The PRULife Vantage Achiever Prime Series are a participating single-premium whole life plan with a single, upfront payment designed to help you plan better for your future.

Although marketed as a whole life policy, the PRULife Vantage Achiever Prime II (SGD) isn’t really the typical whole life plans that you see.

Instead, this is meant for legacy planning – letting you leave wealth for future generations.

Interested in it?

Here’s our review of the PRULife Vantage Achiever Prime Series.

My Review of the PRULife Vantage Achiever Prime Series

The PRULife Vantage Achiever Prime Series, particularly the PRULife Vantage Achiever Prime II (SGD), is designed as a whole life insurance plan that combines the benefits of life coverage with an investment component.

This plan is tailored for individuals seeking to secure their financial future while providing a safety net for their loved ones.

Pros

1. Comprehensive Lifetime Coverage: The policy offers whole life coverage up to the age of 122, ensuring long-term financial security and peace of mind for you and your beneficiaries.

2. Multiplier Benefit: The inclusion of a Multiplier Benefit significantly enhances the death and terminal illness payouts before a certain age, potentially providing beneficiaries with a higher sum than the original coverage amount. This feature is particularly beneficial for maximising the financial legacy left to loved ones.

3. Flexible Premium Payment Options: While the PRULife Vantage Achiever Prime II (SGD) requires a single premium payment, the USD variant of the policy offers regular premium payment terms of 3 to 30 years, providing flexibility for individuals with different financial capabilities and planning needs.

4. Guaranteed Capital for Single Premium Policies: For those opting for the single premium payment option, the policy guarantees the capital after the 20th year for USD plans and the 25th year for SGD plans, offering a safety net for the investment made into the policy.

5. Quit Smoking Incentive: The Quit Smoking Benefit encourages policyholders to adopt healthier lifestyles by offering a premium refund if they successfully quit smoking, promoting both financial and physical well-being.

Cons

1. High Minimum Premium Requirement: The policy requires a significant initial investment, especially for those aged 17 to 75 years, with a minimum single premium of S$100,000 or U$100,000. This high entry point may not be accessible for all investors.

2. Limited Cash Withdrawal Options: Unlike some other life insurance policies with investment components, the PRULife Vantage Achiever Prime Series does not explicitly mention the availability of partial cash withdrawals, potentially limiting liquidity for policyholders.

3. Long-Term Commitment Required: Especially for those opting for regular premium payments in the USD policy variant, the commitment can extend up to 30 years. This long-term commitment may not suit everyone’s financial planning horizon or flexibility needs.

The PRULife Vantage Achiever Prime Series offers a blend of life insurance coverage and investment potential, making it a compelling option for individuals looking to secure their financial future and leave a substantial legacy.

However, its suitability will depend on your financial goals, your ability to commit to a long-term investment, and your need for comprehensive health coverage.

Nonetheless, whether you should purchase a PRULife Vantage Achiever Prime Series depends on your own financial goals, risk tolerance, and budget.

You may wish to consult with a financial advisor for a second opinion to understand if this policy is best for you.

Should you be interested, we partner with unbiased financial advisors who can help you with this.

Click here for a free non-obligatory second opinion.

Let’s now explore the PRULife Vantage Achieve Prime in detail:

Criteria

- Entry age: 1 – 75 years old

- Single premium payment option only for SGD policies

- Regular premium payment of 3 to 30 years for USD policies

General Features

Before we move forward, it’s critical to make this clear, the PRULife Vantage Achiever Prime Series has 3 different policies – PRULife Vantage Achiever Prime II (SGD), PRULife Vantage Achiever Prime II (USD), and PRULife Vantage Achiever Prime (USD).

For simplicity, we will refer to the PRULife Vantage Achiever Prime II (SGD) as the main policy in this review as it’s the most popular amongst Dollar Bureau readers.

Premium Payments

While there may be regular premium payment terms for other policies in the PRULife Vantage Achiever Prime Series, those who purchase the PRULife Vantage Achiever Prime II (USD/SGD) policy are only allowed to make a single premium payment.

In addition, the minimum premium required for you to be insured under this policy would depend on your age on your next birthday.

| Entry Age (Age Next Birthday) | Minimum Single Premium Amount |

| 1 – 16 years old | S$35,000 or U$35,000 |

| 17 – 75 years old | S$100,000 or U$100,000 |

If you’re interested in the regular premium payment option, the minimum multiplier benefit is U$250,000.

Policy Terms

As the PRULife Vantage Achiever Prime Series are whole life plans, the policy does not have a “maturity date”; rather, it only terminates when the main insured passes away or you surrender the policy.

Multiplier Benefit

For the Death Benefit

The Multiplier Benefit adds an extra amount to the death payout.

This extra amount is a percentage of the sum of money promised for the death payout, which you can see on your policy documents.

The exact percentage depends on how old you are when you start the policy and when the Multiplier Benefit lasts.

For the Accelerated Terminal Illness Benefit

This is similar to the Death Benefit, but it only applies in the event the insured is diagnosed with a terminal illness (TI).

The Multiplier Benefit also adds an extra amount to the TI payout, and the percentage depends on your age, when you start the policy and how long the Multiplier Benefit lasts.

One important thing to note is that the Multiplier Benefit comes from a different fund and does not affect how the other parts of the policy work, where your money is invested.

Think of it as a bonus on top of your basic policy!

Death Benefit

As this plan has a Multiplier Benefit, the payout your family will receive depends on the age at which the unfortunate event occurs.

| Age of Passing | Amount Payable by Prudential |

| Before the Multiplier Benefit’s Expiry Age | Either the coverage amount plus any added bonuses or the Multiplier Benefit, whichever amount is higher |

| On or After the Multiplier Benefit’s Expiry Age | The original amount of coverage plus any bonuses that have been added to the policy |

In both cases, any money you owe will be deducted from the payout that your loved ones would receive from Prudential.

Additionally, any claim under the Accelerated Terminal Illness (TI) or Accelerated Disability Benefits will reduce the sum assured under the Death Benefit.

Upon a successful payout of the Death Benefit, the policy will be terminated.

Accelerated Terminal Illness Benefit

Like the Death Benefit, the Accelerated Terminal Illness Benefit payout depends on the age at which the life assured is diagnosed with a terminal illness (TI).

| Age of TI Diagnosis | Amount Payable by Prudential |

| Before the Multiplier Benefit’s Expiry Age | Either the coverage amount plus any added bonuses or the Multiplier Benefit, whichever amount is higher |

| On or After the Multiplier Benefit’s Expiry Age | The original amount of coverage plus any bonuses that have been added to the policy |

It is important to note that any money you owe to Prudential will be deducted from the benefit amount payable to your beneficiaries.

To be eligible for a claim under this benefit, the following conditions would have to be met:

- There must not have been a previous claim under the Death Benefit;

- The TI diagnosis must be made by an appropriate registered medical practitioner and accepted by Prudential’s appointed doctor; and

- The insured’s condition must be highly likely to result in their demise within 12 months.

If you were previously successful in claiming the Accelerated Disability Benefit, your Accelerated Terminal Illness Benefit will be reduced by the amount previously paid out.

In the unfortunate event of the insured’s passing at the time of the claim, Prudential will process the claim under the Death Benefit instead.

This policy will also cease once a successful claim is made under this benefit.

Surrender Benefit

Like most participating insurance policies, your premiums will be invested into a participating fund.

This means that the value of your policy will grow over time, allowing you to receive some money upon surrendering your plan.

However, this would indicate an early termination of the policy in question and termination costs would apply.

This means the amount you get back might be zero or less than your premiums.

As such, it is advisable that you carefully plan your finances before committing to any insurance plans, especially when it involves long-term policies such as whole-life plans.

Optional Add-on Riders

Accelerated Disability Benefit (ADB)

Considering that the basic policy only covers you for death and TI, you can sign up for this rider to increase the coverage you can receive!

With this rider, you are covered if you experience a total permanent disability (TPD) before age 70.

Under the ADB, you will receive the higher amount of the sum assured, in addition to non-guaranteed bonuses or the Multiplier Benefit, less any outstanding balances.

Crisis Waiver (USD)

If you are on a USD policy, you may opt for the Crisis Waiver (USD) rider to waive future premiums if you’re diagnosed by any of the 30 critical illness conditions covered.

Key Features

Capital Guaranteed

For single premium policies under PRULife Vantage Achiever Prime II, your capital is protected after the 20th year for USD plans and the 25th year for SGD plans from the start of your policy.

This means that no matter what happens in the market, you can be sure that your money is secure and you will not lose the amount you originally invested.

It’s a way to provide you with peace of mind and financial stability over the long term.

Quit Smoking Benefit

Considering that smoking is a persistent social and health problem, Prudential encourages you to lose this bad habit by offering you a unique Quit Smoking Benefit.

If you quit smoking for at least 1 or 2 years within the first 36 months of getting the policy, you can request a review of your smoking status.

You must make this request between Months 37 and 42 from the policy start date.

If you get the approval and your nicotine test is successful, you will be eligible to receive a refund equal to 8% of the single premium.

For example, if your initial single premium paid was $100,000, your refund amount would be $100,000 x 8% = $8,000.

Reversionary Bonus

At the start of every calendar year, you can enjoy a guaranteed bonus, otherwise known as a Reversionary Bonus, which Prudential adds to your basic sum assured under the existing policy benefits.

As the Reversionary Bonus is guaranteed, Prudential will not reverse the issuance once it has been declared.

The Reversionary Bonus and Accumulated Reversionary Bonus rates have also been illustrated in the Product Summary to be $5 and $7.50 per $1,000 sum assured, respectively.

Performance Bonus

Unlike the Reversionary Bonus, the Performance Bonus is not guaranteed and depends on the performance of the participating fund.

The Performance Bonus is a one-time amount you may receive if you decide to surrender your insurance policy or if you make a claim for any of the basic benefits.

As this bonus is calculated based on a percentage of the total reversionary bonuses accumulated over time, the bonus amount may vary depending on when your policy ends.

Change of Life Assured

Those considering signing up for the PRULife Vantage Achiever Prime Series will be glad to hear that this plan can be treated as a form of legacy planning for your significant other or your children.

While this is a whole-life plan that carries on until the person insured passes away, the initial insured person can opt to change the person covered by the policy.

Even though this would prevent the initial insured person from claiming the policy benefits, this allows the invested premiums and accumulated bonuses to grow, thus increasing the amount that your newly appointed insured person would receive when making a claim or surrendering the policy.

It is important to note that those who purchase this plan can only change the person covered by this policy 2 years after the policy start date.

Those who purchase this plan as an individual will only be able to exercise this change option once throughout the policy term.

However, policies owned by business organisations will not have any limit on the number of changes made.

If you consider changing your plan’s life assured, the following conditions must be met.

- There must be satisfactory evidence that you have an insurable interest in the new life assured and meet the applicable terms and conditions;

- The new life assured must meet Prudential’s underwriting requirements;

- The new life assured must not be born after the original policy start date; and

- You must not have a previously successful claim under the Accelerated Terminal Illness or Accelerated Disability Benefits.

Upon successfully changing the life assured, Prudential reserves the right to increase the sum assured or impose one-time additional charges, depending on the new life assured’s health condition.

Policy Loan

Even though the PRULife Vantage Achiever Prime Series policies allow for a Policy Loan, taking them reduces the long-term value of your policy, and you are also subject to non-guaranteed loan interests.

PRULife Vantage Achiever Prime Series Fund Performance

As there are multiple policies to analyse, for simplicity, we will only analyse the PRULife Vantage Achiever Prime II (SGD) as we can compare them to local benchmarks.

Asset Allocation

Because the PRULife Vantage Achiever Prime II (SGD) is a participating endowment plan, it invests the money collected from policyholders to buy sub-fund units.

When your investments grow, you are entitled to bonuses which are like rewards for being a part of the plan.

As such, when you decide to get an endowment or annuity plan like this, it is important to pay attention to how well these investments are doing, as this can greatly impact how much money you eventually get from the plan.

As of 31st December 2021, your premiums are allocated by Prudential as shown in the table below:

| Type of Asset | Allocation Goals | Actual Allocation |

| Bonds | 75.0% | 89.9% |

| Equities | 15.0% | 9.3% |

| Property | 10.0% | 0.0% |

| Other Assets

(Such as Policy Loans and Cash) |

0.0% | 0.8% |

| Total | 100% | 100% |

Fund Performance

When you take part in asset investment through your policy, there is a chance that you can make more money compared to just keeping your savings in a regular bank account.

But you should remember that investments can be risky, and the value of your policy can go up and down depending on how well the investments do.

Here’s some information about how well the investments have done in the past:

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| Investment Returns | 11.12% | 6.42% | -1.27% | 5.30% | 4.57% | N.A. |

Accurate as of 31 December 2021.

While the returns have been decreasing from 2019 to 2021, it is still evident from the average figures that the average over the last 3 years is higher than that of the last 5 years.

This indicates that the fund is still performing better in recent years, something that investors can be optimistic about.

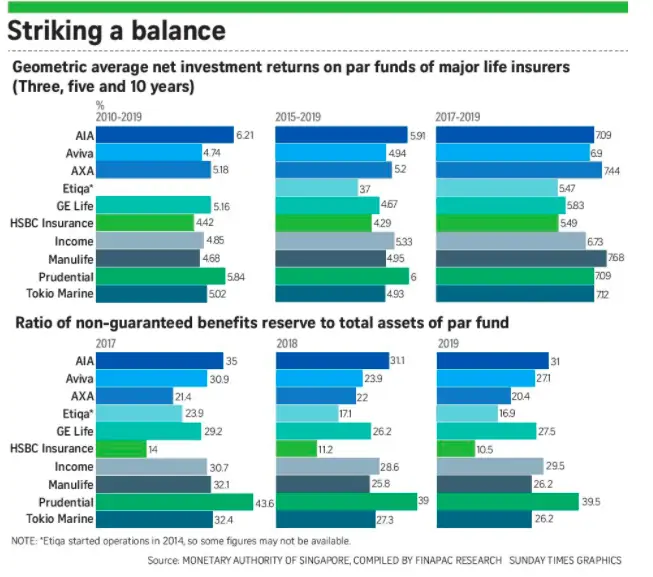

A quick look at the geometric 3, 5, and 10-year net investment returns for par funds and you will find that Prudential is definitely a standout choice, consistently making the highest returns amongst all insurers.

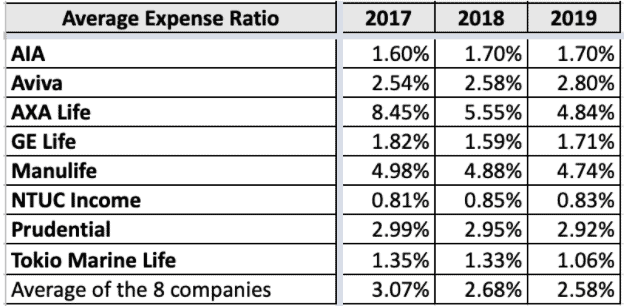

Total Expense Ratio

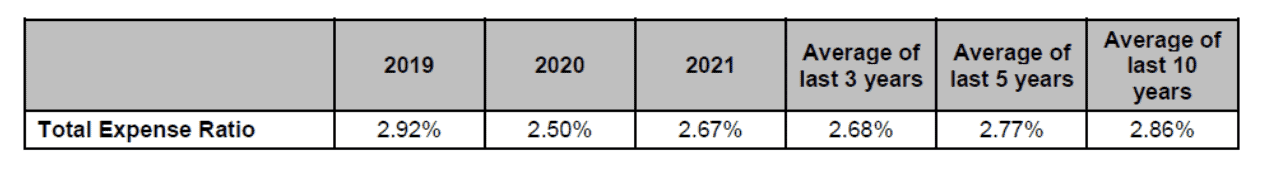

The performance of the participating fund can then be analysed by looking at the fund’s Total Expense Ratio (TER), which gives us a guideline on how the fund’s expenses are managed.

Accurate as of 31 December 2021.

From the table, the fund’s TER has remained relatively consistent around the 2%+ mark since 2019.

This number remains relatively unchanged, even considering the average over the past 3, 5, and 10 years.

This highlights that Prudential’s participating fund is considerably stable and consistent, indicating that investors are unlikely to get a sudden shock from a surge in investment expenses.

When investing in par funds, comparing the expense ratios of different insurers is also crucial.

While Prudential may not have the lowest average expense ratio, it has still been performing at the market average compared to other funds, with a good number of companies falling below and going above Prudential’s expense ratio.

It’s important to note that while expense ratios are a factor to consider, you should also take into account other factors, such as historical performance and investment strategy, before making any investment decisions.

PRULife Vantage Achiever Prime Series Fees And Charges

Those who purchase this plan with investment in mind ought to know that this plan shares in the experience of the fund.

This means that any expenses incurred by the fund can be charged to the policy according to some rules.

These expenses include:

- Fees paid to fund managers;

- Costs related to claims for death or terminal illness;

- Marketing expenses;

- Commission fees paid; or

- Fees for managing new business and other overhead expenses.

However, you will also be glad to hear that these fees have already been included in your premium calculations, and you will not be charged separately for these fees.

An Illustration of How Prulife Vantage Achiever Prime II (SGD) Works

For those wondering, let’s take a look at how the Multiplier Benefit takes effect.

Mr Ashian has $10 million worth of assets and wants to leave $3 million to each of his 2 children after he passes away.

Without PRULife Vantage Achiever Prime Series

However, instead of leaving his assets directly to his children, he decides to use $6 million of his assets to purchase a life insurance policy from PRULife Vantage Achiever Prime Series.

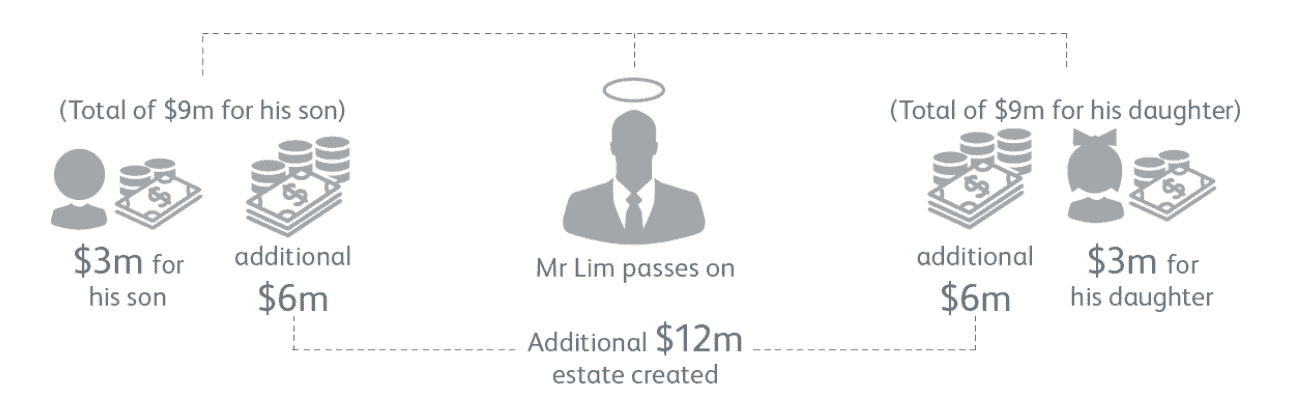

With PRULife Vantage Achiever Prime Series

By doing so, Mr Ashian’s loved ones can potentially receive a payout of $18 million from the insurance policy if he passes away before the Multiplier Benefit expiry age of 85 or 100, depending on the terms of the policy.

This is 3 times the amount he paid in premiums ($6 million)!

This would allow each of his children to receive $9 million from the policy payout, which is more than the $3 million he originally planned to leave to each of his children.

Summary of Prulife Vantage Achiever Prime Series

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Yes, via rider |

| Terminal Illness | Available |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | Yes |

| Total Permanent Disability | Yes, with rider |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Additional Benefits | |

Optional Riders-Addons

|

Available |