TM Protect PA is a personal accident insurance plan that protects you financially in the event of an accident.

When you are involved in an accident, the first thing on your mind should be recovery and your well-being rather than worrying about medical bills.

You can do just that with a plan like the TM Protect PA (not to be confused with TM PA – please come up with better names TM 😂).

For those interested in learning more about this plan’s features, keep reading for our review of Tokio Marine’s TM Protect PA.

Criteria

- Issue age for insured: 1 to 70 years old

- Fixed policy term of 1 year

- Non-guaranteed annual renewal until the insured turns 75

- No medical underwriting required

General Features

Premium Payment Terms

Under the TM Protect PA, the premiums for your preferred plan type are not guaranteed and are dependent on your occupational class.

Premiums are also payable annually or monthly, with the corresponding premium rates listed below.

| Occupational Class | Annual Premiums | |||

| Plan A | Plan B | Plan C | Plan D | |

| 1 | $285.00 | $380.00 | $660.00 | $1,066.00 |

| 2 | $356.00 | $474.00 | $826.00 | $1,332.00 |

| 3 | $499.00 | $664.00 | $1,156.00 | $1,865.00 |

| 4 | $712.00 | $949.00 | $1,650.00 | $2,665.00 |

Here are the monthly premiums:

| Occupational Class | Monthly Premiums | |||

| Plan A | Plan B | Plan C | Plan D | |

| 1 | $24.70 | $32.90 | $57.10 | $92.25 |

| 2 | $30.80 | $41.05 | $71.45 | $115.25 |

| 3 | $43.20 | $57.45 | $100.00 | $161.35 |

| 4 | $61.60 | $82.10 | $142.75 | $230.55 |

There aren’t any indications as to what classifies under each of the Occupational Classes – so you’ll have to check with a financial advisor for that.

It is important to note that if you choose to pay your premiums annually, you can make either direct or GIRO payments to Tokio Marine.

However, only the GIRO payment option is available if you pay your monthly premiums.

Table of Benefits

We consolidated the various basic benefits and their corresponding sum assured for the TM Protect PA.

The compilation for each of the 4 available plans can be found below.

| Basic Sum Assured | ||||

| Basic Benefit | Plan A | Plan B | Plan C | Plan D |

| Accidental Death Benefit | $100,000 | $250,000 | $500,000 | $1,000,000 |

| Double Indemnity Benefit | $100,000 | $250,000 | $500,000 | $1,000,000 |

| Accidental Dismemberment & Burns Benefit (Adult Only) | Up to $150,000 | Up to $375,000 | Up to $750,000 | Up to $1,500,000 |

| Accidental Medical Reimbursement Benefit | $2,500 | $4,000 | $7,500 | $10,000 |

| Sub-limit for Out-patient Treatment | $250 | $400 | $750 | $1,000 |

| Sub-limit for Dental Treatment | $250 | $400 | $750 | $1,000 |

| Accidental Weekly Income Benefit (Adult Only) | $140 | $210 | $280 | $350 |

Protection

Accidental Death Benefit

In the event that the insured person, unfortunately, passes away within 180 days from the date of an accident, the TM Protect PA will pay the full sum assured in one lump sum.

However, any outstanding amounts owed to Tokio Marine will reduce the Accidental Death Benefit payout.

Any amounts previously paid out under the Accidental Dismemberment and Burns Benefit (covered later) will also reduce the amount payable under the Accidental Death Benefit.

After this payment is made, the policy comes to an end.

Double Indemnity Benefit

Part of the TM Protect PA’s unique features would be the Double Indemnity Benefit.

In addition to the previous Accidental Death Benefit, Tokio Marine pays out an additional 100% of the sum assured if the insured’s accidental passing:

- Occurs due to an accident while travelling in a private car or public transport;

- Is not due to engaging in hazardous or risky activities; and

- Is not due to motorcycling, whether as a main rider or pillion rider.

For example, if the insured person has purchased Plan A, which allows him to have a sum insured of $100,000, his passing due to an accident while riding the bus would allow his loved ones to claim $100,000 under the Accidental Death Benefit, and another $100,000 under the Double Indemnity Benefit.

Similar to the Accidental Death Benefit, any amount payable under this benefit will also be reduced by any amounts already paid or payable under the Accidental Dismemberment and Burns Benefit.

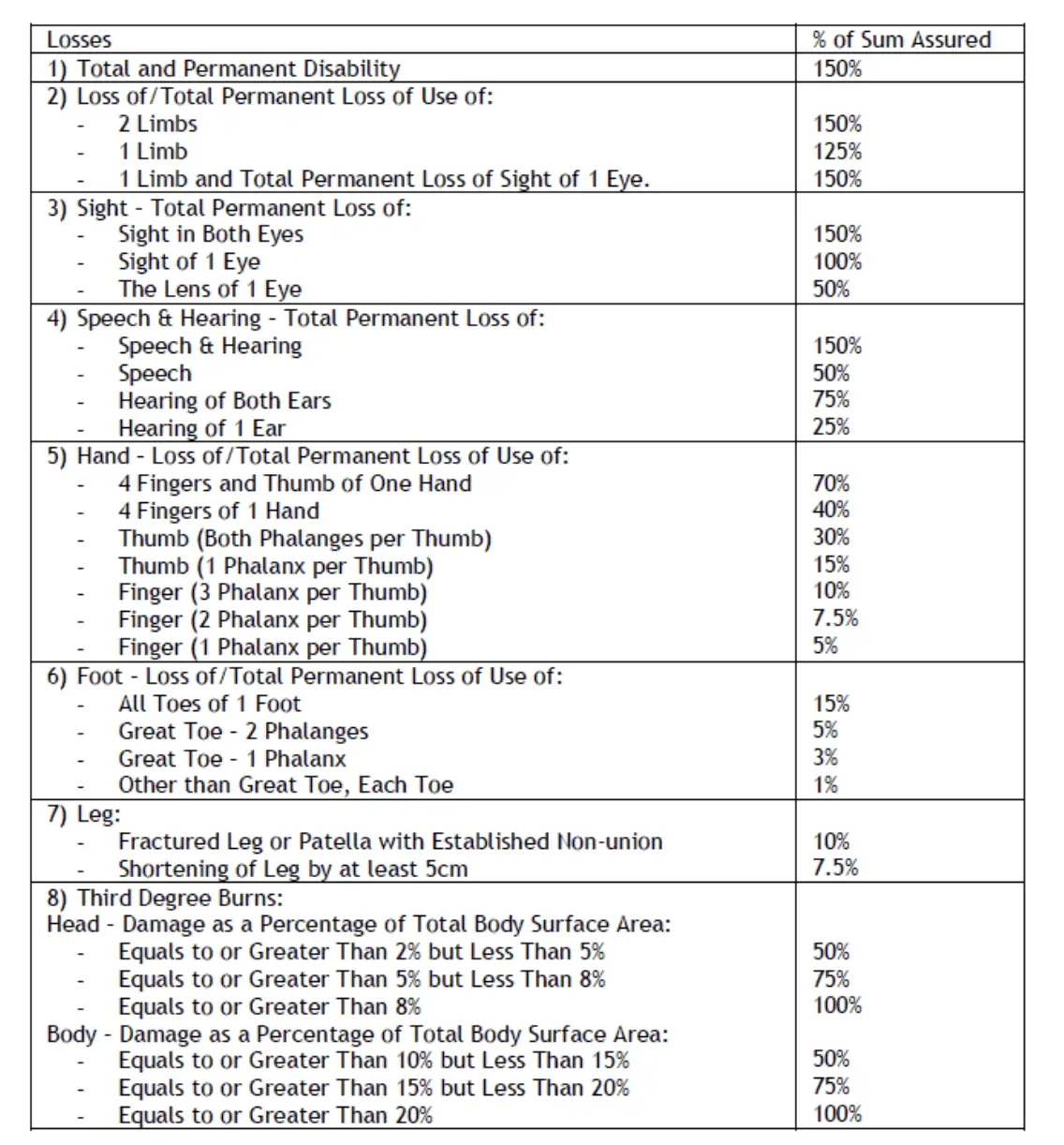

Accidental Dismemberment & Burns Benefit

Apart from accidental death, the TM Protect PA policy also covers you if you experience any of the specified losses due to an injury arising from an accident.

To be eligible for this benefit:

- The injury must be sustained within 180 days from the accident date;

- The injury must be diagnosed and confirmed by a certified medical practitioner; and

- The insured must be above the age of 18.

Depending on the type of loss, a percentage of the sum assured will be paid out accordingly.

It is important to note that you can make multiple claims for the different losses suffered under this benefit, provided all the losses arise from the same accident.

In addition, the maximum payout for this benefit is up to 150% of the sum assured, and the policy will be deemed terminated if you make claims amounting to 100% or more of the sum assured.

For example, if the insured suffers a total permanent loss of use of 1 limb (125% of sum assured) and a total permanent loss of speech (50% of sum assured), he/she is only eligible to receive 150% of the sum assured, instead of the cumulative amount of 125% + 50% = 175% of sum assured.

As the claimed amount is more than 100% of the sum assured, the policy also ends.

There is also a 6-month waiting period for any disablement claims apart from dismemberment and burns.

For those looking to submit a claim under this benefit, do note that Tokio Marine will not pay this benefit for the loss of any body part that is part of a greater body part that is also claimable.

Putting this into an anecdote, if you have lost a limb, this policy will pay for the loss of 1 limb but will not make any further payments for losing a finger or thumb on the same limb.

Accidental Medical Reimbursement Benefit

When your injury caused by an accident requires any of the following, this policy will reimburse you with the reasonable and necessary expenses.

- Medical treatment, hospitalisation, or surgery;

- Out-patient treatment by a medical practitioner, Traditional Chinese Medicine (TCM) practitioner, or chiropractor; or

- Emergency dental treatment by a dentist.

Should the injury require outpatient or emergency dental treatment, the reimbursement will be paid out up to the sub-limit for the corresponding treatment per accident, as shown in the Table of Benefits.

Do note that for the medical expenses to be eligible for claim under this benefit, the expenses would have to be:

- Incurred within 180 days from the date of the accident; and

- Incurred while the policy is still in force.

In addition, do also note that the sub-limit for outpatient and dental treatment expenses forms part of the overall Medical Reimbursement Limit.

Accidental Weekly Income Benefit

Tokio Marine also understands that in the event that you suffer from an injury, you would face financial burdens not only from the medical expenses but also your inability to work.

As such, unlike the previous Accidental Medical Reimbursement Benefit, which reimburses you for the medical expenses incurred, the Accidental Weekly Income Benefit compensates you for your inability to work due to the accidental injury.

To be eligible for this benefit, you would have to:

- Suffer a total and continuous disability as a result of the accidental injury within 90 days from the date of the accident;

- Be unable to engage in your occupational duties and activities;

- Seek immediate medical treatment after the accident;

- Be between the ages of 18 and 65; and

- Must not have an ongoing claim for another accident under this benefit.

When you claim the Accidental Weekly Income Benefit, there is also a maximum of 52 weeks payable per accident.

Policy Extensions

Subject to the terms and conditions of the TM Protect PA, Tokio Marine has also extended the coverage for all benefits in this plan to include the following events:

- Strike, Riots, and Civil Commotion

- Terrorism

- Suffocation by Smoke, Poisonous Fumes, Gas & Drowning

- Natural Disaster

- Disappearance

- Hijack, Murder, and Assault

- Food Poisoning

- Dengue Fever

- Hand, Foot, and Mouth Disease (HFMD)

- Insect / Animal Bite, Sting, or Attack

If you don’t know, this is amazing, as most of the items on this list are exclusions typically found in PA and travel insurance plans.

Now, I’m not saying you should do any of the above, but in case you’re caught in the middle of any of it (touchwood), you’re covered by Tokio Marine’s TM Protect PA.

Among these extensions, food poisoning, dengue fever, and hand, foot, and mouth disease (HFMD) are not eligible for coverage under the Accidental Weekly Income Benefit.

Summary of TM Protect PA

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | No |

| Accidental Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the TM Protect PA

From my point of view, the TM Protect PA is a comprehensive personal accident insurance plan suitable for people of all ages, from 1 to 70 years old.

Apart from covering you with the usual benefits associated with personal accident plans, such as accidental death and dismemberment benefits, the TM Protect PA also provides you with a double indemnity benefit which gives you extra coverage if the insured suffers an accidental death while travelling in a private car or public transport.

While Singapore’s transport system may be relatively safe, you will be glad to hear that this policy covers you globally, meaning you are protected even when travelling overseas!

Not forgetting that the policy extensions cover scenarios where it is more likely to happen overseas.

In addition, this policy also ensures you are well-protected financially if you sustain an injury.

Apart from reimbursing you for the medical expenses, you can also claim an Accidental Weekly Income Benefit, which sets your mind at ease, allowing you to recuperate from your injuries.

However, compared to other personal accident policies, the premiums, even for the lowest tier (Plan A) of the TM Protect PA, may be a tad higher than that of most other low to mid-tier personal accident plans, potentially deterring prospective policyholders.

If you were to compare the cost-to-benefit ratio, the coverage for medical expenses may not be as high as the market average.

Despite this, the accidental death benefit does provide you with a cost-to-benefit ratio that is higher than most of the other personal accident plans.

In addition, it is important to note that just by looking at the sum assured for medical expenses, the lowest tier (Plan A) for the TM Protect PA is also comparable to the highest-tier personal accident plans by other insurance firms.

With the above evaluations, I would feel that the TM Protect PA policy is more well-suited for those worried about their income in the event of an injury and willing to spend more on their personal accident insurance for higher coverage amounts.

Ultimately, weighing your options with your financial advisor or getting a second opinion to evaluate what is necessary for you is always important.