Great Eastern’s Prestige Life Rewards 6 (SGD) is a single premium participating whole life insurance plan designed to offer comprehensive protection and financial benefits.

One of its key features is the provision of lifetime monthly payouts, starting from the 13th policy month – ensuring a consistent income stream for policyholders.

The plan also provides financial protection in the unfortunate event of death or terminal illness, ensuring adequate protection.

Here’s our review of Great Eastern’s Prestige Life Rewards 6 (SGD).

My Review of the Great Eastern Prestige Life Rewards 6 (SGD)

Great Eastern’s Prestige Life Rewards 6 (SGD) is a noteworthy contender in the single premium participating whole life insurance plans space.

Here’s a closer look at what makes this policy a potential cornerstone of your financial planning.

Key Features That Benefit You

Lifetime Monthly Payouts: Starting from the 13th policy month, you’re entitled to monthly payouts for life. This feature is particularly attractive as it promises a consistent income stream, which is crucial for long-term financial planning and stability in retirement.

Flexibility in Managing Payouts: The policy offers the flexibility to either withdraw your monthly payouts or accumulate them with Great Eastern to potentially earn non-guaranteed interest. This adaptability allows you to tailor the policy to your changing financial needs over time.

Comprehensive Protection: Beyond its investment benefits, the plan serves as a robust safety net, offering substantial coverage in the event of death or terminal illness. This ensures that your loved ones are financially protected, providing peace of mind.

Bonuses to Enhance Your Returns: The policy includes both guaranteed and non-guaranteed bonuses, adding a layer of potential upside to your investment. The cash bonus, declared yearly, and the terminal bonus, payable under specific conditions, can significantly enhance the policy’s value over time.

Considerations Before Committing

Single Premium Commitment: The requirement for a single premium payment means a significant upfront financial commitment. This may not be suitable for everyone, especially those who prefer spreading their investment over time or have liquidity concerns.

Surrender Costs: Early surrender of the policy comes with high costs, potentially resulting in a surrender value that is less than the total premiums paid. This makes it crucial to view this policy as a long-term commitment rather than a short-term investment.

Participating Fund Performance: While Great Eastern’s participating fund has shown above-average performance, it ranks 4th out of 8 when compared to its peers. For those prioritising the highest possible returns, exploring other options or insurers with a stronger performance record might be advisable.

Given the long-term nature and significant financial commitment associated with Great Eastern’s Prestige Life Rewards 6 (SGD), weighing its benefits against your financial goals and circumstances is essential.

If you’re seeking a combination of lifetime income, financial protection, and the potential for enhanced returns through bonuses, this policy could be a fitting addition to your financial portfolio.

However, it’s equally important to compare this plan with other available options.

The insurance market is diverse, with many products offering varying benefits, coverage levels, and investment potentials.

Consulting with an unbiased financial advisor can provide personalised insights and help you navigate these choices effectively.

Moreover, regardless of how appealing Prestige Life Rewards 6 (SGD) may seem, always consider getting a second opinion or comparing it with other policies.

The financial landscape is complex, and what works for one individual may not be the best fit for another.

If you’d like to tailor a financial strategy based on your future goals, we partner with unbiased financial advisors who have helped thousands of our readers and are happy to assist you with this too!

Click here for a non-obligatory chat.

Here’s more on what the Great Eastern Prestige Life Rewards 6 (SGD) has to offer:

General Features

Premium Terms

The Great Eastern Prestige Life Rewards 6 (SGD) is a single premium policy.

The exact premiums you have to pay depend on your age, sum assured, gender, and many other factors at the time of your application.

Policy Term

The policy term for the Prestige Life Rewards 6 (SGD) is defined as “Whole of Life.”

This means that the coverage and benefits of the insurance plan extend throughout the your entire lifetime.

Protection

Death Benefit

The Great Eastern Prestige Life Rewards 6 (SGD) provides a Death Benefit based on the age of the life assured at entry:

For ages 75 and below at entry:

In the unfortunate event of the life assured’s death, the benefit paid is 105% of the standard single premium plus attaching bonus (if any), less any debt.

For ages 76 and above at entry:

If the life assured’s age at entry is 76 or above, the Death Benefit is 101% of the standard single premium plus attaching bonus (if any), less any debt, upon the life assured’s death.

This benefit provides financial support to the designated beneficiaries upon the passing of the life assured, ensuring a payout that reflects the premium paid and any accrued bonuses.

Terminal Illness Benefit

The Prestige Life Rewards 6 (SGD) includes a Terminal Illness Benefit.

If the life assured is definitively diagnosed with an illness expected to lead to death within 12 months of the diagnosis, the death benefit will be paid in one lump sum.

This benefit provides financial assistance during a challenging time, offering support when the life assured is facing a terminal illness.

Key Features

Lifetime Monthly Payout

Great Eastern’s Prestige Life Rewards 6 offers a lifetime monthly payout (Guaranteed Survival Benefit Payout) from the 13th to 24th policy month.

Starting from the 25th policy month (2nd policy anniversary) onward, monthly payouts continue until a claim is admitted or the plan is terminated, whichever occurs earlier.

The payout comprises the Guaranteed Survival Benefit and 1/12 of the yearly cash bonus.

You can either withdraw these payouts or keep them to earn non-guaranteed interest.

If you owe Great Eastern any money at the time of payout, the payouts are utilised first to reduce any outstanding debt.

The remaining balance is then paid to you.

Survival Benefit (Monthly Income)

The Survival Benefit, also called the monthly income, is a guaranteed payout provided by Prestige Life Rewards 6 (SGD).

It is payable at the end of each policy month, starting from the 13th policy month onwards, as long as the life assured survives and until a claim is admitted or the plan is terminated, whichever occurs earlier.

The exact amount depends on each policy, so make sure to check your policy documents.

Bonuses

The plan offers both guaranteed and non-guaranteed benefits.

Guaranteed benefits, which include already declared bonuses, are paid regardless of the participating fund’s performance.

Non-guaranteed benefits come in the form of future bonuses, dependent on the fund’s performance.

There are 2 primary types of bonuses in this plan:

Cash Bonus

It is declared yearly starting from the 2nd policy anniversary, and once declared, the cash bonus becomes guaranteed.

The cash bonus and the survival benefit are divided into 12 monthly instalments, paid out at the end of each month over the next 12 policy months.

Terminal Bonus

A one-time bonus is payable upon the occurrence of the following events:

- Death of the life assured.

- Diagnosis of terminal illness for the life assured.

- Surrender of the policy.

The terminal bonus is usually reviewed yearly.

Surrender Value

The surrender value is the amount you will pay if you decide to surrender your policy after the single premium has been paid.

It’s important to note that surrendering the policy before its maturity usually incurs high costs.

The surrender value, if any, payable to you may be zero or less than the total premiums you have paid into the policy.

Similarly, the surrender value varies from policy to policy, so check your policy documents for the exact amount.

Participating Fund Performance

Asset Allocation

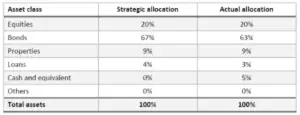

The fund practises diversification by primarily investing in equities, fixed-income, and alternative asset classes.

As of December 31, 2022, the actual investment mix and strategic asset allocation for the year 2023 are as follows.

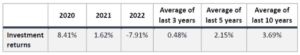

Investment Rate of Return

The past investment rates of return for the Participating Fund, considering deducted investment expenses, are outlined below:

It’s important to note that historical investment rates of return, while providing insight into past performance, may not accurately predict future incomes.

When examining participating funds, it’s best to examine their geometric average and compare it to the industry average.

We’ve compiled all the geometric returns for major life insurers in Singapore in the table below:

| Insurer | Geometric Mean | 3-Year Geometric Mean (2020-2022) | 5-Year Geometric Mean (2018-2022) | 10-Year Geometric Mean (2013-2022) | 15-Year Geometric Mean (2008-2022) |

|---|---|---|---|---|---|

| AIA | 3.88% | 0.25% | 1.88% | 3.33% | 3.53% |

| Etiqa | 4.17% | - | - | - | - |

| Great Eastern | 4.14% | 0.48% | 2.15% | 3.69% | 3.43% |

| HSBC Life | 2.80% | -4.24% | -0.58% | 1.59% | 1.99% |

| Manulife | 4.65% | 1.17% | 2.74% | 3.17% | 3.65% |

| NTUC Income | 4.49% | 2.84% | 3.74% | 4.09% | 3.58% |

| Prudential | 3.62% | -3.50% | -0.26% | 2.82% | 2.64% |

| Singlife | 3.57% | -1.79% | 0.65% | 2.37% | 2.82% |

| Tokio Marine | 4.22% | -3.54% | -0.22% | 2.10% | 2.43% |

As you can see, Great Eastern’s participating fund has an above-average performance against the industry mean.

However, they’re ranked 4/8, with better performance coming from insurers like NTUC Income and Manulife.

So if high returns are something you’re looking for, you might have better results elsewhere.

Total Expense Ratio

The Participating Fund incurs various expenses related to investment, management, distribution, taxes, and other operational costs.

Below are the past Total Expense Ratios for this participating fund:

However, it’s important to note that if the actual expenses significantly deviate from the expected level, it may impact the non-guaranteed benefits you could receive.

Comparing the total expense ratios across insurers, Great Eastern’s funds are performing below the industry average (or should we say above average?) – which is a good thing.

| Insurer | AIA | Etiqa | Great Eastern | HSBC Life | Manulife | NTUC Income | Prudential | Singlife | Tokio Marine | Industry Average |

|---|---|---|---|---|---|---|---|---|---|---|

| Average Expense Ratio | 1.54% | 6.56% | 1.68% | 4.44% | 3.99% | 0.90% | 2.78% | 2.64% | 0.95% | 2.83% |

| 2016 | 1.70% | - | - | - | - | - | - | - | - | 1.70% |

| 2017 | 1.60% | 5.32% | 1.82% | 8.45% | 4.98% | 0.81% | 2.99% | 2.54% | 1.35% | 3.32% |

| 2018 | 1.70% | 8.07% | 1.59% | 5.55% | 4.88% | 0.85% | 2.95% | 2.58% | 1.33% | 3.28% |

| 2019 | 1.70% | 7.46% | 1.71% | 4.84% | 4.74% | 0.83% | 2.92% | 2.80% | 1.06% | 3.12% |

| 2020 | 1.50% | 5.40% | 1.20% | 3.72% | 3.67% | 0.82% | 2.50% | - | 0.74% | 2.44% |

| 2021 | 1.40% | - | 2.02% | 2.20% | 3.30% | 1.01% | 2.67% | - | 0.63% | 1.89% |

| 2022 | 1.20% | - | 1.74% | 1.88% | 2.35% | 1.07% | 2.65% | - | 0.58% | 1.64% |

Summary of Great Eastern’s Prestige Life Rewards 6

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits | Yes |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | N/A |

| Terminal Illness | Yes |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |