The Great Eastern LifeSecure is a disability income insurance plan designed to provide lifetime monthly benefits to offset the hardships of long-term disability resulting from illness or injury.

Here’s our review of it.

My Review of the Great Eastern LifeSecure

Great Eastern’s LifeSecure offers comprehensive benefits to provide financial support and security during times of disability.

Its flexibility, specialised support for juveniles, and premium waiver make it a valuable addition to your current insurance policies.

Suppose you or a loved one acquires a disability, this plan covers you for various scenarios, which will step in and counteract any financial difficulties resulting from the unforeseen situations you may find yourself in.

With its flexible options, including a waiting period for disability claims caused by accidents, coverage for children’s specialised needs, and well-defined exclusions, LifeSecure offers peace of mind to you as a policyholder and your family should you pass on.

While the plan’s contract should be reviewed for specific terms and conditions, this disability insurance plan is designed to provide financial support during challenging times.

Whether as a stand-alone plan or a rider attached to selected whole-life plans, LifeSecure demonstrates Great Eastern’s commitment to offering accessible, affordable, and dependable protection for Singaporeans seeking to secure their financial future.

Great Eastern’s LifeSecure disability income plan is a reliable and comprehensive solution for individuals seeking to safeguard their financial well-being in the face of unexpected disability.

But before purchasing a disability income plan, arguably one of the least important policies, you should cover yourself for total and permanent disability (TPD) via a term life insurance plan or a whole life policy first.

If you haven’t already, then a CareShield Life supplement is another essential to get on top of your CareShield coverage.

This makes sure that your family is immediately protected should you face a severe disability.

Only then will disability income insurance make sense in your overall insurance coverage.

Of course, there are also other alternatives in the market, and you don’t have to stick to the Great Eastern LifeSecure.

Given that you’ll rely on this plan for income when you’re disabled, it’s best to take some extra effort to research the best one for yourself.

So make sure to explore your other choices and get a second opinion from an unbiased financial advisor as to whether the Great Eastern LifeSecure is truly the best policy for you.

We partner with MAS-licensed financial advisors who’ve helped hundreds of our readers compare policies, explore alternative solutions, and second opinions as to whether a policy is for them.

If you’re interested in this, we can connect you to them all for free!

Click here for a free non-obligatory chat.

Let’s now dive deeper into what the Great Eastern LifeSecure offers.

Criteria

- Must be a Singaporean citizen or a Permanent Resident.

- Must have acquired a disability confirmed by a registered medical professional

General Features

Premium Terms

The Great Eastern LifeSecure’s premiums depend on gender, smoking status, occupation, and sum assured.

You can choose between monthly, quarterly, bi-annually, or yearly premium payments – and these will last for as long as the policy is active.

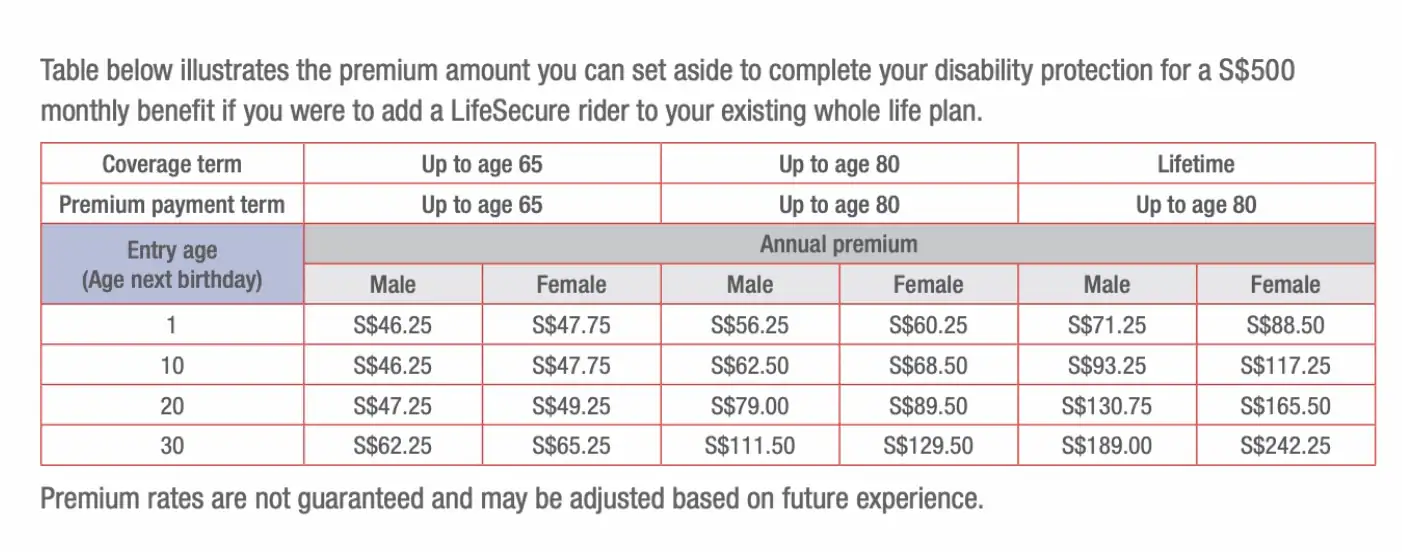

Here are the premiums for the Great Eastern LifeSecure if you are looking for a $500/month monthly benefit as a rider on your whole life plan:

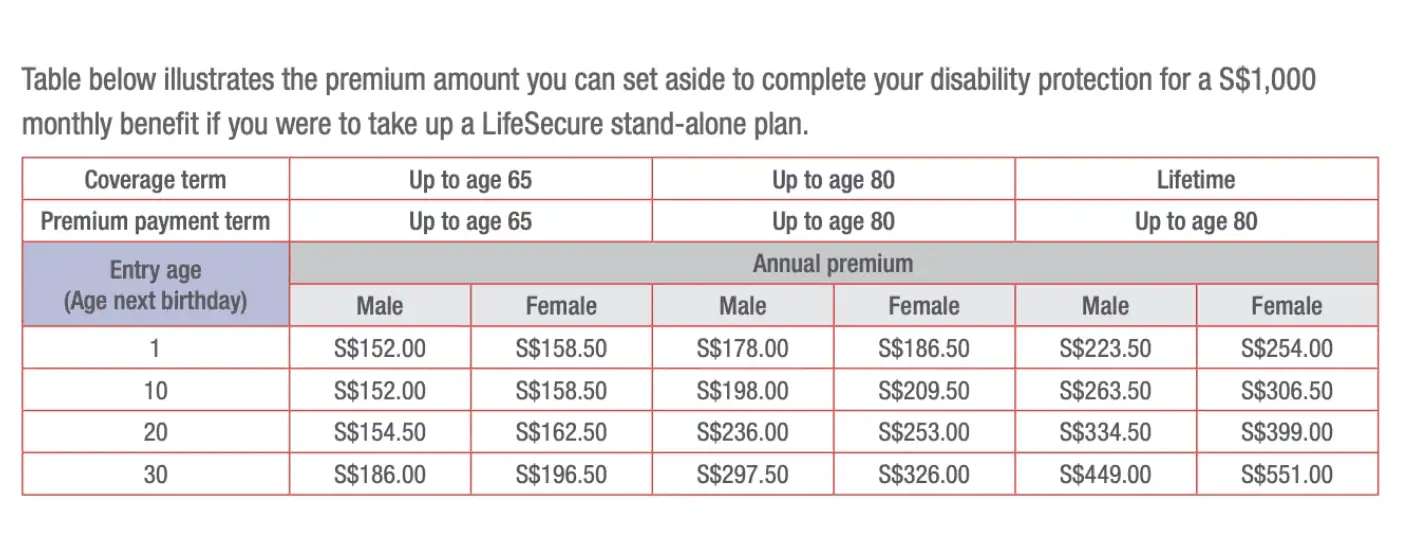

Here are the premiums for the Great Eastern LifeSecure if you are looking for a $1,000/month monthly benefit as a standalone plan:

Policy Term

The Great Eastern LifeSecure can be purchased as a stand-alone plan or as a rider attached to the whole life plan.

It offers the following options:

- Coverage for the whole of your life with premiums payable up to the plan anniversary immediately before you reach the age of 80.

- Coverage up to age 80 with premiums payable up to the plan anniversary immediately before you reach age 80.

- Coverage up to age 65 with premiums payable up to the plan anniversary immediately before age 65.

Here are the whole life plans offered by Great Eastern:

Protection

Please see the Disability Definiton Age table illustration below.

| Disability Definition Age | Disability Definition Age at Which Disability Definition is Applicable on the commencement of the Disability |

| Activities of Daily Living Disability (ADL) | Age 17 next birthday and above |

| Total & Permanent Disability (Juvenile) | Below Age 17 next birthday |

| Total & Permanent Disability (Occupational) | Between and inclusive of age 17 next birthday to age 64 next birthday |

| Total & Permanent Disability (Presumptive) | All Ages |

On the plan anniversary preceding the commencement of disability, if it satisfies more than 1 Disability Definition, Great Eastern shall only pay under 1 Disability Definition.

Activities Of Daily Living Benefits

This benefit assists you if you cannot perform at least 2 activities of Daily Living (ADLs), even with the use of special equipment and always require another person to help you throughout the activity.

The 6 Activities of Daily Living are as follows:

- Ability to dress yourself

- Ability to feed yourself

- Ability to move around and be mobile by yourself

- Ability to go to the toilet by yourself

- Ability to move from a bed to an upright chair or wheelchair, and vice versa

- Ability to wash yourself and maintain good hygiene

There is a Deferment period of 90 days from the claim date (inclusive) for the ADL Disability.

Total & Permanent Disability (Juvenile).

This refers to Total & Permanent Disability suffered due to accident or

sickness to such an extent that you must be confined to a home, hospital, or

other institutions to receive constant care and medical attention.

The Total & Permanent Disability (Juvenile) must be deemed permanent by a registered medical practitioner.

There is a Deferment period of 180 days from the claim date (inclusive) for the Total & Permanent Disability (Juvenile).

Total & Permanent Disability (Occupational)

This refers to Total & Permanent Disability suffered due to accident or

sickness to such an extent that there is no occupation whatsoever that you can

perform.

The Total & Permanent Disability (Occupational) must be deemed permanent by a registered medical practitioner.

There is a Deferment period of 180 days from the claim date (inclusive) for the Total & Permanent Disability (Occupational).

Total & Permanent Disability (Presumptive)

Presumptive disability means a disability in which, due to accident or sickness, you suffer from a state of incapacity which is Total & Permanent and which takes the form of

- Total & irrecoverable loss of sight in both eyes or

- Total & irrecoverable loss of the use of 2 limbs at or above the wrist or ankle or

- Total & irrecoverable loss of sight in 1 eye and

- Total & irrecoverable loss of the use of 1 limb at or above the wrist or ankle.

Note: No Deferment Period applies to the Presumptive Total & Permanent Disability.

Death Benefit

In the unfortunate event of your passing, the Great Eastern LifeSecure will pay a Death Benefit equal to 3 times of your monthly benefit.

The Death Benefit provides a substantial payout to your beneficiaries, ensuring their financial stability moving forward during difficult times.

Key Features

Monthly Benefit

The Great Eastern LifeSecure will pay a monthly benefit after the relevant Deferment Period until death or until your disability ceases, whichever is the earliest, if you meet any of the disability definitions above.

The monthly benefit ensures financial support with a steady income stream during disability, helping you to cover daily expenses and maintain financial stability.

Payments continue until the disability ceases or in the sad event that you pass away, thereby offering long-term support.

Payback Benefit

Should you be eligible for the Disability Definition, the Great Eastern LifeSecure will pay a lump sum payment based on the type of disability as follows:

- 3 times the monthly benefit for the Assisted Daily Living Disability or

- 6 times the monthly benefit for the Total & Permanent Disability (Juvenile) or

- 6 times the monthly Total & Permanent Disability (Occupational) benefit, provided that you are still disabled.

The lump sum payment offers a significant financial boost during disability.

The benefit structure caters to various types of disabilities, ensuring appropriate support.

No Payback Benefit is payable for the Total & Permanent Disability (Presumptive).

If the Deferment Period is not applicable or waived, no Payback Benefit will be payable.

Out-Of-School Benefit

The Out-Of-School benefit applies to children between the ages of 7 and 16.

It is provided if your child needs to be confined at home or in a hospital due to a disability.

Suppose you are eligible for the Disability Definition under the Total & Permanent Disability (Juvenile) or the Total & Permanent Disability (Presumptive) before the age of 16 and have reached the age of 6.

The Great Eastern LifeSecure will pay a monthly Out-Of-School benefit of $500.

The benefit payment will stop when you reach the age of 16, subject to a minimum payment period of 1 year while you are disabled.

- This benefit is tailored to provide extra financial support for young individuals facing disabilities.

- The Out-Of-School Benefit helps cover educational expenses, ensuring that your child’s education continues despite the disability.

The out-of-school benefit ends when your child reaches the age of 16.

The benefit is subject to a minimum of 12 monthly instalments of the benefit having been paid.

Premium Waiver

With the LifeSecure plan, Great Eastern will waive any premium that falls due while receiving any benefit.

They will refund any premiums paid for the period for which you are entitled to any benefits.

Premium payment will resume after the benefit payments have ceased.

This premium waiver will provide you with peace of mind regarding finances.

Summary of the Great Eastern LifeSecure

| Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |

| Additional Features & Benefits | Yes, Out-Of-School Benefit |