Singlife Disability Income is a disability income policy (duh) designed to offer financial support by providing a monthly income in the unfortunate event of disability resulting from illness or accident.

Here’s our review of the Singlife Disability Income:

My Review of the Singlife Disability Income

The Singlife Disability Income is an okayish solution to ensure that disability doesn’t result in financial strain for you.

This plan replaces the income you lost during periods of severe disability.

Under the Partial Disability Benefit, individuals can receive up to 75% of their declared income, and premiums are adjusted accordingly to accommodate this coverage.

A key advantage is the premium waiver feature, eliminating the need to continue paying premiums while receiving disability payouts.

For those concerned about the impact of inflation, you can increase the monthly payout by 3% annually for your Total Disability Benefit, ensuring that the coverage keeps pace with the rising cost of living.

However, payouts from the Total Disability Benefit only start at $500 and increase until it hits the monthly benefit you purchased for this plan (75% of your salary).

In the unfortunate event of a policyholder’s demise while receiving disability income, Singlife Disability Income offers the beneficiaries a Death Benefit of $5,000 as financial support.

Furthermore, the plan extends coverage beyond income replacement by reimbursing rehabilitation expenses.

This includes costs associated with medical therapies and workplace modifications to aid the policyholder’s recovery.

While Singlife Disability Income stands out for its flexibility and affordability in disability income insurance, it’s important to note that it offers partial coverage during non-working periods.

Before committing to the Singlife Disability Income, we suggest comparing it with other disability income insurance policies to find one that’s the best fit for you.

With a policy you’ll really need if you’re disabled, it’s best to make sure that it suits your needs well.

If you need help comparing policies, we partner with unbiased financial advisors who have helped thousands of our readers compare and find the perfect insurance policies – and they’re happy to help you with this too!

Click here for a free comparison session.

Here’s a breakdown of what the Singlife Disability Income offers:

General Features

Premium Terms

The premiums are not guaranteed and may be adjusted based on:

- Age Next Birthday

- Smoker or Non-smoker

- Inclusion of Escalation Benefit

- Inclusion of a 35% perpetual discount (subject to availability)

- Changes in occupation or country of residence.

Policy Term

It is unclear as to how long you can purchase this policy and for up to what age it’ll be in force, but I managed to get a quotation for 35 years up to the age of 65.

So this means that you can have it covered for at least 35 years or until you turn 65.

Key Features

The following benefits are payable where you suffer total or partial disability and cannot continuously work to earn an income for the first 2 years (non-working period).

Total Disability Benefit

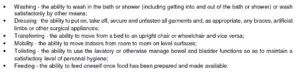

By total disability, you should be unable to perform at least 3 of the below ADLs continuously on your own;

The Total Disability Benefit is money you will receive if you are continuously unable to work for an extended period due to the above ADLs.

It applies during the first 2 years of this period if you can’t continue working.

After that, it covers situations in which you can’t do any suitable job based on your skills, education, or experience and don’t earn any money from any work.

If you stop working, the policy still covers you for 2 years or until the benefits end date, whichever comes first.

The initial Total Disability Benefit is $500, increasing by 3% each year to counter inflation, but it won’t go above 100% of the monthly benefit in the plan.

Partial Disability Benefit

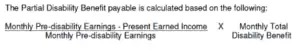

After a stretch of total disability where the Working Total Disability Benefit was paid, if you go back to work in a reduced capacity, leading to a decrease of over 25% in pre-disability income, the Partial Disability Benefit kicks in.

“Partial Disability” means that, following a period of Working Total Disability, you have resumed full-time or part-time employment (working period).

However, due to the same illness or accident that caused the total disability, you can’t perform the key tasks of your job and are earning less than 75% of what you used to earn before the disability.

Rehabilitation Benefit

If you suffer a total or partial disability, extra medical or occupational therapy might help you recover and return to work, either fully or partially.

The Singlife Disability Income will pay you up to 3 times the monthly Total or Partial Disability Benefit.

These rehabilitation expenses could cover things like medical aids and changes to the workplace.

Escalation Benefit

The Escalation Benefit applies only if you choose this option when signing up.

If you did, your Working Total Disability and Partial Disability Benefits would increase by 3% each year, compounded annually.

This increase starts from the Policy Anniversary right after the date when the benefit was first paid.

Waiver of Premium Benefit

When you receive either the Total or Partial Disability Benefits, you will not be required to pay any premiums during that time.

Death Benefit

In the unfortunate demise of the Life Assured while receiving the disability benefits, a lump sum amount of $5,000 will be paid out as the Death Benefit.

Summary of Singlife Disability Income

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |