The AXA SavvySaver is categorised as an endowment plan. Its purpose is to be flexible enough for you to enjoy liquidity while also helping you save for your long-term goals.

This article will provide you with a product summary of the AXA SavvySaver while also sharing with you who it suits best.

Criteria

- Below 60 years old to qualify to sign up for AXA SavvySaver

- Start saving with as low as S$100 monthly

Features

Payout Options

Upon signing up for this plan, you have 2 payout options available. The first option is that you can choose to receive a yearly payout from the guaranteed portion from the 2nd policy year until the policy matures.

Alternatively, you could decide to redeposit these payouts and receive a higher lump sum upon policy maturity.

The minimum withdrawal limit is equivalent to your one-year guaranteed cash payout. Payouts that were withdrawn cannot be deposited back with AXA.

Policy Terms

There are 4 policy terms that you are able to choose from. Depending on your needs, you can choose to opt for a policy term that is 15, 18, 21, or 24 years long.

The guaranteed yearly cash payout is 5% of the sum assured for the 15- and 18-year terms, while the 21- and 24-year terms have a 5.5% guaranteed yearly cash payout of the sum assured.

Protection

In the scenario of death or terminal illness, you will receive either

- 101% of the total premiums paid if the event happens within the first two years, or 105% if the event happens thereafter; or

- The Total Surrender Value

If there are any accumulated cash payouts and interest, you will also receive them.

Hassle-free Application

There is no need for a medical examination as all applications for the basic plan will readily be accepted. You may include riders in this policy to waive future premiums in the event of disability or critical illness.

However, riders are optional and are subject to medical underwriting.

Coverage Add-ons

This part of the AXA SavvySaver is optional. It is definitely good to have, but not a necessity!

As you will be seeing below, the need to purchase add-ons depends on how much coverage your main insurance policies provide, and whether you can afford to pay for your premiums if you *touchwood* encounter any critical illness, total, and permanent disability.

PremiumEraser Total

In the event of critical illness or total and permanent disability (before age 70) of the Life Assured, future premiums of the basic policy will be waived.

Smart Payer PremiumEraser

In the event of death or total and permanent disability (before age 65) of the Payer, future premiums of the basic policy will be waived.

Smart Payer PremiumEraser Plus

In the event of death or total and permanent disability (before age 65) or critical illness of the Payer, future premiums of the basic policy will be waived.

How much will I receive upon maturity of the AXA SavvySaver?

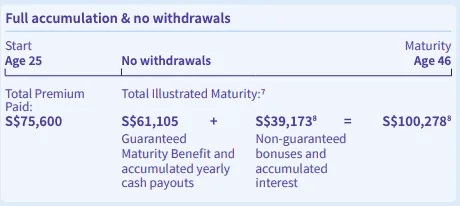

In the scenario where you don’t make any withdrawals and accumulate the full amount, save $3,600 yearly, and choose the 21-year term, you will receive a total of S$100,278 upon maturity.

Below are the calculations:

| Total Premiums Paid: | Guaranteed Portion: | Non-Guaranteed Portion: | Total Received: |

| S$3,600 x 21 years = S$75,600 | S$61,105 | S$39,173 (Based on a projected investment rate of return of 4.75% per annum) | S$100,278 |

My Review on The AXA SavvySaver

The AXA SavvySaver definitely has its pros and cons. As this is mostly a savings plan, the insurance coverage provided by the AXA SavvySaver is expectedly limited.

It is also limited to its 24-year plan, which means that you will have to make yearly premium payments and will not receive a lifetime cash payout.

However, the AXA SavvySaver may be a good fit for you if you think that you will need the liquidity or assurance to withdraw money while generating returns at the same time.

This policy encourages you to save in the short, medium, and long term while offering you the flexibility of making withdrawals.

Furthermore, the basic plan has a hassle-free application as it requires no medical underwriting.

The AXA SavvySaver is definitely great for those who think they might require cash for when they need it.

SFP Advisor’s Take on AXA SavvySaver

We have similar sentiments to Jaslyn’s analysis of the AXA SavvySaver.

Generally, if you are someone who is reluctant to take risks, savings plans are good for you.

Savings plans, however, are not meant to accumulate wealth like the investment plans available in the market. They are good for you if you have difficulties saving money on your own.

However, do take note that product analyses are mostly an overview and generalised.

Different individuals have their own needs, desires, and goals. Not forgetting that everyone also has their own specific situations and what they can afford.

Thus, to prevent overspending and buying the wrong financial products, always ensure that you consult with a financial advisor before making any purchases.