quarantine, MSIG TravelEasy will pay a daily benefit for each complete 24-hour period of quarantine or isolation.

- Travel Cancellation & Postponement: If you have to cancel or postpone your trip due to COVID-19, like testing positive or being denied boarding due to symptoms, MSIG TravelEasy will cover the costs under certain conditions.

- During Trip Benefits: MSIG TravelEasy extends medical and travel assistance for COVID-19-related issues during your trip.

Comparison Against Other Single-Trip Travel Insurance Policies

In this section, the insurers that we’re comparing MSIG TravelEasy Insurance against its competitors:

- AIG Travel Guard Direct

- AIA Around the World Plus (II)

- Allianz Travel Bronze

- Klook TravelCare

- Singlife Travel Insurance

- NTUC Income Travel Insurance

- Sompo Travel (COVID-19) Insurance

- Etiqa TIQ Travel Insurance (with COVID-19 cover)

- FWD Travel Insurance Plan

The basis for this comparison will be the coverage for an individual travelling to ASEAN for a week and the lowest-tiered plan across all insurers.

| Travel Insurance Plan | Total Premium | Overseas Medical Expenses | Accidental Death and TPD | Overseas Travel Delay ($100 for every 6 hours) | Trip Cancellation (death, illness, and natural disaster) | Baggage Delay ($200 every 6 hours) | Baggage Loss/Damage | Cost-to-benefit Ratio |

| MSIG TravelEasy Standard | $37.20 | $250,000 | $150,000 | $500 | $5,000 | $600 | $3,000 | 10997.31 |

| AIG Travel Guard Direct Basic | $83.00 | $50,000 | NA | $200 | $2,500 | NA | $3,000 | 671.08 |

| Singlife Travel Insurance Lite | $49.36 | $250,000 | $50,000 | $500 | $5,000 | $500 | $3,000 | 6260.13 |

| AIA Around the World Plus (II) Classic | $55.45 | $200,000 | $150,000 | $1,000 | $5,000 | $1,000 | $3,000 | 6492.34 |

| Allianz Travel Bronze | $36.96 | $200,000 | $50,000 | $500 | $5,000 | $500 | NA | 6926.40 |

| Sompo Travel (COVID-19) Insurance Essential | $48.00 | $200,000 | $200,000 | $800 | $5,000 | $1,200 | $1,000 | 8500 |

| FWD Travel Insurance Premium + COVID-19 Enhanced Travel Benefits | $44.84 | $200,000 | $200,000 | $300 | $7,500 | $150 | $3,000 | 9168.15 |

| NTUC Income Travel Insurance Classic | $36.60 | $250,000 | $100,000 | $1,000 | $5,000 | $1,000 | $3,000 | 9836.07 |

| Etiqa TIQ Travel Insurance Entry (with COVID-19 cover) | $34.20 | $200,000 | $200,000 | $300 | $5,000 | $200 | $2,000 | 11915.20 |

| Klook TravelCare Lite | $27.65 | $150,000 | $200,000 | $400 | $5,000 | $400 | $3,000 | 12976.49 |

- Total Premium: MSIG TravelEasy Standard’s premium is $37.20, which is moderately priced compared to others. The cheapest is Klook TravelCare Lite at $27.65, while the most expensive is AIG Travel Guard Direct Basic at $83.00.

- Overseas Medical Expenses: MSIG offers $250,000, which is the highest, matching the coverage offered by NTUC Income and Singlife.

- Accidental Death and TPD: MSIG’s coverage of $150,000 is substantial, higher than most except for Sompo Travel , FWD, and TIQ, which offer $200,000.

- Overseas Travel Delay: MSIG provides $500 for every 6 hours of delay, which is average compared to others. AIA Around the World Plus (II) Classic and NTUC Income offer the highest at $1,000.

- Trip Cancellation: MSIG’s coverage of $5,000 is quite standard, similar to most other insurers.

- Baggage Delay: MSIG offers $600 for every 6 hours, which is higher than the standard $200 or $400 offered by others but lower than Sompo Travel’s $1,200.

- Baggage Loss/Damage: MSIG’s coverage of $3,000 is common among most plans.

- Cost-to-Benefit Ratio: MSIG’s ratio is 10997.31, which is lower compared to others, indicating a less favorable cost-to-benefit balance. The highest ratio is seen in Klook TravelCare Lite at 12,976.49, and the lowest in AIG Travel Guard Direct Basic at 671.08.

In summary, MSIG TravelEasy Standard offers competitive coverage in most categories, with particularly strong offerings in Accidental Death and TPD coverage.

Its total premium is reasonable, though not the cheapest, and its cost-to-benefit ratio suggests a less favorable balance compared to some other options.

Comparison Against Other Annual-Trip Travel Insurance Policies

Next up, let’s compare the insurers for annual trips. (We’ve removed Sompo Travel Insurance here because they do not offer travel insurance for annual trips).

The basis for this comparison will be the coverage for a single individual travelling to ASEAN for an annual trip and the lowest-tiered plan across all insurers.

| Travel Insurance Plan | Total Premium | Overseas Medical Expenses | Accidental Death and TPD | Overseas Travel Delay ($100 for every 6 hours) | Trip Cancellation (death, illness, and natural disaster) | Baggage Delay ($200 every 6 hours) | Baggage Loss/Damage | Cost-to-Benefit Ratio |

| AIG Travel Guard Direct Basic | $554.00 | $50,000 | NA | $200 | $2,500 | NA | $3000 | 100.54 |

| AIA Around the World Plus (II) Classic | $460.50 | $200,000 | $150,000 | $1,000 | $5,000 | $1,000 | $3,000 | 781.76 |

| Allianz Travel Bronze | $570.60 | $200,000 | $50,000 | $500 | $5,000 | $500 | NA | 448.65 |

| FWD Travel Insurance Premium | $407.45 | $200,000 | $200,000 | $300 | $7,500 | $150 | $3,000 | 1008.59 |

| MSIG TravelEasy Standard | $447.20 | $250,000 | $150,000 | $500 | $5,000 | $600 | $3,000 | 914.80 |

| NTUC Income Travel Insurance Classic | $495.90 | $250,000 | $100,000 | $1,000 | $5,000 | $1,000 | $3,000 | 725.95 |

| Singlife Travel Insurance Lite | $460.00 | $250,000 | $50,000 | $500 | $5,000 | $500 | $3,000 | 769.57 |

| Etiqa TIQ Travel Insurance Entry (with Covid-19 cover) | $369.00 | $200,000 | $200,000 | $300 | $5,000 | $200 | $2,000 | 1104.34 |

Here’s what we found:

- Total Premium: MSIG TravelEasy Standard’s premium is $447.20, which is moderately priced. The cheapest is Etiqa TIQ Travel Insurance Entry at $369.00, and the most expensive is Allianz Travel Bronze at $570.60.

- Overseas Medical Expenses: MSIG offers $250,000, which is among the highest, matched by NTUC Income and Singlife but surpassed by FWD Travel Insurance Premium and Etiqa TIQ.

- Accidental Death and TPD: MSIG’s coverage of $150,000 is substantial, equal to AIA Around the World Plus (II) Classic.

- Overseas Travel Delay: MSIG provides $500 for every 6 hours of delay, which is average. The highest coverage is offered by AIA Around the World Plus (II) Classic and NTUC Income at $1,000.

- Trip Cancellation: MSIG’s coverage of $5,000 is quite standard, similar to most other insurers.

- Baggage Delay: MSIG offers $600 for every 6 hours, which is higher than the standard $200 or $500 offered by others but lower than AIA Around the World Plus (II) Classic’s $1,000.

- Baggage Loss/Damage: MSIG’s coverage of $3,000 is common among most plans.

- Cost-to-Benefit Ratio: MSIG’s ratio is 914.80, which is relatively high, indicating a more favourable cost-to-benefit balance compared to some options like AIG Travel Guard Direct Basic (100.54) but lower than Etiqa TIQ (1104.34) and FWD (1008.59)

In summary, MSIG TravelEasy Standard offers competitive coverage in most categories, with particularly strong offerings in Overseas Medical Expenses and Accidental Death and TPD coverage. Its total premium is reasonable, and its cost-to-benefit ratio is relatively high, making it a favourable option among the annual travel insurance plans compared.

Who Is MSIG TravelEasy Travel Insurance Best Suited For

MSIG TravelEasy is particularly well-suited for a specific segment of travellers who prioritise comprehensive coverage in key areas over cost.

This plan is ideal for:

Frequent Travellers and Families: With high coverage limits for overseas medical expenses, accidental death, and total permanent disability (TPD), MSIG TravelEasy is a strong choice for frequent travellers and families who seek extensive protection. The high medical coverage is particularly beneficial for destinations where medical costs can be excessive.

Adventure Seekers: The plan covers a range of adventurous activities (under the Adventurous Activities Cover), making it a good option for those who engage in such activities during their travels.

Travellers Seeking Comprehensive Coverage: Individuals prioritising a wide range of protections, including high coverage for medical expenses and accidental death, will find this plan appealing. It’s also beneficial for those who want additional terrorism and passive war coverage.

Travellers to Remote or High-Risk Destinations: Given its extensive medical and evacuation coverage, this plan is well-suited for travel to remote or high-risk areas where medical facilities may be limited and evacuation might be necessary.

However, it’s less suited for

Budget Travellers: Those looking for the most cost-effective option might find the premium slightly higher compared to basic plans from other insurers.

Travellers Seeking Minimal Coverage: For those who travel light or do not require extensive coverage, especially in areas like baggage loss or delay, there might be more suitable, less comprehensive options.

My Review of the MSIG TravelEasy Travel Insurance

So, after extensive research and comparison with other travel insurance policies in Singapore, MSIG TravelEasy stands out as one of the best policies for frequent travellers and travellers going on adventurous journeys.

With MSIG TravelEasy, your premiums are manageable, so you get value for your money, and paying for premiums doesn’t break your bank account.

It offers a good balance between coverage and price – especially if you’re looking to overseas medical and accidental death & TPD coverage.

While MSIG TravelEasy is a well-rounded travel insurance policy, it’s always important to remember that there are other policies on the market that may be more suited to your needs.

What works for one might not be the best fit for another.

For example, if you’re looking for something really basic – then this isn’t for you. You’re better off saving some money on a policy that’s cheaper while covering you for what you need.

To ensure you’re making the most informed decision, take a moment to explore and compare various travel insurance options.

Dive into these comprehensive guides to get a clearer picture of what’s available:

You can find the perfect travel insurance tailored to your needs and adventures by comparing different policies.

Criteria For MSIG TravelEasy Travel Insurance

To qualify for MSIG TravelEasy Travel Insurance, applicants typically need to meet the following requirements:

- Have a valid NRIC or FIN

- Be at least 16 years old at the time of purchase (only required if you’re the applicant)

- The insurance is designed for travellers on single or multiple trips throughout the year (annual plans). The duration of each trip under the annual plan is usually capped (e.g., 90 consecutive days per trip).

- Declare Health & Pre-existing Conditions

- The insurance is typically available for leisure or business travel. However, additional terms or exclusions may apply if the trip involves high-risk activities or destinations.

- The policy should be purchased before the commencement of the trip. The policy must be bought a specified number of days before the travel start date for certain benefits like trip cancellation.

- Applicants must agree to the policy’s terms and conditions, including any exclusions or limitations of coverage.

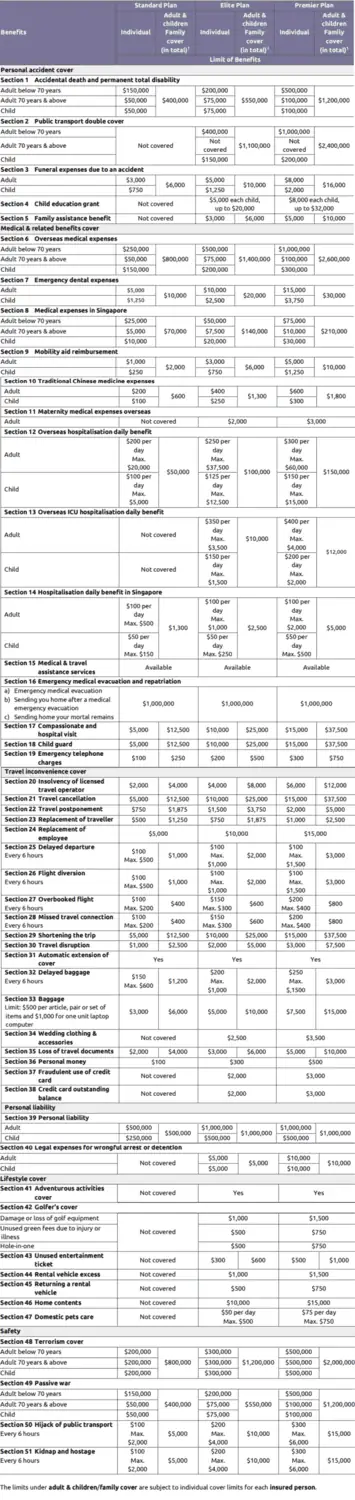

Benefits Summary

Individual & Corporate Policyholder Summary of Cover & Limits

Applicable to TravelEasy Single return trip or Annual plan cover.

Click to enlarge

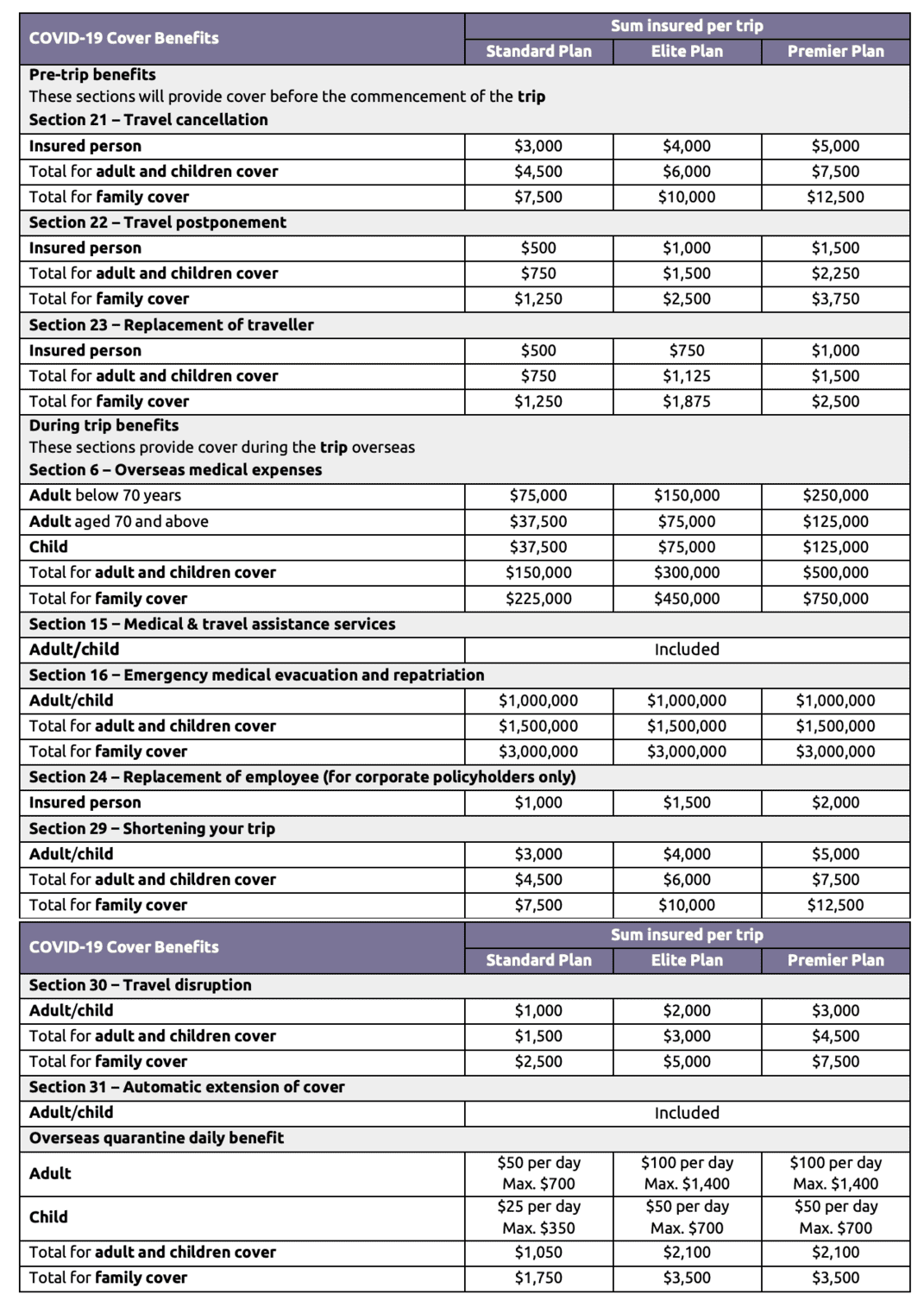

The following is the COVID-19 Cover Benefits for individual policyholders:

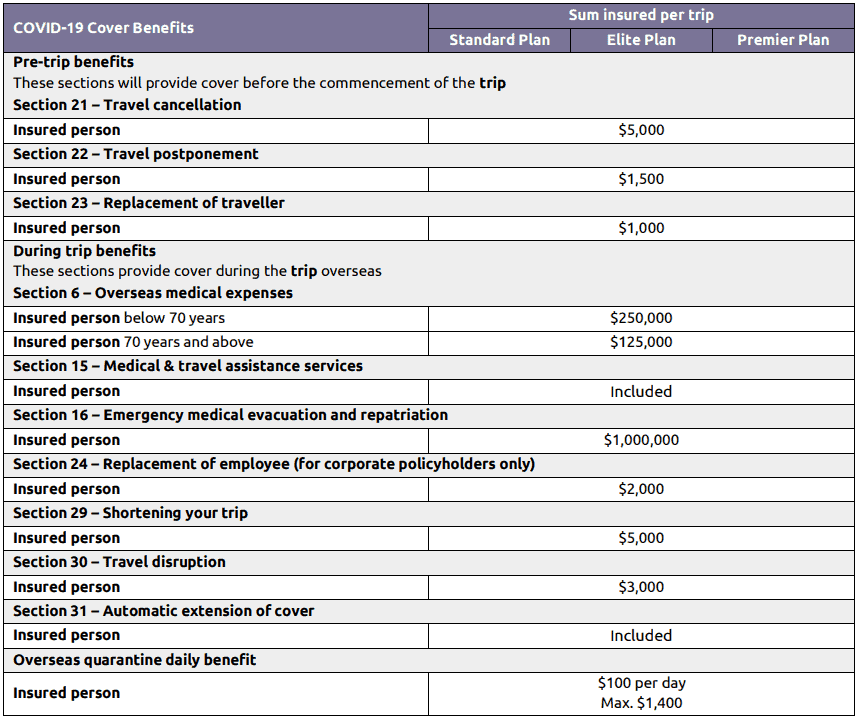

The following is the COVID-19 Cover Benefits for corporate policyholders:

They are subject to the conditions and exclusions specified in the policy.

The limits specified are sub-limits of the limits specified in the main policy for the same sections.

Premium Rates (Single Trip)

Here are the prices for both single trip (7 days) & annual plans for ASEAN and Global coverage for a 25-year-old Singaporean.

| MSIG TravelEasy Insurance Plan | Standard | Elite | Premier |

| Price (ASEAN) | S$68 per week | S$90 per week | S$126.50 per week |

| S$289 per year | S$399 per year | S$559 per week | |

| Price (Global) | S$73.50 per week | S$99 per week | S$132.50 per week |

| S$523 per year | S$658 per year | S$882 per year |

Prices are before any discounts.

These benefits are specific to the COVID-19 Cover.

They are subject to the conditions and exclusions specified in the policy.

The limits specified are sub-limits of the limits specified in the main policy for the same sections.

All sums are in Singapore dollars.

Premiums Rates (Annual Plans)

Here are the prices for both single trip (7 days) & annual plans for ASEAN and Global coverage for a 25-year-old Singaporean.

| MSIG TravelEasy Insurance Plan | Standard | Elite | Premier |

| Price (ASEAN) | S$68 per week | S$90 per week | S$126.50 per week |

| S$289 per year | S$399 per year | S$559 per week | |

| Price (Global) | S$73.50 per week | S$99 per week | S$132.50 per week |

| S$523 per year | S$658 per year | S$882 per year |

Prices are before any discounts.

Benefits Explained For MSIG TravelEasy Travel Insurance

Section 1: Accidental Death & Permanent Total Disability

MSIG TravelEasy will pay the compensation for Death or Permanent Total Disability if an insured person suffers an injury during the journey, which, within 12 calendar months of its happening, is the only cause of death or disability.

What is Covered

- If you suffer an injury during your journey that leads to death within 12 months of the incident, MSIG TravelEasy will compensate you 100% of the limit for this section.

- In the case of Permanent & Total Disability, where you cannot engage in any business, profession, or occupation for life, you’ll receive 100% compensation. This cover is valid if the disability persists for 12 months from the injury date.

- If you lose sight completely in both eyes, you are entitled to 100% compensation.

- The loss of 2 or more limbs (permanent and total loss of use or complete physical severance) also qualifies for 100% compensation.

- If you lose sight in 1 eye and lose 1 limb, you’ll receive 100% compensation.

- Losing 1 limb entitles you to 50% compensation.

- Total and irrecoverable loss of sight in 1 eye qualifies for 50% compensation.

Note:

- “Loss of Limb(s)” means permanent and total loss of use or loss by complete and permanent physical severance of a hand at or above the wrist or a foot at or above the ankle.

- If the insured person suffers an injury resulting in more than 1 of the results described above, MSIG will pay the maximum of 100% of the limit in this section.

Coverage Structure

Plan Type | Adult Insured Persons Aged Below 70 | Adult Insured Person Aged 70 or Above | Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $150,000 | $50,000 | $50,000 | $400,000 |

Elite Plan | $200,000 | $75,000 | $75,000 | $550,000 |

Premier Plan | $500,000 | $100,000 | $100,000 | $1,200,000 |

What is Not Covered

Specific exclusions for this section will be covered later on.

Section 2: Public Transport Double Cover

What is Covered

If you, as a fare-paying passenger, suffer an injury on public transport outside of Singapore during your journey and this injury is the sole cause of death within 12 months, MSIG TravelEasy offers double the death compensation limit of Section 1.

Coverage Structure

Plan Type | Adult Insured Persons Aged Below 70 | Adult Insured Person Aged 70 or Above | Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | Not Covered | Not Covered | Not Covered | Not Covered |

Elite Plan | $400,000 | Not Covered | $150,000 | $1,100,000 |

Premier Plan | $1,000,000 | Not Covered | $200,000 | $2,400,000 |

What is Not Covered

This double cover does not apply to the Standard Plan or any insured person aged 70 or above.

In case of a claim that falls under both Section 1 (Accidental Death & Permanent Total Disability) and this section, MSIG TravelEasy will compensate under either 1 of the sections, but not both.

Section 3: Funeral Expenses Due To Accidental Death

What is Covered

Suppose the insured person suffers an injury during the journey outside Singapore, which, within 12 calendar months of its happening, is the only cause of their death.

In that case, MSIG TravelEasy will reimburse the reasonable expenses for their funeral or burial.

The maximum MSIG TravelEasy will pay under this section is as follows:

Coverage Structure

Plan Type | Coverage per Adult Insured Person | Coverage per Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $3,000 | $750 | $6,000 |

Elite Plan | $5,000 | $1,250 | $10,000 |

Premier Plan | $8,000 | $2,000 | $16,000 |

What is Not covered

Please see the section on exclusions.

Section 4: Child Education Grant

What is Covered

This benefit applies if an adult insured person suffers an injury during the journey outside Singapore which, within 12 calendar months of its occurrence, is the sole cause of their death.

The policy will pay a specified amount to each of the deceased adult’s insured persons’ biological or legally adopted children.

The Standard Plan does not cover this benefit.

Chosen Plan | Standard Plan | Elite Plan | Premier Plan |

Per Adult Insured Person’s Child | Not Covered | $5,000 | $8,000 |

Total for Each Adult Insured Person | Not Covered | $20,000 | $32,000 |

What is Not Covered

For exclusions, please refer to the policy’s exclusion section.

Section 5: Family Assistance Benefit

What is Covered

If you, as an insured person, unfortunately, pass away due to an injury sustained during your journey outside Singapore, MSIG TravelEasy provides a Family Assistance Benefit.

This applies if the death occurs within 12 months of the injury and is directly caused by it.

Coverage Structure

Plan Type | Coverage per Insured Person | Total Coverage for Adult & Children or Family Cover |

Standard Plan | Not Covered | Not Covered |

Elite Plan | $3,000 | $6,000 |

Premier Plan | $5,000 | $10,000 |

What is Not Covered

- The benefit does not apply if the death is not directly caused by the injury sustained during the journey.

- Specific exclusions will be detailed in the general exclusions section of the policy.

Section 6: Overseas Medical Expense

What is Covered

MSIG TravelEasy covers medical, surgical, nursing, or hospital charges incurred outside Singapore due to injury or illness during the journey, as deemed medically necessary by a doctor.

Coverage Structure

Plan Type | Insured Person Aged Below 70 | Insured Person Aged 70 or Above | Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $250,000 | $50,000 | $150,000 | $800,000 |

Elite Plan | $500,000 | $75,000 | $200,000 | $1,400,000 |

Premier Plan | $1,000,000 | $100,000 | $300,000 | $2,600,000 |

What is Not Covered

Costs for dental treatment, mobility aids, or prostheses are not covered.

- The policy has specific exclusions for certain illness or injury causes, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6.

- For claims under Pre-Ex Standard, Pre-Ex Elite, or Pre-Ex Premier plan due to pre-existing medical conditions, payments are based on the sub-limits stated under section 52.

Section 7: Emergency Dental Expenses

What is Covered

MSIG TravelEasy Emergency Dental Expenses coverage is designed to provide financial assistance for emergency dental treatments due to injuries sustained during your journey.

This includes treatments for restoring healthy and natural teeth or repairing a fractured jaw.

The coverage applies to treatments received outside and within Singapore (subject to conditions).

- Outside Singapore: If you require emergency dental treatment while abroad due to an injury, MSIG TravelEasy will cover the expenses.

- Upon Return to Singapore: If you didn’t receive dental treatment abroad, or if further treatment is needed after returning to Singapore, MSIG TravelEasy will cover the expenses up to 30 days after your return. However, you must seek the first dental treatment in Singapore within 72 hours of your return.

Coverage Structure

Plan Type | Coverage per Adult Insured Person | Coverage per Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $1,250 | $10,000 |

Elite Plan | $10,000 | $2,500 | $20,000 |

Premier Plan | $15,000 | $3,750 | $30,000 |

What is Not Covered

- MSIG TravelEasy does not cover treatment costs related to gum diseases, tooth decay, dentures, implants, crowns, bridges, or the use of precious metals.

- Routine dental care and non-emergency procedures are not included.

- The policy has specific exclusions for certain dental conditions and treatments, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6 – Overseas Medical Expenses.

Section 8: Medical Expenses In Singapore

What is Covered

MSIG TravelEasy provides coverage for medical expenses incurred in Singapore as a continuation of treatment for an injury or illness suffered during an overseas journey.

This coverage is applicable for up to 30 days after the insured person returns to Singapore.

- Continuation of Overseas Treatment: If you received medical treatment for an injury or illness during your journey, MSIG TravelEasy will cover the continued medical expenses upon your return to Singapore.

- Initial Treatment in Singapore: If you did not receive medical treatment outside Singapore, you must seek medical treatment in Singapore within 72 hours of your return. MSIG TravelEasy will cover further medical expenses up to 30 days after your return.

Coverage structure

Plan Type | Insured Person Aged Below 70 | Insured Person Aged 70 or Above | Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $25,000 | $5,000 | $10,000 | $70,000 |

Elite Plan | $50,000 | $7,500 | $20,000 | $140,000 |

Premier Plan | $75,000 | $10,000 | $30,000 | $210,000 |

What is Not Covered

- MSIG TravelEasy does not cover costs for dental treatment, mobility aids, or prostheses under this section.

- The policy has specific exclusions for certain medical conditions and treatments, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6 – Overseas Medical Expenses.

Section 9: Mobility Aid Reimbursement

What is Covered

MSIG TravelEasy covers the necessary expenses incurred for purchasing mobility aids as prescribed by a doctor due to an injury suffered during an overseas journey.

Mobility aids include crutches, wheelchairs, or walkers but do not cover prostheses.

Coverage structure

Plan Type | Coverage per Adult Insured Person | Coverage per Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $1,000 | $250 | $2,000 |

Elite Plan | $3,000 | $750 | $6,000 |

Premier Plan | $5,000 | $1,250 | $10,000 |

What is Not Covered

- MSIG TravelEasy does not cover the cost of prostheses under this section.

- The policy has specific exclusions for certain conditions and situations, which will be detailed in the general exclusions section.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6 – Overseas Medical Expenses.

Section 10: Traditional Chinese Medicine Expenses

What is Covered

MSIG TravelEasy offers coverage for the cost of traditional Chinese medical treatment (TCM) by a TCM practitioner, which is necessary for injuries and illnesses suffered during an overseas journey.

This coverage also extends to TCM treatments received in Singapore as a continuation of the overseas treatment, limited to 30 days after the insured person’s return to Singapore.

- Overseas Treatment: If you receive TCM treatment during your journey, MSIG TravelEasy will cover the expenses.

- Treatment in Singapore: If TCM treatment is not first received outside Singapore, you must seek TCM treatment in Singapore within 72 hours of your return.

MSIG TravelEasy will cover these expenses up to 30 days after your return.

Coverage structure

Plan Type | Coverage per Adult Insured Person | Coverage per Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $200 | $100 | $600 |

Elite Plan | $400 | $250 | $1,300 |

Premier Plan | $600 | $300 | $1,800 |

What is Not Covered

- MSIG TravelEasy has specific exclusions for certain conditions and situations, which will be detailed in the general exclusions section of the policy.

- The maximum limit for sections 6 to 11, including extension under section 52 (Pre-Ex Critical Care), will not exceed the maximum limit under section 6 – Overseas Medical Expenses.

Section 11: Maternity Medical Expenses Overseas

What is Covered

MSIG TravelEasy covers necessary medical expenses incurred outside Singapore for pregnancy-related illnesses the adult insured person suffers during an overseas journey.

Coverage structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not Covered |

Elite Plan | $2,000 |

Premier Plan | $3,000 |

What is Not Covered

- MSIG TravelEasy does not cover claims relating to:

- The first trimester of pregnancy (0 to 12 weeks).

- Ectopic pregnancy, childbirth, or stillbirth.

- Care and treatment for the newborn.

- Abortion or miscarriage unless due to an injury.

- Tests or treatments related to fertility, contraception, sterilisation, birth defects, or congenital disorders.

- Perinatal mental illnesses such as depression or anxiety disorders.

- Treatment for pregnancy is conceived through medical assistance.

- Medical expenses incurred in the country where the insured person is a citizen or permanent resident.

Section 12: Overseas Hospitalisation Daily Benefit

What is Covered

- This cover provides financial support for each complete 24-hour period an insured person spends in a hospital outside Singapore.

- This coverage is activated when the insured person requires hospitalisation due to an injury or illness incurred during their overseas journey.

- It’s important to note that this benefit applies to stays in a registered hospital where the insured person is admitted as an inpatient based on medical necessity and under a doctor’s recommendation.

- The coverage is specifically for stays in standard hospital wards.

- Additionally, while receiving benefits under this section, the insured person will not be eligible for benefits under section 13, which pertains to Overseas ICU Hospitalisation Daily Benefit.

Coverage Structure

Plan Type | Standard Plan | Elite Plan | Premier Plan |

Daily Benefit for Adult Insured Person | $200 | $250 | $300 |

Daily Benefit for Insured Child | $100 | $125 | $150 |

Maximum Benefit for Adult Insured Person | $20,000 | $37,500 | $60,000 |

Maximum Benefit for Insured Child | $5,000 | $12,500 | $15,000 |

Total Maximum for Adult & Children Cover or Family Cover | $50,000 | $100,000 | $150,000 |

What is Not Covered

- The benefit is only for stays in a regular hospital ward.

- No benefit will be paid under Section 13 – Overseas ICU Hospitalisation Daily Benefit during the period the insured person is paid under this section.

- Specific exclusions for certain conditions and situations will be detailed in the general exclusions section of the policy.

For detailed exclusions related to this section, it is advised to refer to the specific exclusions section of the policy document.

Section 13: Overseas ICU Hospitalisation Daily Benefit (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides a daily benefit for each complete 24-hour period of an insured person’s stay in an Intensive Care Unit (ICU) outside Singapore due to an injury or illness suffered during the overseas journey.

This coverage applies when the insured person is admitted as a registered inpatient in an ICU on the advice of a doctor.

Coverage Structure

Plan Type | Daily Benefit per Adult Insured Person | Daily Benefit per Insured Child | Maximum Total for Adult | Maximum Total for Child | Total for Adult & Children or Family Cover |

Standard Plan | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered |

Elite Plan | $350 | $150 | $3,500 | $1,500 | $10,000 |

Premier Plan | $400 | $200 | $4,000 | $2,000 | $12,000 |

What is Not Covered

- The benefit is only for stays in an ICU.

- No benefit will be paid under Section 12 – Overseas Hospitalisation Daily Benefit during the period the insured person is paid under this section.

- Specific exclusions for certain conditions and situations will be detailed in the general exclusions section of the policy.

Section 14: Hospitalisation Daily Benefit In Singapore (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers a daily benefit for each complete 24-hour period of hospital stay in Singapore if the insured person is hospitalised within 24 hours after returning to Singapore due to an injury or illness suffered during the overseas journey.

This coverage applies when the insured person is admitted as a registered inpatient in a hospital on the advice of a doctor.

Coverage Structure

Plan Type | Daily Benefit per Adult Insured Person | Daily Benefit per Insured Child | Maximum Total for Adult | Maximum Total for Child | Total for Adult & Children or Family Cover |

Standard Plan | $100 | $50 | $500 | $150 | $1,300 |

Elite Plan | $100 | $50 | $1,000 | $250 | $2,500 |

Premier Plan | $100 | $50 | $2,000 | $500 | $5,000 |

What is Not Covered

Specific exclusions for certain conditions and situations will be detailed in the general exclusions

Section 15: Medical & Travel Assistance Services (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers various medical and travel assistance services through their appointed assistance company.

These services are accessible to insured persons, but it’s important to note that all costs and expenses, including telecommunication charges, are the insured’s responsibility.

Overview of Services

Service Category | Specific Services Offered |

Medical Assistance | Medical advice over the phone |

Referral to a medical service provider | |

Arranging hospital admission | |

Guarantee of medical expenses during a hospital stay | |

Travel Assistance | Referral to an embassy or interpreter |

Lost luggage assistance | |

Lost travel document assistance | |

Legal referral | |

Emergency message transmission | |

Children escort assistance |

What is Not Covered

- The insured person is responsible for all costs and expenses for the services listed.

- General exclusions applicable to these services.

Section 16: Emergency Medical Evacuation & Repatriation (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers extensive support and coverage for situations requiring emergency medical evacuation and repatriation due to serious medical conditions encountered during overseas travel.

This section addresses emergencies where the insured needs immediate medical attention or repatriation.

Detailed Coverage Structure:

Emergency Medical Evacuation:

- Scope: In case of a severe injury or illness during the journey, MSIG TravelEasy organises and covers the cost of transportation (air, land, or sea) to the nearest hospital where appropriate medical care is available.

- Decision Making: MSIG TravelEasy, considering all known facts and circumstances, decides the evacuation destination and the transport method.

- Coverage Limit: Up to $1,000,000 per insured person.

Sending Home After Medical Evacuation:

- Scope: If deemed medically necessary, MSIG TravelEasy arranges and pays for the insured person’s return to Singapore following an emergency evacuation. This includes scheduled airline flights (economy class) or other suitable transportation methods.

- Ticket Utilisation: The insured person must surrender any unused portion of their original ticket to MSIG TravelEasy.

- Additional Costs: Covers extra transportation costs to and from the airport if the original ticket is invalid.

Sending Home Mortal Remains:

- Scope: In the unfortunate event of the insured person’s death overseas, MSIG TravelEasy makes all necessary arrangements (including meeting local formalities) for sending the body or ashes back to Singapore.

- Coverage Limit: Included within the overall limit of $1,000,000.

Maximum Coverage Limit:

- The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, regardless of the number of events involved.

Sub-limits for Pre-Existing Conditions:

- For claims related to pre-existing medical conditions under the Pre-Ex Standard, Elite, or Premier plans, payments are based on the sub-limits specified in section 52 – Pre-Ex Critical Care.

What is Not Covered

- MSIG TravelEasy does not cover expenses for services not arranged or approved by them.

- Any costs exceeding the maximum limit of $1,000,000 per insured person per journey.

Section 17: Compassionate & Hospital Visit (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

What is Not Covered

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 18: Child Guard (MSIG TravelEasy)

What is Covered

MSIG TravelEasy’s Child Guard section provides coverage for the travel and accommodation expenses of a family member or relative.

This support is provided when an adult insured person is hospitalised outside Singapore due to injury or illness and cannot accompany their children, who are also on the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable costs for economy air travel or first-class rail travel and accommodation for the family member or relative who travels to accompany the children.

This ensures that the children are safely returned to Singapore in the absence of the hospitalised adult insured person.

Maximum Coverage Limit:

The overall maximum coverage for all services under sections 16 to 19 is limited to $1,000,000 per insured person for any single journey.

This cap applies irrespective of the number of events involved.

What is Not Covered

MSIG TravelEasy specifies that expenses for services not arranged or approved by them are excluded from this coverage.

The policy document will also detail specific exclusions applicable to this section.

Section 19: Emergency Telephone Charges (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

What is Not Covered

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 20: Insolvency Of Licensed Travel Operator (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

What is Not Covered

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 21: Travel Cancellation (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

What is Not Covered

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 22: Travel Postponement (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for reasonable additional travel expenses to reschedule the insured person’s journey if it is unexpectedly and unavoidably postponed due to specific covered reasons occurring within 30 days before the journey’s start but after purchasing the insurance.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult and Children or Family Cover |

Standard Plan | $750 | $1,875 |

Elite Plan | $1,500 | $3,750 |

Premier Plan | $2,000 | $5,000 |

Coverage is for additional travel expenses due to unexpected and unavoidable postponement of the journey.

Covered reasons include

- Death, serious injury, or illness of the insured person or their family member/travel companion.

- Being called as a witness in a Singapore court.

- Homes or businesses in Singapore are becoming uninhabitable or seriously damaged.

- Unexpected strikes, industrial action, riots, civil commotions, natural disasters, airport/airspace closures.

- Denial of boarding due to infectious disease symptoms.

Policy Termination:

- Policy ends for the insured person who postpones the trip after a claim is made under this section.

- The policy continues for other insured persons who continue with the trip.

Claim Limitation:

- Only 1 claim is payable under Sections 20, 21, 22, or 23 if they result from the same event.

What is Not Covered

MSIG TravelEasy specifies that expenses and losses not covered by this section will be detailed in the policy document’s exclusions section.

In a single return trip policy, once a claim is made for travel postponement under this section and the trip is postponed, the policy will immediately end for the insured person who postpones the trip.

The policy remains in force for other insured persons who continue with the trip.

Section 23: Replacement Of Traveller (MSIG TravelEasy)

What is Covered

MSIG TravelEasy offers coverage for one immediate family member’s travel and accommodation expenses.

This coverage starts when the insured person is hospitalised outside Singapore for more than five days without any adult family member present or in the event of the insured person’s death due to injury or illness during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

The coverage includes reasonable expenses for economy air travel or first-class rail travel and accommodation.

It applies when no adult family member is accompanying the hospitalised insured person.

Maximum Coverage Limit:

The total coverage for all services under sections 16 to 19 is capped at $1,000,000 per insured person for any journey, irrespective of the number of events involved.

What is Not Covered

Expenses for services not arranged or approved by MSIG TravelEasy are excluded.

Specific exclusions applicable to this section will be detailed in the policy document.

For complete details, benefits, limits, and exclusions of Section 17, it’s essential to refer to the actual MSIG TravelEasy policy document.

The above information provides a summarised overview of the coverage offered under this section.

Section 24: Replacement Of Employee (MSIG TravelEasy - Corporate Policyholders Only)

What is Covered

MSIG TravelEasy’s Section 24 covers the insured person’s employer for replacement expenses to send a substitute employee.

This coverage is activated if the insured person either passes away during the trip, suffers an injury or illness leading to hospitalisation for more than seven days, or is confirmed by a doctor to be unable to perform work duties for more than seven days.

Coverage Structure

Plan Type | Coverage per Insured Person |

Standard Plan | $5,000 |

Elite Plan | $10,000 |

Premier Plan | $15,000 |

Coverage Details

- Replacement Expenses: Includes all reasonable and necessary expenses for sending a substitute employee. This includes economy return air tickets and accommodation expenses for the substitute employee to travel to the location where the original insured person was carrying out their work duties.

- Travel and Accommodation Class: The transportation and accommodation booked for the substitute employee must not be higher in class or category than that of the insured person.

- Itinerary Requirements: The itinerary of the substitute employee must be similar to and no longer than the original insured person’s duration.

Documentation:

Claims under this section must include supporting documents such as proof of payments made by the policyholder, letters of appointment, and employment contracts.

What is Not Covered

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 25: Delayed Departure (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for delays in public transport departure due to reasons like strikes, industrial action, riots, civil commotion, poor weather conditions, natural disasters, mechanical breakdowns, or closure of airport or airspace.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $500 | $1,000 |

Elite Plan | $1,000 | $2,000 |

Premier Plan | $1,500 | $3,000 |

Benefits Offered:

- Delay Benefit:

- MSIG TravelEasy will pay $100 to each insured person for every full 6 hours of continuous delay.

- The delay period is calculated from the scheduled departure time to the actual departure time of the replacement flight.

- Alternative Travel Arrangement:

- Suppose the insured person books alternative transportation to the same destination that departs earlier than the next available scheduled departure. MSIG TravelEasy will cover the additional administrative or travel expenses incurred in that case.

- The maximum reimbursement under this option will not exceed the amount payable under the Delay Benefit, less any refund recovered.

Claim Eligibility:

- To qualify for a claim, the insured person must have checked in as per the original itinerary and received written confirmation from the carrier or their handling agents stating the reason and length of the delay.

Claim Limitation:

- If a claim under Section 25 or related sections (26 to 30, 50) results from the same event, MSIG TravelEasy will pay under only 1 of these sections.

What is Not Covered

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 26: Flight Diversion (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage if the insured person’s scheduled flight is diverted due to poor weather conditions, natural disasters, emergency medical treatment for a fellow passenger, or mechanical breakdown of the aircraft, resulting in a delay in reaching the planned destination.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $500 | $1,000 |

Elite Plan | $1,000 | $2,000 |

Premier Plan | $1,500 | $3,000 |

Compensation Details:

- MSIG TravelEasy will pay $100 for every full 6 hours of continuous delay due to flight diversion.

- The delay period is calculated from the scheduled arrival time at the planned destination to the flight’s actual arrival time.

Documentation Requirement:

- The insured person must obtain written confirmation from the carrier, operator, or handling agent stating the reasons and length of the delay.

Claim Limitation:

- If a claim under Section 26 or related sections (25, 27 to 30, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

What is Not Covered

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 27: Overbooked Flight (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage if the insured person is denied boarding on a scheduled flight for which they have a confirmed reservation due to overbooking by the travel agent or airline.

Coverage Structure

Plan Type | Compensation per Six Hours of Delay | Maximum Compensation per Insured Person | Total Maximum for Adult & Children or Family Cover |

Standard Plan | $100 | $200 | $400 |

Elite Plan | $150 | $300 | $600 |

Premier Plan | $200 | $400 | $800 |

Compensation Details:

- MSIG TravelEasy will pay the specified amount for every full 6 hours of continuous delay due to an overbooked flight.

- The delay period is calculated from the scheduled departure time to the actual departure time of the replacement flight.

Documentation Requirement:

- The insured person must obtain written confirmation from the carrier, operator, or handling agent stating the reasons and length of the delay.

Claim Limitation:

- If a claim under Section 27 or related sections (25, 26, 28 to 30, 50) results from the same event, MSIG TravelEasy will only pay under one of these sections.

What is Not Covered

- Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 28: Missed Travel Connection (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage if the insured person misses an onward scheduled public transport connection outside Singapore due to the late arrival of their incoming transport.

This coverage applies when the insured person has a confirmed reservation for the missed connection.

Coverage Structure

Plan Type | Compensation per Six Hours of Delay | Maximum Compensation per Insured Person | Total Maximum for Adult & Children or Family Cover |

Standard Plan | $100 | $200 | $400 |

Elite Plan | $150 | $300 | $600 |

Premier Plan | $200 | $400 | $800 |

Compensation Details:

- MSIG TravelEasy will pay the specified amount for every full six hours of continuous delay due to a missed travel connection.

- The delay period is calculated from the actual arrival time of the incoming transport at the transfer point to the actual departure time of the replacement transport.

Documentation Requirement:

- The insured person must obtain written confirmation from the carrier, operator, or handling agent stating the reasons and length of the delay.

Claim Limitation:

- If a claim under Section 28 or related sections (25, 26, 27, 29 to 30, 50) results from the same event, MSIG TravelEasy will only pay under one of these sections.

What is Not Covered

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 29: Shortening The Trip (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers unused travel fare, accommodation charges, deposits, and reasonable additional travel expenses if the insured person needs to make a direct trip home due to specific covered reasons occurring during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $5,000 | $12,500 |

Elite Plan | $10,000 | $25,000 |

Premier Plan | $15,000 | $37,500 |

Covered Reasons for Shortening the Trip:

- Death, serious injury, or severe illness of the insured person, their family member, or travel companion.

- The insured person or their travel companion is called a witness in a Singapore court.

- The insured person’s home or place of business in Singapore is becoming uninhabitable or seriously damaged.

- Unexpected strike, industrial action, riot, civil commotion, natural disasters, airport/airspace closure, hijacking, or denial of boarding due to infectious disease symptoms at the destination.

Notification Requirement:

- The insured person must immediately notify the tour, public transport, or accommodation provider that a change or cancellation is required.

Claim Limitation:

- If a claim under Section 29 or related sections (25, 26, 27, 28, 30, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

What is Not Covered

The policy document’s exclusions section will detail specific exclusions applicable to this section.

Section 30: Travel Disruption (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for additional travel expenses needed to continue the originally scheduled journey if the trip is disrupted due to specific covered reasons.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $1,000 | $2,500 |

Elite Plan | $2,000 | $5,000 |

Premier Plan | $3,000 | $7,500 |

Covered Reasons for Travel Disruption:

- Death, serious injury, or severe illness of the insured person, their family member, or travel companion.

- Unexpected strike, industrial action, riot, civil commotion, natural disasters, airport/airspace closure, hijacking, or fire at the accommodation at the destination.

- Denial of boarding of public transport due to infectious disease symptoms.

Notification Requirement:

- The insured person must immediately notify the tour, public transport, or accommodation provider upon finding out that a change or cancellation is required.

Claim Limitation:

- If a claim under Section 30 or related sections (25, 26, 27, 28, 29, 50) results from the same event, MSIG TravelEasy will pay under only one of these sections.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 31: Automatic Extension Of Cover (MSIG TravelEasy)

What is Covered

MSIG TravelEasy ensures that the policy coverage is automatically extended without any additional premium under certain circumstances if the insured person cannot complete their homeward journey before the policy’s end date.

Coverage Structure

The coverage extension is provided under 2 specific conditions:

- Public Transport Delay:

- If any public transport in which the insured person is travelling as a fare-paying passenger is delayed, the cover will be extended for up to 14 days.

- Injury or Illness Prevention:

- Suppose the insured person’s intended return journey is prevented due to their injury or illness arising from a cause covered under the policy. The cover will be extended for up to 30 days in that case.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 32: Delayed Baggage (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage if the insured person’s checked-in baggage is temporarily lost or misdirected by the carrier and not returned within six hours after arrival at the baggage pick-up point of the scheduled overseas destination.

Coverage Structure

Plan Type | Compensation per Six Hours of Delay | Maximum Compensation per Insured Person | Total Maximum for Adult & Children or Family Cover |

Standard Plan | $150 | $600 | $1,200 |

Elite Plan | $200 | $1,000 | $2,000 |

Premier Plan | $250 | $1,500 | $3,000 |

Compensation Details:

- MSIG TravelEasy will pay the specified amount for every total six hours of continuous delay in receiving the checked-in baggage.

- If the baggage is delayed on arrival in Singapore, the maximum sum payable is $200, provided a minimum period of six hours of delay has elapsed.

Claim Conditions:

- Only one baggage delay claim will be paid per insured person, regardless of the number of baggage pieces delayed or the number of insured persons sharing one piece of delayed baggage.

- Any payment will be deducted from the amount payable under Section 33 – Baggage if the baggage is later found to be permanently lost.

Documentation Requirement:

- The insured person must obtain written confirmation from the carrier, operator, or their handling agents stating the reason and length of the delay.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 33: Baggage (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers accidental loss or damage to personal baggage, including clothing, personal belongings, one laptop computer, and one mobile device owned or taken by an insured person during the journey outside Singapore.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $3,000 | $6,000 |

Elite Plan | $5,000 | $10,000 |

Premier Plan | $7,500 | $15,000 |

Coverage Details:

- Jewellery, laptop computers, and mobile devices must be carried as hand luggage; loss or damage to these items in checked-in baggage is not covered.

- MSIG TravelEasy may opt to pay for or repair damaged items, considering wear and tear and market value.

- For electronic items bought within one year before the accident, market value loss may not be considered if original receipts are provided.

- If an item is beyond economical repair, it is treated as lost.

- The maximum payment for any single item, pair, or set of items is $500, but up to $1,000 for a laptop computer (one laptop and one mobile device per trip).

Claim Process:

- For loss or damage caused by public transport, accommodation, or service providers, claims must be made to them first. Proof of compensation denial is required when claiming from MSIG TravelEasy.

What is Not Covered

Items covered under Section 34 – Wedding Clothing and Accessories, Section 35 – Loss of Travel Documents, or Section 42 – Golfer’s Cover are excluded.

The maximum payment under Sections 33 to 35 combined will not exceed the maximum limit under Section 33 – Baggage.

Section 34: Wedding Clothing & Accessories (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers accidental loss or damage to bridal and ceremonial clothing, wedding rings, jewellery, and wedding accessories owned, hired, or on loan to the adult insured person for their wedding.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $2,500 |

Premier Plan | $3,500 |

Coverage Details:

- Includes bridal and ceremonial clothing, wedding rings, jewellery, and accessories to be used by the bride or groom for the wedding ceremony, reception, or overseas wedding photoshoot.

- These items must be transported as carry-on baggage during travel on public transport; loss or damage in checked-in baggage is not covered.

- The maximum payment for any single item, pair, or set of items is $750, or up to 40% of the limit for this section for wedding rings and jewellery.

Claim Limitation:

- The maximum payment under Sections 33 to 35 combined will not exceed the maximum limit under Section 33 – Baggage.

- If a claim under Section 34 and Section 33 results from the same event, MSIG TravelEasy will pay under Section 34.

What is Not Covered

- This benefit does not apply to an insured child.

- Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 35: Loss Of Travel Documents (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers the cost of obtaining replacement passports, travel tickets, and other relevant travel documents due to accidental loss or damage while overseas.

It also covers reasonable additional travel expenses needed to replace lost travel documents if the loss results from robbery, burglary, or theft during the journey outside Singapore.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $2,000 | $4,000 |

Elite Plan | $3,000 | $6,000 |

Premier Plan | $5,000 | $10,000 |

Reporting Requirement:

- The loss must be reported to the local police at the place of the incident within 24 hours after it occurs.

- Claims must be accompanied by written documentation from the police.

Claim Limitation:

- The maximum payment under Sections 33 to 35 combined will not exceed the maximum limit under Section 33 – Baggage.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 36: Personal Money (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers the loss of an insured person’s cash, banknotes, or traveller’s cheques for social and domestic purposes.

The loss must arise from robbery, burglary, or theft while the insured person is outside Singapore during the journey.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | $100 | $100 |

Elite Plan | $300 | $300 |

Premier Plan | $500 | $500 |

Reporting Requirement:

- The loss must be reported to the local police at the place of the incident within 24 hours after it occurs.

- Claims must be accompanied by written documentation from the police.

What is Not Covered:

Loss or theft of money while transported as checked-in baggage is not covered.

Section 37: Fraudulent Use Of Credit Card (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers financial loss resulting from the fraudulent use of the adult-insured person’s personal credit card.

This coverage applies to unauthorised charges made overseas following the loss of the card due to robbery, burglary, or theft while the adult insured person is outside Singapore during the journey.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $2,000 |

Premier Plan | $3,000 |

Reporting Requirement:

- The loss of the credit card must be reported to the credit card issuer within six hours of the robbery, burglary, or theft.

- Failure to report within this timeframe will result in no benefit being paid under this section.

- A claim must be accompanied by a report from the credit card issuer showing the amount of loss and confirming the insured person’s liability for the loss.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 38: Credit Card Outstanding Balance (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for the outstanding balance on an adult insured person’s personal credit card account.

This coverage is applicable if the insured person suffers an injury during the journey outside Singapore, which, within 90 days of its occurrence, is the sole cause of their death.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $2,000 |

Premier Plan | $3,000 |

Coverage Details:

- The policy will pay the outstanding balance on the insured person’s personal credit card account as of the date of the accident leading to their death.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 39: Personal Liability (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for legal liabilities incurred by the insured person for accidents during the journey outside Singapore, leading to death or injury of others or loss of or damage to others’ property.

Coverage Structure

Plan Type | Coverage per Adult Insured Person | Coverage per Insured Child | Total for Adult & Children or Family Cover |

Standard Plan | $500,000 | $250,000 | $500,000 |

Elite Plan | $1,000,000 | $500,000 | $1,000,000 |

Premier Plan | $1,000,000 | $500,000 | $1,000,000 |

Coverage Details:

- The policy covers legal costs and expenses awarded against or paid by the insured person with MSIG TravelEasy’s written permission.

- The coverage includes compensation for accidents resulting in death or injury to any person and loss of or damage to property belonging to others.

Maximum Payment:

- The maximum payment under this section for any 1 event or series of events from 1 original cause, and in total for all events in any one trip, is specified in the table above.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section

Section 40: Legal Expenses For Wrongful Arrest Or Detention (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for legal costs and expenses that the insured person is legally obligated to pay due to wrongful arrest or detention by any government or local authority during their journey outside Singapore.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | Not covered | Not covered |

Elite Plan | $5,000 | $5,000 |

Premier Plan | $10,000 | $10,000 |

Coverage Details

The policy covers legal costs and expenses, including those awarded against or paid by the insured person with MSIG TravelEasy’s written permission.

- The coverage applies to wrongful arrest or detention incidents during the journey.

Maximum Payment

- The maximum payment under this section for any 1 event or series of events from 1 original cause, and in total for all events in any one trip, is specified in the table above.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 41: Adventurous Activities Cover (MSIG TravelEasy - Elite & Premier Plans Only)

What is Covered

MSIG TravelEasy covers accidental death or injury incurred while participating in or practising certain adventurous activities for leisure and non-competitive purposes.

The activities must be conducted with a licensed operator, and the insured person must adhere to all safety and health instructions, guidelines, or regulations.

Covered Activities:

- Aerial Activities: Zip-lining, zip-riding, bungee jumping, parasailing, tandem sky diving, tandem paragliding, tandem hang gliding.

- Aerial Sightseeing: Hot-air balloon, helicopter, airplane.

- Water Activities: Canoeing or white-water rafting up to Grade 3, jet skiing, helmet diving, scuba diving (up to the depth of certification, max 30 meters).

- Winter Sports: Ice skating, tobogganing, sledging, snow tube sliding, dog sledding, snow rafting, skiing, snowboarding, snowmobiling (excluding off-piste, ungroomed, unpatrolled areas).

- Hiking and Trekking: Up to 3,000m above sea level.

- Marathon Running: Up to 42.195km.

Coverage Structure

Plan Type | Coverage Details |

Elite Plan | Coverage, included as per policy terms |

Premier Plan | Coverage included as per policy terms |

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 42: Golfer’s Cover (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers golf-related incidents, including loss or damage to golfing equipment, non-refundable green fees due to injury or illness, and expenses for a celebratory round of drinks for scoring a hole-in-one.

Coverage Structure

Plan Type | Golfing Equipment | Green Fees | Hole-in-One |

Standard Plan | Not covered | Not covered | Not covered |

Elite Plan | $1,000 | $500 | $500 |

Premier Plan | $1,500 | $750 | $750 |

Coverage Details:

- Golfing Equipment: Covers loss or damage to golf clubs and bags. Excludes loss or damage during play or practice.

- Green Fees: Reimburses non-refundable pre-booked green fees if unable to play due to injury or illness.

- Hole-in-One: Covers the cost of celebratory drinks for scoring a hole-in-one in an organised event at any 18-hole golf course outside Singapore.

Claim Conditions:

- For golfing equipment, MSIG TravelEasy may opt to pay or repair items, considering wear and tear and market value.

- For hole-in-one claims, written evidence from the golf club official and original receipts for the cost of celebratory drinks are required.

Claim Limitation:

- If a claim under Section 33 – Baggage and Section 42 – Golfer’s Cover results from the same event, MSIG TravelEasy will pay under Section 42.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 43: Unused Entertainment Ticket (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers the cost of any prepaid or unused portion of entertainment tickets meant for use overseas during the trip.

The coverage applies if the insured person is prevented from using the ticket due to specific reasons occurring within 30 days before or during the trip.

Covered Reasons

- Health Issues: Death, serious injury, or severe illness of the insured person, their family member, or travel companion.

- Civil Unrest: Unexpected strike, industrial action, riot, civil commotion at the destination.

- Natural Disasters: Occurrences at the destination prevent the journey’s start or continuation.

- Transport Issues: Closing of airport or airspace or denial of boarding due to infectious disease symptoms.

Coverage Structure

Plan Type | Coverage per Insured Person | Total for Adult & Children or Family Cover |

Standard Plan | Not covered | Not covered |

Elite Plan | $300 | $600 |

Premier Plan | $500 | $1,000 |

Claim Process:

- The insured person must first seek a cancellation refund from relevant parties (e.g., tour operator, event organiser).

- Claims must be submitted with proof or denial of any compensation from these parties.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 44: Rental Vehicle Excess (MSIG TravelEasy)

What is Covered

MSIG TravelEasy covers the excess amount an adult insured person must pay under a rental agreement for accidental loss or damage to a rented car or campervan.

Coverage Conditions:

- Rental Requirements: The vehicle must be rented from a licensed rental agency, and the rental agreement includes an excess (or deductible) condition.

- Driver Eligibility: The adult insured person must be a named driver or co-driver of the rental vehicle and comply with all rental agreement requirements.

- Driving Conditions: The insured person must be licensed to drive the vehicle and not participate in speed/time trials or drive under the influence of alcohol or drugs.

- Insurance Requirement: Full motor insurance against loss or damage to the rental vehicle must be taken as part of the hiring arrangement.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $1,000 |

Premier Plan | $1,500 |

Limitations:

- Coverage is limited to 1 adult insured person per rented vehicle, regardless of the number of insured persons registered to rent or authorised to drive the vehicle.

- The limit for 1 adult insured person applies for the entire trip, irrespective of the number of vehicles rented.

What is Not Covered

- Loss or damage due to wear and tear, gradual deterioration, insects/vermin, built-in faults, or non-obvious faults/damage.

- Damage to tyres and rims unless it occurs with damage to other parts of the vehicle in the same accident.

Section 45: Returning a Rental Vehicle (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for the costs associated with returning a rented car or campervan to the nearest hire depot if the adult insured person, due to injury or illness, is unable to return it personally.

Coverage Conditions:

- Rental Agreement: The insured person must be legally responsible for these costs under the rental agreement.

- Driver Eligibility: The insured person must be a named driver or co-driver of the rental vehicle.

- Compliance: All rental agreement requirements must be adhered to by the insured person.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $500 |

Premier Plan | $750 |

Limitations:

- Coverage is limited to 1 adult insured person per rented vehicle, regardless of the number of insured persons registered to rent or authorised to drive the vehicle.

- The limit for 1 adult insured person applies for the entire trip, irrespective of the number of vehicles rented.

What is Not Covered

Specific exclusions applicable to this section will be detailed in the policy document’s exclusions section.

Section 46: Home Contents (MSIG TravelEasy)

What is Covered

MSIG TravelEasy provides coverage for physical loss or damage to the contents of the insured person’s home in Singapore caused by fire or theft (with force and violence) while the home is vacant during the insured person’s trip.

Home Contents Definition:

- Includes household furniture, domestic appliances, audio and video equipment, clothing, and personal belongings owned by the insured person or their immediate family members living with them.

- Excludes deeds, bonds, bills of exchange, promissory notes, cheques, traveller’s cheques, securities, cash, documents, perishable goods, livestock, motor vehicles, bicycles, boats, and accessories.

Coverage Structure

Plan Type | Coverage per Adult Insured Person |

Standard Plan | Not covered |

Elite Plan | $10,000 |

Premier Plan | $15,000 |

Coverage Limitations:

- For Platinum, Gold, Silver, etc.: Maximum of $2,000.

- For Any 1 Item: Maximum of $1,000 for any 1 item, set, or pair of items.

Claim Process:

- MSIG TravelEasy may opt to pay, reinstate, or repair damaged items, considering wear and tear and market value.

- For electronic items bought within 1 year before the accident, market value loss may not be considered if original receipts are provided.

What is Not Covered