Manulife ReadyMummy is a 3-year single premium maternity plan designed for pregnant women and their babies.

For the mother, it covers unexpected death, pregnancy complications, and hospitalisation due to pregnancy-related issues.

For the newborn, it provides coverage in case of death, congenital illnesses, and hospitalisation.

Here is a complete review of Manulife ReadyMummy.

My Review of the Manulife ReadyMummy

Manulife ReadyMummy is a maternity plan that provides protection for pregnant women and their babies for a period of 3 years.

The coverage starts as early as 13 weeks into the pregnancy and continues until the 3rd year of the policy.

The plan covers the mother against 14 different pregnancy complications.

If any of these complications occur, the plan pays 100% of the chosen coverage amount. This includes coverage for miscarriage due to an accident.

Additionally, the plan covers psychotherapy treatment for the mother at 10% of the chosen coverage amount.

Both the mother and the child are covered against the unfortunate event of death. The plan also provides coverage for the child against 24 different congenital illnesses.

If either of these 2 events occurs, the plan pays 100% of the chosen coverage amount.

In case the mother or the child needs to stay in the hospital, the plan offers a daily cash benefit equal to 1% of the chosen coverage amount for each day of hospitalisation, up to a maximum of 30 days.

Mummies looking for IVF or ICI procedures can also have it covered by this Manulife ReadyMummy.

Finally, within 90 days from the birth of the child, the parents have the option to purchase additional eligible plans offered by Manulife without the need to answer any health questions.

In summary, the Manulife ReadyMummy plan provides comprehensive coverage for both the mother and the child, offering financial protection against various pregnancy complications, death, congenital illnesses, and hospitalisation expenses.

However, it might not suit all mummies, as everyone has different needs, and other policies might suit them better.

This is why we always recommend understanding the available alternatives in the market and doing a thorough comparison before deciding.

This makes sure that you and your baby have the best level of protection you can afford.

If you are interested in a comparison session, we partner with unbiased financial advisors who have helped thousands of our readers select the right insurance policy for them – and they’re happy to help you too!

Click here for a free comparison session.

Here’s more on the Manulife ReadyMummy:

Criteria

- The mother who will be covered must be in the stage of pregnancy that falls between 13 and 36 weeks.

General Features

Policy Terms

- Premium Payment Term: A single premium payment

- Policy Term: 3-year

Protection

Benefits For Insured Mother

Death Benefit

If the mother who is insured under the policy passes away, 100% of the amount of coverage that was chosen is paid.

Once this payment is made, all benefits for the mother will cease.

However, the benefits for the insured child will continue as long as the policy is active.

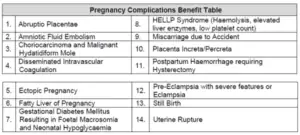

Pregnancy Complications Benefit

If the mother is diagnosed with any of the listed pregnancy complications or conditions during her pregnancy, a 100% payment of the chosen coverage amount is offered.

This benefit will end:

- upon its payment, or

- when the insured child is born, or

- the mother’s pregnancy is terminated, whichever comes first.

The other benefits will remain in effect if the policy is active.

Additionally, if the mother is diagnosed with Postpartum Haemorrhage requiring Hysterectomy within 30 days after the birth of the insured child, a payment of 100% of the chosen coverage amount is offered.

After that, this benefit will end.

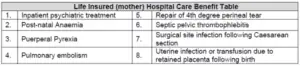

Hospital Care Benefit

If the mother is hospitalised due to a pregnancy complication or an insured event, the policy will provide a daily payment of 1% of the chosen coverage amount for each day of hospital stay, up to a maximum of 30 days during the policy period.

The benefit amount is the same even when the mother is hospitalised due to multiple pregnancy complications or multiple insured events during the policy period.

This benefit will end either when

- 30% of the chosen coverage amount has been paid out or

- by the 90th day after the birth of the insured child, whichever comes first.

However, the other benefits will remain active if the policy is in effect.

Below is the Hospital Care Benefit Table for the Insured mother.

Psychotherapy Treatment

If the mother is diagnosed with Major Depressive Disorder (MDD) or Generalised Anxiety Disorder (GAD), 10% of the chosen coverage amount will be paid.

To be eligible for this benefit, the diagnosis must be made and assessed by a registered psychiatrist who is a medical examiner.

Additionally, the mother must have been prescribed medication by the registered psychiatrist and undergoing regular psychotherapy treatment for at least 6 consecutive months with the same registered psychiatrist.

It’s important to note that this policy does not cover any other psychiatric disorders, treatments, or psychotherapy for other mental health conditions.

Benefits For Insured Child

Death Benefit

If the child passes away, the policy will pay 100% of the chosen coverage amount. However, this benefit will not be payable if the death is due to stillbirth.

Once this payment is made, all benefits for the insured child will cease. However, the benefits for the mother will continue as long as the policy is active.

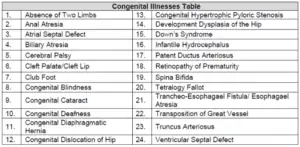

Congenital Illness Benefit

If the insured child is diagnosed with any of the listed congenital illnesses, 100% of the chosen coverage amount is paid.

Once this benefit is paid out, it will end. However, the other benefits will remain effective if the policy is active.

Child Hospital Care

If the insured child is hospitalised due to an insured event, this policy provides for a daily payment of 1% of the chosen coverage per day hospitalised, up to a maximum of 30 days during the policy period.

This payment is irrespective of whether the hospitalisation is due to single or multiple insured events.

This benefit will end once 30% of the chosen coverage amount has been paid out.

However, the other benefits will remain active if the policy is in effect.

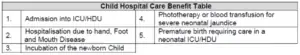

The Child Hospital Care Benefits are as set out in the table below:

Outpatient Phototherapy Treatment

If the child requires phototherapy treatment for severe neonatal jaundice, a daily payment of 1% of the chosen coverage amount is provided for the rental of a phototherapy machine.

This benefit is limited to a maximum of 10 days during the policy period.

This benefit will end once the maximum 10 days are paid out or by the 30th day after the birth of the insured child, whichever comes first.

However, the other benefits will remain in effect if the policy is active.

Key Features

Assisted Conception Procedures

If you’re looking for or might need assisted conception procedures such as In Vitro Fertilisation (IVF) or Intracervical Insemination (ICI), you can get it covered by the Manulife ReadyMummy for an additional cost.

Cover for up to 2 Children

This policy provides coverage for up to 2 children born from a single pregnancy of the insured mother.

Each child is treated separately as an insured child, and the benefits applicable to the insured children will apply to each child individually.

If a claim is made for one insured child, the benefits will still be available for the other insured child.

Guaranteed Issuance Benefit for Insured Child

While this policy is active, you can purchase any eligible plan(s) offered by Manulife for the insured child without needing medical underwriting.

This benefit can be availed within 90 days from the birth of the insured child as long as the plan is available and meets the terms and conditions set.

The current policy available to be converted into is the Manulife LifeReady Plus (II).

You can choose to attach the Early Critical Care Rider (III) and/or Critical Care Rider (III) to this policy to make your child’s coverage even more robust.

Summary of Manulife ReadyMummy

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |