The Prudential PRUMortgage Refund is a term life insurance mortgage plan that decreases over time, aiming to match the declining amount of your outstanding mortgage.

Think of this plan as a safety net for your mortgage loan.

If something unexpected, like death or terminal illness, occurs during the PRUMortgage Refund term, this plan provides financial protection.

Here is a comprehensive review of this plan.

Criteria

- Minimum policy term of 10 years

General Features

Premium Terms

The term for your premium payments totals 3 years less than the entire coverage duration.

With this plan, you have many premium payment choices: monthly, quarterly, every 6 months, or annually.

PRUMortgage Refund premiums remain the same throughout the premium term, provided that you make your payments within 30 days of their due date.

Please note that you can’t use Medisave funds for the premium payments.

Policy Term

The policy terms are between 10 to 35 years. It can also extend up to your 75th birthday, whichever comes earliest.

Protection

Death Benefit

The Death Benefit comes into effect if the insured person passes on.

In this unfortunate instance, the payout would be either the scheduled sum assured or the total amount of premiums paid, as stated in the Certificate of Life Assurance, whichever is higher.

However, any amount owed to the policy will be deducted from this payout.

However, there are exceptions:

- If the insured person commits suicide within the first 12 months of the plan or its reinstatement, the plan becomes void.

Prudential will then refund the total premiums received, deducting any expenses incurred.

- If 2 people are covered, and one commits suicide within 12 months of the PRUMortgage Refund or its reinstatement, the difference in the premium paid for the deceased person is refunded.

The surviving person’s Death Benefit continues if the regular premiums continue to be paid.

- Lastly, if the insured person passes on due to an activity listed under Special Exclusions or Special Terms and Conditions, the Death Benefit is not paid.

Instead, Prudential will pay back all the premiums received, after deducting the expenses or pay the surrender value, whichever is higher.

Terminal Illness Benefit

The Terminal Illness Benefit is a part of your plan that kicks in if the insured person is diagnosed with a terminal illness before your plan ends.

The payout you’ll get will be the sum assured or the total amount of premiums you’ve paid, whichever is higher in value, keeping in mind that the amount you receive will be after deducting any plan debts.

If 2 people are covered under the same plan, the one who gets diagnosed first will receive the benefit, and the coverage for the second person will stop.

In a scenario where both are diagnosed simultaneously, only the person whose name is stated first on the Certificate of Life Assurance will receive the benefit.

Once a Terminal Illness claim is settled, the benefit ends.

Here’s what happens next:

- If the Death Benefit equals the Terminal Illness Benefit, the entire plan, including any Disability Benefit, will terminate.

- If the Death Benefit exceeds the Terminal Illness Benefit, it will be reduced by the amount paid for the Terminal Illness Benefit.

The policy continues with the reduced Death Benefit and any other benefits, on condition that you continue paying the premiums.

Optional Add-On Riders

You can tailor your coverage to your specific needs:

By paying an extra premium, you can enhance your policy with additional safeguards.

The supplementary benefits available include:

- The Accelerated Disability Benefit

- Crisis Waiver III Benefit, and

- Early Stage Crisis Waiver Benefit.

Accelerated Disability Benefit

The Disability Benefit offers financial assistance should you become Totally and Permanently Disabled before the plan anniversary of the age of 70.

You need to add this benefit at the start of the plan.

Here’s what’s covered:

- Suppose the insured person becomes Totally and Permanently Disabled before the plan expires.

The payout will either be the scheduled sum assured or the total premiums you’ve paid, whichever is higher, after deducting outstanding policy debts.

- This payout is made 6 months after a Registered Medical Practitioner has confirmed your disability.

For certain conditions, this waiting period may not apply.

If the policy covers 2 people, the payout will be effective when the first person becomes disabled.

The Disability Benefit for the second person will end.

In the unlikely but possible situation that both people become disabled at the same time, the payout is made only for the individual stated in the Certificate of Life Assurance.

If you’ve previously reduced your sum assured, your premium is also reduced, and this automatically affects how the premiums are calculated.

Before any Disability Benefit claim is paid, all disability claims from all policies with Prudential will be considered, and the total payout is capped at a maximum of $2,000,000 after the waiting period.

Should the sum assured exceed $2,000,000, the payment will be released in one complete amount.

This lump sum will be paid 12 months from the initial payment date or when the life assured passes away, whichever occurs first.

If you recover, the Total and Permanent Disability payment will be stopped before any scheduled payment occurs.

By continuously paying your premiums, you can still maintain your Death Benefit.

Here are the TPD definitions:

- Are completely and irreversibly disabled, preventing you from engaging in any income-generating occupation, business, or activity.

- Suffer total and irreversible:

- Loss of sight in both eyes

- Loss of use of 2 or more limbs, each above the wrist or ankle (excluding hands and feet)

- Loss of sight in 1 eye and loss of use of 1 limb at or above the wrist or ankle (excluding hands and feet).

If you are between the age of 66 years and before the plan anniversary before your 70th birthday, the Disability Benefit applies when you (the life assured):

- Experience total and irreversible vision loss in both eyes or cannot use 2 or more limbs, each above the wrist or ankle.

This also includes the loss of sight in 1 eye and the inability to use any 1 limb at or above the wrist or ankle, excluding hands and feet.

- Find yourself unable (whether aided or unaided) to carry out at least 3 of 6 defined “Activities of Daily Living” continuously for a period not less than 6 months.

A Registered Medical Practitioner must validate the disability.

After the payout

Once the Total and Permanent Disability claim is settled, the Disability Benefit ends.

Here’s what happens next:

- If the guaranteed amount for the Death Benefit matches the amount assured for the Disability Benefit, the plan ends along with all its perks, including the Terminal Illness Benefit.

- If the amount guaranteed for the Death Benefit exceeds the Disability Benefit, the Death Benefit amount will be reduced to the difference between the amounts of the 2 benefits.

You can keep this plan active for this reduced Death Benefit and any additional benefits by paying the necessary premiums.

- If the amount guaranteed for the Terminal Illness Benefit exceeds the Disability Benefit, the Terminal Illness Benefit amount will be reduced to the difference between the 2 benefits.

This remains valid as long as you continue to pay premiums for both the Death and Terminal Illness Benefits.

- If the amount guaranteed for the Terminal Illness Benefit is either less than or equal to the Disability Benefit, the Terminal Illness Benefit ends.

Once the Disability Benefit is paid out, there won’t be any payout for the Terminal Illness Benefit.

The Disability Benefit doesn’t cover the following:

- If the insured person has passed away, the claim Disability Benefit won’t apply.

In this scenario, the Death Benefit will be paid out instead.

- Any disability that already existed at the time when the coverage started or when this benefit was reinstated

- Disabilities that result from:

-

- Attempted suicide or hurting oneself, regardless of mental state.

- Flying on a non-commercial operated airline, except for military aircraft.

- Participating in activities expressly excluded or subject to special terms and conditions, as mentioned in your Certificate of Life Assurance.

Early Stage Crisis Waiver & Crisis Waiver III Benefit

With the Early Stage Crisis Waiver advantage, if diagnosed with any of the covered early critical illnesses, the premiums for included benefits are suspended for a period of 5 years.

After this period, premium payments for the insured benefits will pick up again, excluding the Early Stage Crisis Waiver.

Furthermore, a second claim can be made, leading to another 5-year waiver on premiums.

However, this subsequent claim must not be for an identical medical condition and should belong to a different category than the initial ECI claim.

Should there be a diagnosis of intermediate-stage CI, the benefit offers a 10-year premium waiver.

Yet, if an earlier claim was made under any ECI conditions, only half of that duration, 5 years, will be provided as a waiver.

Crisis Waiver III provides a premium-free period upon diagnosis with any of the specified 35 critical illnesses.

Once this period concludes, regular payments for the covered benefits will continue, but the premiums specific to this rider will not be charged.

Key Features

Joint Lives Coverage

In Joint Lives Coverage, let’s consider this policy as a safety net for 2 people in a mortgage application, in this instance, you and your spouse.

The plan will help in the following scenarios:

- One of the life-assured passes away.

- One of the life-assured becomes totally and permanently disabled or

- One of the life-assured suffered from a terminal illness during the plan term.

Once the benefits are paid out to the other life assured, the coverage for the other person automatically ends.

Now, let’s consider a really rare situation where both lives assured experience one of these unfortunate events simultaneously.

In such a case, the policy will only provide benefit to the first person named on the Certificate of Life Assurance.

So, while it covers both of you, the payout is limited to one event.

Refund of Premium Benefit

This refund feature makes the plan very attractive.

Should you reach the end of your plan term without making any claims for Terminal Illness or Disability, this benefit refunds you on all your premiums paid to the basic plan and the optional Disability supplementary benefit.

Interest, however, is not included in this refund.

Before the refund is issued, any outstanding balance related to your plan will be deducted from the refundable amount.

Additionally, the refund does not extend to premiums paid for any extra benefits.

Any adjustments leading to reducing your sum assured or premium will influence the total premiums you’ve paid throughout the policy term.

The refund will be based on the adjusted total, computed as though you’ve been paying the reduced premium right from the onset of your policy.

This calculation method applies to all circumstances where you’ve lowered your premium.

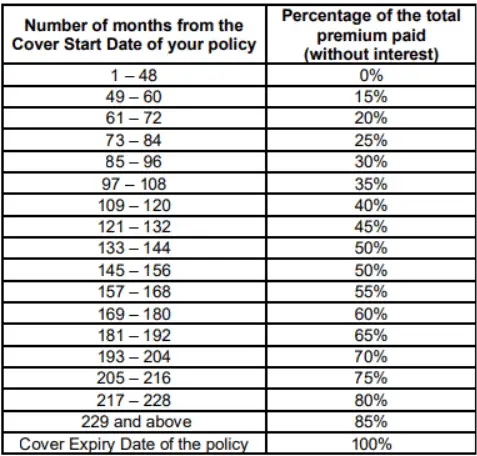

Refund of Premium Upon Termination

The Refund of Premium Upon Termination option in this policy lets you get some of your money back if you decide to end your plan before its Cover Expiry Date.

The amount you get will be a portion of your total premium payments without any interest added, depending on how many months your plan has been active.

Before receiving this refund, any money you still owe to Prudential will first be deducted.

Remember, you can request a refund of the premium upon cancellation at any point you choose.

This effectively ends your policy.

Here’s a representation of the partial refund of the premium upon cancellation:

If you’ve lowered your sum assured at any point, the premium you pay will also decrease accordingly.

When calculating the refund of premiums upon termination, the PRUMortgage Refund assumes that this lower premium was what you started paying from the beginning of your plan.

If you’ve reduced your sum assured on more than one occasion, the calculations for the refund will be based on the most recent lowered premium amount.

Nomination or Trust

You may appoint beneficiaries or establish a trust for your plan, ensuring that your loved ones benefit from it.

You can do this if you:

- Are the life insured in the plan, as mentioned in your Certificate of Life Assurance.

- Haven’t set up any premium financing deals with a financial institution or bank.

- Haven’t transferred the legal ownership of your plan to someone else.

Summary of PRUMortgage Refund

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes, with rider |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Riders | |

|

Yes |

My Review of Prudential’s PRUMortgage Refund

Prudential’s PRUMortgage Refund is a plan that provides comprehensive financial protection against death, terminal illness, and total permanent disability.

The goal of this plan is to ensure your mortgage is paid off, providing peace of mind for you and your loved ones.

One of the standout features of this policy is its flexibility.

With coverage terms ranging from 10 to 35 years, policyholders are given a wide range of options to choose from while also offering a break from paying premiums for the last three years of coverage.

The sum assured or guaranteed amount you receive back depends on the interest rate and the plan term you choose at the start.

As you pay off your mortgage, the sum assured reduces annually according to a preset schedule.

Perhaps the most unique feature of the PRUMortgage Refund is the premium refund.

If no claim is made by the end of the plan term, all premiums paid will be refunded without any interest.

This feature sets the PRUMortgage Refund apart from many other insurance policies, as it offers both protection and a refund if the coverage is not used.

In addition to death and terminal illness, the policy covers total and permanent disability, albeit with an additional rider.

If such an unfortunate event occurs, a lump sum payout is provided, significantly aiding in managing financial needs during such a difficult time.

Overall, the PRUMortgage Refund is a comprehensive insurance plan that provides financial protection and peace of mind.

However, as always, it is recommended to get a second opinion to ensure the plan meets your unique needs.

After all, this is a long-term policy, and you wouldn’t want to make the wrong choice now.