AIA Hospital Income is a hospital cash income policy providing you with financial support during hospitalisation.

You will receive daily cash benefits if you are admitted to a hospital due to sickness or injury.

So when you cannot work due to unforeseen circumstances, you will still have some peace of mind, knowing that, in some way, you are still covered financially.

Here’s our review of the AIA Hospital Income plan to help you decide if it’s the right policy for you.

Keep reading.

Criteria

- Issuance Age: 0-74 years

- Minimum premium payment: $21.30/month

General Features

Premium Terms

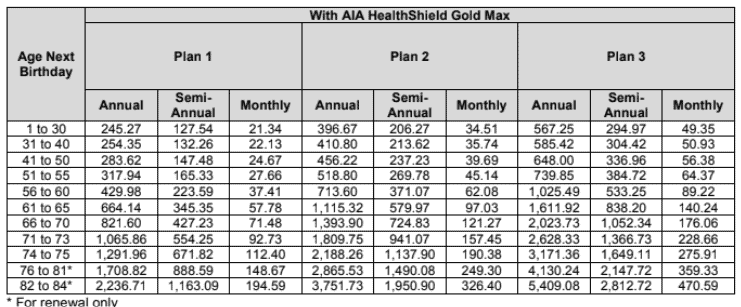

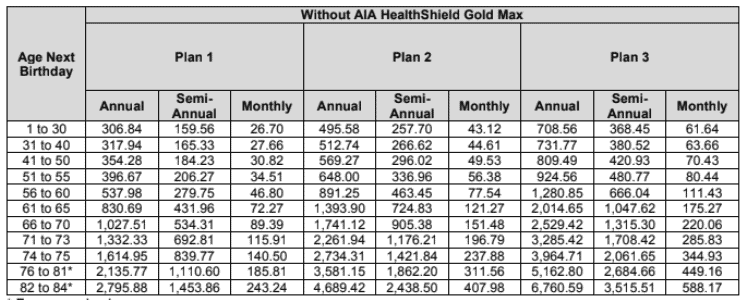

Below is a table showing the premium rates for the 3 plans of AIA’s Hospital Income.

If you have the AIA HealthShield Gold Max, these are the premiums:

If you don’t have AIA HealthShield Gold Max, these are the premiums:

The policy is not Medisave-approved, and you cannot use your Medisave to pay your premiums.

Policy Term

The AIA Hospital Income is a yearly renewable policy, and you can renew it until you turn 85 years old.

Protection

Daily Hospital Income Benefit

With AIA Hospital Income, you can receive the Daily Hospital Income Benefit if you fall ill or experience an injury that requires hospitalisation.

The table shows the amount payable per benefit under different daily plans:

| Benefit | Insured Amount | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Daily Hospital Income Benefit | $100/day | $200/day | $300/day |

Here are some conditions to know about this benefit:

- Hospitalisation due to illness or injury must be medically necessary to qualify for the Daily Hospital Income Benefit.

- The benefit pays for each day you are hospitalised, up to a maximum of 500 consecutive days for the same admission and will apply even if you renew your policy during this period.

- The policy will not pay out more than the insured amount specified for this benefit per day of hospitalisation.

Intensive Care Unit Benefit

Suppose you are injured or admitted to a hospital’s Intensive Care Unit (ICU).

In that case, the policy will pay you the Intensive Care Unit Benefit daily during the confinement.

The table shows the amount payable per benefit under different daily plans:

| Benefit | Insured Amount | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Intensive Care Unit Benefit | $300/day | $450/day | $750/day |

You will receive this benefit along with the Daily Hospital Income Benefit under the following situations:

- The hospitalisation must be medically necessary.

- You must already be receiving the Daily Hospital Income Benefit as per the terms of your policy.

- The ICU Benefit is payable for a maximum of 30 days for the same hospitalisation, regardless of whether you renew your policy during this period.

- The policy will not pay out more than the insured amount specified for this benefit per day of hospitalisation.

Get Well Benefit

The Get Well Benefit is payable if you are eligible for the Daily Hospital Income Benefit as per the terms of your policy.

This means you qualify for the Daily Hospital Income Benefit and may also be eligible for the Get Well Benefit.

This benefit is limited to a maximum of one payment for the same confinement.

Therefore, even if you have an extended stay in the hospital, you will only receive one payment under the Get Well Benefit.

The table shows the amount payable per benefit under different daily plans:

| Benefit | Insured Amount | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Get Well Benefit | $200 | $300 | $400 |

Post-hospitalisation Home Rest Benefit

This policy supports your recovery journey if an injury or illness requires hospitalisation.

After being discharged from the hospital, the policy will provide a post-hospitalisation Home Rest Benefit if you still require rest and recovery at home.

The table shows the amount payable per benefit under different daily plans:

| Benefit | Insured Amount | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Post-Hospitalisation Home Rest Benefit | $50/day | $100/day | $150/day |

Specific criteria must be met to be eligible for the Post-hospitalisation Home Rest Benefit.

- The Daily Hospital Income Benefit is currently payable.

- This benefit applies for a maximum of 5 consecutive days of confinement at home, regardless of any policy renewal.

- It is important to note that the benefit amount will depend on the insured amount specified in the policy.

- Additionally, a medical certificate confirming your confinement at home after discharge is required to avail of this benefit.

Day Surgery Income Benefit

For every day you undergo a day surgery due to an injury or illness, the AIA Hospital Income will pay you the Day Surgery Income Benefit.

The table shows the amount payable per benefit under different daily plans:

| Benefit | Insured Amount | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Day Surgery Income Benefit | $200/day | $350/day | $500/day |

Nonetheless, certain conditions must be met:

- The surgery must be medically necessary.

- You will not receive the Daily Hospital Income and Intensive Care Unit Benefit during the surgery.

- The benefit will not be paid more than 5 times for the same incident or illness.

- The policy will not pay out more than the insured amount.

Key Features

Integration With AIA Vitality

You can combine the AIA Hospital Income policy with AIA Vitality.

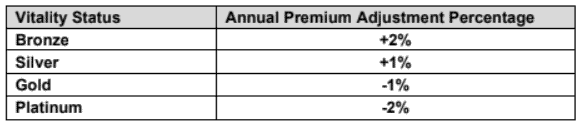

When combining the 2 plans, the premiums for the combined product will be calculated by multiplying the premium before the adjustment by a cumulative premium factor or percentage.

The annual premium adjustment percentage based on your vitality status is shown in the following table:

The AIA Vitality is a comprehensive program that allows you to enjoy premium discounts of up to 15% in your first year.

Summary of AIA Hospital Income

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Additional Benefits | |

|

Yes |

My Review of the AIA Hospital Income

The AIA Hospital Income is a comprehensive hospital cash policy that provides financial support during hospitalisation.

With this policy, you will receive daily cash benefits if you are admitted to a hospital due to sickness or injury, whether you’re in Singapore or overseas.

The coverage also extends to outpatient recovery after day surgery, with additional benefits like a get-well benefit upon discharge.

One of the notable features of AIA Hospital Income is its integration with AIA Vitality.

Combining these 2 allows you to earn Vitality Status and enjoy premium discounts of up to 15% in the first year.

This integration offers financial protection and encourages a healthier lifestyle through the AIA Vitality program.

The issuance age range for this policy is 0-74 years, making it accessible to a wide range of individuals.

It’s important to note that premiums are not guaranteed and may be adjusted in the future.

The Daily Hospital Income Benefit is a key component of this policy, offering financial support for each day of hospitalisation, up to a maximum of 500 consecutive days for the same admission.

The Intensive Care Unit Benefit also provides coverage for a maximum of 30 consecutive days for the same hospitalisation.

For a smoother recovery journey, the policy includes a Get Well Benefit, limited to one payment per confinement, and a post-hospitalisation Home Rest Benefit that supports recovery at home for a maximum of 5 consecutive days.

The Day Surgery Income Benefit provides coverage for each day of medically necessary day surgeries, a maximum of 5 times per incident or illness.

It’s worth mentioning that while AIA Hospital Income offers several benefits and features, it’s important to consider the potential drawbacks or limitations of the policy.

The premiums for AIA Hospital Income are not guaranteed and may be subject to change, making it challenging to plan for long-term affordability.

In addition, the policy may not cover all expenses incurred during hospitalisation, potentially resulting in additional out-of-pocket costs for policyholders.

That’s why it’s important to have a health insurance plan to have more comprehensive coverage.

Further, AIA Hospital Income has specific exclusions, such as fertility-related issues and self-inflicted injuries.

While the policy includes a post-hospitalisation home rest benefit, it is limited to a maximum of 5 consecutive days of confinement at home.

For individuals with prolonged recovery periods, this benefit may not fully address their needs.

So, is the AIA Hospital Income for you?

That depends – a policy that’s good for someone might not be good for someone else.

It’s best to consult an unbiased financial advisor to determine if the AIA Hospital Income meets your needs or if there is a better alternative.