GREAT Hospital Cash is a hospital cash insurance plan that provides daily cash payouts during hospital stays.

In addition, the plan includes a Get Well Benefit payout for hospitalisation and surgery the life assured has undergone.

Moreover, there’s an Emergency Accidental Outpatient Benefit, reimbursing expenses incurred for treatment at a hospital’s Accident and Emergency (A&E) department when treated as an outpatient due to injury.

But is it any good?

Here’s our review of Great Eastern’s GREAT Hospital Cash:

My Review of the Great Eastern GREAT Hospital Cash

Great Eastern’s GREAT Hospital Cash plan is designed to alleviate the financial strain that can accompany hospital stays, offering daily cash payouts and additional benefits for hospitalisation and specific treatments.

Key Features and Benefits

Daily Hospital Cash Benefit: A standout feature of this plan is the daily cash benefit provided for each day of hospitalisation due to illness or injury, up to a maximum of 730 days per hospitalisation. This benefit supports your financial needs during hospital stays, covering incidental expenses or compensating for lost income.

Additional ICU Benefit: For hospitalisations in the Intensive Care Unit (ICU), the plan offers an additional daily cash benefit for up to 60 days. This acknowledges the higher costs and increased financial burden associated with ICU stays.

Get Well Benefit: The Get Well Benefit is a thoughtful inclusion, offering a lump sum payment for hospitalisations that incur at least 3 days of room and board charges, post-surgery hospitalisations, and day surgeries. This benefit can help cover convalescence expenses, aiding in your recovery process.

Emergency Accidental Outpatient Benefit: In cases of emergency outpatient treatment following an accident, this benefit reimburses medical expenses, ensuring that sudden, unforeseen injuries don’t lead to financial distress. It’s important to note that this benefit is subject to specific conditions regarding the nature and severity of the injury.

Considerations

Premium Terms and Discounts: The plan’s premiums are determined by the chosen plan type and the life assured’s age, with various discounts available for renewal, coverage under certain Great Eastern health plans, and for insuring children under 18. These discounts can make the plan more affordable, but it’s crucial to understand the premium structure and how it may change over time.

Policy Term and Renewal: As an annually renewable policy, GREAT Hospital Cash offers flexibility but requires attention to renewal terms and conditions. The ability to renew up to age 75, with renewal applications beyond this age, provides long-term coverage potential, though it’s essential to consider how ageing might affect premium costs and coverage benefits.

Exclusions and Limitations: While the plan offers comprehensive benefits for hospitalisation and specific treatments, it’s important to be aware of exclusions and limitations, particularly regarding the Emergency Accidental Outpatient Benefit. Understanding what is and isn’t covered will help you gauge the plan’s suitability for your needs.

Great Eastern’s GREAT Hospital Cash plan presents a robust option for those seeking financial protection against the costs associated with hospital stays and specific medical treatments.

Its combination of daily cash benefits, additional ICU coverage, and Get Well Benefits provides a comprehensive safety net that can be tailored to individual needs and circumstances.

However, as with any insurance product, it’s crucial to carefully review the policy terms, premium structure, and coverage limitations to ensure it meets your expectations and financial planning objectives.

Comparing GREAT Hospital Cash with other available hospital cash plans can also offer valuable insights, helping you make an informed decision that best suits your healthcare coverage needs.

For those considering this plan, consulting with a financial advisor can provide personalised advice and clarity, ensuring that your choice aligns with your overall financial and healthcare objectives.

If you’d like to compare the GREAT Hospital Cash with other alternatives, we partner with unbiased financial advisors to assist you with this – all at no cost to you.

Click here for a comparison session.

Here’s more about the Great Eastern GREAT Hospital Cash:

Criteria

- Entry age: 1-75 years next birthday

- Ages 76 onwards, apply for renewal only

General Features

Premium Terms

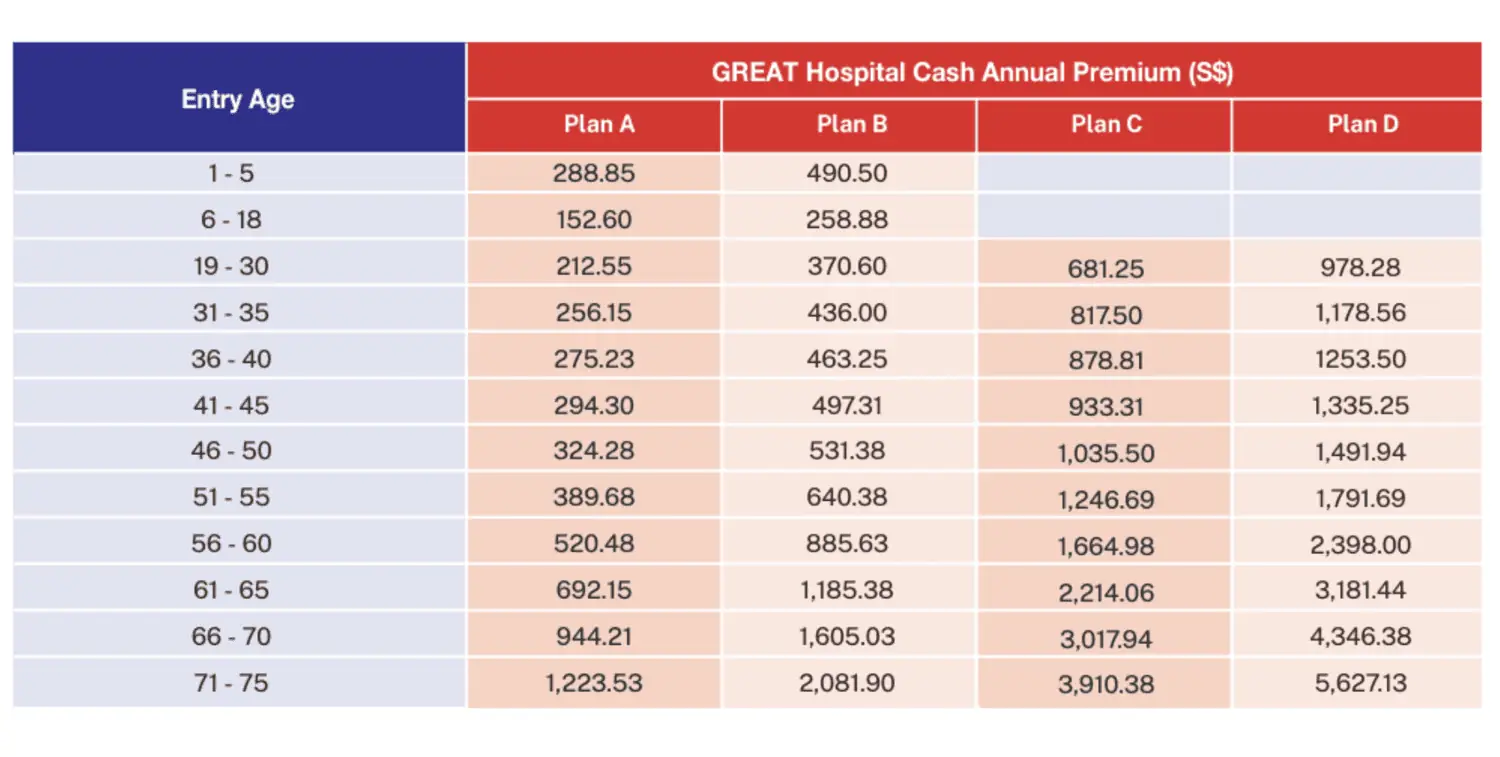

The cost of insurance premiums for GREAT Hospital Cash will be determined by the type of plan selected and the age of the life assured as of their next birthday, starting from the commencement date.

The first-year annual premium rates for GREAT Hospital Cash, as of January 1, 2024, are detailed below.

Premium Renewal

You should also take note of the following premium renewal terms:

- From the second year onwards, a 5% renewal discount is offered each year, regardless of the claim status.

- A yearly 20% discount on GREAT Hospital Cash premiums is available if the Life Assured is covered under plans like GREAT SupremeHealth (As-Charged), GREAT SupremeHealth (Non As-Charged), or GREAT SupremeHealth Standard.

- However, if the GREAT SupremeHealth plan is bought after GREAT Hospital Cash, no premium or renewal discount will be applied to the premiums of GREAT Hospital Cash.

- For parents insuring a child under 18, a 10% Child Discount will be given on the First Year premium if the proposer/policyholder is the child’s parent and is also insured under GREAT Hospital Cash or Supreme MediCash.

Policy Term

The policy is an annual cover renewable before the expiry date.

Key Features

For all benefits to be considered payable, all hospitalisations due to illness or injury must be medically approved and last 12 consecutive hours and above.

Hence, a room and board charge would be incurred concerning the hospitalisation.

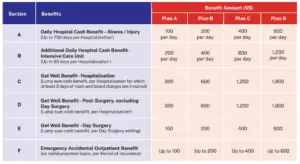

Depending on your chosen plan type, which meets your budget and needs, the summary table below shows the benefits amounts payable under the four available plans as of 1 January 2024.

Daily Hospital Cash Benefit

The Daily Hospital Cash Benefit will be paid for each day you or the life assured is hospitalised in a hospital or a virtual hospital ward by a restructured hospital due to illness or injury.

This benefit is provided for a maximum of 730 days for each hospitalisation.

Additional Daily Hospital Cash Benefit

In addition to the benefits provided by the Daily Hospital Cash Benefit, there is an Additional Daily Hospital Cash Benefit for the Intensive Care Unit (ICU).

This benefit is payable for each day the life assured is hospitalised in an Intensive Care Unit due to illness or injury, with a maximum period of 60 days for each hospitalisation.

If the hospitalisation in an ICU lasts longer than 60 days, it will be considered a hospitalisation in a regular ward.

The benefits will be paid under the standard Daily Hospital Cash Benefit, up to 730 days for each hospitalisation.

Get Well Benefit

The Get Well Benefit is applicable in 3 different situations:

Get Well Benefit for Hospitalisation

Payable for each hospitalisation where you incur at least 3 days of room and board charges due to illness or injury.

This benefit is only paid if the Daily Hospital Cash Benefit or Additional Daily Hospital Cash Benefit for that hospitalisation is also paid.

Get Well Benefit for Post-Surgery (excluding Day Surgery)

Payable for each hospitalisation during which you or the life assured undergoes surgery due to illness or injury.

This benefit is only paid if the Daily Hospital Cash Benefit or Additional Daily Hospital Cash Benefit for that hospitalisation is also paid.

Get Well Benefit for Day Surgery

This is payable for each day of surgery where you or the life assured undergo surgery due to illness or injury in a hospital or day surgery centre without hospitalisation.

The benefit is paid only once if there are 2 or more surgeries in a single-day surgery setting.

This benefit is not paid if the Daily Hospital Cash Benefit or Emergency Accidental Outpatient Benefit is provided.

Emergency Accidental Outpatient Benefit

The Emergency Accidental Outpatient Benefit, provides reimbursement for medical expenses you incur or the life assured if they receive treatment at the hospital’s Accident and Emergency (A&E) department as an outpatient due to injury.

The treatment must be administered within 72 hours of the accident.

This benefit will not be paid if the injury is minor and doesn’t necessitate urgent treatment to prevent death or severe impairment to their immediate or long-term health.

Additionally, where such injuries can reasonably be treated outside a hospital or the A&E, this benefit will not be applicable.

Summary of GREAT Hospital Cash

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |