The ManuProtect Decreasing (II) is a non-participating decreasing mortgage insurance plan that keeps your premiums affordable with decreasing payouts.

With the rising costs of housing in Singapore, it is undeniable that the highest expense for most families would be their home mortgages.

Should anything untoward happen to you, this heavy burden will then fall onto the shoulders of your loved ones.

To avoid this, Manulife’s ManuProtect Decreasing (II) covers you for death and terminal illness (TI) throughout the entire policy term, ensuring that your loved ones can still pay for your mortgage in the event of any unforeseen circumstances.

If you’re looking for affordable mortgage insurance, continue reading this review of the Manulife ManuProtect Decreasing (II)!

Criteria

- Flexible policy term and interest rate option

- Guaranteed premiums for the basic policy and optional rider

- No medical underwriting required

General Features

Policy Terms

The ManuProtect Decreasing (II) allows you to choose your preferred policy term to suit your mortgage situation and your preferences best.

Regardless of your selected policy term, your sum assured will still decrease over the years.

However, the rate at which the sum assured decreases will still depend on factors such as your chosen sum assured, interest rate, and policy term.

I know this doesn’t make sense – why would I pay to have my sum assured continuously decreasing?

But this is how mortgage plans differ from term plans – you’re charged a much lower premium, and the sum assured decreases as you slowly pay your mortgage.

To give you a rough gauge of the payout reduction, we have drawn up a table below based on a 30-year-old male who does not smoke.

By making annual premiums for a 10-year policy term at an interest rate of 1% and a basic sum assured of $150,000, this results in a yearly premium of $93.47.

| End of Policy Year / Age | Total Basic Premiums Paid To-Date | Death Benefit |

| 1 / 31 | $93 | $150,000 |

| 2 / 32 | $187 | $135,663 |

| 3 / 33 | $280 | $121,182 |

| 4 / 34 | $374 | $106,557 |

| 5 / 35 | $467 | $91,785 |

| 6 / 36 | $561 | $76,865 |

| 7 / 37 | $654 | $61,797 |

| 8 / 38 | $748 | $46,577 |

| 9 / 39 | $748 | $31,206 |

| 10 / 40 | $748 | $15,681 |

Premium Payment Terms

While the ManuProtect Decreasing (II) gives you flexibility on your policy term, the premium payment term is consistently fixed to be 2 years less than the policy term.

This means that the longer the policy term, the longer you would have to pay your premiums.

However, an upside about this policy is that the amount you pay for premiums is guaranteed to stay the same throughout the entire policy term, and you would not have to worry about any unforeseen changes to the premiums payable.

On top of your regular premiums, couples will be glad to hear that you can enjoy a 5% discount on the premiums if you apply for this insurance plan together.

Protection

Death Benefit

As part of its basic coverage, the ManuProtect Decreasing (II) ensures that your beneficiary receives a single lump sum payment in the unfortunate event of your passing during the policy term.

However, the sum assured payable by Manulife would correspond to the reduced coverage specified in your policy illustration for that particular policy year.

Terminal Illness Benefit

Those insured diagnosed with a terminal illness (TI) can also make a claim under this benefit for the Death Benefit to be paid out early as a lump sum.

To qualify for this benefit, the following conditions would have to be met:

- The insured’s condition would have to be conclusively diagnosed to result in their passing within 12 months;

- The diagnosis must be supported by a medical examiner and verified by Manulife’s appointed medical examiner; and

- The condition must not be related to any Human Immunodeficiency Virus (HIV) infection.

Considering all policies covering the same person, the maximum amount payable for TI claims is $1 million (the maximum amount would be $2 million for TI and critical illness claims).

If a TI claim is made and the sum assured is not depleted, the policy will remain effective and continue to provide coverage for the death benefit.

Optional Add-On Riders

Total & Permanent Disability Rider (II)

The Total & Permanent Disability Rider (II) is an optional add-on benefit to the main insurance plan, the ManuProtect Decreasing (II).

In addition to the basic Death and TI Benefits, this rider provides extra protection specifically for total and permanent disability (TPD) conditions, making it suitable for those who are seeking wider coverage.

Like the basic policy, the coverage for this supplementary benefit will decrease over time, following the same interest rate chosen for the main policy it is attached to.

Total and Permanent Disability (TPD) Plus Benefit

Should the insured suffer from a TPD while this supplementary benefit is effective, they will receive a lump sum payment by Manulife equal to the reduced sum insured under the TPD Plus supplementary benefit.

This benefit will be paid out as an acceleration of the basic policy’s death benefit.

For your claim to be successful, the duration of the disability must be a continuous period of no less than 6 months.

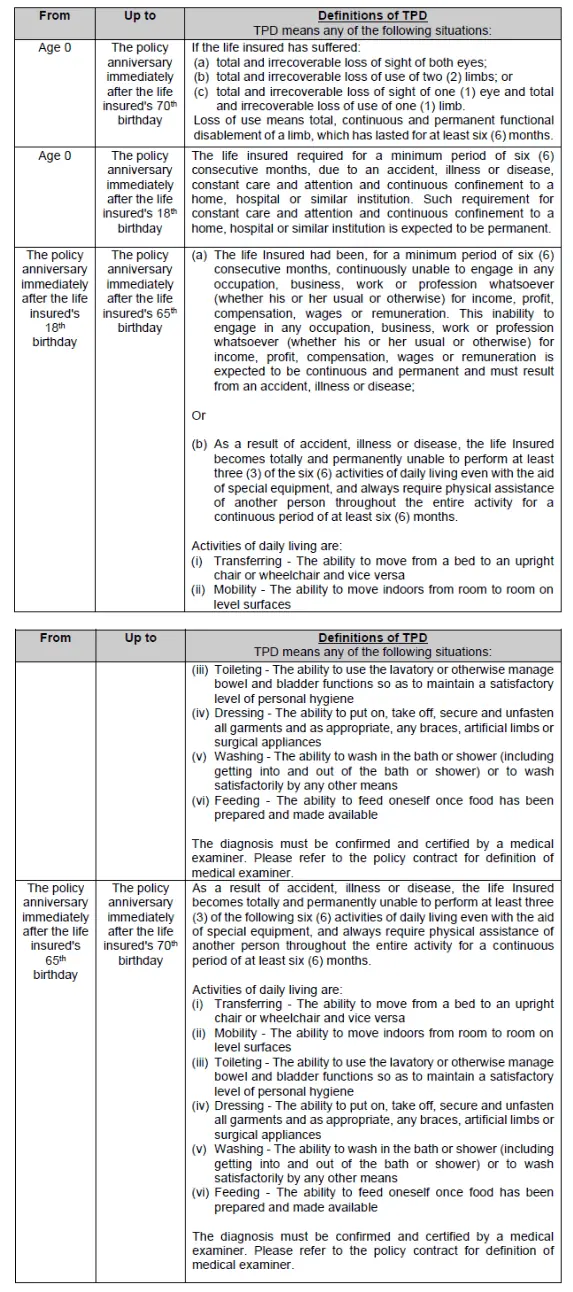

Depending on the insured’s age, the definition of the TPD Plus supplementary benefit will vary, as detailed in the table below:

It is important to note that when a disability claim is made, the maximum payout is $5 million for all the insurance policies held by the insured person with Manulife.

In the event that the basic policy’s sum insured is not fully paid out following this TPD claim, the basic policy will remain active and continue providing coverage for the Death and TI Benefits.

Premium Payment Terms

The premium payment structure for this optional rider would follow that of the basic policy, where premiums are guaranteed and payable up to 2 years before the end of the supplementary benefit term.

However, while it is not specifically mentioned for the basic policy, this optional rider is not MediSave-approved, meaning that you cannot pay its premiums using your MediSave funds.

Joint-Lives Insured

Just like the basic policy (which we will be covering in the next section!), those who choose to purchase this supplementary benefit can have up to 2 life insureds, but only the first insured person to be diagnosed with a TPD can claim the TPD Plus Benefit.

Key Features

Joint-Lives Insured

Unlike most other insurance policies, which usually cover only 1 person, the ManuProtect Decreasing (II) policy has a different take on this.

Considering that this is a mortgage insurance plan, and housing matters usually involve both parties in a couple, the ManuProtect Decreasing (II) policy allows for joint-lives insured where you can nominate up to 2 persons to be insured under this policy.

However, while there can be up to 2 life insureds, the Death and TI Benefits are only payable for the first insured person who passes away or is diagnosed with a TI.

Summary of ManuProtect Decreasing (II)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawal | N/A |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Optional |

| Terminal Illness | Yes |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of the Manulife ManuProtect Decreasing (II)

The Manulife ManuProtect Decreasing (II) gives you a way to cover your mortgage liabilities at a low price point.

There are also many other benefits to this simple yet effective term plan.

For a start, this policy emphasises flexibility by allowing you to customise a range of policy factors, such as the policy term, the interest rate, and the basic sum insured.

Doing so ensures that you can build a plan that best suits your needs and preferences, alongside matching your coverage to your mortgage loan throughout the policy term.

More importantly, the premiums you pay for the basic insurance plan and its optional riders (if any) will remain fixed throughout the entire duration of your policy, thus giving you peace of mind knowing that your premiums will not unexpectedly increase.

As an added advantage, the ManuProtect Decreasing (II) plan allows you to apply for joint-lives insured, where you can apply for the insurance plan with your loved one.

Doing so not only grants you convenience by having only 1 policy in effect at any point in time, but it also gives you an extra 5% discount on your regular premiums.

While this policy might not have very comprehensive coverage, Manulife has given you the option to add extra protection to your insurance plan through riders.

These riders cover additional situations like TPD, giving you enhanced financial security in case of these unexpected scenarios.

Despite reading this review, it is still important to refer to the policy’s specific terms to get all the information you need before committing to this coverage.

Alternatively, you may also wish to consult a financial advisor or seek a second opinion to check if this plan is right for you!