How would you rate your health today? Would you say it’s good or bad?

If you said ‘good’, then you’re probably not alone. According to the World Health Organization (WHO), nearly half of the global population is overweight or obese.

And over 30% of adults worldwide are living with diabetes.

Healthcare costs are rising at an alarming rate. The WHO estimates that healthcare spending globally will reach US$47 trillion by 2030.

This means that healthcare providers will need to adopt new strategies to ensure they remain profitable.

Let’s not forget Singapore’s ageing population.

Healthcare stocks offer investors a way to profit from the growing demand for better healthcare services.

In this post, we look at 11 healthcare stocks in Singapore.

11 Best Healthcare Stocks in Singapore

- Medtecs International

- First REIT

- UG Healthcare

- Raffles Medical

- Parkway Life REIT

- Clearbridge Health

- Riverstone Holdings

- Thomson Medical Group

- Healthway Medical Corporation

- HAW PAR Corporation

- IHH Healthcare

| Stock | Ticker | Current

Stock Price |

P/E | P/B | Dividend Yield |

| Medtecs International | 546:SI | 0.27 | 0.9953 | 0.5909 | 24.50% |

| First REIT | SGX: AW9U | 0.30 | 7.63 | 0.8 | 8.46% |

| UG Healthcare | SGX:8K7 | 0.27 | 4.92 | 0.799 | 1.48% |

| Raffles Medical | SGX:BSL | 1.31 | 27.65 | 2.66 | 1.53% |

| Parkway Life Real Estate Investment Trust | SGX:C2PU | 4.59 | 8.37 | 1.9 | 2.625% |

| Clearbridge Health | SGX:1H3 | 0.10 | N/A | 1.14 | – |

| Riverstone Holdings | SGX:AP4 | 0.73 | 2.17 | 2.34 | 11.14% |

| Thomson Medical Group Limited | SGX:A50 | 0.085 | 121.43 | 4.5 | 0.18% |

| Healthway Medical Corp Ltd | SGX:5NG | 0.036 | 17.65 | 1.46 | – |

| HAW PAR Corporation Ltd | SGX:H02 | 11.92% | 32.24 | 0.8 | 2.52% |

| IHH Healthcare Bhd | SGX:Q0F | 2.13 | 33.59 | 2.3 | 0.58% |

1. Medtecs International Corporation Limited Stock (546:SI)

Medtecs International Corporation Ltd is an integrated provider of health products and services. In addition, it’s a manufacturer and distributor of medical consumables for hospitals, healthcare distributors, and pharmaceutical companies.

Examples of these products include; gowns, scrub suits, blankets, rectal tubes, bedsheets, or aprons.

The company has been around since 1989 and its head office is in Taipei, Taiwan. Nonetheless, it also distributes medical supplies in the Asia-Pacific region.

Furthermore, it has spread its wings to include Singapore, the US, Hong Kong, Cambodia, China, and the Philippines.

Over the past 5 years, Medtech’s earnings have grown by an impressive 86.7%. Currently, the dividend yield stands at 5.6% which is higher than the industry average of 1.6%.

The chart below illustrates the performance of the share in the past 5 years.

From the chart, it’s clear that there was minimal growth in the share price between 2017 to 2020. However, the price ascended to an all-time high of S$1.61 in August 2020, mainly due to the COVID-19 pandemic when there was a global demand for medical supplies.

Despite this, the share price has been on a downward trend from September 2020 to February 2022. However, there is optimism in the industry since, despite the price decline, the PB ratio is currently at 0.5909 and the P/E ratio 0.9953 which indicates its a potentially undervalued stock.

The share is Contrarian and therefore, in my opinion, the stock is consistently profitable with long-term growth possibilities.

Besides the dividend yield is 24.50% which is favourable should you are looking for dividends.

2. First Real Estate Investment Trust (SGX: AW9U)

One of the best ways to get exposure is to invest in REITs since they are more stable and provide rather consistent dividends.

As the name suggests, First Real Estate Investment Trust is a Singapore-based enterprise in healthcare.

The trust aims to invest in healthcare-related real estate properties in Asia. Besides Singapore, the trust also operates in South Korea and Indonesia.

The REIT operates, develops, and acquires properties like hospitals, residential properties, and restaurants.

As well, the company’s main focus is to develop high-yielding properties in the Asian region. It also considers mergers & acquisitions in its growth strategy.

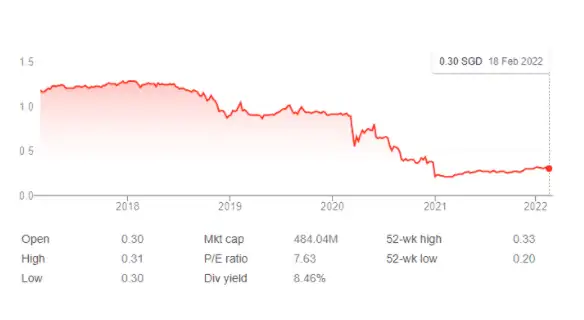

The chart below illustrates the performance of the share in the past 5 years.

The stock’s price is currently at S$0.30 and has been constantly on the decline since 2020.

Despite this, it’s a good value based on the P/B ratio which is currently at 0.8 against the industry average of 0.9. Even though the PE ratio is low, the stock is technically an attractive valuation.

Last year, the REIT paid a dividend of S$0.03 per share. Moreover, its current trailing dividend yield is 8.46%.

Going forward, the trust’s share will go ex-dividend on 18th February 2022 and the next expected payment date is 29th March 2022.

On the whole, the shares fall under the Neutral classification.

3. UG Healthcare Ltd (SGX: 8K7)

UG Healthcare Corporation is based in Malaysia and deals with manufacturing gloves for medical use. The company’s main activity is investment holding.

It has 3 divisions namely, nitrile examination gloves, latex examination gloves, and ancillary products.

Even though it has its command in Malaysia, it also operates in other countries such as the UK, Brazil. China, the US, and Germany.

It trades the gloves under the Unigloves brand. Other things in its trading line include medical disposables, face masks, cleanroom disposable gloves, surgical and vinyl gloves.

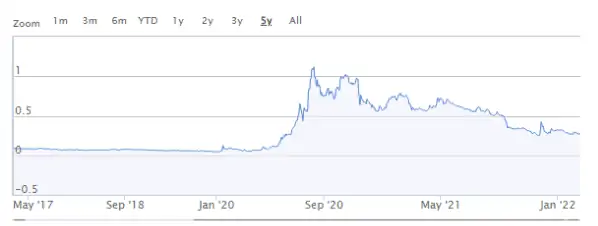

Here is the 5-year performance of the SGX: 8K7 shares.

The shares closed at S$0.28 and had a market capitalisation of S$171.55 million. As for the share price, it worsened by -63.15% in the last year.

Correspondingly, in the same period, it underperformed the FTSE Developed Asia Pacific Index by up to -42.42%.

Even though the price decline was massive, the historical dividend yield based on the trailing 12-month period is 1.48%.

Again it recorded a P/E and PB ratio of 4.92 and 0.7997 respectively which shows its an undervalued stock.

With a declining price, the stock is an excellent option for investors looking to buy.

On the whole, based on its value, the UG Healthcare Ltd stock is a Contrarian which means there’s an opportunity to buy the share below its intrinsic value.

Even though it’s a risk, it’s rewarding in the long term.

4. Raffles Medical Group Ltd Stock ( SGX: BSL)

Raffles Medical Group Ltd is a renowned provider of multiple health services across the region.

The company’s objective is to provide a wide range of medical services starting from primary to tertiary health care.

In Asia, it has over 100 clinics spread across 14 cities and towns in Cambodia, Japan, China, Singapore, and Vietnam.

The company’s health division creates and distributes vitamins, medical equipment, supplements, and nutraceuticals.

Additionally, it has several subsidiaries including Raffles Medical, Raffles Dental, Raffles Health Insurance, Raffles Health, Raffles Healthcare Institute, Raffles Hospital, and Raffles Chinese Medicine.

5-year performance of SGX: BSL

Presently, the share price stands at S$1.31 giving the company a capitalisation of S$2.45 billion.

From the chart, the share price was fluctuating prior to the COVID-19 pandemic. Regardless, it has been rising steadily to register a 33.67% climb in the last year.

The increase is due to the demand for medical supplies caused by the pandemic.

In the previous year, the company paid a total dividend of 0.03 and its forward dividend yield is 1.53%. As well, it has a P/E and P/B ratio of 27.65 and 2.66 respectively.

Based on the findings, the shares are High Flyers meaning they generally have high valuations.

Across the board, this share is for you if you’re looking to buy and hold.

5. Parkway Life Real Estate Investment Trust (SGX: C2PU)

Parkway Life Real Estate Investment Trust is a healthcare REIT based in Singapore that focuses on revenue-generating real estate in the Asia Pacific region.

The assets are used mainly for the education, healthcare research, and manufacture of storage equipment for drugs.

The divisions include Nursing Home and Care Facility Properties, Medical Centre Units, and Hospital Properties.

Additionally, the portfolio is comprehensive to include a wide array of properties including Parkway East Hospital Property, Gleneagles, and Mount Elizabeth Hospital Property.

5-year performance of SGX: C2PU

From the chart, the share price has been rising especially after the pandemic.

However, there has been a decline in the share price over the last six months. But, the pull-back is a great opportunity to purchase the dips.

The company registered a dividend yield of 2.62% based on a trailing twelve-month period.

As well, the share price is currently at S$4.59 with a 2.78 billion market capitalisation.

More so, the P/E ratio and P/B ratio are 8.37 and 1.9 respectively.

According to the values, the shares are Neutral which means their volatility is similar to the wider market.

Therefore the stock is expected to perform as per the expected returns of the market.

6. Clearbridge Health (SGX: 1H3)

Clearbridge Health Limited engages in a wide spectrum of healthcare services as well as medical technology.

The company is based in Singapore and offers specialist services and general medical services such as imaging and vaccinations.

Other services include orthodontics, dental or aesthetic services.

Additionally, the Healthcare Division has 6 major components including health information systems, finance, essential medicines, leadership, workforce, and service delivery.

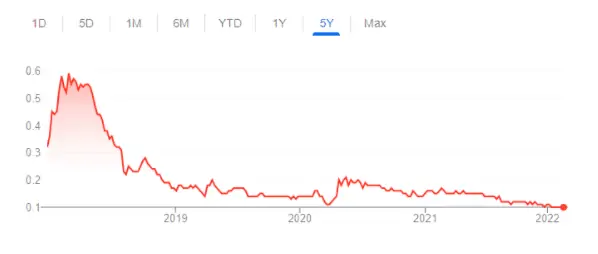

5-year performance of SGX: 1H3

Currently, the share is trading at S$0.10 giving the company a market cap of S$65.59 million. Whereas there’s no P/E ratio, the PB ratio currently stands at 1.14.

The share moved by -39.29% over the last year, while the company has not paid any dividends as yet.

From the figures, the shares can be classified as Neutral, whereby the share may not signal a BUY or SELL.

However, it’s a good starting point for those who are looking for long-term opportunities.

7. Riverstone Holdings stock (SGX: AP4)

Riverstone Holdings Ltd is a Singapore-based company that predominantly focuses on the creating and sale of technical cleanroom equipment necessary for critical and controlled environments.

The company also assembles healthcare gloves, finger cots, packaging bags, face masks, and nitrile gloves.

Other products include face pouches, jumpsuits, boots, hoods, swabs, task wipes, and shoe covers. Some of the sectors where these products are common include semiconductor and electronics firms.

Even though the company is based in Singapore, it also has facilities in China, Thailand, and Malaysia. Also, it has an established sales network in Europe and America.

5-year performance of SGX: AP4

From the chart, firstly, the share price shows a sign of bottoming out before the pandemic.

However, it broke the trend in 2020 and rose steadily for a while in 2021 but eventually started to decline.

The dividend yield is currently at 11.43% based on a 12-month trailing period. Last year, the company paid a dividend of 0.26 per share.

Because the shares have a lower value, it offers an opportunity to buy which makes the forward dividend yield look more attractive.

Riverstone Holdings shares are trading at S$0.73 whereas the share price has moved by -46.43%.

Overall, the shares are Contrarian and therefore present an excellent buying opportunity.

As well, the shares are a great option for investors looking to hold rather than sell.

8. Thomson Medical Group Limited (SGX: A50)

Thomson Medical Group Ltd is a healthcare company established in Singapore. Its business includes TMC Life Sciences Berhad and Thomson Medical Pte Ltd.

Additionally, the company’s main divisions include investment holdings and specialised services.

The hospital services segment comprises integrated healthcare facilities with a focus on gynaecology, paediatrics, and obstetrics services.

They also include imaging services, 24-hour outpatient services, pharmacy, and lab services.

Other specialised services are provided by cardiology, cancer, paediatric, prenatal, and Chinese medicine centres.

5-year performance of SGX: A50

Thomson Medical Group Ltd’s share price is currently at S$0.085 delivering a market capitalisation of S$2.36 billion.

The share has shifted by -12.37% over the last year and currently, the company has a 0.18% dividend yield. The PE and PB ratios are 121.43 and 4.5 respectively.

As per the figures, the overall assessment of the shares is Neutral. The share prices are expected to increase since over the past 6 months, the relative strength of the stock against the market climbed to 2.3%.

9. Healthway Medical Corp Ltd SGX: 5NG

Healthway Medical Corporation Ltd is a private company based in Singapore that focuses on the provision of healthcare services.

Its activities revolve around investment in the holding company and conducting healthcare management business.

Other than Singapore, the company also operates in Mainland China. Further, it is divided into 2 divisions including Specialist and Primary Health care.

The Primary Health Care division comprises dentistry, family medicine, strategic medical-related businesses investments, and healthcare benefits management.

On the other hand, the Specialist Healthcare division comprises paediatrics, aesthetic medicine, gynaecology, orthopaedics, Nobel specialists, and obstetrics.

5-year performance of SGX: 5NG

Healthway Medical Corp Ltd’s share price is currently S$0.036 which delivers a market capitalisation of S$143.73 million.

The share price hasn’t moved an inch in the last year. Additionally, considering its relative-price strength, it has moved by 8.78%.

Over the past 1 year, the company’s P/E ratio is 17.48 and the P/B ratio is 1.46.

Overall, the share classification is Neutral.

10. HAW PAR Corporation Ltd (SGX: H02)

Haw Par Corporation Limited is a Singaporean company that mainly deals with licensing, holding including owning Tiger trademarks.

The company owns the Tiger Trademarks brand and has several segments.

Some of the divisions include Investments and Healthcare which manufactures and sells analgesic products.

The company also engages in multiple activities in major securities in the Asian region.

There is also the leisure division offering tourism-related activities such as oceanariums.

Additionally, Tiger Balm has other products in its trading line including Red and White Ointment, Tiger Balm Plaster, and Tiger Balm Soft.

5-year performance of SGX: H02

The share price is currently at S$11.92 thereby delivering a market capitalisation of S$2.64 billion.

The price hasn’t moved in the last year, however, in terms of relative price strength, it moved by 8.78%.

In the last year, the company paid a 0.3% dividend and currently the dividend yield is 2.52% based on the trailing 12-month period.

Further, the PE and PB ratios are 32.24 and 0.8 respectively.

The stock falls under High Flyer categorisation which means the company is considered overvalued.

11. IHH Healthcare Bhd (SGX: Q0F)

IHH Healthcare Bhd Corporation is a Malaysian-based company and a leader in the provision of health services.

The company has a broad portfolio that it manages. These are top brands in Asia including Pantai, Prince Court, Mount Elizabeth, Fortis, Parkway, IMU, and Gleneagles.

Beyond Singapore, the company extends its operations in other areas such as China, India, Turkey, Hong Kong, and Malaysia.

In addition, it has 5 divisions including Parkway Pantai, a major healthcare provider and hospital in Asia.

It also has Acibadem Holdings, a top healthcare provider in Europe, North Africa, and the Middle East.

Overall, the company has a wide network extending to over 80 hospitals across the globe.

5-year performance of SGX: Q0F

Currently, the company’s shares are trading at S$2.13, thereby giving it a market capitalisation of S$57.63 billion.

For the past 12 months, the share price moved by a remarkable 26.04%.

In regards to relative price strength, considering the market trend, the price moved by 37.11% in the same period.

In terms of the dividend yield, the company registered a 0.6% which is based on the trailing 12-month period. On the same note, a 0.04 dividend per share was paid.

The P/E and P/B ratio of IHH Healthcare Bhd currently stands at 33.59 and 2.3 respectively.

Overall the shares fall under the High Flyers category.

Conclusion

In conclusion, we hope you enjoyed reading this article about the best healthcare stocks in Singapore. We hope you found it useful and informative.

Remember, always do your research when investing in stocks, select a brokerage best for you, and be patient.

If you need help investing, you can always get help from a financial advisor.