Wealth Plus Solitaire from NTUC Income is a single premium participating annuity plan designed especially for legacy planning.

With up to 3.75% in yearly payouts and 120% maturity benefits, is this NTUC Income Wealth Plus Solitaire as good as it sounds?

Well, here’s our review.

Keep reading.

Criteria

- Single premium

- Policy Term: Up to your 120 birthday

- Insured entry age: 0-70 years

- Policyholder entry age: 16* years and above

*Note that you cannot take a policy on the life of your child if they are 18 years and above.

General Features

Premiums Payment Terms

The NTUC Income Wealth Plus Solitaire is a single premium policy; thus, you only make premium payments when you’re signing up for it.

Policy Term

The NTUC Income Wealth Plus Solitaire provides you coverage until you are 120 years old.

Protection

Death Benefit

In the unfortunate event of death, beneficiaries will receive a payout that includes the following:

- 105% of the net premium amount paid

- a terminal bonus, if applicable

- any accumulated cash benefits

Where a policy loan is owed, that amount will be deducted from the payout.

After the death benefit is paid out, the policy will come to an end.

It’s important to note that if a secondary insured person has been appointed, the death benefit will not be paid.

Instead, they will take over as the new insured, and the policy will continue for them.

Terminal Illness (TI) Benefit

In the event that the insured person is diagnosed with a Terminal Illness, their payout will include:

- 105% of the net premium amount

- a bonus, if applicable

- and any accumulated cash benefits

Where a policy loan is outstanding, that amount will be deducted from the payout.

Similar to the death benefit, if a secondary insured person has been appointed, they will take over as the new insured, and the policy will continue for them.

Key Features

Cash Benefit

Starting from the 49th month after the policy inception, you will be eligible to receive a monthly cash benefit.

This benefit is calculated as 0.072% of your net single premium and paid at the beginning of each month.

Annually, this is equivalent to 0.864% of your net single premium.

As long as the insured is still alive and the policy is still active, the payments will be made until the policy anniversary, immediately after the original insured person’s 120th birthday.

You also have the option to accumulate these cash benefits with NTUC Income at the prevailing interest rate.

This could increase the value of your cash benefits over time, with the flexibility to withdraw it whenever you need it.

Secondary Insured Option

The NTUC Income Wealth Plus Solitaire offers a feature that many find both practical and comforting — the Secondary Insured Option.

As long as the policy is active and in effect, the original person insured can appoint someone else who will continue with the policy in case of demise.

This option is subject to the following conditions:

- The premiums for the policy must be paid in cash,

- No beneficiary has been nominated for the policy, and

- There haven’t been any changes to the ownership of the policy, such as assigning it to someone else, going bankrupt, or placing it in a trust.

The secondary insured can be either yourself or your spouse (below 65 years old) or your child (below 18 years old) at the time of appointment.

It’s also important to note that you can appoint a secondary insured up to 3 times throughout the policy’s duration.

Guaranteed 80% Surrender Value

When you surrender or terminate the policy before its intended term, you receive a fixed guaranteed surrender value equivalent to:

- 80% of the net single premium, and

- A non-guaranteed surrender value after deducting any applicable fees.

However, it’s important to note that significant costs may be involved if you terminate your policy early.

Hence, the total amount you receive may be less than the total premiums you have paid or even zero.

Maturity Benefit

Upon reaching the end of the policy term (the anniversary immediately after your 120th birthday), you will receive a payout of 120% of your net single premium paid and a terminal bonus.

You will also receive any accumulated cash benefits and cash bonuses.

However, if you have an outstanding policy loan, that amount and any interest will be deducted from the final payout.

Bonuses

Cash bonus

You may receive this payment from the 49th month of the policy until the policy ends.

The amount of cash bonus you receive is not guaranteed and can vary from year to year.

If there is a cash bonus, it will be paid out along with the monthly cash benefit.

Terminal bonus

This additional payment may be paid out when you claim maturity or surrender of the policy.

It’s important to note that future bonuses, which haven’t been added to your policy yet, are not guaranteed.

NTUC Income Wealth Plus Solitaire Fund Performance

Investment Strategy

The Life Participating Fund pools the premiums paid by all participating policyholders and invests them in a variety of assets.

Diversifying the investments in different types of assets allows the fund to manage risks more effectively and achieve a balance between potential growth and stability.

These asset classes include local and overseas equities (which are shares of companies), bonds (which are debt instruments), property (such as real estate), and cash (liquid funds).

Each asset class has its characteristics and potential returns, reducing the impact of any one asset class underperforming.

Below is the investment strategy and the achieved asset mix for this policy as of 31 December 2021:

| Type of Assets | Allocation Goals (%) | Actual Mix (%) |

| Equities and Properties | 36 | 37 |

| Fixed income, cash & others | 64 | 63 |

| Total | 100 | 100 |

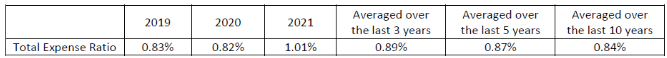

Total Expense Ratio (TER)

The Total Expense Ratio is a way to measure the expenses of the Life Participating Fund compared to the amount of money it holds (its assets).

When you pay premiums for your policy, a certain amount is already set aside to cover the expected expenses of the Life Participating Fund.

So, these expenses are already factored into your premiums and are not an additional cost to you.

However, when the actual expenses incurred by the Life Participating Fund turn out to be significantly different from what was expected, it may impact the non-guaranteed benefits you may receive from your policy.

The past Total Expense Ratios are shown in the table below for this Life Participating Fund:

The table below shows the top 8 insurance companies’ performance from 2017 to 2019 regarding expense management to ensure better returns to policyholders:

From the above analysis, it’s evident that NTUC Income ranks as the best in expense management, with the lowest and most consistent expense ratio in the market and below the industry average.

That’s a good indicator that if you invest in NTUC Income’s Wealth Plus Solitaire, you will likely receive higher monthly cashouts and maturity benefits due to better returns.

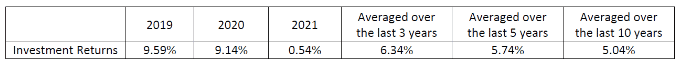

Investment Rate of Return

Various changes can influence the performance of the Life Participating Fund investment in the economic and investment landscape.

These changes can have an impact on how well the fund performs.

Consequently, the performance of the Life Participating Fund directly affects the bonus allocation of your participating policy each year.

Additionally, the fund needs to be financially sound in order to ensure the sustainability of the bonus rates over time.

Below are the past investment rates of return for the Life Participating Fund:

The 3-year IRR average is impressive compared to the 5-year average, considering 2021 had a below 1% IRR.

High inflation and interest rates may have significantly impacted various aspects of the global economy, including investment markets.

As a result, it is possible that the 2021 investment rate of return for the Life Participating Fund was affected and deviated negatively from the previous year’s.

As compared to industry average:

NTUC Income performs averagely across 3, 5, and 10-year geometric average net returns.

However, you shouldn’t choose a policy based on its returns alone, as its features will play a big part in fitting in your overall investment plans.

Illustration of Legacy Planning with NTUC Income Wealth Plus Solitaire

Let’s imagine a situation involving Mr Cheng and his family.

Mr Cheng is 40 years old and has decided to invest $1 million the Wealth Plus Solitaire. He also includes his 5-year-old son, Jiang, as a secondary insured person in the plan.

After 4 years of having the policy, something interesting happens. The plan starts providing Mr Cheng with monthly cash payouts, specifically $3,125 each month consisting of a guaranteed amount of $720 and a non-guaranteed bonus amount, which in this case, it averages $2,405 per month.

He chooses to receive these payouts to support his family’s lifestyle and cover their expenses.

Sadly, when Mr Cheng reached the age of 70, he passed away.

However, the policy doesn’t end there. It continues until the anniversary, right after Mr Cheng would have turned 120 years old, as Jiang now becomes the new insured.

The monthly cash payouts previously paid to Mr Cheng continue to be paid to Jiang until the policy matures.

Jiang, fortunately, lives until the end of the policy term, reaching the age of 85.

Hence, during the entire duration of the policy, the family receives a total of $2,850,000 in monthly cash payouts.

Additionally, when the policy reaches maturity, which is when it comes to an end, Jiang also receives a lump sum payment as the maturity benefit.

In this case, the maturity benefit amounts to $1,520,000.

Combined, the total benefits paid to Cheng and Jiang add up to a total cash payout of $4,730,000.

| Policy Year | Events | Amount | Sum Total |

| 5th | Receives monthly Cash payouts for 26 years | $3,125 | $975,000 |

| 30th | Cheng (Secondary insured) receives monthly Cash payouts for 50 years | $3,125 | $1,875,000 |

| 80th | The policy matures (after Cheng’s 120th birthday) | $1,520,000 | $1,520,000 |

| Total Cash Payouts | $4,730,000 | ||

Illustrated based on a 4.25% p.a. return.

NTUC Income Wealth Plus Solitaire Fees and Charges

When it comes to managing the Life Participating Fund, there are various expenses that are incurred in the process.

These include underwriting costs, commissions, distribution costs, policy issues and claims expenses, depreciation, general overheads, etc.

Expenses directly related to the Life Participating Fund are charged specifically to that fund.

This means that the costs associated with running and managing the fund are deducted from the fund.

However, there are also certain expenses that are shared across all the funds managed by the company. In this case, these shared expenses are apportioned to each fund.

The allocation is done in a way that accurately reflects the costs associated with running the business for each specific fund.

Summary of NTUC Income Wealth Plus Solitaire

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the NTUC Income Wealth Plus Solitaire

The NTUC Income Wealth Plus Solitaire is a robust annuity plan if you are looking to create a financial legacy for yourself and your loved ones.

First, applying for the Wealth Plus Solitaire is simple and convenient.

What stands out is your guaranteed acceptance regardless of your health condition, and there is no need for any medical check-ups.

Starting from the 4th year of the policy, you will receive regular monthly cash payouts until you reach the age of 120.

These payouts can amount to 3.75% of the net single premium you paid for the policy. This includes both guaranteed and non-guaranteed portions.

Alternatively, you can accumulate these payouts with NTUC Income and earn interest of up to 3.00% per year on the accumulated amount.

The policy provides coverage and protection for you until the age of 120.

This means that your loved ones will be financially supported in case of unfortunate events like a terminal illness or death.

If diagnosed with a terminal illness, the life assured will receive a lump sum benefit of 105% of the net single premium you paid and a non-guaranteed terminal bonus.

Along the policy term, you can appoint a loved one as the secondary insured who will continue receiving the monthly cash payouts until the anniversary immediately after their 120th birthday.

This allows you, the primary insured, to leave a financial legacy for your loved ones.

Speaking of which, 80% of your premiums are guaranteed immediately, so there are fewer worries should the participating fund perform poorly.

Finally, when the original insured reaches the age of 120, the policy matures, your secondary insured will receive a maturity benefit of 120% of the net single premium and a non-guaranteed terminal bonus.

This provides a substantial financial boost for the secondary insured and family.

When choosing a policy, there may not be a plan that can have all the features you need.

That’s why exploring different options and comparing various plans is crucial to ensure you find the best fit for your specific requirements.

You can consult with a financial advisor or get a second opinion to understand if this policy is best for you.