To all the parents, have you ever felt worried about the healthcare costs your children might incur?

Have you then ever wished for an insurance plan designed solely for children?

The AIA Star Protector Plus is a personal accident insurance plan customised to protect your children and ease worries.

Apart from financial protection against the high healthcare costs for your children, this plan also cushions any economic disruptions to your children’s education through an education fund.

Here’s our comprehensive review of the AIA Star Protector Plus.

My Review of the AIA Star Protector Plus

From my perspective, the AIA Star Protector Plus gives parents peace of mind knowing that you have affordable protection for your children, allowing you to confidently handle any injuries or mishaps they may encounter during their day-to-day activities.

Apart from protecting you from the financial burden of your child’s potential medical expenses, this policy is also designed to protect your children if the policy owner (yourself) encounters an accident.

This is evident from the lump sum education fund payout your child would receive and the waiver of future premiums for this policy until the insured reaches 21 years old.

Another positive take would be the double indemnity benefits in this policy, which, under certain circumstances, allows you to claim double the insured amount you would have originally received.

This ensures you are well protected financially, enabling you to focus on caring for your child.

However, a drawback of the AIA Star Protector Plus is that it is meant to be a short-term accident policy.

This means that it only has a policy term of 1 year, and AIA does not guarantee subsequent renewals.

With that said, should AIA decide to discontinue any renewals for this policy, you would then be required to find another policy for your children.

Ultimately, if you want a policy that provides comprehensive protection for your children’s health and accidents, the AIA Star Protector Plus is a good policy to introduce your little ones to insurance.

The amount of coverage alongside the double indemnity benefits also makes it ideal for parents who might be more worried about the financial support they or their children would get in the event of any accidents.

Nonetheless, it’s always best to explore other personal accident insurance plans before committing to one.

This is because kids are prone to injuries, so you’ll need a PA plan that is both comprehensive and affordable to make sure that your child is sufficiently protected without burning a hole in your pocket.

Next, you should always seek a second opinion or speak to an unbiased financial advisor to understand if the AIA Star Protector Plus is for you and perhaps to even help compare PA plans.

If you’re interested, we partner with unbiased financial advisors who can help you with this.

Click here for a second opinion.

Here’s more about the AIA Star Protector Plus:

Eligibility Criteria

- Issue age for insured between 2 weeks to 16 years old

- Minimum annual premiums of $151.01

- Minimum policy term of 1 year, with annual renewal up to the insured’s 75th birthday

General Features

Policy Terms

The AIA Star Protector Plus plan is a renewable term-based policy issued for 1 year from its effective start date.

This means you can renew the policy for another year, every year, up yo your child’s 75th birthday.

Premium Payment Terms

One plus point about the AIA Star Protector Plus plan is that they allow you to choose from different plans with different coverage amounts you would like for your child.

Of course, the plan you choose also affects the amount of premiums you are required to pay.

In addition, you can also make monthly, semi-annual, or annual payments.

The rates, including an 8% GST charge, can be found below.

| Standard Premium Rates | |||

| Plan 1 | Plan 2 | Plan 3 | |

| Monthly Premiums | $13.15 | $20.62 | $42.13 |

| Semi-annual Premiums | $78.53 | $123.21 | $251.78 |

| Annual Premiums | $151.01 | $236.93 | $484.21 |

Policyholders of the AIA Solitaire PA Plan 2 and above are also entitled to an additional 10% discount on the prevailing premium rates for this policy.

However, this only applies until your child turns 21, and the standard premium rates will apply afterwards.

It’s important to note that this insurance policy is not approved for payment using Medisave in Singapore. Therefore, you will have to pay the premiums using cash.

Additionally, the premiums payable listed above are not guaranteed and are subjected to AIA’s review.

Protection

Accidental Death, Accidental Dismemberment and Burns Benefit

If the insured child suffers an injury from an accident, the AIA Star Protector Plus policy covers the following occurrences within 365 days of the accident.

The insured amount for this benefit is as such:

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $20,000 | $35,000 | $100,000 |

Loss of Life

If the accident results in the insured’s passing, the insured will receive the full insured amount depending on their purchased plan type.

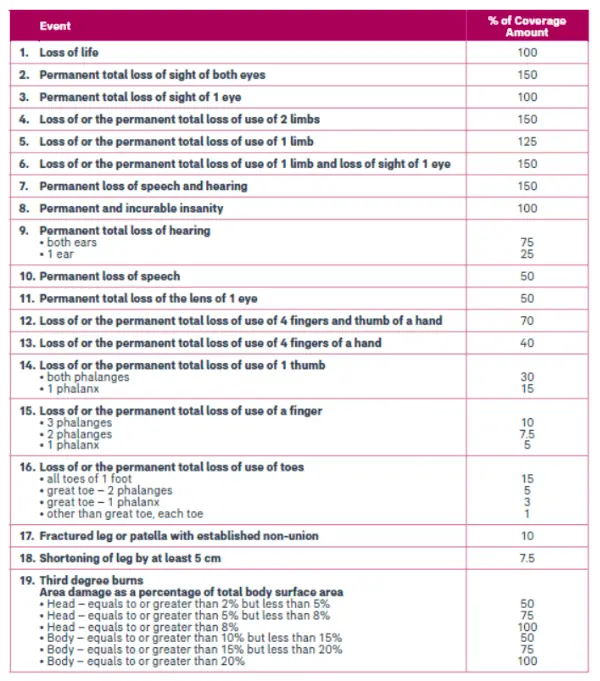

Accidental Dismemberment and Burns

Suppose the accident causes the loss of a body part or severe burns, the insurance company will pay a percentage of the insured amount as specified in the Schedule of Indemnity.

Daily Hospital Income Benefit

For injuries or diseases which require your child to stay in a hospital for a minimum of 6 hours with room and board, AIA will payout the insured amount daily for each day of hospitalisation.

This benefit is provided for a maximum duration of 180 days.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $30/day | $50/day | $100/day |

It is also notable that this benefit will not be applicable if:

- Your child is not a citizen or permanent resident of Singapore or does not have a valid pass in Singapore at the time of the accident or diagnosis of the disease; and

- The hospitalisation occurs in an overseas hospital.

Post-Hospitalisation Home Care Benefit

This benefit applies if your child sustains an injury in an accident or suffers a disease that requires hospitalisation for over 4 consecutive days.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $100 | $150 | $200 |

However, this is payable only once for each accident or disease, regardless of the number of hospitalisations.

Recuperation Benefit

It is undeniable that parents frequently worry about their children contracting 2 of the more common illnesses among children in Singapore:

- Dengue Fever

- Hand, Foot & Mouth Disease

As AIA recognises this, AIA has integrated this benefit into this plan to ease your financial burden as you focus on recuperating.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $50 | $80 | $100 |

However, parents should also keep in mind that regardless of how often your child may be diagnosed with either 2 of the diseases within each 2-year period (starting from the policy’s effective start date), the benefit will be paid only once during that time frame.

Reconstructive Surgery Reimbursement Benefit

This benefit covers 2 main types of reconstructive surgeries deemed medically necessary for your child within 365 days from the date of an accident if they sustain an injury.

Cosmetic Surgery

Reconstructive cosmetic surgery is eligible for claim under this benefit, provided it aims to treat facial disfigurement caused directly by the accident.

Surgery for cosmetic reasons is ineligible for claim under this benefit.

Skin Transplantation

In some burn cases, those who suffer a full-thickness skin destruction of at least 10% of the body surface area can claim this benefit to reimburse the cost of skin transplantation.

For both types of reconstructive surgery, the policy will reimburse you for the surgical expenses incurred up to the insured amount.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | Not Applicable | $5,000 | $15,000 |

However, it is important to note that this benefit does not cover those who purchase Plan 1 for the AIA Star Protector Plus policy.

Mobility Aids Reimbursement Benefit

This policy also reimburses expenses related to the purchase of equipment designed to assist with walking or moving from place to place within 90 days from the accident date.

While the list is not exhaustive, some of these mobility aids include:

- Walking Sticks

- Canes

- Walking Frames

- Braces

- Crutches

- Walkers

- Wheelchairs

- Motorised Scooters

Under this reimbursement benefit, AIA will reimburse you for the amount you paid for the mobility aids, up to the insured amount.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | Not Applicable | $300 | $1,000 |

It is also important to note that this benefit does not cover those who purchase Plan 1 for the AIA Star Protector Plus policy.

Emergency Medical Evacuation and Repatriation Benefit

Emergency Medical Evacuation

For any accident-related injuries sustained while travelling overseas outside of Singapore, this policy will pay for any transportation, medical services, and medical supplies required for emergency medical evacuation.

Repatriation of Mortal Remains

Likewise, for any loss of life arising from accident-related injuries sustained overseas outside of Singapore, this policy will pay for any transportation expenses for returning the insured’s mortal remains to Singapore or their home country or any local burial costs at the place of death.

However, do note that the loss of life would have to occur within 365 days from the accident date for the claim to be valid.

In both cases above, this policy covers up to the insured amount for this benefit.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | Not Applicable | Not Applicable | $50,000 / policy year |

However, current and prospective policy owners should note that this benefit only applies if you purchase Plan 3 for the AIA Star Protector Plus policy.

Key Features

Double Indemnity for Dismemberment and Burns Benefit

In addition to the benefit for accidental dismemberment and burns, this policy offers a special provision with an additional payout equal to 1X the original payable amount under specific circumstances.

This double indemnity benefit applies when the insured child is:

- Within the school premises during an official school day, participating in school activities or travelling to and from school or the location where the school activity is taking place;

- Riding as a fare-paying passenger in public transportation;

- Riding as a passenger or driving a private vehicle; or

- As a pedestrian on the road.

With this double indemnity benefit, it ensures your child has additional coverage for their day-to-day activities, be it being in school or when travelling between places.

Likewise, the insured amount for this benefit is the same as the accidental dismemberment and burns benefit, and the payout amount will depend on the situation as per the Schedule of Indemnity.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $20,000 | $35,000 | $100,000 |

Monthly Catastrophe Cash Benefit

In the event that the child insured suffers a catastrophic disability due to an injury within 180 days of an accident, they will be eligible to receive a monthly payment equivalent to the insured amount for this benefit.

This monthly payment will continue for up to 20 years to help support the insured person during a long-term disability.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $750/month | $1,000/month | $1,500/month |

The list of catastrophic disabilities eligible for this cash benefit would include:

- Coma

- Paralysis

- Loss of or the irrevocable total loss of use of 2 limbs

- Irrevocable total loss of sight in both eyes

- Loss of or the irrevocable total loss of use of 1 limb and irrevocable total loss of sight of 1 eye

Medical Reimbursement Benefits

With their weaker immune systems, children are more susceptible to various diseases, which can rake up a lot in medical bills.

This benefit ensures that your child is financially protected when they contract these diseases and seek medical treatment within 365 days from the date of accident or diagnosis.

As the policyholder, you will be reimbursed for the medical expenses incurred, up to the insured amount for this benefit. This also includes hiring a licensed or graduate nurse, and ambulance charges up to $200.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $1,500 | $3,000 | $5,000 |

However, you will only be reimbursed up to 10% of the insured amount if the medical expenses arise from treatment by a registered traditional Chinese medicine practitioner or a chiropractor.

The reimbursement benefits will also not be applicable if:

- Your child is not a citizen or permanent resident of Singapore or does not have a valid pass in Singapore at the time of the accident or diagnosis of the disease; and

- If the medical expenses are incurred outside of Singapore.

The list of diseases covered under this policy are:

- Hand, Foot and Mouth Disease

- Dengue Fever

- Food Poisoning

- Severe Acute Respiratory Syndrome (SARS)

- Variant Creutzfeldt-Jakob Disease (vCJD) or ‘Mad Cow Disease’

- Nipah Viral Encephalitis

- Japanese Viral Encephalitis

- Malaria

- Pulmonary Tuberculosis

- Measles

- Rabies

- Melioidosis

- Avian Influenza or ‘Bird Flu’ due to Influenza A

- Chikungunya Fever

- Mumps

- Rubella

Double Indemnity for Daily Hospital Income Benefit in ICU

Similar to the double indemnity for dismemberment and burns benefit, AIA will also pay you an additional amount equal to 1X the original payable amount on top of the daily hospital income benefit.

This benefit is activated when the insured child is admitted to an Intensive Care Unit (ICU) for at least 6 hours with room and board.

However, unlike the daily hospital income benefit, this double indemnity for daily hospital income benefit in ICU is only payable for a maximum of 30 days.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $30/day | $50/day | $100/day |

Education Assurance Fund Benefit

In the unfortunate passing of the policy owner (the parent) within 1 year of an accident, AIA will pay the insured amount for the education assurance fund benefit.

However, this benefit will no longer be applicable based on the earliest of the following events:

- When your child turns 21 years old if they are no longer a student;

- When your child turns 24 years old; or

- When the policy owner reaches 75 years old.

Alternatively, the insured amount will be paid if the insured child, unfortunately, passes away within 365 days of an accident, provided the benefit has not been claimed before.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | $10,000 | $17,500 | $50,000 |

National Service Cover Benefit

Unlike most insurance policies, AIA also understands that certain risks may be involved when your children undergo National Service (NS) training.

To ease your financial burden in case of mishaps, this policy protects the insured if they are a Singapore Full-time National Serviceman (NSF) and engage in military service, duties, training, exercises, manoeuvres, or warlike operations.

For any loss of life, you will receive a payout equivalent to the insured amount for this benefit.

Should the insured suffer from accidental dismemberment or burns, the payout amount will depend on the specifications within the Schedule of Indemnity.

| Plan 1 | Plan 2 | Plan 3 | |

| Insured Amount | Not Applicable | $10,000 | $20,000 |

Do note that any of the above mishaps would have to occur within 1 year from the accident for the benefit to be claimable.

It is also important to note that this benefit does not cover those who purchase Plan 1 for the AIA Star Protector Plus policy.

Payor Benefit

Under this benefit, any future premiums for the policy will be waived if the policy owner (the parent) passes away within 365 days of an accident before their 75th birthday.

However, this waiver of premiums will only be effective until the insured turns 21 years old.

From that point onwards, all subsequent premiums for the policy will be payable according to the terms of the plan.

Renewal Bonus

As mentioned earlier, this policy is purchased on a 1-year term, with renewal required yearly.

To encourage you to renew your policy with AIA, the renewal bonus allows you to accumulate 5% of the insured amount for accidental death, accidental dismemberment, and burns benefit each time you renew the policy, up to a maximum of 5 years.

In the event that a claim is made under the accidental death, accidental dismemberment, and burns benefit, you will be eligible to receive a percentage of the accumulated renewal bonus.

However, this depends on the specifications under the Schedule of Indemnity (albeit with a maximum limit of 100% of the accumulated renewal bonus).

Optional Riders

Child Critical Illnesses Benefit

One unique feature of this plan is the optional child critical illnesses benefit.

By signing up for this optional rider, the insured amount will be paid if your child develops a critical illness, and the benefit will be deemed terminated.

However, this benefit will not be payable if the insured passes away within 30 days from the date of diagnosis of a child’s critical illness.

Do also note that this benefit will terminate on the policy anniversary after your child turns 21.

This benefit is also subject to the critical illness per life limit of $3,000,000.

Conversion Privilege

When your child grows up and reaches between 18 and 21, this benefit can also be converted to a whole life or an endowment policy, provided the benefit has not been claimed before and has not been terminated.

The new policy would cover death, terminal illnesses, total and permanent disability (TPD) and/or critical illnesses, without any further underwriting required, up to the insured amount of the child’s critical illnesses benefit.

The child critical illnesses the optional benefit covers are listed below:

- Acquired Brain Damage

- Aplastic Anaemia

- Bone Marrow Transplant

- Brain Surgery

- Glomerulonephritis

- Haemophilia

- Death as a Result of Hand, Foot & Mouth Disease

- Insulin Dependent Diabetes Mellitus

- Leukaemia

- Loss of Limbs Due to Sickness

- Kawasaki Disease with Heart Complications

- Rheumatic Fever with Heart Involvement

- Severe Asthma

- Severe Epilepsy

- Still’s Disease Including Severe Juvenile Rheumatoid Arthritis

- Tuberculous Meningitis

- Viral Encephalitis

Optional Benefit Premium Payment Terms

The premiums payable for the optional benefit can be found below.

| Optional Benefit Premium Rates | |||

| Option 1 | Option 2 | Option 3 | |

| Insured Amount | $30,000 | $50,000 | $100,000 |

| Annual Premiums | $5.06 | $8.43 | $16.86 |

| Semi-annual Premiums | $30.23 | $50.39 | $100.77 |

| Monthly Premiums | $58.14 | $96.90 | $193.79 |

Policyholders of the AIA Solitaire PA Plan 2 and above are also entitled to an additional 10% discount on the prevailing optional benefit premium rates for this policy.

However, this only applies until your child turns 21, and the standard optional benefit premium rates will apply after that.

Schedule of Indemnity

Parents need to note that the maximum amount payable due to injuries arising from the same accident should not exceed 150% of the coverage amount.

Summary Table of Sum Assured

All the benefits offered under AIA Star Protector Plus are subject to maximum limits (sum assured). You should therefore refer to the table below when making any claim.

| Benefit | Sum Insured | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Accidental Death, Accidental Dismemberment and Burns Benefit | $20,000 | $35,000 | $100,000 |

| Double Indemnity for Dismemberment and Burns Benefit | $20,000 | $35,000 | $100,000 |

| Monthly Catastrophe Cash Benefit | $750/month | $1,000/month | $1,500/month |

| Medical Reimbursement Benefit | $1,500 | $3,000 | $5,000 |

| Daily Hospital Income Benefit | $30/day | $50/day | $100/day |

| Double Indemnity for Daily Hospital Income Benefit in ICU | $30/day | $50/day | $100/day |

| Post-Hospitalisation Home Care Benefit | $100 | $150 | $200 |

| Recuperation Benefit | $50 | $80 | $100 |

| Education Assurance Fund Benefit | $10,000 | $17,500 | $50,000 |

| Reconstructive Surgery Reimbursement Benefit | – | $5,000 | $15,000 |

| Mobility Aids Reimbursement Benefit | – | $300 | $1,000 |

| National Service Cover Benefit | – | $10,000 | $20,000 |

| Emergency Medical Evacuation & Repatriation Benefit | – | – | $50,000/policy year |

Summary of the AIA Star Protector Plus

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes (Accidental) |

| Total Permanent Disability | Yes (Accidental) |

| Terminal Illness | No |

| Critical Illness | Yes, with rider |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |