Are you looking for ways to support your parents’ healthcare needs?

Topping up their Medisave account is a great way to ensure they have sufficient funds for medical expenses.

In this post, we will guide you through the simple steps of how to top up Medisave for your parents, ensuring their peace of mind and access to quality healthcare.

Why Top Up Medisave for your Parents

Medisave is a national medical savings scheme designed by the Ministry of Health to set aside a portion of your income to pay for any medical needs.

With longer life expectancy and rising healthcare costs, saving up for your parents’ health security is growing ever more important.

Here are 6 key reasons why you should top up your parents’ Medisave accounts:

Grow Their Healthcare Savings

By depositing money into their Medisave accounts, your parents’ healthcare savings will grow with an up to 5% compounded annual interest rate.

For some context, if you top-up $1,000 per year into their accounts, you would have accumulated over $5,500 over 5 years with only $5,000 of your money invested.

This acts as a form of safety net or security for your parents, and regular top-ups will ensure that their healthcare savings grow at a steady rate.

More healthcare savings prepare your parents for rainy days when they may need money to pay for their healthcare expenses.

Furthermore, if you support your parents financially, this allows you to have less of a financial burden when their healthcare expenses are high.

These healthcare expenses can include hospitalisation, repeated treatment, insurance premiums, and palliative care, all of which will be discussed in further detail.

This brings us to our next use for Medisave, paying for healthcare expenses.

Paying for Healthcare Expenses

In the unfortunate event that your parents need to be hospitalised, they can withdraw up to $550 from their Medisave for their first 2 days in the hospital, with $400 for each subsequent day.

For those who require long-term care needs, Singaporeans above 30 years old who are severely disabled can withdraw $200 a month from their Medisave to pay for their care needs.

For repeated treatments such as renal dialysis, Singaporeans can also withdraw up to $450 a month to ease the burden of accumulated expenses.

Cancer patients may withdraw up to $1,250 monthly to pay for chemotherapy.

Covered Screenings and Scans

In addition, your parents can spend up to $700 per year on medical screenings to help detect medical conditions early and treat them effectively.

On top of this, Medisave withdrawals of up to $300 per year can also be used to pay for scans such as CT or MRI scans.

Screenings and scans are crucial to your parents’ health, as they assist in detecting potential health disorders in patients who may not have developed symptoms just yet.

Palliative Care

For patients who are unfortunately in palliative care, they may use up to $350 per day from their Medisave account to pay for any relevant palliative expense at approved hospices.

This eases the financial burden on loved ones who may be paying for their costly healthcare expenses.

Pay for their Insurance Plans

Firstly, Medisave savings can be used to pay for your parents’ insurance premiums, namely those of Medishield Life, Integrated Shield Plans, ElderShield, and CareShield Life.

Here’s a table which outlines the uses of each plan:

| Plan: | Uses & Parameters: |

| MediShield Life | – Basic health insurance plan.

– Covers large hospital bills for hospitalisation or day surgery. – Covers expensive, recurring outpatient treatment such as kidney dialysis, cancer drugs, and radiotherapy. – Provides long-term care through coverage of costs incurred in community hospitals and inpatient palliative care services. |

| Integrated Shield Plans (IP) | – Combines MediShield Life with additional private insurance provided by a private insurer.

– Can only pay for IP premiums up to the Additional Withdrawal Limits. |

| ElderShield | – Long-term care insurance scheme targeted at severe disability, especially for the elderly.

– Eligibility depends on a few assessed factors such as mobility and washing ability of applicants. – Cash payouts of $300 or $400 per month provided, for up to 5 or 6 years, depending on the plan type. |

| CareShield Life | – Long-term care insurance scheme, offering financial support and monthly cash payouts for those with severe disability.

– Lifetime cash payouts starting at $600/month and increasing over time. – Monthly payouts continue as long as the applicant is unable to do at least 3 of the Activities of Daily Living (ADLs). |

Build on Government Top-ups

It’s also important to note that the government has introduced a few schemes to support our elderly through Medisave.

One of the more recent government Medisave benefits would be the $270 million top-up for Pioneer Generation (born before 1950) and Merdeka Generation (born from 1950 to 1959) Singaporeans.

This table shows the amount of government top-ups which your Pioneer Generation parents will receive annually, depending on their age:

| Year of Birth | No serious pre-existing condition | With serious pre-existing condition |

| Born before or in 1934 | $900 | $1,100 |

| Born in 1935 – 1939 | $700 | $750 |

| Born in 1940 – 1944 | $500 | |

| Born in 1945 – 1949 | $250 | |

For those of you whose parents fall under the Merdeka Generation, they would have received $200 Medisave government top-ups over the last 5 years.

As such, topping up on the government contributions will have your parents grow even greater accumulated savings through the effect of compounding interest.

How to Top Up Your Parents’ Medisave Accounts: 3 Simple Steps

So here it is! Follow these 3 simple steps to top up your parents’ Medisave accounts.

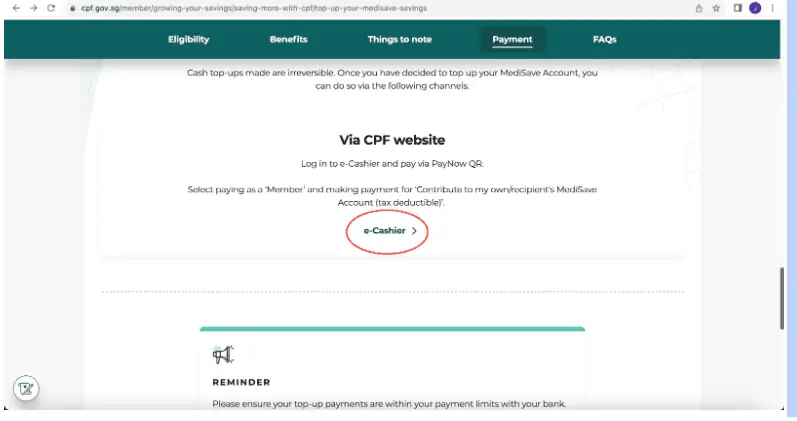

Step 1: Open the E-cashier in the CPF Website

Head over to the CPF website, then scroll down to find the e-Cashier link, which should look like this:

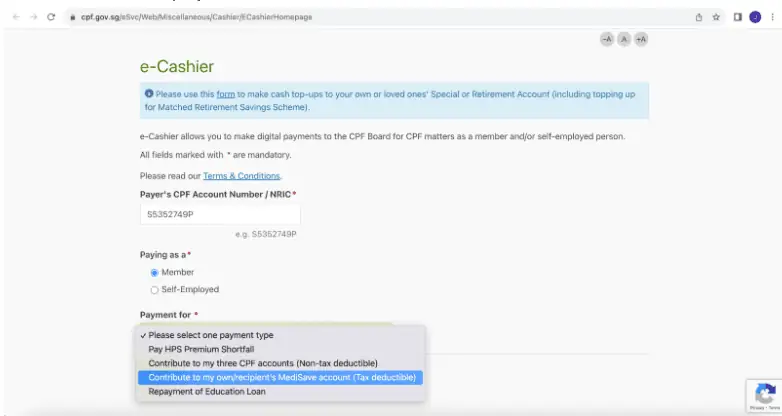

Step 2: Key in Your Details

Once you’re in the e-Cashier, you’ll be prompted to key in your NRIC.

Do note that for this portion, even though you’re topping up your parent’s account, you should still be keying in your own NRIC, not theirs.

As for the Member or Self-Employed Option, click on the respective field which best describes you.

If you’re uncertain which category you fall into, this page shows the conditions for being considered a self-employed individual and the different benefits that come with it.

Click on the drop-down option under “Payment For” and select the “Contribute to my own/recipient’s MediSave account (Tax deductible)” option.

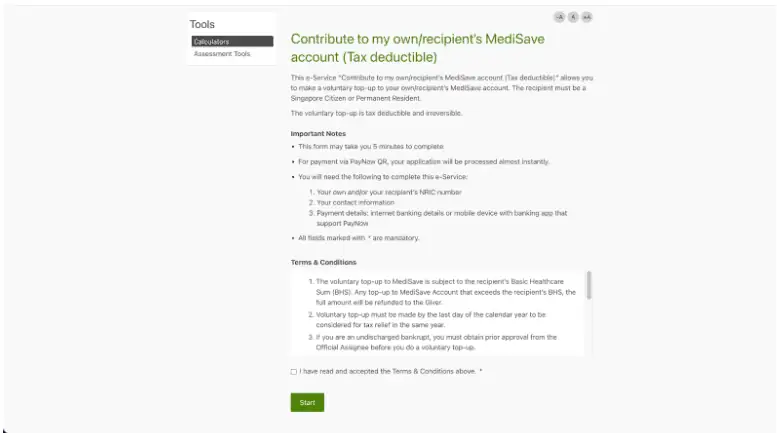

Step 3: Fill up the Medisave Top-up Form

Upon clicking “Next”, the CPF website will bring you to the next page, which has some terms and conditions for you to note before you begin the process of topping up.

Here are a few things which you’ll need to prepare before filling out the form:

- Your parent’s NRIC Number (in the previous page, you used your own NRIC, but do remember to input your parent’s NRIC here)

- Your contact information

- Your payment details (this can be internet banking details or a mobile device with a banking application that’s linked to PayNow)

This form is straightforward and will take about 5 minutes to complete.

Additional Things to Note

A few technicalities are surrounding Medisave top-ups, which I’ll quickly break down for you.

If you are an undischarged bankrupt, you’ll need to gain approval from your Official Assignee to top-up your parent’s Medisave account.

Secondly, top-ups are only for Singaporeans and Permanent Residents, meaning both you and your parents must be Singaporeans or PRs for you to be able to top up their accounts.

Lastly, you must be at least 16 years old to top up your or your parents’ Medisave account!

Final Words

So that’s it! Your comprehensive guide for how to top up your parents’ Medisave accounts.

I want to reiterate that saving up for your parents’ potential health expenses is really important with rising healthcare costs.

That being said, Medisave is one of the ways you can do that for your parents.

Check out our other articles for more ways to secure your parents’ health expenditures and I hope this article has been useful to you!

References

- https://www.moh.gov.sg/healthcare-schemes-subsidies/medisave

- https://www.healthhub.sg/a-z/costs-and-financing/12/medisave

- https://www.iras.gov.sg/taxes/individual-income-tax/basics-of-individual-income-tax/tax-reliefs-rebates-and-deductions/tax-reliefs/compulsory-and-voluntary-medisave-contributions

- https://www.mof.gov.sg/news-publications/press-releases/pioneer-and-merdeka-generation-seniors-to-receive-270-million-in-medisave-top-ups-in-july-2022

- https://www.cpf.gov.sg/member/growing-your-savings/saving-more-with-cpf/top-up-your-medisave-savings

- https://www.cpf.gov.sg/member/healthcare-financing/medishield-life

- https://www.cpf.gov.sg/member/healthcare-financing/getting-supplementary-coverage

- https://www.cpf.gov.sg/member/healthcare-financing/eldershield

- https://www.cpf.gov.sg/member/healthcare-financing/careshield-life

- https://www.cpf.gov.sg/member/infohub/educational-resources/10-uses-of-medisave