The Manulife IncomeGen is a participating retirement plan that provides a steady income until the age of 120.

It offers a guaranteed and non-guaranteed monthly income starting from the end of your 49th or 61st policy month, depending on your premium payment term, allowing you to enjoy a monthly flow of income.

With protection against death, accidental death, and terminal illness, you and your loved ones can rest assured knowing that the Manulife IncomeGen can help you tide over tough times.

Continue reading our review to find out if the Manulife IncomeGen is a good fit for you!

My Review of the Manulife IncomeGen

The Manulife IncomeGen is a pretty decent annuity plan that provides you with a lifetime of income.

The policy covers death and terminal illnesses until you reach the age of 120. Hence, if anything happens to you during this period, your loved ones will receive a payout to help them financially.

An additional benefit will be paid out in the unfortunate event of accidental death before age 80, which equals to 50% of the total premiums you have paid so far.

This provides extra support to the late family during a difficult time.

One of the unique features of Manulife IncomeGen is the opportunity to receive a regular monthly income.

This starts from your policy’s 49th or 61st month, depending on the chosen premium payment term.

You will receive a monthly income that will continue until you reach the age of 120. This income can provide you with financial stability and help cover your expenses throughout your retirement years.

Additionally, when the policy matures at age 120, you will also receive a lump sum payout as a maturity benefit.

If you experience a total and permanent disability during the premium payment term of your policy, you won’t have to worry about paying any future premiums.

The coverage will continue, and the premiums will be waived.

This ensures that even if you cannot work due to disability, this insurance coverage remains intact, and you don’t have to bear the burden of premium payments.

Even though there isn’t any information on how well the participating funds are performing, based on the aggregated returns across all participating funds from Manulife, it’s clear that Manulife outperforms all insurers in this area consistently.

| Insurer | Geometric Mean | 3-Year Geometric Mean (2020-2022) | 5-Year Geometric Mean (2018-2022) | 10-Year Geometric Mean (2013-2022) | 15-Year Geometric Mean (2008-2022) |

|---|---|---|---|---|---|

| AIA | 3.88% | 0.25% | 1.88% | 3.33% | 3.53% |

| Etiqa | 4.17% | - | - | - | - |

| Great Eastern | 4.14% | 0.48% | 2.15% | 3.69% | 3.43% |

| HSBC Life | 2.80% | -4.24% | -0.58% | 1.59% | 1.99% |

| Manulife | 4.65% | 1.17% | 2.74% | 3.17% | 3.65% |

| NTUC Income | 4.49% | 2.84% | 3.74% | 4.09% | 3.58% |

| Prudential | 3.62% | -3.50% | -0.26% | 2.82% | 2.64% |

| Singlife | 3.57% | -1.79% | 0.65% | 2.37% | 2.82% |

| Tokio Marine | 4.22% | -3.54% | -0.22% | 2.10% | 2.43% |

Overall, I think the Manulife IncomeGen is pretty decent. However, we prefer the Manulife RetireReady Plus (III).

I shan’t go in-depth to why here, so I suggest taking a quick look at our review of the Manulife RetireReady Plus III here.

Spoiler alert: We think the Manulife RetireReady Plus (III) is the best retirement annuity plan in Singapore, winning up to 2 categories in our list.

But as this requires 3 to 5 years of premium payments from you, and you’ll rely on this policy as part of your retirement income, it’s best to get a second opinion from an unbiased financial advisor as to whether the Manulife IncomeGen (or any other policy) is the best option for you.

Of course, what’s best is pretty subjective, but it’s worth exploring other options before committing to a policy.

If you’re looking to get a second opinion, we partner with MAS-licensed financial advisors who have helped hundreds of our readers with their retirement planning needs.

Click here for a non-obligatory second opinion.

Let’s now explore what the Manulife IncomeGen has to offer in detail:

Criteria

| Premium Payment Term | When you start receiving your monthly income |

| 3 years | End of 49th policy month |

| 5 years | End of 61st policy month |

*Maturity benefit will be paid out upon policy maturity at age 120

General Features

Premium Payment

With this plan, you can choose from either a premium payment term of 3 or 5 years.

You have the flexibility to make payments monthly, quarterly, half-yearly, or yearly using cash.

Policy Term

Since the maturity benefit is paid upon reaching 120 years of age, the policy term is 120 years.

Protection

Death Benefit

In the unfortunate event that the insured passes away while the Manulife IncomeGen is still active, the Death Benefit will be payable in a single lump sum payment consisting of:

- The higher of

- 105% of all premiums paid until the death date (excluding any advance premiums); or

- The guaranteed surrender value

- The non-guaranteed claim bonus (if any); and

- Any monthly income accumulated with interest

It is important to note that any outstanding amounts owed to Manulife will be deducted from the Death Benefit.

Upon payment of the Death Benefit, the policy will be terminated, and no further benefits will be paid.

Accidental Death Benefit (ADB)

If the insured passes away due to an accident before the policy anniversary following their 80th birthday, they will receive an Accidental Death Benefit (ADB) on top of the Death Benefit.

The ADB is equal to 50% of the total premiums paid up to that point (excluding any advance premiums), and is not affected by the performance of the participating fund.

In addition, the maximum payout for ADB under the Manulife IncomeGen as well as any other policies that cover the same insured is $1,500,000.

Terminal Illness (TI) Benefit

In a scenario where the insured is diagnosed with a terminal illness (TI) while the policy is active, the insured will receive the TI Benefit in a lump sum in advance.

This benefit only applies if the illness may lead to the insured’s passing within 12 months of diagnosis.

With the TI Benefit, the insured and their loved ones can rest assured knowing that their financial burden can be relieved during the insured’s remaining time.

Change of Life Insured Option

Under the Manulife IncomeGen, you can request a change of life assured.

| Owner | Conditions for Change of Life Insured Option |

| Individual |

|

| Corporation |

|

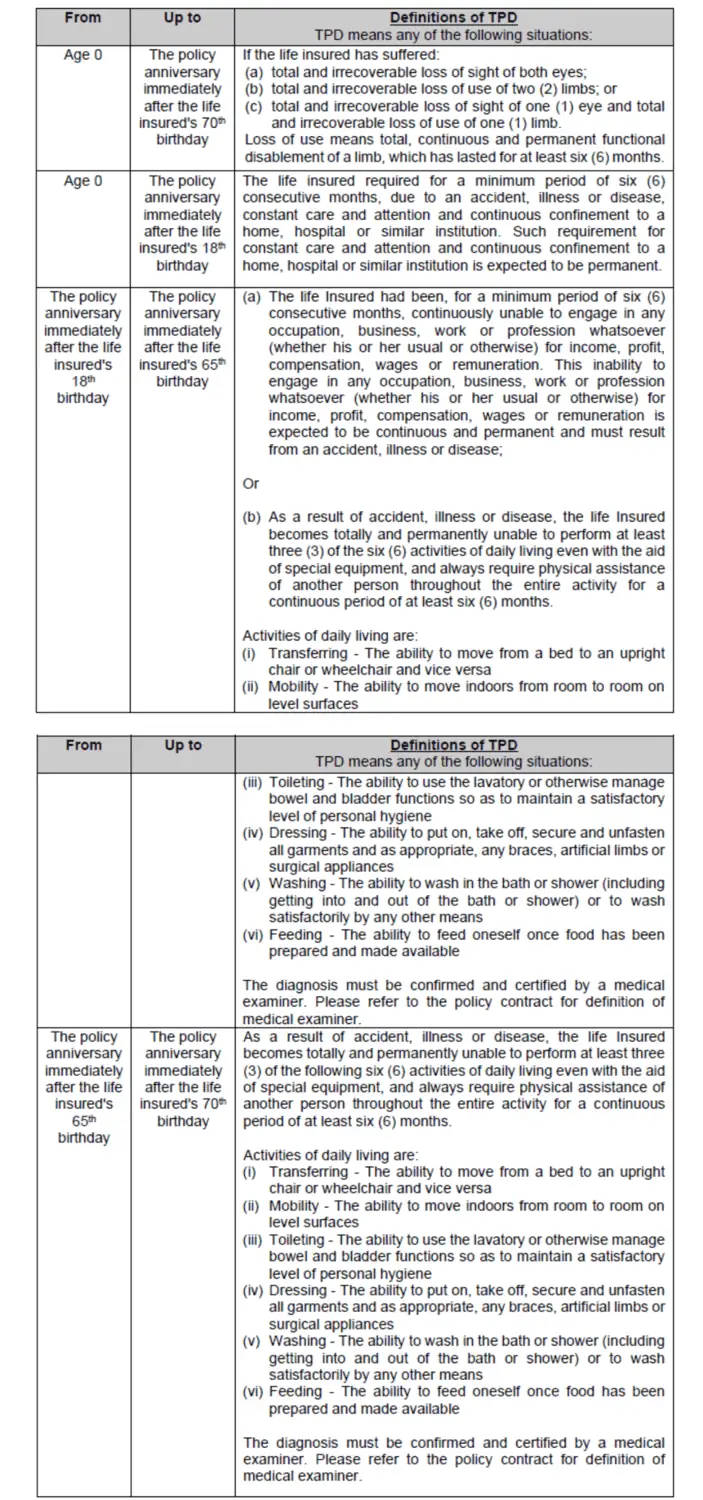

TPD Waiver of Premium

If the insured is diagnosed with a Total and Permanent Disability (TPD) before the premium payment term ends, the insured will receive a waiver for future premium payments.

To claim for this waiver, the disability must last for a minimum period of 6 consecutive months and be confirmed by an appointed medical practitioner.

You may refer to the table below for the classification of TPD at different ages:

Key Features

Monthly Income Benefit

With the Manulife IncomeGen, you will start receiving a Monthly Income Benefit starting from the end of the 49th or 61st policy month, depending on the payment term that you have chosen.

This Monthly Income Benefit consists of a guaranteed amount and a non-guaranteed amount.

You can opt to receive the Monthly Income benefit in the form of cash or accumulate it at an interest rate of 3.00% per year.

Guaranteed Monthly Income:

The guaranteed monthly income you will receive is calculated by taking 0.81% of the sum insured and dividing it by 12.

Non-Guaranteed Monthly Income:

Based on an illustrated investment rate of return of 4.25% per year, the non-guaranteed monthly income is calculated by taking 2.43% of the sum insured and dividing it by 12.

Maturity Benefit

On the policy anniversary immediately after your 120th birthday and the policy is still in force, the Maturity Benefit payable will be the sum of the components listed below.

- The guaranteed surrender value as of the maturity date;

- The maturity bonus (if any); and

- Any accumulated monthly income with interest

The maturity bonus is an additional non-guaranteed amount which depends on the performance of the policy.

Any outstanding amounts owed to Manulife, such as policy loans or unpaid premiums, will be deducted from the Maturity Benefit.

Upon payment of the maturity benefit, the policy will be terminated.

Surrender Benefit

After making premium payments for at least 2 policy years, you are eligible to receive a surrender benefit when you surrender the policy. The surrender benefit consists of the sum of:

- The guaranteed surrender value;

- The non-guaranteed surrender bonus (if any); and

- Any accumulated monthly income with interest (if not previously withdrawn)

Any outstanding amounts owed to Manulife will be deducted from the surrender benefit.

Bonuses

Surrender Bonus

A surrender bonus, which is expressed as a percentage of the sum insured, may be payable if you surrender the policy after the start of the 3rd policy year.

It is important to note that you will not be eligible for the surrender bonus if you surrender the policy within the first 2 years.

Claim Bonus

A claim bonus, which is expressed as a percentage of the sum insured, may be payable when you claim the policy.

Maturity Bonus

Upon the maturity of the policy, a maturity bonus, which is expressed as a percentage of the sum insured, may be payable.

Manulife IncomeGen Fund Performance

Current Asset Mix

As a whole, the fund’s current asset allocation closely aligns with its target allocation.

Bonds from the government and corporate sectors make up the fixed-income portion of the portfolio, which covers the bulk of the guaranteed bonuses.

Equities such as stocks and real estate investments are included to generate higher returns, specifically to support non-guaranteed bonuses.

Money-market instruments and cash also form part of the portfolio.

The following table shows the strategic and actual asset allocation for the invested participating fund.

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Fixed-Income | 70 | 74 |

| Equities | 27.5 | 26 |

| Property | 2.5 | 0 |

| Total | 100% | 100% |

By diversifying the fund’s investments across different asset classes, Manulife aims to balance the stability provided by fixed-income assets with the growth potential offered by equities and real estate.

Using this approach, they are able to manage risk, maintain the fund’s financial stability, and generate enhanced returns to support participating policies’ non-guaranteed benefits.

Investment Rate of Return

As this Participating Sub-Fund was only established in April 2021, historical investment rates for their participating funds are unavailable.

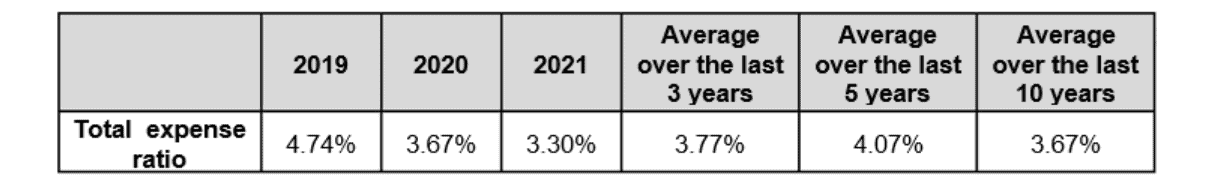

Total Expense Ratio

By examining the total expense ratio, you can gain insight into how the participating fund’s cost structure may affect the policy’s overall performance.

An expense ratio measures how much of a fund’s total expenses it incurs in relation to its assets.

When paying for your policy premiums, an expected level of expense is already factored into the premium amount.

As a result, these expenses are not an additional cost to you.

In some cases, however, if the actual level of expenses deviates significantly from the expected level, it may affect the non-guaranteed benefits you can receive.

Accurate as of 31 December 2021.

To compare Manulife’s TER against other companies, we can take a look at the table below:

It is evident that Manulife has a much higher TER compared to the industry standard.

While this means that other companies offer participating funds with lower TERs, it is important that you consider the features of the policies of those companies to find one that best suits your needs.

Manulife IncomeGen Fees and Charges

Fees and charges are incurred for the proper functioning of the participating fund and the provision of the associated policies.

They contribute to covering the costs of operations, ensuring compliance with regulations, and supporting the overall management and growth of the fund.

These expenses include, but are not limited to:

- Commission and Override Commission: These are fees paid to agents or intermediaries who sell the participating policies.

- Investment Fees: These fees are paid to the fund managers who handle the management services of the participating fund, including making investment decisions.

- Marketing and Advertising Fees: These fees cover the costs associated with promoting and distributing the participating policies.

- Administration Fees: These fees are related to the administrative tasks involved in new business underwriting and policy renewals.

- Employee Salaries and Allowances: This includes the expenses associated with employee compensation and benefits for the staff involved in managing the participating fund.

- Professional and Regulatory Fees: These fees cover the costs of legal services, auditing, consulting, and other regulatory requirements.

- Tax: This includes any applicable taxes imposed on the participating fund.

- Overhead Expenses: These are general operating expenses such as office rental, utilities, and equipment rental.

Illustration Of How Manulife IncomeGen Works

Meet Catherine, a 50-year-old who purchased Manulife IncomeGen to enhance her retirement income.

Here’s a quick breakdown of how she can benefit from the Manulife IncomeGen over the years!

Premium Payments

To secure this plan, Catherine pays an annual premium of $20,000 over a period of 5 years.

Monthly Income Benefit

In the 6th year of the policy, Catherine starts receiving a monthly income of $270. This monthly income is made up of a guaranteed amount of $67.50 and a non-guaranteed amount of $202.50.

The guaranteed amount is the minimum that Catherine will receive, while the non-guaranteed amount may fluctuate depending on the performance of the participating fund.

Change of Life Insured Option

When Catherine reaches the age of 75, she decides to transfer the Manulife IncomeGen to her daughter, Ashley, who is 40 years old at that time.

Ashley becomes the new insured and continues to receive the same monthly payout that Catherine has received for the next 45 years.

Maturity Benefit

The policy reaches maturity in its 70th year, as Catherine would have reached the age of 120.

In this case, Ashley receives a lump sum maturity benefit of $116,077, which also serves as the final payout from the policy.

Here’s a table summarising the benefits received from the Manulife IncomeGen plan.

| Policy Year | Event | Benefit $ |

| 0 | Catherine purchases the policy | – |

| 5 | Completion of premium payment | – |

| 6 | Catherine starts receiving a monthly income of $270 ($67.50 guaranteed + $202.50 non-guaranteed) for 20 years | 64,800 |

| 25 | Catherine transfers the policy to Ashley | – |

| 25-70 | Ashley becomes the new policy owner and receives monthly payouts for the next 45 years | 145,800 |

| 70 | Policy reaches maturity based on Catherine’s initial age when she took out the policy | – |

| 70 | Ashley receives a potential maturity benefit as a lump sum | 116,077 |

| Total Benefits | 326,677 | |

Summary of Manulife IncomeGen

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes, waiver |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |