The Prudential PRUMortgage is a mortgage term insurance plan designed to cover your mortgage liabilities.

With the ever-increasing housing expenses in Singapore, it’s clear that most families’ biggest financial commitment is their home loans.

In case of any unexpected events, the responsibility of managing this substantial burden would then fall on your loved ones.

To safeguard against this, PRUMortgage by Prudential covers you for death and terminal illness (TI) throughout the entire policy duration.

That ensures your family can still meet your mortgage obligations in unforeseen circumstances.

Here’s our review of Prudential’s PRUMortgage.

Keep reading.

Criteria

- Available as a joint-life policy so that you and your partners benefit from the coverage.

- 10 to 35 years policy term

General Features

Policy Term

The policy coverage period is between 10 to 35 years.

Premium Terms

PRUMortgage offers a premium payment term of up to before 3 years from the end of your policy term.

Hence, you do not need to pay premiums during the last 3 years of the coverage term.

For example, if you have a policy term of 10 years, you will only need to pay premiums for 7 years.

You may choose to pay monthly, quarterly, half-yearly, or yearly.

PRUMortgage is not a Medisave-approved policy.

Protection

The benefits under PRUMortgage are triggered when either of the lives assured (the first occurrence only) experiences one of the covered events, including death or terminal illness, during the policy term.

This means the policy payout is triggered by the first occurrence of either death or terminal illness during the policy term.

After that, the particular benefit for the surviving life assured will automatically terminate upon the occurrence of a covered event for either the assured persons.

In the rare event that both lives assured (e.g., spouses or partners) experience a covered event simultaneously, the respective benefits will only be payable for the first life assured.

Death Benefit

Under PRUMortgage, the Death Benefit provides a lump sum payout in the event of the insured person’s death.

In the case where 2 lives are covered under the policy, this benefit is payable upon the earlier death of the life covered.

This ensures that the benefit is paid out as soon as either of the lives assured passes away.

When this benefit is paid for either of the lives assured, the death cover for the surviving life assured automatically terminates.

If both lives covered by the policy pass away simultaneously (e.g., in a common accident or event), the PRUMortgage will pay the Death Benefit only for the first life insured named on the Certificate of Life Assurance.

Terminal Illness Benefit

PRUMortgage’s Terminal Illness Benefit provides financial support if someone covered by the policy is diagnosed with a terminal illness.

If the policy covers 2 people, the benefit is paid when either of them is diagnosed.

If the benefit is paid for either person, it ends for the other, but the policy still provides death benefits if any are left.

If the sum assured for both benefits is the same (reducing the death benefit to zero), the entire policy ends.

If there’s a Disability Benefit and its sum assured is more than the Terminal Illness Benefit, it gets reduced by the Terminal Illness Benefit.

If it’s less or the same, the Disability Benefit stops.

Optional Add-On Riders

Disability Benefit (PRUMortgage)

The Accelerated Disability Benefit provides additional protection by addressing the financial impact of Total and Permanent Disability.

This optional benefit can only be added to the policy at the time of its inception and will protect you until you reach 70.

If a valid claim for TPD is made and approved by Prudential, they will pay out the sum assured for the Accelerated Disability Benefit in a lump sum.

Where either of the lives is covered under the PRUMortgage, the benefit is payable on the earlier occurrence of TPD for either of the insured lives.

Once the benefit is paid for either life assured, the Accelerated Disability Benefit coverage for the other life automatically terminates.

However, if 2 persons covered by the policy become Totally and Permanently Disabled simultaneously, the benefit is paid out only for the first life assured named on the Certificate of Life Assurance.

This ensures that the benefit is not duplicated in the case of simultaneous disabilities.

The criteria for considering whether the persons assured are Totally and Permanently Disabled under the policy are as follows:

- They cannot engage in any occupation, business, or activity that pays an income.

- The loss of sight in both eyes.

- The loss of use of either limb, each above the wrist or ankle (excluding hands and feet).

- Combination of loss of either eye and any limbs at or above the wrist or ankle (excluding hands and feet).

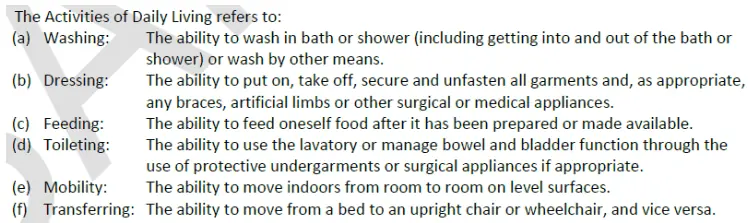

- For individuals ages 66 and before their 70th birthday, the life assured is unable to perform (aided or unaided) at least 3 of “Activities of Daily Living” for a continuous period of at least 6 months.

Key Features

Nomination/Trust

The policyholder can nominate beneficiaries or establish a trust for the specific benefit of their loved ones.

The person making the nomination or establishing the trust must be the person assured by the policy.

You must not have entered into any premium financing arrangement with any bank or financial institution.

Summary of Prudential’s PRUMortgage

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | Yes, with rider |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Additional Benefits | |

|

Yes |

My Review of Prudential’s PRUMortgage

PRUMortgage is a no-frills insurance plan designed to provide homeowners with peace of mind by offering financial protection for their families in case of unexpected circumstances such as death, Terminal Illness, or Total and Permanent Disability.

PRUMortgage is available as a joint-life policy, allowing both partners to enjoy coverage if they are joint mortgage loan owners.

This ensures that both individuals are protected in case of unforeseen events.

Policyholders can choose the policy term that suits their needs, ranging from 10 to 35 years.

Additionally, they can select from various interest rates between 1% to 7% to determine an appropriate sum assured amount for covering their outstanding loan repayment.

In the unfortunate event of the policyholder’s demise or Terminal Illness, PRUMortgage provides a lump sum payout.

This payout can help cover the outstanding mortgage debt, offering financial relief to the family.

You also have the option to add protection against Total and Permanent Disability.

This feature ensures that if you become totally and permanently disabled, the policy can provide financial support to manage the mortgage debt.

Compared to our previous review of a mortgage plan from Manulife, the Manulife Manuprotect Decreasing (II), they offer similar benefits and coverage.

Mortgage plans are often very specific with their benefit, which results in a less comprehensive coverage.

However, this policy might be exactly what you need for your family and personal financial protection.

What we suggest is talking to an unbiased financial advisor to see if it really fits your needs.