Are you looking for a way to invest your money and earn a higher return than a traditional savings account?

Have you heard about Syfe Income Plus and want to know if it’s worth the investment? Well, you’ve come to the right place!

In this article, I’ll review Syfe Income Plus and give you my honest opinion on whether it’s a good investment option.

So, whether you’re a beginner investor or a seasoned pro, keep reading to learn everything you need to know about Syfe Income Plus and whether it could be the right investment choice.

What is Syfe Income+?

Syfe introduced a new product under Syfe Wealth called Syfe Income+, consisting of 2 portfolios – Syfe Income+ Preserve and Syfe Income+ Enhance.

Both portfolios let you earn monthly passive income that you can choose to reinvest or withdraw straight to your bank account.

Powered by PIMCO, you can invest in a relatively low-risk investment portfolio of retail and institutional funds that may yield higher returns amidst the current high inflationary environment.

Before I move on to talk more about Syfe Income+, I believe I should take a side step and explain more about PIMCO, as they play a huge part in Syfe Income+’s portfolios.

What is PIMCO?

PIMCO, or Pacific Investment Management Company LLC, is a global investment management firm that provides a wide range of investment solutions for individuals, institutions, and financial advisors.

PIMCO was founded in 1971 and is headquartered in Newport Beach, California. The firm manages investments across various asset classes, including bonds, equities, commodities, and more.

PIMCO is known for its expertise in fixed-income investments and is one of the largest bond fund managers in the world, with U$1.8 trillion in assets under management (AUM) as of 31 March 2023.

Why PIMCO?

Highly diversified funds

With PIMCO’s active management, they apply their best income-generating ideas across global fixed-income sectors to the bonds of individual funds.

Simply put, the underlying bonds in each fund you invest in are always the best options.

It is also much safer than going all-in on one bond since the funds are highly diversified across geographies.

A unique investment strategy that works

The portfolio construction process at PIMCO is guided by the company’s forward-looking views on the market and its time-tested investment process for maximising income in any market environment.

This is done by rebalancing the portfolio twice every year, taking into account forward-looking views, and providing the best value for customers.

PIMCO has been in the fixed-income game for over 50 years, and 70% of its funds have outperformed benchmarks after fees over 5 years.

With this, keep in mind that PIMCO manages the funds in Syfe Income+, so you know you’re in pretty good hands.

Okay, back to the topic.

Syfe Income+ Features

Below is a list of features of Syfe Income+ that we would like you to take a look at:

Powered by PIMCO

As mentioned in the previous section, PIMCO has over 50 years of managing fixed-income assets, and over 70% of its funds have outperformed its respective benchmarks.

PIMCO also has U$1.8 trillion in AUM as of 31 March 2023, indicating that many investors around the globe trust PIMCO with their investments.

Investing in Unit Trusts

Unlike Syfe’s usual focus on ETFs, this is Syfe’s first foray into actively managed funds, and for a good reason.

Unlike passively managed ETFs, the active management of funds lets the fund managers adjust the underlying assets based on uncertain market conditions – potentially bringing you better returns during such times.

Unit trusts are more effective in inefficient markets and uncertain market conditions.

Given that we’re unsure of where the economy is going in 2023 and that a significant part of the portfolio invests in emerging markets, this is where unit trusts will thrive in generating the best returns for you.

Institutional Fund Access + Trailer Fee Rebates

Syfe Income+ portfolios contain a mixture of retail and institutional funds that most regular investors like me and you will not have access to.

Most of the funds are institutional share-class, which gives you lower management fees than similar retail funds.

Should Syfe Income+ utilise the retail share-class funds, you will receive trailer fee rebates, meaning the overall management fees you pay will be much less than when you purchase it yourself.

Attractive Monthly Payouts

Another attractive feature of Syfe Income+ is that it offers monthly dividend payouts straight to your bank account – the dream of every fixed-income investor.

Depending on which portfolio you opt for, you can expect a monthly payout of between 4.0% to 6.0% p.a.

The monthly payout, however, is computed using a weighted average of the past distributions.

SGD-Hedged

To reduce exposure to currency fluctuations, Income+ portfolios invest in SGD-hedged share classes of the funds that make up the portfolio.

This is especially crucial for investors searching for consistent dividends unaffected by negative or unwanted movements in foreign currencies.

Payments made in unhedged USD can translate to lower payments, disrupting the final amount you receive in dividends.

At the same time, SGD hedged share classes will facilitate convenience in the overall process, ensuring clients’ ongoing income needs are met without interruption.

No Lock-in Period

In times of crisis, lock-in periods can be a source of concern.

Fortunately, Syfe has kept it pretty flexible by offering no lock-in periods with Syfe Income+ and even its other portfolios!

Don’t worry about having your funds locked up when you need them!

Tax Efficiency

A significant feature of Syfe Income+ portfolios is that they are tax-efficient.

Most fixed-income funds or most investors tend to choose to invest in the US markets due to ease of access.

The problem with US markets is that you are subject to a 30% dividend withholding tax, which is pretty significant, especially if fixed-income is what you’re after.

The funds in Syfe Income+ are domiciled in Ireland. This means that instead of incurring a 30% dividend withholding tax, you only pay 15%.

Syfe Income+ Portfolio Composition

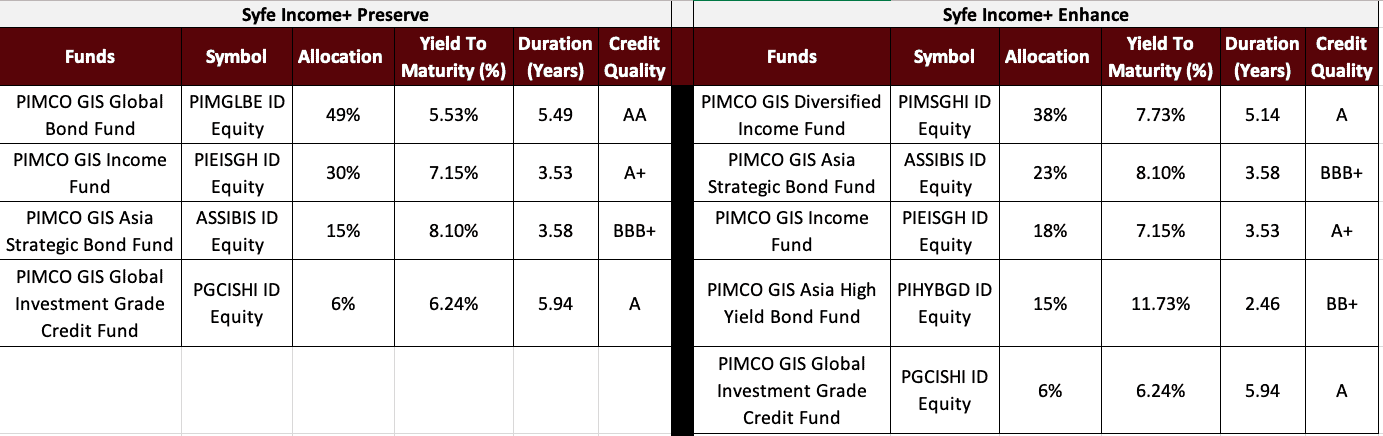

Both Syfe Income+ Preserve and Enhance have different compositions based on different objectives.

Firstly, let’s break down the portfolios by fund allocations:

Accurate as of 11 May 2023.

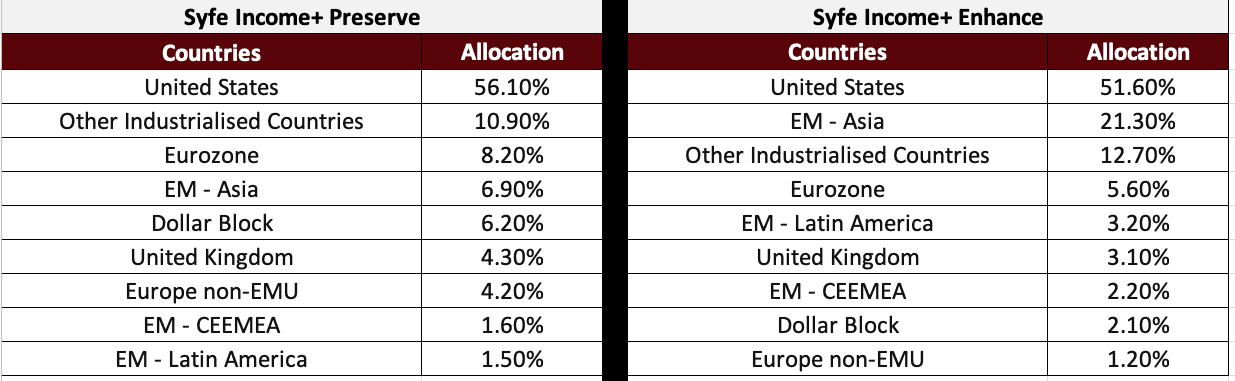

Next, let’s break it down by country distribution:

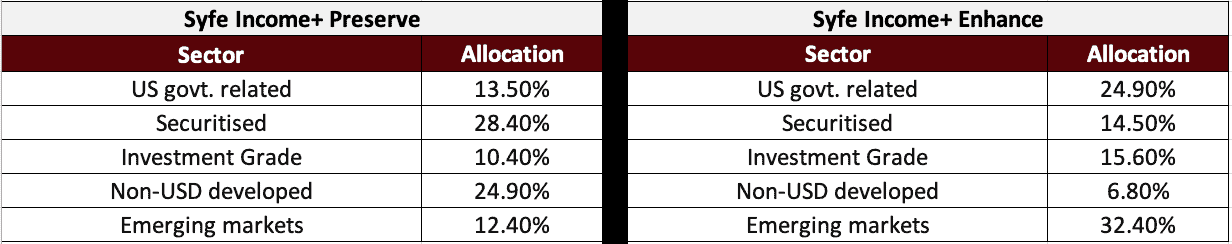

Finally, let’s see the sector distribution for each portfolio:

As you can see, both Syfe Income+ Preserve and Income+ Enhance invest in funds that are pretty diversified in geographic allocation and industrial sectors.

Let’s dive deeper into the Syfe Income+ Preserve portfolio

The Syfe Income+ Preserve allocates your investments to the following 4 funds:

- PIMCO GIS Global Bond Fund

- PIMCO GIS Income Fund

- PIMCO GIS Asia Strategic Bond Fund

- PIMCO GIS Global Investment Grade Credit Fund

We extracted key data from Syfe’s materials below:

| Fund | Fund Exposure | Fund Objective | Allocation | YTM | Distribution Yield | Distribution Frequency |

| PIMCO GIS Global Bond Fund | Global, Diversified Investment Grade | Maximising total return and capital preservation | 49% | 5.19% | 2.30% | Monthly |

| PIMCO GIS Income Fund | Global, Multi-sector | Generating high current income and long-term capital appreciation | 30% | 6.56% | 6.12% | Monthly |

| PIMCO GIS Asia Strategic Bond Fund | Asia, Investment Grade | Generating attractive and stable income and long-term capital appreciation | 15% | 7.65% | 5.25% | Monthly |

| PIMCO GIS Global Investment Grade Credit Fund | Global, Corporate Investment Grade | Maximising total return and capital preservation | 6% | 5.94% | 3.07% | Quarterly |

| Syfe Income+ Preserve | 6.44% | 4.3% | Monthly | |||

Accurate as of 28 February 2023.

As you can see, Syfe forecasts the Yield to Maturity (YTM) to be 6.44% and a distribution yield of 4.3%.

I combed through each fund fact sheet and saw that the YTM and distribution yield already consider the initial sales charge and fund management fees.

Thus you don’t have to worry about any other fund-level fees when looking at the returns and only consider Syfe’s platform fees, which I will go through later.

Firstly, YTM. It is only possible for you to reach the YTM figure (6.44%) if you hold their bonds to maturity and there are no defaults by any bonds in the funds.

As Syfe Income+ is focused on providing you with dividend income, your focus should be on the distribution yield of 4.3%.

It’s also worth noting that the PIMCO GIS Global Investment Grade Credit Fund is available only to accredited investors and institutions.

Now, the Syfe Income+ Enhance portfolio

The Syfe Income+ Enhance allocates your investments to the following 5 funds:

- PIMCO GIS Diversified Income Fund

- PIMCO GIS Asia Strategic Bond Fund

- PIMCO GIS Income Fund

- PIMCO GIS Asia High Yield Bond Fund

- PIMCO GIS Global Investment Grade Credit Fund

Again, I extracted key data from Syfe’s materials:

| Fund | Fund Exposure | Fund Objective | Allocation | YTM | Distribution Yield | Distribution Frequency |

| PIMCO GIS Diversified Income Fund | Global, Investment Grade & High Yield | Efficient access to broad global credit market exposure with an objective of maximising total return | 38% | 7.05% | 3.90% | Monthly |

| PIMCO GIS Asia Strategic Bond Fund | Asia, Investment Grade | Generating attractive and stable income and long-term capital appreciation | 23% | 7.65% | 5.25% | Monthly |

| PIMCO GIS Income Fund | Global, Multi-sector | Generating high current income and long-term capital appreciation | 18% | 6.56% | 6.12% | Monthly |

| PIMCO GIS Asia High Yield Bond Fund | Asia, High Yield | Diversified exposure to Asian High Yield with an objective of maximising total return | 15% | 11.06% | 7.76% | Monthly |

| PIMCO GIS Global Investment Grade Credit Fund | Global, Corporate Investment Grade | Maximising total return and capital preservation | 6% | 5.94% | 3.07% | Quarterly |

| Syfe Income+ Enhance | 8.22% | 5.6% | Monthly | |||

Accurate as of 28 February 2023.

The YTM is projected to be 8.22%, and the dividend yield is 5.6%.

The higher returns you see here are due to the higher risk you’re taking. Looking at the allocations, more of your investments are put into high-yield funds with lower credit ratings and, thus, a higher risk of default.

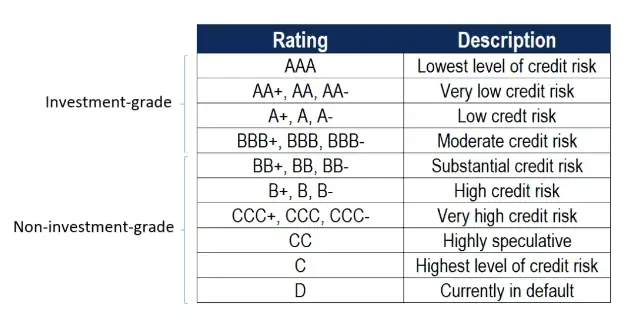

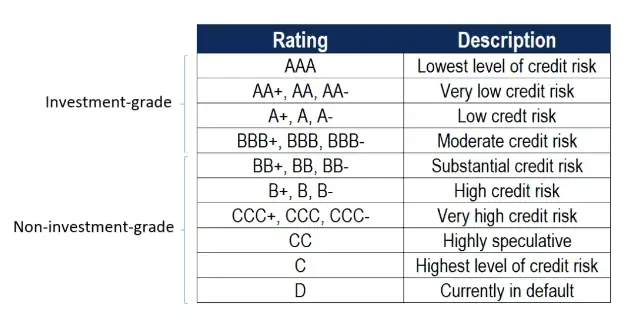

Source: Corporate Finance Institute

The PIMCO GIS Asia High Yield Bond Fund has a credit rating of BBB+, which is still considered as investment grade.

However, the PIMCO GIS Asia High Yield Bond Fund has a credit rating of BB+, which is a junk bond fund with high risk.

Should any of the bonds default, a negative impact will be felt on the distribution yield and the fund’s net assets.

What is the possibility of the PIMCO GIS Asia High Yield Bond Fund defaulting?

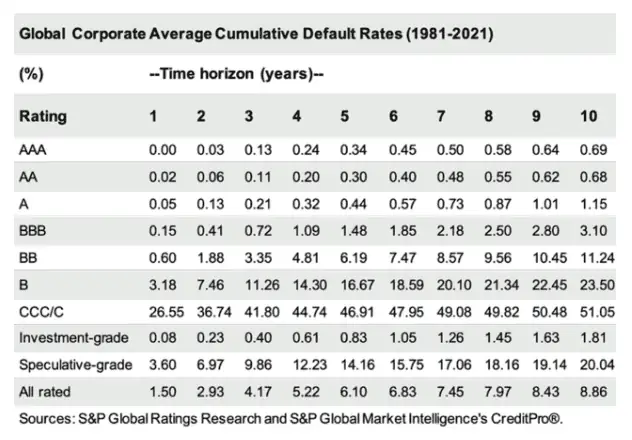

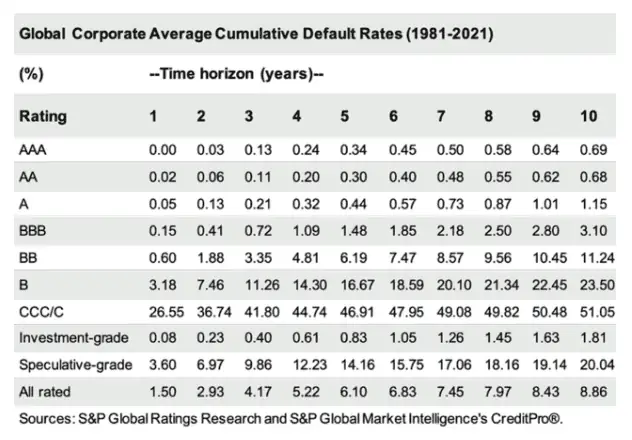

Well, according to research done by S&P, here is the risk of default:

Source: Seeking Alpha

BB+ falls between BBB and BB. Basically, the likelihood of the BB+ bond default over 5 years is between 1.48% to 6.19%.

Over 10 years, the risk of PIMCO GIS Asia High Yield Bond Fund defaulting will be between 3.10% to 11.24%.

Of course, take this as a rough guide to understanding your risks better.

Oh, similarly, the PIMCO GIS Global Investment Grade Credit Fund is available only to accredited and institutional investors.

Syfe has also compiled a summary of each of its portfolios here:

| Features | Syfe Income+ Preserve | Syfe Income+ Enhance | |

|

Objective |

Steady income with capital preservation | Higher-income with capital appreciation | |

|

Monthly Payout* |

4.0 – 4.5 % p.a. | 5.0 – 6.0 % p.a. | |

|

Sector Allocations |

US Gov. Related 14%

Securitised 28% Investment Grade 10% Non-USD Developed 25% Emerging Markets 12% |

US Gov. Related 25%

Securitised 14% Investment Grade 16% High Yield 14% Emerging Markets 32% |

|

| Portfolio Characteristics | Yield to Maturity | 6.44% | 8.22% |

| Duration (Years) | 4.64 | 4.14 | |

| Credit Quality | A+ | A- | |

| Beta to S&P500 | 0.12 | 0.22 | |

| Risk Rating (Syfe) | Low | Moderately Low | |

* Monthly payout ranges are computed based on the weighted average of the annualised historical distribution amount or dividend/distribution yield of the constituent funds from the latest three months. The upper and lower bounds of the range are rounded up to the higher 0.5% and down to the lower 0.5%, respectively. The dividend amount or dividend rate/yield of the constituent funds is not guaranteed. Past distributions are not necessarily indicative of future trends, which may be lower. A positive monthly payout or distribution yield does not imply a positive return

To make it simple for both you and me, if you are looking for steady returns on your investments without putting too much of your capital at risk, the Syfe Income+ Preserve is the portfolio for you.

Conversely, Syfe Income+ Enhance would be for investors interested in generating higher current income and wanting to enjoy capital appreciation by staying invested long-term.

What is the risk of Syfe Income+ portfolios defaulting?

Firstly, let’s talk about the Syfe Income+ Preserve. It comprises investment-grade corporate bonds, US government treasuries, etc; and has a credit rating of A+.

This credit rating means that it is investment-grade with a low level of risk.

The Syfe Income+ Enhance has a lower credit rating of A- due to higher allocations to riskier assets in the PIMCO GIS Asia Strategic Bond Fund and PIMCO GIS Income Fund.

Bringing back the above table:

As a whole over 5 years, both Syfe Income+ portfolios are relatively at low risk of defaulting, with the probability ranging between 0.3% to 0.44% for Income+ Preserve and 0.44% to 1.48% for Income+ Enhance.

How do Syfe and PIMCO work together?

Okay, at this point in time, you already know that PIMCO powers Syfe Income+ portfolios. However, I need to clarify the relationship between Syfe and PIMCO.

PIMCO’s involvement in the process of portfolio development aims to offer insights based on credit spreads, yields, economic forums, and the market environment.

Syfe then recommends the portfolio allocations in both Income+ Preserve and Enhance.

You, as the investor, have the option to accept these recommendations or to maintain your current allocations.

As this is an actively managed portfolio, it’s best always to accept the recommendations so that your investments adapt to changing market conditions.

However, the portfolios may be automatically rebalanced by Syfe if they are out of alignment with their respective target asset allocations due to price drifts.

Doing so ensures that your portfolio is aligned with the target asset allocation while optimising your portfolio.

Syfe Income+ Minimum Investment Amount

The minimum investment to get started with Syfe Income+ portfolios is $5,000.

Should I withdraw my Syfe Income+ dividends or reinvest them?

To decide whether you should withdraw or reinvest your Syfe Income+ dividends, you should understand your financial goals better – do you want or need the dividends, or would you prefer to reinvest and let your portfolio grow?

Thus, depending on your current income requirements, you will have to choose between receiving a monthly distribution and having your dividends automatically reinvested.

However, for you to begin receiving dividends, you need to have a minimum of $5,000 in your Income+ portfolio.

In the event that your funds drop below $5,000, the portfolios will revert to their default setting, where your dividends are automatically reinvested.

Syfe Income+ Fees

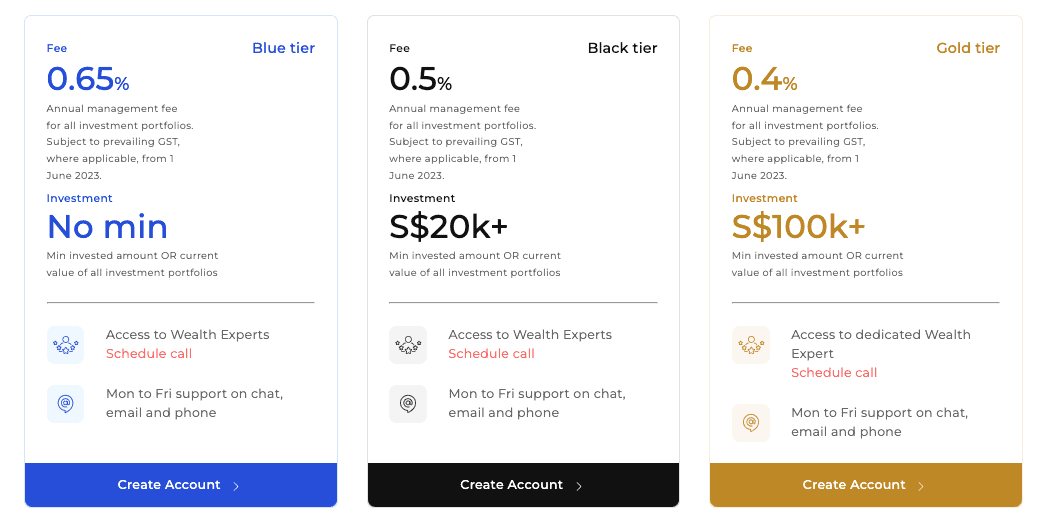

Depending on your Syfe tier, you can expect to pay between 1.08% to 1.33% in fees for the Syfe Income+ Preserve and between 1.05% to 1.30% in fees for the Syfe Income+ Enhance.

As mentioned, Syfe Income+ invests in institutional share-class funds, which means that the fees are already lower than similar retail share-class funds.

Even with lower fees, Syfe rebates the trailer fees it earns to you, giving you even lower fees.

On top of the fund-level fees, you must consider Syfe’s platform fees, which depend on your tier.

Here are our calculations for how much you can expect to pay in fund-level fees + Syfe platform fee – trailer rebates:

| Portfolio | Fund Level Fees | Trailer Fee Rebate | Net Fund Level Fees | Syfe Tier | Syfe Fees | Net Fees |

| Income+ Preserve | 0.97% | 0.29% | 0.68% | Blue | 0.65% | 1.33% |

| 0.68% | Black | 0.50% | 1.18% | |||

| 0.68% | Gold | 0.40% | 1.08% | |||

| Income+ Enhance | 0.83% | 0.18% | 0.65% | Blue | 0.65% | 1.30% |

| 0.65% | Black | 0.50% | 1.15% | |||

| 0.65% | Gold | 0.40% | 1.05% |

Accurate as of 28 February 2023.

The fees you see above also include the 15% withholding tax.

How much can I expect to receive with Syfe Income+? Is Syfe Income+ good?

Depending on the portfolio and your Syfe tier, after fees and tax, you can expect net returns between 3.35% to 4.10% p.a for the Syfe Income+ Preserve and 4.35% to 5.60% p.a for the Syfe Income+ Enhance.

You can expect to receive dividends between 4.0% to 4.5% for the Syfe Income+ Preserve and 5.0% to 6.0% for the Syfe Income+ Enhance.

Correction: I previously deducted Syfe’s platform fees from the dividends you can expect to receive monthly. Syfe’s team came forward and shared that Syfe will deduct platform fees from the Net Asset Value (NAV) of your Syfe Income+ portfolio instead.

So this means that your portfolio will slowly decline in value should you not reinvest your dividends or make any top-ups. This also assumes the interest rate hasn’t dropped, causing your NAV to increase.

Thus, you should start with more than $5,000 in your portfolio to prevent it from automatically reinvesting your dividends for the month.

Also, your dividends will slowly decline over time due to the deduction in NAV. So keep track and check if you need to reinvest or top up your account if you’re looking to maintain a stable dividend income.

Here are our calculations as to how much you can expect to receive in dividends with the Syfe Income+ before platform fees:

If you’re on the Blue Tier that charges 0.65% in fees, here is how much you would receive in dividends:

For Black Tier investors incurring a 0.5% fee, here’s how much you can expect to receive:

Lastly, for Gold Tier investors incurring 0.4% fees, here’s how much you can expect to receive with the Syfe Income+:

All figures are accurate as of 28 February 2023.

All calculations are net 15% withholding tax, fund-level fees, and Syfe platform fees.

Who is the Syfe Income+ portfolio for?

We believe the Syfe Income+ portfolios are for 3 main groups of investors – those looking for monthly dividends, those looking for higher returns than traditional fixed-income options, and those looking to capitalise on the current high-interest rate and inflationary environment.

Firstly, I must say that the overall fees you incur are not cheap. But the fees are worth it if you’re not keen or don’t know how to constantly manage and rebalance your portfolio.

Also, fees shouldn’t matter much if you don’t know what you’re doing. What matters is that your money grows and brings the expected returns for you.

Yes, the returns and your capital here are not guaranteed by Syfe, but if the projected net returns are similar to your actual net returns, then it shouldn’t be much of a problem for you.

Next, let’s summarise the net returns and the risks you’re taking for each portfolio.

For the Syfe Income+ Preserve portfolio, you can expect to receive between 3.35% to 4.10% in net returns after fees between 1.08% to 1.33%.

For the Syfe Income+ Enhance, you can expect to receive between 4.35% to 5.60% in net returns after fees between 1.05% to 1.30%.

Compared to the Syfe Cash+, which at the point of writing (13 May 2023), has a return of 3.7% after fees, I’d say that for the additional risk you’re taking on, the potential to earn 0.4% extra (if you’re Gold Tier) from the Income+ Preserve might not be worth it.

In fact, most of us would be in the Blue or Black Tier – which, conservatively, have lower net returns of 3.35% or 3.5%, respectively. That’s lower than Syfe Cash+’s 3.7%.

The Syfe Income+ Preserve is definitely not worth it as Syfe Cash+ invests in money market funds with much lower risks than Syfe Income+ Preserve offers.

However, Gold Tier Syfe investors can expect up to 5.60% net returns if they select the Syfe Income+ Enhance. In my opinion, this might be worth investing in if you fall within the 3 groups of investors identified.

Even at the Blue Tier, the 4.35% to 5.35% net returns from Syfe Income+ Enhance might still be pretty worth it.

Let’s not forget that, unlike Syfe Cash+, there is potential for capital gains for both Syfe Income+ Preserve and Enhance when interest rates start to drop.

And when interest rates start to drop, you might see your Net Asset Value maintain at the initial investment or even grow!

I can’t give you exactly how much your capital will appreciate, but the YTMs provided should be a good estimate.

Also worth noting, the YTMs already assume you’re withdrawing your dividends.

If you opted to reinvest your dividends, it’ll definitely be much, much more.

This is something to definitely consider when deciding to invest in Syfe Income+ portfolios, as your overall returns will be even higher.

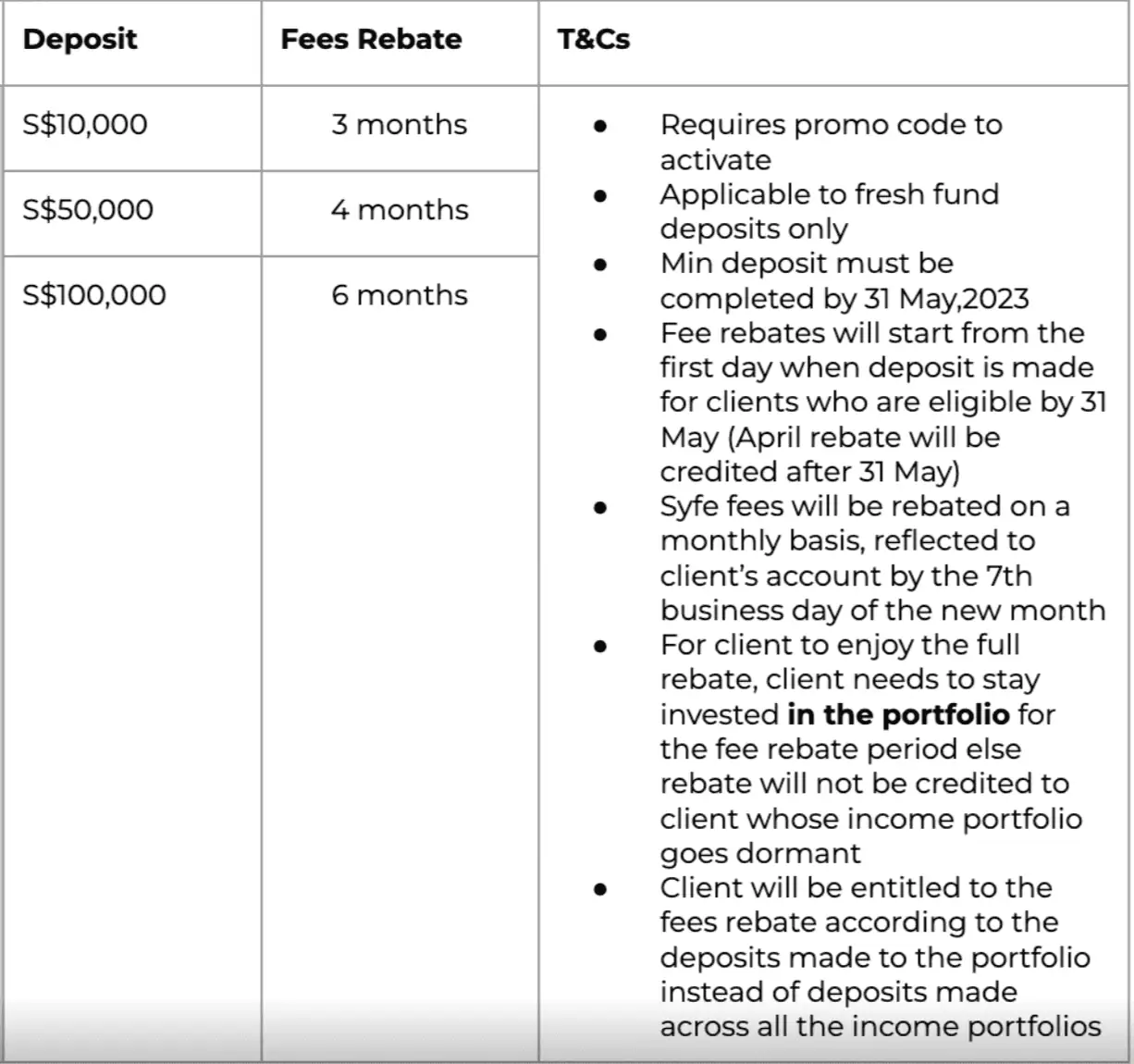

Syfe Income+ Promo & Referral Code

If you’ve decided that Syfe Income+ is for you, new Syfe Wealth users can use our promo code “DOLLARBUREAU” to receive fee waivers for up to S$50,000:

| New Users | |

| Min. Deposit | Your Reward |

| $ 10,000.00 | 3 Months Fee Waiver |

| $ 20,000.00 | |

| $ 50,000.00 | |

Copy our Syfe Income+ promo code here: DOLLARBUREAU

Click here to sign up for Syfe Income+: https://www.syfe.com

For current Syfe Wealth users, use our promo code “DBRB” to receive up to 6 months worth of fee waivers.

Click here to sign up for Syfe Income+: https://www.syfe.com