AIA Solitaire PA (II) is a personal accident insurance plan that provides 24/7 worldwide coverage in the case of an accident.

This plan compensates you in the unfortunate event of accidental injuries, disability, or death.

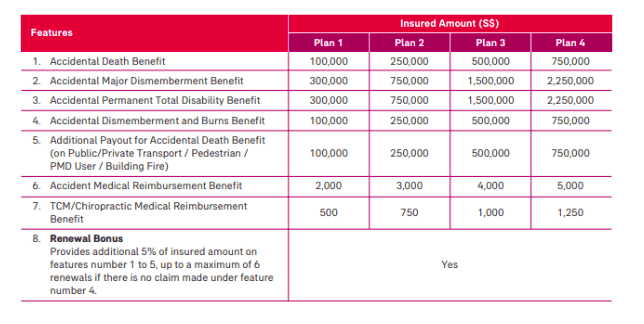

AIA Solitaire PA (II) offers 4 different plans that vary in compensation in the event of an unfortunate accident.

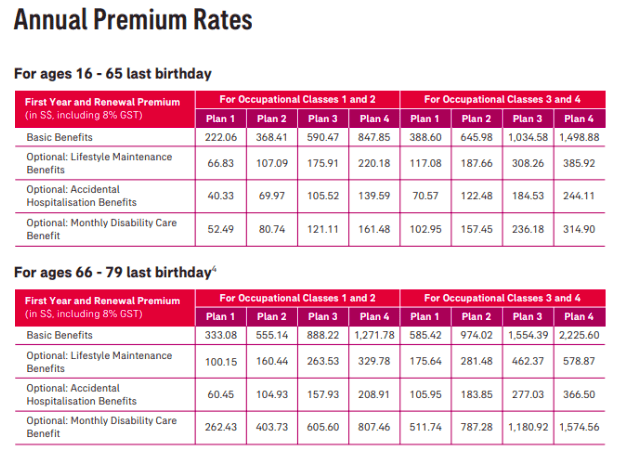

Additionally, you can supplement the plan’s basic benefits with optional benefits for more comprehensive coverage.

From there, you can customise a plan that suits your needs and budget.

Here’s our complete review of the AIA Solitaire PA (II).

My Review of the AIA Solitaire PA (II)

The AIA Solitaire PA (II) is a comprehensive accident insurance plan that covers you worldwide anytime.

It offers 4 different plans and 3 optional benefit groups, giving you 12 options to choose from.

With these plans, you receive financial protection for medical expenses, including traditional Chinese medicine and chiropractic treatments.

The plans vary in the amount of coverage, and the benefit groups determine the additional coverage you can get for more comprehensive coverage.

The best part is that you can enjoy all these benefits for as little as $0.61 per day, and you do not need to undergo a medical check-up to qualify for the AIA Solitaire PA (II).

For accidental death, the payout is doubled if it occurs in specific situations, such as while travelling on public or private transport, using personal mobility devices, or in cases of building fires.

This additional payout ensures even greater financial support for loved ones during accidental death.

In the event of a serious injury resulting in the loss of use of limbs, third-degree burns, or accidental death, you will receive a lump sum payout.

This provides sufficient funds to help you deal with the financial impact of such unfortunate circumstances.

If you selected the AIA Solitaire PA (II) Plan 2 and above, you can also enjoy a 10% premium discount on the AIA Star Protector Plus plan, which offers additional coverage options.

Furthermore, the AIA Solitaire PA (II) plan offers an optional monthly disability payout for up to 10 years if you cannot perform at least 2 Activities of Daily Living (ADL).

You will receive regular monthly payments without needing medical questions or assessments.

Nevertheless, this may not be the plan for everyone because what’s good for me might not suit you.

That’s why we always recommend talking to an unbiased financial advisor for a second opinion on any policies that have been recommended to you.

You should also always understand what’s available in the market to know your choices for personal accident insurance plans.

Start by reading our comparison of the best personal accident plans in Singapore to get an idea of your alternatives.

After which, it’s best to talk to a financial advisor for a second opinion of what’s best for you.

We partner with MAS-licensed financial advisors who’ve helped thousands of our readers with comparisons and second opinions.

If this interests you, we can connect you to them for free, with no obligations necessary on your end.

Click here for a free comparison session.

Let’s now explore what the AIA Solitaire PA (II) offers.

Criteria

- Issue Age: 16 – 70 Years

General Features

Premium Payment Terms

If you have chosen the AIA Solitaire PA (II) Plan 2 or a higher level plan, you can get a 10% discount on your child’s AIA Star Protector Plus plan premium before they reach 21 years old.

Protection

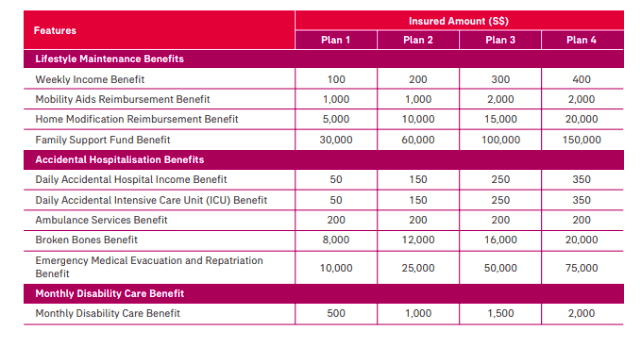

Summary Table of Basic Benefits and Amounts Insured

Before we proceed, you’ll need to know the sum assured limits for each tier offered by the AIA Solitaire PA (II).

This will be the basis of the explanation for each section of this review.

When you turn 75 and renew your insurance plan, your basic benefits coverage will be halved.

Accidental Death Benefit

Should the insured person pass away within 365 days after an accident, the coverage amount agreed-upon for the accidental death benefit will be disbursed.

However, any payments made or to be made under other benefits such as Accidental Dismemberment and Burns Benefits, Accidental Permanent Total Disability, and Accidental Major Dismemberment will reduce the payment amount.

In addition to the regular accidental death benefit, there is an extra payout (Additional Payout for Accidental Death Benefit) if an accident happens:

- while travelling as a paying passenger on public transportation,

- while travelling as a passenger or driving a private vehicle,

- as a pedestrian, the accident is caused by public transport, private transport, or a personal mobility device,

- while using a personal mobility device and the accident occurs or

- as a result of a building fire.

Accidental Major Dismemberment Benefit

This benefit is applicable if you experience an injury resulting in specific events listed below within 365 days after an accident.

However, any payments made or to be made under the accidental dismemberment and burns benefit, and the accidental permanent total disability benefit will be deducted from this benefit.

If permanent disability results from the accident, this benefit will be paid after 6 consecutive months from the date of the disability and when there is no hope of improvement or recovery.

The events that qualify for this benefit include:

- Complete and permanent loss of eyesight in both eyes.

- Loss of use of 2 limbs.

- Loss of use of 1 limb and permanent 1 eyesight loss

- Permanent total loss of speech and hearing

Accidental Permanent Total Disability Benefit

The sum assured for this benefit is provided should you suffer 6 consecutive months of disability due to an injury within 1 year of the accident, and there is no hope of improvement or recovery.

However, deductions for any payments made under the Accidental Dismemberment and Burns Benefit, and the Accidental Major Dismemberment benefit will be made.

To qualify for this benefit, the injury must result in complete and continuous disability permanently to engage in any occupation or job for which you are reasonably qualified.

Alternatively, if you have no occupation at the time of the injury, you should not be unable to perform at least 3 activities of daily living.

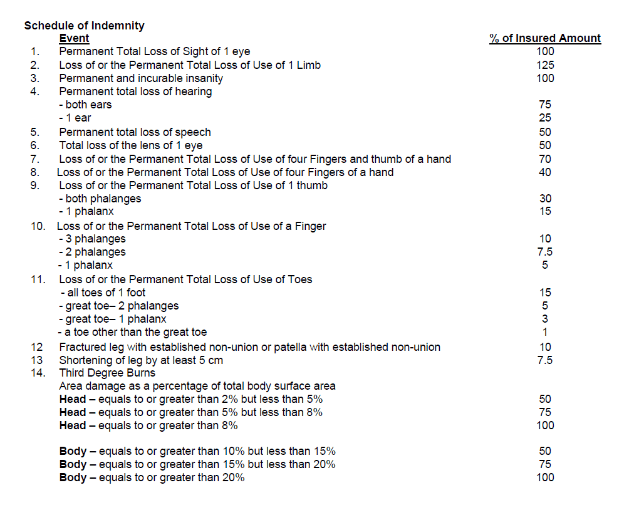

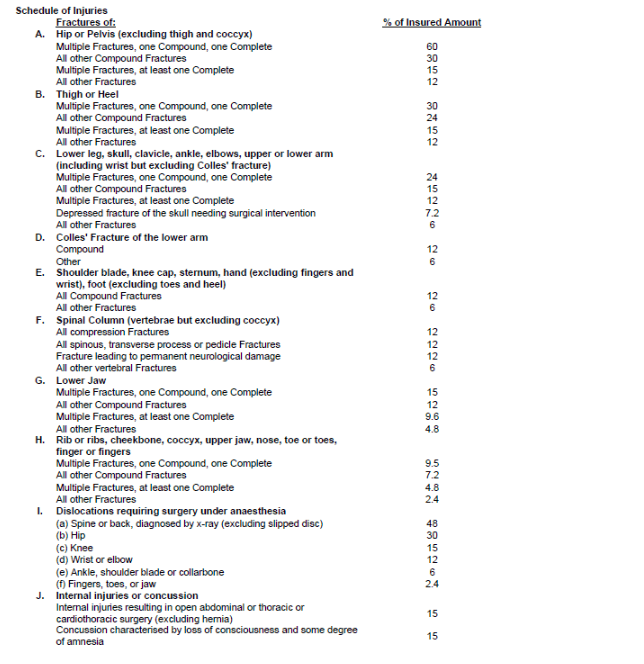

Accidental Dismemberment and Burns Benefit

A percentage of the insured amount will be paid out if you experience any losses per the Schedule of Indemnity, as shown below, within one year of an accident

Below is the Schedule of Indemnity:

For losses not specifically mentioned in the above Schedule of Indemnity table, the insurer will determine the percentage of the insured amount to be paid.

There will be no additional claim payment for a specific item if it is already part of a larger item for which a claim is payable under this policy.

However, multiple events are eligible for payment if the total amount paid for all events is 125% of the insured amount.

Key Features

Reimbursement Benefits

The policy provides 2 types of reimbursement for certain medical expenses.

Injuries must be sustained within 1 year from the same accident and within the insured limit, regardless of any policy renewals.

There is no reimbursement for expenses related to an injury for which compensation is already payable under applicable law, sources, or policies.

These are the 2 types of reimbursement:

Accident Medical Reimbursement Benefit

This benefit covers the insured person who suffers an injury and requires medical treatment.

The policy will reimburse expenses for admission to a hospital, treatment by a physician or physiotherapist and nursing as long as they are reasonable and customary.

Traditional Chinese Medicine/Chiropractic Reimbursement Benefit

Where treatment from a Traditional Chinese Medicine Practitioner or a Chiropractor is needed, reasonable and customary reimbursement for medical expenses incurred within 1 year from the accident date.

Renewal Bonus Benefit

When you renew your policy, you may get a 5% bonus on the insured amount of the individual benefits up to a maximum of 6 years.

To qualify for this bonus, no claims should have been paid for the Accidental Dismemberment and Burns Benefit before the policy year in which the renewal bonus applies.

Otherwise, the renewal bonus will be terminated.

However, the termination will not affect any renewal bonuses already earned before termination.

Additionally, if there is a change in the selected plan during renewal, the renewal bonus will be calculated based on the revised insured amount, starting from the first day of coverage in the policy year when the plan change was made.

Optional Riders

These benefits under the Accidental Hospitalisation Benefits Group and Lifestyle Maintenance Benefits Group are provided as long as you paid all the required additional premiums in advance.

However, they will end immediately after your 75th birthday or upon policy renewal.

Additionally, no claims will be admitted for charges incurred due to an injury for which compensation is already payable under any laws, government programs, or other insurance policies.

Lifestyle Maintenance Benefits Group

Weekly Income Benefit

If you become disabled due to an injury within 90 days of the accident, a weekly income benefit for every 7 days you are disabled (or a pro-rated) will be paid.

This benefit starts from the date of disability.

For temporary total disability, you will be paid 100% of the insured amount, and for temporary partial disability, the payout is 25%.

Else, if temporary total disability occurs immediately after a previous period of temporary total disability, 25% of the weekly income benefit will be provided.

Mobility Aids Reimbursement Benefit

If you need to use mobility aids as recommended by a physician, the reasonable and customary cost of purchasing these aids, up to the insured amount for this benefit, is reimbursed.

These expenses must be incurred within 90 days of the accident for the same accident.

Home Modification Reimbursement Benefit

The policy will reimburse you up to the insured amount for reasonable and customary expenses incurred in order to modify your home for the sole purpose of facilitating movement in view of certain disabilities within 90 days of an accident.

This benefit is payable on the condition that 50% or more of the insured amount for either of the 3 basic accidental benefits are paid or will be payable for the same injury.

Family Support Fund Benefit

If a claim is launched and approved under either the accidental death or the accidental permanent total disability benefits, the insured amount for this benefit will be paid.

Accidental Hospitalisation Benefits Group

Daily Accidental Hospital Income Benefit

Should the insured be admitted to a hospital due to an injury, there is a Daily Accidental Hospital Income benefit for each day of your hospital stay.

However, the number of benefit days is limited to 365 days for the same accident and cannot exceed the insured amount for each day of confinement.

Daily Accidental Intensive Care Unit Benefit

Where the injury requires confinement in an Intensive Care Unit (ICU), there is a payout in addition to the Daily Accidental Hospital Income Benefit for each day spent in ICU.

However, the number of benefit days is limited to 30 days for the same accident and cannot exceed the insured amount for each day of confinement in the ICU.

Ambulance Services Benefit

If an injury requires ambulance services to transport you to a local hospital by land, the policy will reimburse the reasonable and customary expenses incurred.

The reimbursement is up to the insured amount of this benefit for the same accident.

Broken Bones Benefit

Suppose the insured sustains specific injuries within 90 days of the accident, as diagnosed by a physician.

In that case, there is a payout schedule for each injury as a percentage of the insured amount of this benefit.

Emergency Medical Evacuation and Repatriation Benefit

Suppose the insured gets injured while travelling outside Singapore and must be medically evacuated, the most suitable transportation means will be arranged by AIA or the External Service Provider based on the nature of the insured patient’s condition.

In the unfortunate demise, within 365 days of the accident, arrangements by AIA or the External Service Provider will be made to return the remains to Singapore or the home country.

Monthly Disability Care Benefit

The monthly cash benefit is paid after a certain waiting period if the insured sustains an injury within 180 days of the accident and cannot perform at least 2 out of 6 daily activities.

The total payment under this benefit will be at most 120 months during the insured lifetime, regardless of policy renewals.

A new disability, at least 12 months from the last payment, will be treated as a new disability, and a new waiting period will apply.

During the waiting period, a waiver of premiums for this benefit applies and a refund of any premiums already paid.

However, once the benefit is no longer payable, you must resume paying the premiums.

Summary Table of Optional Benefits and Amounts Insured

Summary of AIA Solitaire PA (II)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawal | N/A |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |