The Tokio Marine TM PA (Personal Accident) is a personal accident insurance plan which acts as an umbrella to shield you financially against injuries in the event of accidents.

With flexibility in mind, the Tokio Marine TM PA policy provides you with global coverage round the clock and offers you optional benefits to design a plan you are most comfortable with.

If you want to delve deeper into what the TM PA policy offers, read on to learn more!

Criteria

- Issue age for insured: 16 – 60 years old

- Guaranteed annual renewal until the insured turns 75

- Simplified issuance (SIO) for underwriting

General Features

Premium Payment Terms

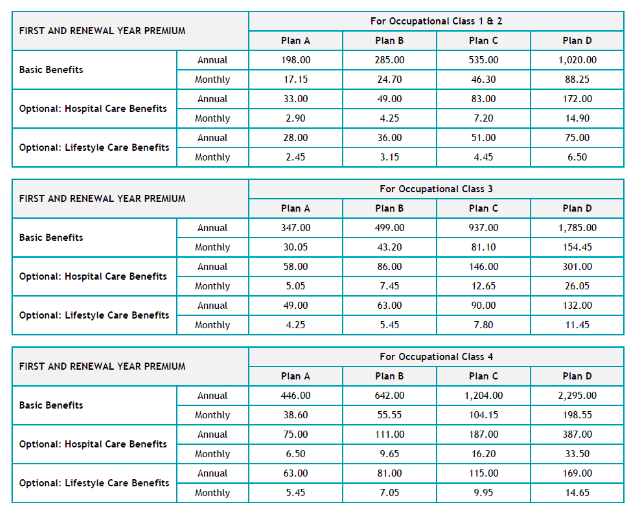

Depending on your occupational class and preferred plan type (plans A to D), the premiums payable for the basic policy and optional benefits will differ.

Regardless of whether you pay your premiums annually or monthly, Tokio Marine has stipulated that only GIRO payments will be accepted.

This means you cannot pay for this policy using your MediSave savings.

However, note that the premiums payable are not guaranteed, and any changes will be conveyed to you 30 days in advance.

The different plan types and their corresponding premiums payable are also compiled below for your reference.

Protection

Accidental Death Benefit

Similar to other personal accident insurance plans, the TM PA provides coverage in the event of your passing due to an accident-causing injury.

However, the amount payable under this benefit depends on the date of passing relative to the accident date.

| Date of Accidental Passing | Amount Payable |

| On or Within 180 Days From the Date of the Accident | 100% of the Sum Assured |

| After 180 Days From the Date of the Accident | $3,000 |

Regardless of the date of the insured’s accidental death, any payout under this benefit will be made after deducting any amounts owed to Tokio Marine.

If the accidental passing occurs on or within 180 days from the accident date, the final amount payable will also be less any amounts paid out under the Accidental Dismemberment and Burns Benefit.

The policy will then be deemed terminated after the payout has been made under this benefit.

Double Indemnity Benefit

In addition to the Accidental Death Benefit, the TM PA provides you with extra compensation if certain conditions are met.

Your loved ones will be entitled to an additional 100% of the sum assured if:

- The accident resulting in the insured’s passing occurs while travelling on a vehicle registered with the local government (following the location of the accident);

- The vehicle was used for regular commutes; and

- The passing occurs within 180 days from the date of the accident.

Once the Double Indemnity Benefit is paid out, the policy ends.

It’s important to note that any amount payable under this benefit will also be reduced by all existing and previous claim amounts under the Accidental Dismemberment and Burns Benefit.

Death Benefit

If the insured passes away due to a non-accidental cause, their loved ones will be eligible to claim under this benefit for a fixed payout of $3,000, less any outstanding debts owed to Tokio Marine.

Once the claim is successful, the policy terminates and is no longer in effect.

It is important to note that only the Death Benefit or the Accidental Death Benefit will be paid out in the unfortunate event of the insured’s passing.

Accidental Dismemberment and Burns Benefit

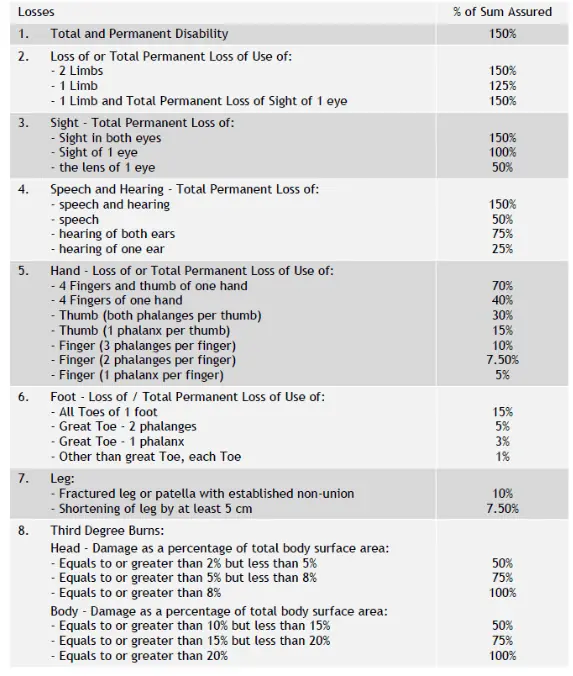

If the insured person is involved in an accident which causes them to suffer a loss or injury stipulated under the Table of Indemnity below, the corresponding percentage of the sum assured will be paid out to you or your beneficiaries.

For your claim to be successful, the injury must be:

- Caused by the accident;

- Within 180 days from the accident date; and

- Diagnosed by a medical practitioner.

Do note that you would be unable to make additional claims on specific body parts losses if they were claimed as part of a larger body part.

For example, if you have claimed for the loss of 1 limb, you would not be able to make any further claims for the loss of any fingers or toes on that particular limb.

Policyholders should also note that all pending and previously-made claims under this benefit are capped at 150% of the sum assured per policy, and the policy will end once the aggregated claim amount under this benefit exceeds 100% of the sum assured.

Those who, unfortunately, suffer Total and Permanent Disability (TPD) as a result of the accident can also claim this benefit provided the insured is:

- Unable to independently perform at least 3 out of the 6 ‘Activities of Daily Living’;

- Continuously suffering from this TPD disabled for at least 6 months, and

- Confirmed to be permanently impaired by a designated medical practitioner.

Table of Indemnity

Medical Reimbursement Benefit

For injuries requiring medical treatment alongside hospitalisation or surgery, this policy promises that you will be reimbursed for any medical expenses incurred, up to the limit under this benefit per accident.

Those who suffer less serious cases requiring either out-patient or dental treatment will be relieved to hear that you will also be reimbursed for any medical costs incurred, up to the respective sub-limit per accident.

Do note that the Medical Reimbursement Benefit will compensate you only for medical fees incurred within 180 days of the accident.

In addition, those seeking out-patient or dental treatment should ensure that the treatment is provided by a medical practitioner, Traditional Chinese Medicine (TCM) practitioner, chiropractor, or dentist.

Free Child Cover

If you are a parent wondering which insurance policy suits your child, the TM PA policy offers policyholders free basic coverage for their children!

Yes, you read that right, free coverage.

This feature provides basic insurance benefits for up to 4 children of the insured, provided that the child is:

- The life assured’s biological or legally adopted child (including guardianship); and

- Unmarried, unemployed, and between 1 month old and 18 years old.

The benefits your child would enjoy include the 2 basic features of an Accidental Death Benefit and a Medical Reimbursement Benefit.

Accidental Death Benefit

In the event that the insured’s covered child, unfortunately, passes away due to an accident-causing injury within 180 days from the date of the accident, the insured’s family will receive a lump sum payment of $20,000.

Medical Reimbursement Benefit

If the covered child instead requires medical treatment due to an accident-related injury, they will be reimbursed with the costs of treatment incurred within 180 days from the accident date, up to a maximum of $500 per child per policy year.

Optional Riders

Hospital Care Benefits

In the event that your injury caused by an accident requires hospitalisation, rest assured that the Hospital Care Benefit will take care of you financially throughout your hospitalisation journey, from transportation to recuperation.

Ambulance Services Reimbursement Benefit

If the insured sustains an injury from an accident which requires an ambulance for transport to the hospital, Tokio Marine will reimburse the ambulance costs up to the limit under this benefit per accident.

Daily Hospitalisation Cash Benefit

Should your injury treatment require hospitalisation, this policy will ensure that you receive a Daily Hospitalisation Cash Benefit for each day of hospitalisation.

However, to be eligible for this cash benefit, your admission to the hospital must be within 180 days from the accident date.

Daily Intensive Care Unit Cash Benefit

If the insured is in a more critical condition requiring a stay in an Intensive Care Unit (ICU), a Daily Intensive Care Unit Cash Benefit will be paid out for each day of confinement in the ICU.

For your claim to succeed, ensure that the hospitalisation occurs within 180 days of the accident and that the injury has been caused by an accident.

Policyholders should also note that for the same period of hospitalisation, you can only make a claim under either the Daily Hospitalisation Cash Benefit or the Daily Intensive Care Unit Cash Benefit.

Weekly Recuperation Cash Benefit

The Weekly Recuperation Cash Benefit is available for those insured if you are:

- Certified by a medical practitioner as medically unfit and exempted from their normal duties at work and at home; and

- Certified immediately after being discharged from the hospital.

Those eligible will then receive a weekly cash benefit for each full 7-day period or a pro-rata amount if it doesn’t extend to a full 7 days.

While this benefit can be claimed for up to a continuous period of 28 days per accident, the total number of days payable for the Daily Hospitalisation Cash Benefit, Daily Intensive Care Unit Cash Benefit, and Weekly Recuperation Cash Benefit is capped at 180 days per accident.

Lifestyle Care Benefits

Unlike the Hospital Care Benefit, which protects you throughout your hospitalisation journey, the Lifestyle Care Benefit focuses more on the road to recovery after your discharge from the hospital.

Mobility Aids Reimbursement Benefit

For those whose injury requires the use of mobility aids, any expenses associated with the purchase or rental of mobility aids within 180 days from the date of the accident will be reimbursed to you.

The list of mobility aids which qualify for this benefit is not limited to:

- Walking sticks

- Canes

- Walking frames

- Braces

- Crutches

- Walkers

- Wheelchairs

- Motorised scooters

Home Modifications Reimbursement Benefit

Understandably, some more serious injuries may take longer for rehabilitation or recovery.

Tokio Marine recognises that this could be a problem faced by their policyholders and has thus included this benefit which reimburses you with the costs of home modifications to facilitate your daily activities better after you have been discharged from the hospital.

To qualify for this benefit:

- The expenses would have to be incurred within 180 days from the accident date;

- The insured must have made a claim amounting to 50% or more of the sum assured under the Accidental Dismemberment and Burns Benefit;

- The claim under the Accidental Dismemberment and Burns Benefit must be due to the same accident; and

- The home modifications must be certified as necessary by a practitioner in rehabilitative services or a similar medical professional.

Nursing Care Reimbursement Benefit

While some individuals may still be able to care for themselves after sustaining an injury, some may require professional nursing care services.

As such, any nursing care expenses can be reimbursed under this benefit on the premise that:

- The nursing care service has to be prescribed by a medical practitioner for medical reasons;

- The nursing care service has to commence immediately after the insured’s discharge from the hospital; and

- Only expenses incurred within 180 days from the date of the accident will be reimbursed to you.

Summary Table of Benefits

| Basic Sum Assured | ||||

| Basic Benefit | Plan A | Plan B | Plan C | Plan D |

| Accidental Death Benefit | $100,000 | $200,000 | $500,000 | $1,000,000 |

| Double Indemnity Benefit | $100,000 | $200,000 | $500,000 | $1,000,000 |

| Death Benefit | $3,000 | |||

| Accidental Dismemberment & Burns Benefit | Up to $150,000 | Up to $300,000 | Up to $750,000 | Up to $1,500,000 |

| Medical Reimbursement Benefit | $2,500 | $4,000 | $7,500 | $10,000 |

| Sub-limit for Out-patient Treatment | $500 | $750 | $1,000 | $1,500 |

| Sub-limit for Dental Treatment | $500 | $750 | $1,000 | $1,500 |

| Free Child Cover | ||||

| Accidental Death Benefit | $20,000 | |||

| Medical Reimbursement Benefit (per Policy Year) | $500 | |||

| Optional Rider: Hospital Care Benefits | ||||

| Ambulance Services Reimbursement Benefit | $200 | |||

| Daily Hospitalisation Cash Benefit (up to 180 Days) | $100 | $150 | $250 | $500 |

| Weekly Recuperation Cash Benefit | $100 | $150 | $250 | $500 |

| Daily Intensive Care Unit Cash Benefit (up to 180 Days) | $200 | $300 | $500 | $1,000 |

| Optional Rider: Lifestyle Care Benefits | ||||

| Mobility Aids Reimbursement Benefit | $1,000 | $1,500 | $2,000 | $3,000 |

| Home Modifications Reimbursement Benefit | $5,000 | $10,000 | $15,000 | $25,000 |

| Nursing Care Reimbursement Benefit | $2,000 | $3,000 | $4,000 | $5,000 |

Summary of Tokio Marine TM PA (Personal Accident)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Accidental Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the Tokio Marine TM PA (Personal Accident)

I would say that the Tokio Marine TM PA (Personal Accident) is similar to most other policies, providing you with the basic coverage you need in the event of various situations, from one’s accidental passing to seeking medical treatment.

However, what stands out from the Tokio Marine TM PA is its Free Child Cover feature.

While most other personal accident plans provide coverage only for the insured, the Tokio Marine TM PA provides your child with the same basic personal accident coverage that you would enjoy under this plan, making this a highly suitable plan if you are a parent.

Some might then ask, aren’t there other personal accident policies for children? The answer is yes.

However, many of those policies provide your child with more comprehensive coverage and tend to be more pricey.

For those who feel that basic coverage would suffice for your child or those who might not want to spend too much on insurance for your little ones, the Tokio Marine TM PA policy might be right for you.

In addition, the Tokio Marine TM PA plan provides optional riders specially designed to suit different needs.

Regardless of which optional rider you choose to add to your plan, you are bound to receive seamless coverage throughout either your hospitalisation or post-hospitalisation journey.

With a direct comparison against the Tokio Marine Protect PA, it appears as though the Tokio Marine TM PA provides you with wider coverage against death and child cover but does not directly compensate you for a loss of income.

Nonetheless, you can still enjoy various cash compensations when nursing your injury with the Tokio Marine TM PA policy if you opt-in for the Hospital Care Benefits rider.

Despite the Tokio Marine TM PA providing those insured with a similar (mostly equal) sum assured against the Tokio Marine Protect PA, the fact that the Tokio Marine TM PA policy requires lower premium payments leads me to believe that the Tokio Marine TM PA may be a better and more suitable personal accident plan for most consumers.

However, this is only a comparison within Tokio Marine, and there are many other personal accident plans out there issued by other companies.

As such, it is key that you sit down and analyse with a financial advisor what you are really looking for in a personal accident plan before you commit to purchasing any policy.