The NTUC Income SilverCare Insurance is a personal accident insurance policy designed for those in their silver years in the event of accidents or untimely deaths.

So, as the saying goes, let’s “rather be safe than sorry!”

That saying cannot be more true for such circumstances.

Keep on reading our review of NTUC Income’s SilverCare Insurance.

My Review of NTUC Income SilverCare Insurance

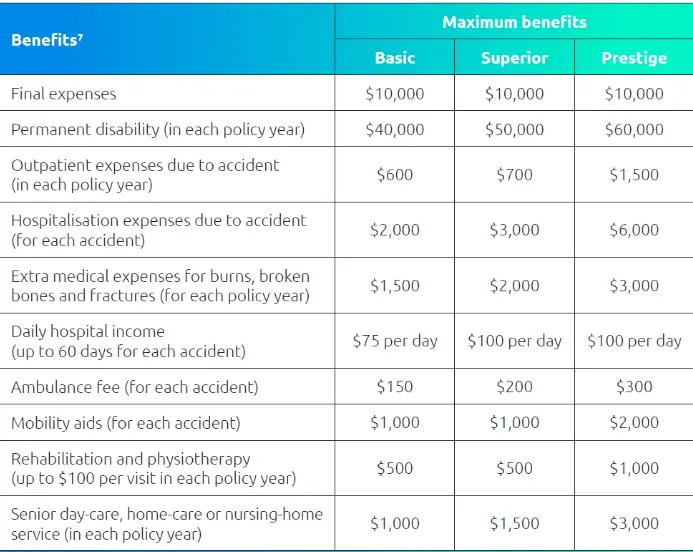

NTUC Income SilverCare Insurance policy provides valuable coverage that brings peace of mind regarding the well-being and protection of your loved ones, especially as they age.

It offers ample coverage against personal accidents, with benefits such as

- Death coverage,

- Permanent disability,

- Outpatient due to accident,

- Hospitalisation due to accident,

- Ambulance fees,

- Hospital income,

- Mobility aids,

- Home-care services,

- Rehabilitation expenses related to accidents,

- Caregiver Training,

- Home Modifications,

- And more!

This comprehensive coverage ensures your family members are safeguarded and have the support and services they need.

With premiums as low as $0.44 a day, you can secure coverage of up to $80,000 in lifetime limits for personal accidents for the basic plan!

The Superior and Prestige tiers have lifetime limits of $100,000 and $200,000 respectively, too!

Its affordability makes it an attractive choice for many individuals and families looking for funds to help themselves as they get older, as well as their families and parents as they start ageing.

It’s the convenience of a lifetime plan and features renewability without requiring a medical check-up, making it easy to continue the coverage over time.

Besides all this, you will also receive a daily cash benefit of up to $100 for every day you spend in the hospital, allowing you to focus on getting well instead of worrying about medical bills.

In the unfortunate event of Permanent Disability due to an accident, NTUC Income SilverCare Policy provides a lump sum benefit of up to $60,000.

In case of accidental death, a $10,000 benefit is paid out to assist with final expenses.

As always, talking to an unbiased financial advisor is recommended, especially if you are considering it.

With this second opinion, you at least get a form of reassurance that this is right for you or that there are better alternatives in the market!

Remember, you don’t want to make the wrong choice; you want to make the right choice!

Let’s now explore the features offered by the NTUC Income SilverCare Insurance in detail:

Criteria

To qualify for NTUC Income SilverCare, you need to meet these criteria:

- Your age ranges between 50 years old and 75 years old

- After the age of 76, only renewals can be accepted

General Features

Premium Terms

Your premiums depend on your entry age and the type of plan you choose.

This policy consists of 3 plan types.

- Basic

- Superior

- Prestige

The Prestige plan option has the highest premiums and the best coverage.

The table below shows how to manage your payments by category, entry age, and monthly or yearly premiums.

Policy Term

- This policy is a one-year personal accident policy and is renewable yearly up to 75 years old.

- Above the age of 75, only existing policyholders aged 76 and onwards will be allowed to renew their policy and will be accepted.

Basic Coverage

This is an annual benefit, so you can utilise it once each policy year.

Key Features

When you suffer a permanent disability, your world changes.

The NTUC Income SilverCare Insurance Policy eases some of the problems you or your family face when dealing with a disabled person in the family or with friends.

These benefits are typically available when you experience a significant level of permanent disability.

The maximum payouts are as shown in the table below:

| Benefit/ Plan | Basic | Superior | Prestige |

| Home Modification | $4,000 | $5,000 | $10,000 |

| Home Cleaning Services | $350 | $500 | $1,000 |

| Caregiver Training | As charged | ||

Home Modification

With NTUC Income SilverCare Insurance, you can change your home to make it more accessible and accommodating to your new needs due to your disability.

These changes include installing ramps, widening doorways, or adding handrails.

Home Cleaning Services

You are entitled to home cleaning services following the accident.

These services will keep your home clean and provide a safe living environment, especially when physical limitations make it challenging to perform household chores.

Caregiver Training

Regardless of your plan, caregiver training costs are covered as charged.

This benefit helps educate a family member or caregiver on properly caring for your specific needs, enhancing the quality of care and support you receive.

Summary of NTUC Income SilverCare Insurance

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Death Benefit Cover | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |