If you are looking for a double investment benefit that will allow you to feel financially secure, there is no need to look further.

Life insurance policies and wealth accumulation are part of the PRUVantage Wealth.

PRUVantage Wealth is a regular premium whole-life investment-linked insurance policy that combines lifelong financial protection with wealth accumulation opportunities through various investment options.

It furthermore provides financial protection against the risk of death for as long as the policyholder is alive and enables policyholders to grow their savings and investments over time.

For a complete analysis of the PRUVantage Wealth policy, keep reading.

My Review of Prudential’s PRUVantage Wealth

The PRUVantage Wealth is a versatile insurance-focused investment-linked policy designed to help you grow your wealth while offering various benefits for you and your loved ones.

PRUVantage Wealth provides a range of professionally managed PRULink Funds, allowing you to align your investments with your financial goals and risk tolerance.

You have the flexibility to make top-up premium payments through the Investment Booster (Lump Sum) feature.

These additional premiums are invested in the Additional Investment Account, allowing further wealth growth.

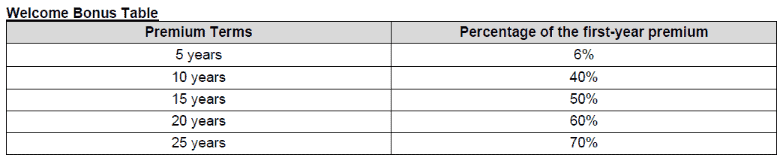

The policy also offers appealing bonuses, including a Welcome Bonus of up to 70% additional units in the first year and a Loyalty Bonus of 0.8% every 8 years.

These bonuses enhance the growth potential of your wealth.

The PRUVantage Wealth features low fees and simplified charges.

It includes a clear and transparent administration charge starting from 1.10% per annum, payable for a limited number of years, potentially as short as 8 years.

If you invest in dividend-paying PRULink funds, you can receive a regular monthly income stream, providing you with additional funds for your spending.

In unforeseen circumstances, your loved ones will receive a death benefit payout of up to 105% of the total premiums paid or the account value, whichever is higher, ensuring financial security and peace of mind for your family.

In the event of both owners passing away at the same time, the joint ownership arrangement ensures that the policy can continue seamlessly with the surviving owner or appropriate estate management.

This arrangement offers flexibility and continuity.

While PRUVantage Wealth offers many benefits, it’s important to note that it does not provide coverage for terminal illness, Total and Permanent Disability (TPD) benefits, or the option to add riders for extra coverage.

These factors may be critical depending on your individual needs and circumstances.

Also, this is an insurance-focused investment-linked policy, which is widely disliked, including by us.

We believe these policies are not value for money and usually pose long-term financial difficulties as your insurance cost increases as you age.

It’s usually recommended to get a term life insurance plan, together with an investment-focused ILP, or just a regular whole life insurance plan.

This gives you more value for money as it’s cheaper while making it clear where your premiums are allocated.

However, this is just our opinion, and even though we dislike it, it might still be good for you.

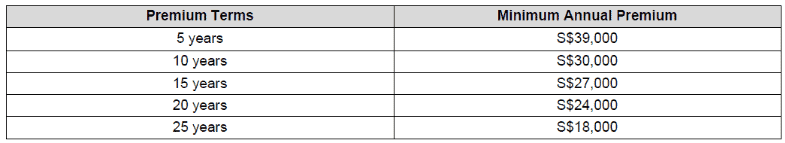

But given that PRUVantage Wealth comes with a minimum annual premium of $18,000 and you must minimally make premium payments for the next 25 years, it’s best that you get a second opinion from an unbiased financial advisor to understand if this policy is really the best for your needs.

You don’t want to commit to a large and long-term financial decision only to realise later on that it’s not good for you – or worse, it’s losing you money at the time of your need.

If you’re interested in getting a second opinion, we partner with MAS-licensed financial advisors who have helped hundreds of Singaporeans with their retirement & insurance needs.

Click here for a free, non-obligatory second opinion.

Now let’s dive deeper into what the Prudential PRUVantage Wealth offers:

Criteria

- Minimum Entry Age (next birthday): 1 year.

- Maximum Entry Age (next birthday): 55-75 years, depending on the premium term chosen.

- Minimum Annual Premium: $18,000.

General Features

Premium Terms

Prudential may impose a surrender charge if you skip payments on your premiums within the first 24 months from the start date of your policy (known as the Minimum Contribution Period).

You may pay your premiums monthly, quarterly, half-yearly, or yearly.

Prudential won’t pay death benefit claims once your policy is terminated due to skipped payments of premiums during the Minimum Contribution Period.

Policy Term

The policy is a whole-life policy.

Protection

Death Benefit

The PRUVantage Wealth provides a death benefit that secures financial protection for your loved ones in the unfortunate event of their passing.

The death benefit paid to your beneficiaries will be the highest of these 3 features, less any amounts owed to Prudential:

- With PRUVantage Wealth, 101% of all basic policy premiums will be paid as of the date of death after deducting any withdrawals already made.

However, for accidental death, the percentage value is higher at a rate of 105%.

- Account values are taken from the Initial Investment Account and the Additional Investment Account, less amounts the assured owes.

The PRUVantage Wealth automatically terminates after the death benefit is claimed.

Key Features

Joint Owner

The PRUVantage Wealth offers options for joint ownership, typically for spouses, where ownership is structured as a joint tenancy.

Should one of the policy owners pass away, the policy will continue and be maintained and controlled by the surviving owner.

Should both policy owners pass away at the same time (e.g. in a common accident), the ownership of the policy will be transferred to the estate of the younger of the 2 policy owners.

Secondary Life Assured

With the PRUVantage Wealth, you can change the secondary life assured during the policy term as long as the original policyowners are still alive.

If the primary life assured passes away, the secondary life assured becomes the new policyholder.

Any supplementary benefits attached to the original primary life assured will end.

However, you can add supplementary benefits to your policy after Prudential accepts the secondary life assured.

Change of Life Assured

You have the option to change the life assured to another person.

You can only change the life assured after 2 years from the cover start date.

When the change in the life assured becomes effective, the coverage for the new life assured will start on the latest cover start date indicated in the revised certificate.

If there were an Accidental Disability Benefit associated with the original life assured, it would automatically terminate.

Switching PRULink Funds

The PRUVantage Wealth lets you switch your investments between different PRULink Funds, subject to certain conditions.

Firstly, you can initiate a fund switch once you have accumulated enough units in your Initial Investment Account and Additional Investment Account (if applicable).

Secondly, funds from different accounts, such as the Initial Investment Account and Additional Investment Account, cannot be combined for switching purposes.

You must switch funds within the same account.

Thirdly, the value of the remaining units in the PRULink fund you are switching from should stay within a minimum specified amount, which will be made known at the time of switch.

If the remaining unit value is below this threshold, you must switch all units out of that fund.

Currently, there are no charges associated with fund switches.

Change of Premium Distribution

You can request a change in the proportions of how your regular premiums are allocated among different PRULink funds at any time.

Doing so adjusts the allocation in multiples of 5%, allowing for control over premium distribution amongst the available PRULink funds.

The requested changes will be in effect the next time you make a regular premium payment.

Top-up Premium (Lump Sum)

You can make additional one-off premium payments, referred to as the Investment Booster (Lump Sum), to increase your investment.

The minimum Investment Booster (Lump Sum) premium amount you can pay is $1,000.

You may allocate your Investment Booster (Lump Sum) premium to one or more of the PRULink funds offered within your policy.

However, you must invest at least 5% of your Investment Booster in any PRULink fund you select.

After that, you can allocate the remaining premium in multiples of 5%.

An upfront premium charge of 3% is applied to your Investment Booster (Lump Sum) premium, meaning that only 97% is used to purchase units in the selected PRULink fund(s).

Premium Holiday

Premium Holiday allows you to temporarily halt premium payments while keeping the policy valid.

However, there should be sufficient units in your investment account to cover the administration charge and premium holiday charge.

You can go on premium holidays for as long as there are sufficient funds to pay for your policy.

Withdrawal of Units

You can partially withdraw from your policy by selling some units in either your Initial Investment Account or Additional Investment Account (if applicable).

A minimum account value of more than $1,000 in your Initial Investment Account and Additional Investment Account (if any) is required.

The remaining units in the policy must be worth at least $1,000.

The drawback of partial withdrawals is that the Additional Investment Account or the Initial Investment Account loses some of its value.

Policy Surrender

If you surrender your PRUVantage Wealth policy, you will get a surrender value composed of the value of the units in your account(s) less any surrender charges (if applicable).

Any premium payments you have made that still need to be invested will also be included.

The surrender value is paid to you after deducting any outstanding amounts you owe to the insurer.

Should the surrender amount be less than the surrender charge amount, no payment will be made as the surrender value.

Note that a surrender charge will apply if you surrender your policy within the specified years from the cover start date, which will be covered later.

Welcome Bonus

The Welcome Bonus is designed to kickstart your investment and provide you with an extra boost during the first year of your policy in the form of additional units to your Initial Investment Account.

The units are allocated to the same proportions as your regular premiums among the available PRULink funds.

The amount of the Welcome Bonus depends on your premium term, as specified in the table below:

Loyalty Bonus

A Loyalty Bonus benefit for policyholders displaying loyalty will be received equal to 0.8% of the latest Initial Investment Account value for every block of 8 completed policy years.

The Loyalty Bonus is converted into additional units and placed into the same fund or funds you have chosen to invest in.

The proportion of these additional units will match your existing investment allocation.

PRUVantage Wealth Fees & Charges

Here is a breakdown of the fees & charges associated with your PRUVantage Wealth policy, usually by cancelling units at the bid price unless stated otherwise.

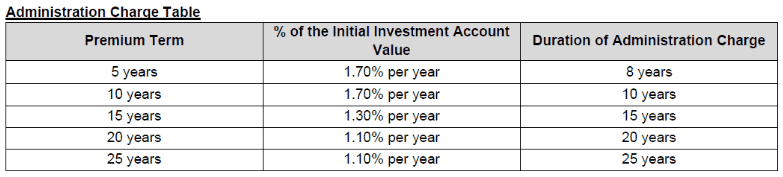

Administration Charge

A percentage of the latest account value of the Initial Investment Account is charged every month on the same day.

The duration of the administration charge will depend on your premium term.

No administration charges are applied to the Additional Investment Account.

Premium Charge

There is a premium charge of 3% on your Investment Booster (Lump Sum) premium.

This charge is applied in advance and is deducted from the Investment Booster (Lump Sum) premium you paid.

Premium Holiday Charge

As tabulated below, a premium holiday charge is imposed every month until the end of its term.

All unpaid premiums during the premium holiday period will return to their regular premium payment status once paid.

In recognition of your commitment to catch up on the unpaid premiums, the insurer will refund 70% of the premium holiday charges.

Surrender Charge

The surrender charge for the PRUVantage Wealth is shown in the table below:

Fund-Related Fees

You will be investing in PRULink funds, which at a quick glance, charges up to 5% of sales charges and between 0.5% to 1.6% in annual charges.

The sales charge works similarly to the premium charge mentioned above, while the annual charge is calculated as a percentage of your fund value.

These fees are excluded from the calculations of your net returns, so make sure to subtract fund-level fees from your fund-level returns.

Summary of PRUVantage Wealth

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |